Which Factors Are Important to Consider When Comparing Car Insurance Services in the UAE

When comparing car insurance services in the UAE, factors like coverage options, premiums, customer service quality, claim process efficiency, and additional benefits play a crucial role. Finding the right balance ensures optimal protection and peace of mind on the road.

0 views • 3 slides

Which Factors Are Worth Making Comparison of Between different Car Insurance in UAE_

When comparing car insurance services in the UAE, factors like coverage options, premiums, customer service quality, claim process efficiency, and additional benefits play a crucial role. Finding the right balance ensures optimal protection and peace of mind on the road.

1 views • 4 slides

Risk of E&O Claims on Brokers: Premiums Soaring

Join Alan Chandler to explore the rise of Errors & Omissions claims against brokers and reasons behind soaring broker Professional Indemnity premiums. Learn to mitigate risks and navigate recent statutes affecting E&O.

0 views • 19 slides

Non-traditional Life Insurance Product

Delve into the world of non-traditional life insurance products like Universal Life Insurance, Variable Life Insurance Plans, and Unit-Linked Insurance Plans. These innovative plans offer a mix of insurance coverage and investment opportunities, allowing policyholders to tailor their premiums and po

2 views • 23 slides

ACU 2024 Benefits Open Enrollment Details

The ACU 2024 Benefits Open Enrollment provides a competitive benefits package with key points including enrollment dates, system information, and changes for the upcoming year. Notable updates for 2024 include a transition in medical administrators, stable premiums for some plans, a new dental netwo

0 views • 26 slides

STATE CORPORATION COMMISSION BUREAU OF INSURANCE

Explore insights from the 2024 ACA rate presentations by the State Corporation Commission's Bureau of Insurance in Virginia. The presentation covers key observations, carrier rates, market share projections, enrollment data, and average premiums, providing a comprehensive overview of the individual

2 views • 51 slides

Overview of 2024 Health Benefits Enrollment and New Offerings

The 2024 health benefits enrollment presentation highlights key updates such as no increase in medical and dental premiums for employees, hearing aid coverage details, new voluntary benefits from MetLife, and the significance of provider networks. Employees can expect improved coverage and access to

0 views • 47 slides

Optimum Health Saver - Affordable Healthcare Solution

Introducing Optimum Health Saver offering a comprehensive and cost-effective healthcare solution. With lower premiums and minimal out-of-pocket costs, this plan provides peace of mind to consumers. Available from Nov 1, it addresses key healthcare challenges and offers valuable benefits. Optimum Hea

0 views • 22 slides

STATE CORPORATION COMMISSION BUREAU OF INSURANCE

Presentation overview of the 2024 ACA rate projections for Virginia's individual and small group health insurance markets. The session covers key observations, carrier rates, and projections of covered lives by major insurance providers. Details on the number of carriers in different markets, enroll

1 views • 51 slides

A Comprehensive Guide to Term Insurance

Term insurance is a popular choice for many individuals looking to secure their family's financial future without the higher premiums associated with other types of life insurance. This guide will delve into the intricacies of term insurance, helping you understand its benefits, features, and how to

0 views • 5 slides

Final Expense Insurance: Product Features and Riders

Final Expense Insurance offers simplified issue whole life coverage with guaranteed premiums and death benefit options for ages 0-85. The policy includes various riders such as accelerated benefits, grandchild protection, and accidental death benefits. Additional features like terminal illness and c

0 views • 12 slides

Understanding Retirement Insurance Benefits Offered by PEBA

This presentation provides an overview of the insurance benefits available for retirement through PEBA, including basic and optional life insurance, dependent life insurance, life insurance premiums, long-term disability coverage, and details on MoneyPlus and Health Savings Accounts for retirees. It

0 views • 11 slides

Perspectives on Antibiotics Use in Dairy Production

Dairy farmers use antibiotics to treat sick cows for improved animal welfare; organic dairy farmers face restrictions but benefit from higher premiums; concerns about antibiotic resistance in children debunked by medical professionals; milk processors prioritize food safety through rigorous testing

0 views • 6 slides

Understanding Financial Risks and Insurance: Course Overview

Learn about financial decision-making, protecting against fraud, and mitigating financial risks in this 9-week course. Explore the basics of insurance, including key terminology such as contracts, risk aversion, and premiums. Understand the importance of insurance in managing financial risks and inv

