Purpose And SARS Vision 2024

Automated refunds and drawbacks system of the South African Revenue Service (SARS). It explains the purpose, SARS Vision 2024, challenges with the current process, new refund and drawback process, benefits, and transitional arrangements.

1 views • 21 slides

Overview of GSA SmartPay Fleet Management Essentials

The GSA SmartPay program enables over 560 federal government agencies to access charge card products and services through a master contract. Agencies can issue task orders with no direct fees, potentially earning refunds. The program includes fleet card services with fixed pricing and options extend

3 views • 71 slides

Insights into CGST & CX Operations in Jaipur Zone

Explore the innovative practices and initiatives undertaken by the CGST & CX department in Jaipur Zone, including modifications to the role of Deputy Director (Cost), monthly newsletters for communication, DC/AC conferences for officers, and guidelines on examining fraudulent refunds. These efforts

1 views • 9 slides

How Can I Change My Swiss Flight After Booking?

Swiss Airlines allows passengers to change flights under various conditions. You can change flight dates and times online, but changes to the origin, destination, or passenger names are not possible online. For tickets purchased directly from Swiss Airlines, flexible tickets enable flight changes wi

3 views • 5 slides

How Can I Cancel My EL AL Flight ?

EL AL Flight allows passengers to cancel reservations online through their website. Refunds may vary depending on fare type and timing. Contact EL AL customer service for assistance. Ensure to review EL AL Flight Cancellation policy for any applicable fees and conditions.\n\nVisit the EL AL website:

1 views • 7 slides

How Can I Cancel My KLM Flight After Booking?

If a flight is canceled within 24 hours of booking, KLM Airlines offers a full refund. Flexible tickets are fully refundable for cancellations made after this time, but limited tickets may have costs or are not refundable. In line with this , KLM Flight Cancellation Policy travelers may choose to ge

1 views • 5 slides

What is the Process For Breeze Airways Flight Cancellation

With Breeze Airways, you may cancel without taking any chances. If you do so within 24 hours of making your reservation and the scheduled flight is at least 7 days away, you can receive a full refund. Tickets may be returned for travel credits, even if many companies don't offer a refund policy. Com

1 views • 5 slides

Benefits of filing the Return of Income

Filing your Return of Income (ROI) is crucial for compliance and offers benefits like improved credit scores, visa application support, loss carryforward, and tax refunds. The best time to file is by the due date, with necessary documents such as For

1 views • 3 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Clover Flex Annual Security Awareness Training for Point of Service Collections Staff

Welcome to the Clover Flex Annual Security Awareness Training for Point of Service Collections Staff! This training module covers essential activities involving the Clover Flex, such as processing sales, voids, refunds, running reports, managing settings, and relocating the device. Learn how to hand

0 views • 13 slides

Understanding College Costs and Financial Obligations at CCRI

CCRI charges tuition based on residency, with additional fees for lab and technology. Students are billed each semester for tuition, fees, and books. Consider hidden costs like transportation and child care. Full-time status is 12-19 credits, while part-time is 1-11 credits. Graduating in two years

1 views • 14 slides

Overview of TRAIN Revenue Regulations No. 13-2018 on Value-Added Tax

These regulations under the Tax Reform for Acceleration and Inclusion (TRAIN) Act (RA 10963) focus on Value-Added Tax provisions, amending Revenue Regulations No. 16-2005. They cover zero-rated sales, VAT-exempt transactions, claims for input tax, refund procedures, and more. Conditions for VAT appl

1 views • 54 slides

Brexit VAT Treatment of Goods and Services Overview

The Brexit VAT treatment of goods and services impacts cross-border supplies to the UK, VAT refunds for goods, separation provisions under the Withdrawal Agreement, and the Ireland/Northern Ireland Protocol. Changes in VAT regulations and protocols are outlined for businesses and traders within the

3 views • 10 slides

Understanding Departmental Audits in GST

Departmental audits in GST involve the examination of records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refunds claimed, and input tax credit availed. This audit ensures compliance with the provisions of the CGST Act, 2017. Types of audits under GST in

7 views • 27 slides

Manage Student Invoicing and Payment in iNEISTM Training Slides

Training slides for managing student invoices, billing, collection, fee charging procedures (automatic and manual), correcting fees, collecting payments, reversing incorrect payments, and handling excess payments or refunds in the Integrated National Education Information System (iNEISTM).

