Massachusetts District and School Accountability System Fall 2023

The Massachusetts District and School Accountability System for Fall 2023 includes various components such as Accountability Indicators, Normative Component, Criterion-Referenced Component, Assessment Participation, Categorization of Schools and Districts, and Reporting. It emphasizes measuring the

2 views • 32 slides

Special Education Circuit Breaker Program Overview FY2024

The Special Education Circuit Breaker Program for FY2024 provides financial assistance to public school districts for high-cost special education services. The program includes Relief Claims and Year-End Claims cycles, with legal references for reimbursement guidelines. Reserve Relief funds are avai

1 views • 27 slides

Understanding NJQSAC District Performance Review Indicators

NJQSAC requires public school districts in New Jersey to complete a District Performance Review (DPR) comprising self-assessment tools measuring compliance with quality performance indicators in areas like instruction, fiscal management, governance, operations, and personnel. The District NJQSAC Com

0 views • 37 slides

Annual ST-3 Training for School Districts - GASB 96 Updates Fall 2023

This training program covers GASB 96 updates, General Fund Transfers, NRT updates, BOCES Expenditure Reporting, and filing ST-3 for school districts. GASB 96 focuses on Subscription-Based Information Technology Arrangements (SBITA), defining short-term and long-term contracts and how to account for

1 views • 76 slides

Division 22 Standards Assurances for the 2022-23 School Year Overview

The Division 22 Standards Assurances outline the requirements that Oregon school districts must meet to be considered standard. These standards cover various areas such as instructional time, state assessments, human sexuality education, counseling, student identification, credit options, suicide pr

0 views • 20 slides

Identifying Student Percentage Reporting SY 2021 - 2022

Identified Student Percentage Reporting (ISP) is essential for districts to report the number of students identified through direct certification and categorical lists in eSchool. This report must be submitted by April 15, 2022, to comply with federal regulations. Understanding how ISP is calculated

1 views • 12 slides

Understanding NJQSAC District Performance Review Indicators

The NJQSAC District Performance Review (DPR) is a comprehensive process that assesses public school districts in five key areas: Instruction and Program, Fiscal Management, Governance, Operations, and Personnel. Districts must complete a self-assessment tool to measure compliance with quality perfor

0 views • 41 slides

Understanding Municipal Management Districts (MMDs) in Texas

Municipal Management Districts (MMDs) in Texas are special districts that are self-governed but require approval from the host municipality. They have the authority to provide infrastructure and approved service plans. MMDs can issue tax-exempt bonds, levy taxes, assessments, and impact fees, and pr

7 views • 21 slides

NJQSAC User Manual Overview and Process

The New Jersey Quality Single Accountability Continuum (NJQSAC) User Manual provides detailed information on the evaluation process initiated by county offices of education for school districts. It outlines the background, purpose, and goals of the NJQSAC, focusing on improving consistency, increasi

0 views • 11 slides

School Calendars and Comparative Analysis for St. Louis Public Schools 2014-2015

Executive Director Deanna Anderson presented the 2014-15 school calendar, compared calendars from other districts, and sought public input. Meetings with staff and analysis of surrounding districts were conducted to finalize the academic schedule. Key dates from various school districts were outline

0 views • 8 slides

Louisiana Cultural Districts: Engaging Communities in Cultural Development

The Louisiana Cultural Districts program, under the Cultural Economy Initiative, aims to revitalize local communities by creating hubs of cultural activity. By building on cultural resources and promoting art and culture, the program benefits from increased occupancy, commerce, and community identit

2 views • 18 slides

Overview of SAPSASA Hockey Current State and Districts for Boys and Girls in 2015

SAPSASA Hockey in 2015 discussed the current state of the game, with detailed information on districts, teams, and age groups. It highlighted the need for growth and sustainability through collaboration with clubs and organizations. The document also outlined specific districts for boys and girls, e

0 views • 8 slides

Rural CCMR Accelerator Program Overview

The Texas Impact Network (TIN) is launching a program to support rural school districts in Texas with resources to improve college, career, and military-readiness outcomes for high school students. The program consists of two phases, with the first phase focusing on strategic planning and the second

0 views • 21 slides

Real World Learning Workbook for School Districts

This workbook is designed to assist leadership teams in creating an action plan to implement and enhance real-world learning in their school districts. It involves self-assessment, reflection, and action plan development. The vision, considerations, and action items for real-world learning are explo