0 views • 61 slides

Insights into the Nigerian Insurance Industry: Trends and Opportunities

The Nigerian insurance industry shows promising growth potential with low penetration rates but increasing awareness and regulatory support. Despite challenges, there has been significant growth in premiums and a shift towards a more diverse professional workforce. A comparison with similar economie

0 views • 10 slides

State-Based Exchange (SBE) Payment Disputes: Overview and Process

The State-Based Exchange (SBE) Payment Dispute process allows issuers to dispute discrepancies in monthly payments through the submission of the SBE Payment Dispute Form to CMS. This process involves identifying and disputing payment amounts related to enrollment data, premiums, tax credits, and mor

1 views • 21 slides

Understanding Mobile Phone Insurance Scenarios

This comprehensive guide explores the basics of mobile phone insurance, including an introduction to common insurance areas, a scenario involving the analysis of selling warranties, and perspectives from both the policyholder and the insurance company. Key considerations such as pricing premiums, ex

0 views • 29 slides

Understanding Your Dental Plan Options for 2024

Explore your dental plan options for 2024 with Dental Plus and Basic Dental coverage. Learn about the differences in premiums, out-of-pocket costs, allowed amounts, enrollment periods, and benefits such as diagnostic services, preventive care, basic fillings, prosthodontics, and orthodontics. Make a

0 views • 8 slides

Insurance and Inventory Management Lecture Insights

Explore the fundamentals of insurance with a focus on risk management and insurance policies, premiums, and a brief history of federal crop insurance. Discover how insurance plays a crucial role in mitigating losses and protecting businesses from various risks, including low yields, natural disaster

0 views • 37 slides

Health Plans Positioning in Healthcare Reform Era

Today's discussion focuses on positioning UCC Health Plans for value in the healthcare reform era, including updates on the healthcare marketplace, comparison of plan benefit options and costs, and details on the 2014 UCC Health Plan benefits. The content emphasizes the importance of understanding p

0 views • 16 slides

Changes to Transitional Severe Disability Premium Element in Universal Credit

Responding to a High Court judgment, changes are being made to the Transitional Severe Disability Premium Element in Universal Credit. Claimants qualifying for the Severe Disability Premium will receive additional amounts reflecting other disability premiums from legacy benefits. This adjustment aim

1 views • 7 slides

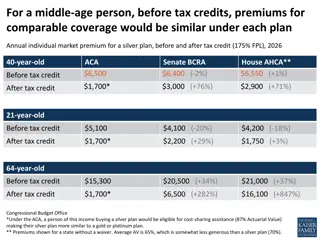

Higher Premium Impact on Older and Low-Income Populations Under BCRA

Premium comparisons reveal that low-income, older adults face substantial increases in premiums under the Senate BCRA compared to the ACA. States with older, lower-income, and rural populations would experience over 100% higher average premiums under the BCRA. The BCRA could result in significant di

2 views • 5 slides

Understanding Long-Term Care Insurance and Hybrid Plans

Explore the importance of Long-Term Care Insurance, primary purposes, payment sources, types of coverage, features, funding options, and hybrid life plan details, including premiums and benefits. Gain insights into how these plans can remove burdens from family, prevent financial impact, and ensure

0 views • 17 slides

Understanding Financial Underwriting with Susan Kerr

Explore the world of financial underwriting with Susan Kerr, the Underwriting Director at Manulife. Discover the purpose, basics, and advanced concepts of financial underwriting, including key considerations like income multiples, estate planning, and key person insurance. Gain insights into maintai

0 views • 17 slides

Understanding Health Insurance Policies: PPO vs. HMO Explained

Learn about the key differences between PPO and HMO health insurance policies, including concepts such as monthly premiums, deductibles, co-pays, and coinsurance. Discover how these factors affect your out-of-pocket costs and access to healthcare services. Gain insights into making informed decision

0 views • 13 slides

Understanding Financial Options: An Overview of Call Options in Corporate Finance

Financial options, specifically call options, provide owners the right to buy securities at specified prices. They offer flexibility to deal with uncertainty and can be valuable tools in corporate financial decision-making. This summary dives into the concept of call options using the example of whe

0 views • 48 slides

Impact of Distracted Driving: Rising Concerns and Legal Changes

The increasing prevalence of distracted driving, particularly due to smartphone use, has raised concerns among insurance companies and law enforcement agencies. Studies show a significant correlation between smartphone use and the rise in car crashes, leading to higher insurance premiums. Several st

1 views • 23 slides

Comprehensive Overview of HR 676 - Expanded and Improved Medicare for All

Expanded and Improved Medicare for All (HR 676) is a healthcare proposal that aims to provide coverage to all individuals in the United States. It eliminates premiums, copays, and out-of-pocket expenses while offering a wide range of benefits including primary care, prescription drugs, mental health