0 views • 9 slides

Manitoba's Response to Welcoming Displaced Ukrainians

Manitoba is actively responding to the humanitarian crisis in Ukraine by welcoming displaced Ukrainians to its regional communities. The province is utilizing a whole-of-government approach, including establishing committees and task forces to coordinate efforts with local organizations and business

0 views • 16 slides

Understanding Transportation Refunds and Inventory Shortages in NC DPI Services

Explore the intricacies of transportation refunds and inventory shortages in North Carolina Department of Public Instruction (NC DPI) Transportation Services led by Derek Graham, Steve Beachum, and Kevin Harrison. Learn about the purpose of PRC 056, special provisions, and why refunds are necessary

1 views • 27 slides

Louisiana SALT Litigation Update: Recent Cases and Developments

This update provides insights into recent Louisiana SALT (State and Local Tax) litigation cases, including decisions from the Louisiana Supreme Court and pending cases before the court. The summary covers challenges to occupational license taxes, constitutional issues related to tax credits, and dis

0 views • 58 slides

Comprehensive Guide to In-Service Death Benefits and Retirement Planning

Discover the in-service death benefits available for active members, including refunds of contributions, monthly benefits, and incidental death benefits. Learn about programs such as SCRS and PORS, the State ORP, and the PORS Accidental Death Program. Find out how your designated beneficiary can rec

0 views • 7 slides

Student Accounting and University Cashiering Services Overview

Student Accounting and University Cashiering Services at Eagle Student Services Center offer a range of services including assessment, tuition, fee payments, installment plans, short-term loans, waivers, and refunds. Payment methods include eChecks, credit/debit cards, cash, and online transactions.

0 views • 18 slides

Overview of Washington State Group Retrospective Rating Plan

Explore the group retrospective rating plan in Washington State's Industrial Insurance Fund, featuring a 30+ year history, unique features, hazard groups, insurance charges, and the process of retrospective premium evaluation. Learn about the inception of the program, individual risk rating, and the

0 views • 18 slides

Common Mistakes in Expense Reports that Delay Refunds

In submitting expense reports, several common mistakes can lead to delays in receiving refunds. Issues such as missing receipts, incorrect documentation, inadequate information, and incorrect claim submissions can all hinder the reimbursement process. This guide outlines key errors to avoid when pre

0 views • 11 slides

Latest Amendments Under Refund FA 2022 and Inverted Duty Structure in GST Law

Latest amendments under Refund FA 2022 include extension of time limit for filing refunds, addressing inverted duty structure issues, and procedural changes for various refund scenarios under GST law. The amendments aim to streamline refund processes and provide relief to taxpayers. The changes also

0 views • 59 slides

Enhancing Customer Experience Through Commercial Gestures on Fnac Marketplace

Fnac Marketplace now offers sellers the ability to generate commercial gestures to address customer issues such as shipping costs, damaged parcels, delays, and more. Sellers can add gestures up to 10% of the order amount, and customers will be informed via email and gift certificates in their accoun

0 views • 4 slides

Important Details for Grad Bash 2024 Event

Grad Bash 2024 event details include dress code, ticket information, bus arrangements, rules, wristbands, and arrival/depature instructions. Ensure compliance with dress code, no refunds on tickets, group allocations, prohibited items, and wristband requirements for check-in. Plan your arrival for a

0 views • 11 slides

Efficient Invoice Creation and Account Allocation Guide

This guide provides step-by-step instructions on creating invoices, charging grant accounts, managing petty cash, handling refunds, and allocating accounts efficiently. Learn how to add account distributions, select natural accounts, and edit expense types with ease.