0 views • 25 slides

Rural Education Achievement Programs: SRSA and RLIS Introduction

The Rural Education Achievement Programs, including the Small, Rural School Achievement Program (SRSA) and the Rural and Low-Income School Program (RLIS), aim to meet the unique needs of rural school districts by providing grants for those lacking resources to compete for federal grants, and for dis

0 views • 12 slides

Understanding OPEB Requirements and Accounting in School Finance

OPEB, or Other Postemployment Benefits, are benefits received by retired employees earned during their careers. GASB Statements 45, 74, and 75 provide guidelines for reporting and accounting for OPEB in school districts. Compliance with GASB 75 is mandatory for all districts to determine OPEB liabil

0 views • 35 slides

Special Districts in the Northeast United States: Enhancing or Hindering Local Government Service Delivery?

Special districts in the Northeast US, independent units of local government, professionalize public service management. They have specialized functions, administrative and financial independence, and low political visibility. The study aims to develop a typology of multi-purpose special districts f

0 views • 12 slides

Special Fire District Performance Reviews Overview

Presentation on the OPPAGA Fire District Reviews detailing statutory requirements, research objectives, findings for individual districts, and recommendations for special fire control districts in rural areas. The performance reviews cover governance, service delivery, resource management, and more,

0 views • 34 slides

Wellborn Zoning Districts Focus Group Meeting

Wellborn Zoning Districts Focus Group Meeting involves planning and development services led by Jessica Bullock, Staff Planner. The districts discussed include Wellborn Estate and Wellborn Restricted Suburban, each with specific purpose statements and dimensional standards. Wellborn Estate focuses o

0 views • 11 slides

Understanding the Truth about Districts and Homeownership Risks

Debunking common misconceptions about districts, this discussion sheds light on the limited obligations and protections for homeowners. It explains how districts provide financial viability and transparency, showcasing the intelligence of homeowners in evaluating their choices.

0 views • 11 slides

Understanding Active vs Primary Status in Education System of British Columbia

In the education system of British Columbia, students classified as Active no Primary are those who are no longer active in their Primary School (School of Record) but are active in a Secondary School. This status affects reporting, tracking, and school record maintenance. Schools and Districts have

0 views • 8 slides

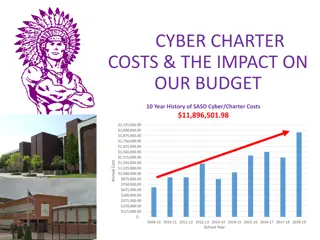

Impact of Cyber/Charter Costs on School Budgets Over 10 Years

The 10-year history of SASD Cyber/Charter Costs reveals a significant increase, with total charter school tuition payments exceeding $2.0 billion in 2018-19 alone. This amount could cover the salaries of 29,700 teachers and surpasses spending on career and technical education programs. The costs ass

0 views • 8 slides

Understanding Collective Bargaining in School Districts

Collective bargaining in school districts involves negotiating over mandatory and permissive subjects such as wages, hours, and conditions of employment. School districts must differentiate between mandatory and permissive subjects, and disputes over mandatory subjects must be resolved through impas

0 views • 29 slides

Addressing Local Wealth Disparities in Ohio's School Funding

School districts in Ohio experience significant variations in property values, affecting their ability to generate local revenue. The state's school funding formula aims to neutralize the impact of local property wealth on educational opportunities by providing more aid to lower-wealth districts. Th

0 views • 5 slides

Enhancing Coordination Between School Districts and Out-of-School Time Programs

Explore the collaboration efforts between school districts and out-of-school time programs, focusing on Massachusetts's Test & Stay Program, which enables asymptomatic students to stay in school buildings while managing COVID-19 exposure risks. Learn about the Department of Elementary and Secondary

0 views • 16 slides

FY2024 Special Education Circuit Breaker Relief Reimbursements

Circuit Breaker Program provides financial assistance to public school districts for high-cost special education services, with relief claims reimbursed for current year expenses and year-end claims reimbursed for prior year expenses. Reserve Relief supports districts with significant instructional

