Hotel Tax Distribution Overview for House Oversight Subcommittee

Hotel Tax Distribution presentation covers changes in hotel tax distribution, including how it is distributed, what is taxed, and the shared regional districts in Rhode Island. It details the breakdown of occupancy taxes, state funds distribution, and the impact on various municipalities and tourism districts. The history of hotel tax allocation, recent budget changes, and the incorporation of state campaigns by regional districts are also highlighted.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

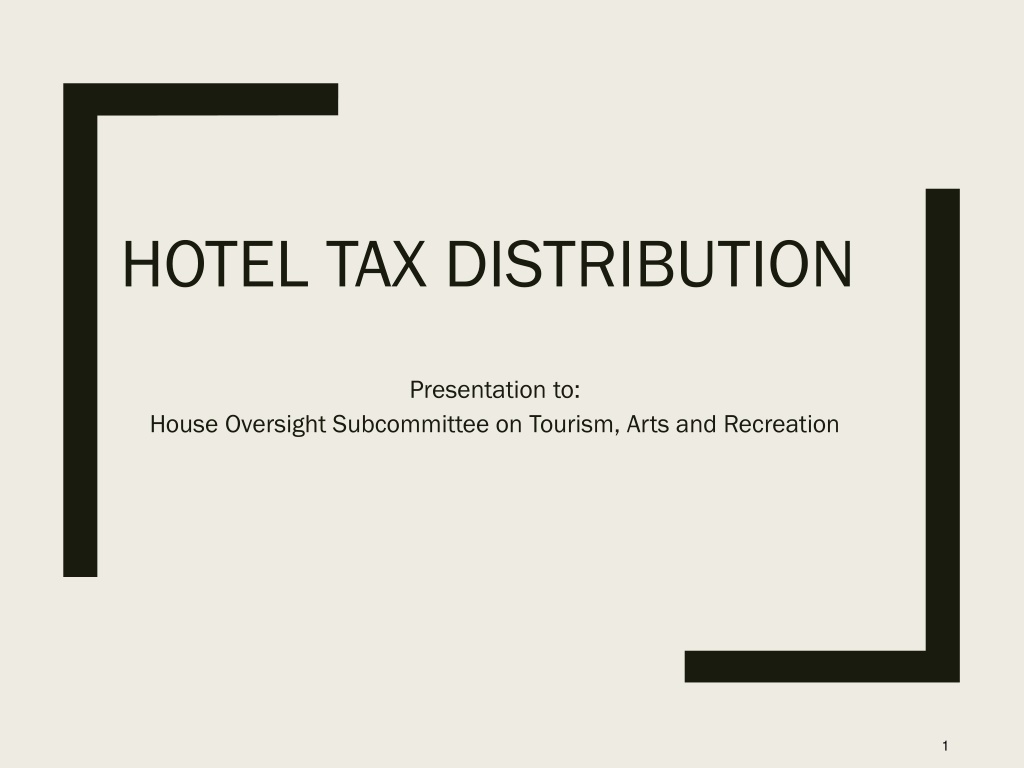

HOTEL TAX DISTRIBUTION Presentation to: House Oversight Subcommittee on Tourism, Arts and Recreation 1

Hotel Tax Distribution Hotel Tax Distribution Hotel Tax has changed numerous times in recent years How it is distributed What is taxed 2

Hotel Tax Distribution Hotel Tax Distribution Hotel room rental subject to occupancy taxes: Sales Tax 7.0% General Fund State Hotel Tax 5.0% Commerce (previously General Fund), municipalities, regional tourism districts, and Providence/Warwick CVB Local Hotel Tax 1.0% Municipalities 3

Hotel Tax Distribution Hotel Tax Distribution State has 4 Shared regional districts South County South County Charlestown Coventry East Greenwich Exeter Hopkinton Narragansett North Kingstown Richmond South Kingstown West Greenwich Westerly Northern RI Northern RI Burrillville Central Falls Cumberland Glocester Lincoln North Smithfield Pawtucket Smithfield Woonsocket Aquidneck Island Aquidneck Island Barrington Bristol Jamestown Little Compton Middletown Newport Portsmouth Warren Statewide Statewide Cranston Foster Johnston North Providence West Warwick 4

Hotel Tax Distribution Hotel Tax Distribution 3 municipalities have own districts Warwick Warwick Providence Providence Block Island Block Island (New Shoreham) (New Shoreham) East Providence is its own unique case. It is not in a shared district Division of taxation holds the district share until it joins a district, - $.4 million as of January 2020 Recently voted to join the Northern RI district H 5361 has the necessary changes 5

Hotel Tax Distribution Detail Distribution prior to Jan 1, 2016 *Statewide regional share goes to general fund too, 47% + 21% = 68% **Except Omni hotel: CVB=30%, State 27%, no local % 6

Hotel Tax Distribution History FY 2016 Budget: major state tourism and marketing campaign Decreased shares for all districts & tourism/marketing entities General Fund share to Commerce Expanded application of taxes Expansion to unlicensed rentals to Commerce and the municipalities Regional districts must incorporate state campaign to receive share 7

Hotel Tax Distribution Detail January 1, 2016 June 30, 2016 9

Hotel Tax Distribution History Concerns over statewide campaign rollout and impact to regionals Temporary reversal of regional reductions FY 2017 Budget One year reprieve Distribution tax returned to CY 2015 shares Regional districts increase taken from Commerce Corporation s share 10

Hotel Tax Distribution Detail Distribution from July 1, 2016- June 30, 2017 11

Hotel Tax Distribution History FY 2019 Budget Permanent change to splits Regional shares partially restored FY 2020 Budget Incorporated shares from hosting platform services into the distribution for other hotels Change shifted resources from Commerce Corporation to regional districts 12

Hotel Tax Distribution FY 19 Distribution July 1, 2018- June 30 2019 13

Hotel Tax Allocation Distribution after June 30, 2019 *Hosting Services distributed along with other proceeds 14

Hotel Tax Hotel Tax Distribution Distribution Example: $150 Room Example: $150 Room Room Room Rental from Hotel Rental from Hotel Room Charge Sales Tax General Fund Hotel Tax Multiple Recipients Local Hotel Tax - Municipality Total Charge Total Charge to Occupant to Occupant Total Taxes Collected Total Taxes Collected $150.00 $10.50 $7.50 $1.50 $169.50 $169.50 $19.50 $19.50 15

Hotel Tax Distribution Example Example - - $150 Room $150 Room Distribution of State 5% Hotel tax Distribution of State 5% Hotel tax - - $7.50 $7.50 16

HOTEL TAX DISTRIBUTION Presentation to: House Oversight Subcommittee on Tourism, Arts and Recreation 17

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)