0 views • 20 slides

Monthly College Budget Challenge: Make Smart Financial Choices

Get hands-on experience in managing your finances while in college with the NGPF Monthly College Budget Challenge. Learn to allocate income, prioritize savings, and create a budget for your freshman year. Follow step-by-step directions to make informed choices regarding income, refunds, gifts, and s

1 views • 38 slides

Key Issues in Shipbuilding Law

The classic problem in shipbuilding law arises when a buyer seeks refunds either from the shipyard under the shipbuilding contract (SBC) or from the guarantor under a Refund Guarantee (RG), and the shipyard alleges illegality or matters contrary to public policy. The complexities of English law on i

0 views • 62 slides

Napier NZPIF Monthly Update - October 2021 Summary

The Napier NZPIF Monthly Update for October 2021 covers a range of topics including conference refunds, AGM decisions, important Healthy Homes compliance dates, and extensions for lockdown situations. It also highlights changes in the Residential Tenancies Act for 2020. The update emphasizes the nee

0 views • 28 slides

Overview of the Common Agricultural Policy (CAP) in Europe

The Common Agricultural Policy (CAP) in Europe emerged after World War II to address food shortages. It aims to increase agricultural productivity, support farmers' livelihoods, stabilize markets, ensure food security, and maintain reasonable prices for consumers. CAP is guided by principles of a si

0 views • 21 slides

Effective Distance Learning Strategies for Fall 2013

Explore key topics such as student identification, last day of attendance, correspondence vs. distance education, regular and effective contact, and upcoming hands-on workshops. Get insights on verifying student identity, calculating financial aid refunds, and engaging students through various tools

0 views • 16 slides

All About University of Louisville Bursar's Office & Student Billing

University of Louisville Bursar's Office is responsible for student billing, electronic billing, payment processing, refunds, and setting up payment plans. Students need to establish a PIN for privacy and security compliance. Delegated access can be granted for others to manage your finances. Commun

0 views • 33 slides

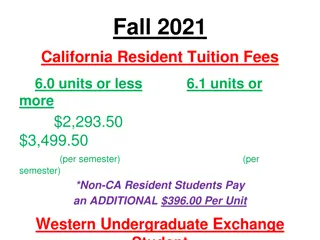

CSUEB Fall 2021 Tuition Fees and Payment Information

The Fall 2021 tuition fees for California resident students at CSU East Bay range from $2,293.50 to $3,499.50 per semester for 6.0 units or less. Non-CA resident students pay an additional $396.00 per unit. The installment plan includes three payments with deadlines, and late fees apply for missed p

0 views • 11 slides

Student Finance Office Information and Payment Options

Student Finance Office at 1051 Haskell St., Fort Worth, TX provides services like cashier services, payment options, installment plans, waivers, refunds, and more. Key points include financial obligations and payment deadlines. Payment options include in-person at the cashier's office or online thro

0 views • 14 slides

Fort Hamilton Youth Center MST Summer Camp Overview

Fort Hamilton Youth Center offers a dynamic MST Summer Camp for grades 6-12, featuring field trips, special events, and activities such as bowling, swimming, movie screenings, and themed parties. The camp operates on weekdays from 13:00-17:30 with extended hours for specific events. Advanced registr

0 views • 4 slides

Proposed Amendments to Burglar Alarm Ordinance

The Department of Administration & Regulatory Affairs presented a proposal to amend the Burglar Alarm Ordinance due to issues faced by permit holders post-Hurricane Harvey. The current ordinance does not address concerns such as permit transfers, refunds for false alarm fees, and refunds for permits

0 views • 5 slides

Louisiana's Unclaimed Property Program Overview

Louisiana's Unclaimed Property Program, managed by Kimneye S. Cox, MBA, Accountant Manager in the Unclaimed Property Division of the State Treasury Department, focuses on reuniting residents with unclaimed assets such as funds, wages, and refunds. The program boasts a high return rate, efficient sta

0 views • 28 slides

Student Financial Literacy and Bursar Services at Stony Brook University

Providing a comprehensive overview of financial services at Stony Brook University, including details on student accounts, tuition and fees, and the importance of financial responsibility. The university offers support for managing finances, issuing invoices, processing payments, and handling refund

0 views • 15 slides

GST Refund Procedure and Guidelines

Introduction to GST refunds focusing on refund of accumulated credit under GST for zero-rated supplies, the procedure for claiming refund of accumulated ITC, and filing and obtaining GST refund. It covers the eligibility criteria, required documents, formula for calculating refund amount, and step-b

0 views • 7 slides

Understanding Bonus Systems and Premium Refunds in Insurance

Bonus systems in insurance reward policyholders with fewer claims in the past by offering premium refunds. Various models are used to calculate premium refunds, factoring in individual claim history or overall portfolio performance. This article explores common solutions such as premium refunds base

0 views • 26 slides