0 views • 17 slides

Protecting Your Business with Key Person Cover from Fidelity Life

Key Person Cover from Fidelity Life provides financial protection for businesses by helping replace key staff members unable to work due to sickness or injury. Established businesses and newly self-employed individuals can benefit from this cover, with options for benefit amounts, waiting periods, a

0 views • 12 slides

Open Enrollment 2022 for State Health Plan, NCFlex, and UNC Benefit Plans

Open Enrollment 2022 provides a comprehensive guide for participants to review materials, prepare, decide, and take action on available benefits and resources. From understanding plan options to enrolling at CONNECTCAROLINA, participants can ensure they make informed choices for the upcoming benefit

0 views • 21 slides

Understanding Real Income Protection Benefits

Real Income Protection provides a monthly benefit in case you are unable to work due to sickness or injury. It offers certainty at claim time, partial and severe disability benefits, waiver of premiums, and optional features like booster benefit and inflation adjustment. This coverage provides finan

0 views • 15 slides

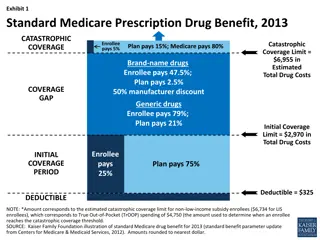

Medicare Part D Prescription Drug Benefits Overview

Detailed information on the standard Medicare Part D prescription drug benefit for 2013, including coverage details for catastrophic, brand-name, and generic drugs. Additionally, data on the distribution of Part D plans by benchmark status, weighted average premiums, and premium trends for high-enro

0 views • 22 slides

Debating Alternatives to the Individual Mandate in Healthcare Reform

Recent bipartisan discussions have called for exploring alternatives to the individual mandate in healthcare, citing its unpopularity and criticisms of being coercive or ineffective. The industry supports the mandate but believes it should be better enforced. Studies suggest that eliminating the man

0 views • 16 slides

Understanding Retiree Insurance Eligibility and Funding

Retiree insurance eligibility is a crucial aspect that retirees should understand before retiring. The process involves determining eligibility for retiree group insurance, which is separate from retirement eligibility. By meeting certain requirements such as having served consecutively in a full-ti

0 views • 12 slides

Analysis of P/C Insurance Industry Trends and Outlook

The Property/Casualty (P/C) insurance industry has seen three consecutive years of growth from 2013-2015, with a potential continuation in 2016. Net premium growth rates, catastrophic losses, and combined ratio points associated with catastrophe losses are key indicators examined in this overview. D

0 views • 62 slides

Understanding Insurance Terms: Business Bingo and Definitions

Dive into the world of insurance with a fun Business Bingo game featuring key terms like Policy, Insurer, Premium, and more. Explore definitions such as insurable interest, indemnity, and the role of an actuary in calculating premiums. Learn about different aspects of insurance contracts and the imp

0 views • 7 slides

Teachers Retirement System of Kentucky Budget Review

The Teachers Retirement System of Kentucky receives funding requests in line with recent years, with the state paying nearly all recommended contributions. TRS members include various educational institutions, with different benefit structures. The actuarial status as of June 30, 2019, highlights as

0 views • 12 slides

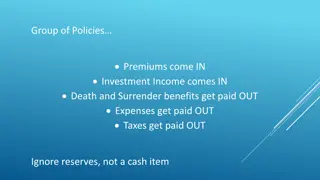

Understanding Policy Premiums and Benefits in Insurance

Policies in insurance involve premiums coming in along with investment income, while benefits like death and surrender are paid out. Expenses, taxes, and other factors impact the cash flow and accumulated earnings. Assumptions play a crucial role in pricing specific products, and various factors aff

0 views • 17 slides

Understanding Bond Premiums and Their Impact on Financial Decision-Making

Bond premiums occur when bond prices increase in the secondary market due to a drop in market interest rates. They can be used for approved project costs, debt service, or reducing bond principal. Utilizing bond premiums wisely can lead to cost savings for taxpayers. Learn how bond premiums can affe

0 views • 5 slides

Understanding Covered Calls and Cash-secured Puts

Options trading involves the ability to buy or sell a security at a predetermined price within a specific time frame. Covered calls and cash-secured puts are common strategies in options trading, offering potential opportunities for generating income while managing risk. By selling covered calls, yo

0 views • 11 slides