0 views • 13 slides

Understanding Fund Accounting in School Districts

Explore the world of fund accounting in school districts through an in-depth look at different fund types, their definitions, and the regulations governing them. Learn about the unique characteristics of instructional funds, debt service funds, capital projects funds, food and community service fund

0 views • 36 slides

Understanding Transfer of Service (TOS) in Wisconsin School Districts

Transfer of Service (TOS) in Wisconsin school districts involves the transfer of financial responsibility from a local municipality to a school district, allowing for exemptions to revenue limits. Eligibility requirements include being within the application timeline and having students come from ot

0 views • 36 slides

Teacher Salary Comparison in Fayette County vs. Jessamine County School Districts

This slide provides a comparison of teacher salaries in Fayette County and Jessamine County School Districts for different education levels and years of experience. It highlights the differences in pay scales between the two districts, showcasing the earning potential for teachers at various stages

0 views • 4 slides

Housing Initiatives in Texas School Districts

Several Texas school districts have implemented workforce housing initiatives to provide affordable housing options for teachers and staff. Initiatives include property ownership, rental units, and partnerships with housing finance corporations. Examples include Ector County ISD's housing for teache

0 views • 13 slides

Montana School Funding Equalization Mechanisms Overview

Montana's Property Tax Advisory Council's Education Subcommittee explains the Guaranteed Tax Base (GTB) and School Equalization and Property Tax Reduction (SEPTR) mechanisms that aim to equalize revenue-generating capacity among school districts. GTB aid subsidies are provided to districts with less

0 views • 13 slides

Regional Special Education Transportation (RSET) Program Overview

RSET, which stands for Regional Special Education Transportation, is an initiative developed by ACES to help districts save money while safely transporting students to out-of-district placement sites. The program benefits districts by reducing transportation costs, addressing parent concerns, and ma

0 views • 13 slides

Oregon HB 3499 Implementation Public Comments

Public comments provide feedback on the implementation of HB 3499 in Oregon, focusing on the rules and improvements needed for English Language Learners (ELL) at the district and school levels. Suggestions include more details with flexibility, accountability for ELL improvement, addressing concerns

0 views • 11 slides

Analysis of EL Numbers in Oregon Schools and Districts

This analysis, presented during the HB 3499 ELL Program Advisory Group Meeting, highlights the distribution of Oregon districts and schools based on the number of current English Learners (ELs). It emphasizes the importance of considering EL numbers in identifying low-performing institutions and dis

0 views • 4 slides

Hotel Tax Distribution Overview for House Oversight Subcommittee

Hotel Tax Distribution presentation covers changes in hotel tax distribution, including how it is distributed, what is taxed, and the shared regional districts in Rhode Island. It details the breakdown of occupancy taxes, state funds distribution, and the impact on various municipalities and tourism

0 views • 17 slides

Understanding the Minnesota School Food Buying Group (MSFBG)

Discover how the Minnesota School Food Buying Group (MSFBG) helps school districts save money through joint purchasing agreements, its history, goals, and impact over the years. Learn about its award process, cost-saving opportunities, and current participating districts and distributors.

0 views • 25 slides

Comprehensive Overview of Colorado Springs Special Districts Work Sessions

Delve into the detailed sessions held by the Colorado Springs Special Districts on various topics including district accountability, transition of governance, dissolution, and more. Learn about the progression from prior sessions to the latest updates on mill levies, taxable status, and property ass

0 views • 19 slides

Federal Programs for Limited English Proficient (LEP) Immigrant Children and Youth

This document outlines the procedures and requirements for subgranting funds under Title III-A for Limited English Proficient (LEP) immigrant children and youth. It covers subgranting procedures, allowable expenditures, claiming reimbursement procedures, and annual reporting guidelines. Districts mu

0 views • 25 slides

Alternative Certification Program for School Districts in West Virginia

West Virginia Association of School Human Resource Officials discussed the implementation of Alternative Certification (AC) programs for school districts facing critical teacher shortages. The process involves applying for an Alternative Teaching Certificate, commitment to program requirements, and

0 views • 23 slides

Introduction to Partnership Agreement Fundamentals in Districts - Webinar on December 14, 2022

In this webinar, explore the key components of partnership agreements within districts. The Office of Partnership Districts introduces liaisons and outlines support levels, roles, and expectations. The model and coverage areas, including benchmarks and outcomes, are discussed. Additionally, details

0 views • 48 slides