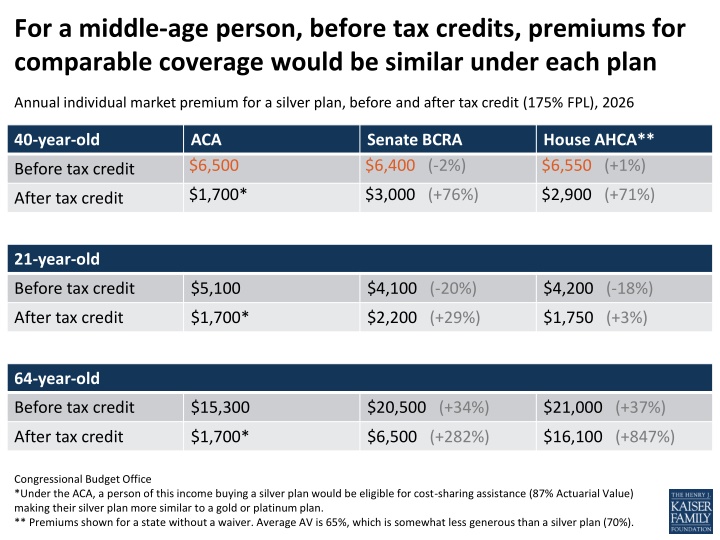

Higher Premium Impact on Older and Low-Income Populations Under BCRA

Premium comparisons reveal that low-income, older adults face substantial increases in premiums under the Senate BCRA compared to the ACA. States with older, lower-income, and rural populations would experience over 100% higher average premiums under the BCRA. The BCRA could result in significant disparities in premium costs across different demographics and states, impacting access to healthcare for vulnerable populations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

For a middle-age person, before tax credits, premiums for comparable coverage would be similar under each plan Annual individual market premium for a silver plan, before and after tax credit (175% FPL), 2026 40-year-old ACA $6,500 Senate BCRA $6,400 (-2%) House AHCA** $6,550 (+1%) Before tax credit $1,700* $3,000 (+76%) $2,900 (+71%) After tax credit 21-year-old Before tax credit $5,100 $4,100 (-20%) $4,200 (-18%) After tax credit $1,700* $2,200 (+29%) $1,750 (+3%) 64-year-old Before tax credit $15,300 $20,500 (+34%) $21,000 (+37%) After tax credit $1,700* $6,500 (+282%) $16,100 (+847%) Congressional Budget Office *Under the ACA, a person of this income buying a silver plan would be eligible for cost-sharing assistance (87% Actuarial Value) making their silver plan more similar to a gold or platinum plan. ** Premiums shown for a state without a waiver. Average AV is 65%, which is somewhat less generous than a silver plan (70%).

Low-income, older adults would face highest premium increases under Senate BCRA Monthly Premium for a Silver Plan Among Exchange Enrollees (By Income and Age), 2020 Income Below 200% of Poverty ACA Premium After Tax Credit After Tax Credit $26 $58 Income 200% of Poverty or Above ACA Premium After Tax Credit After Tax Credit $176 $170 $247 $247 $296 $369 $323 $556 $399 $782 $439 $862 $311 $489 BCRA Premium % Change BCRA Premium % Change Age < 18 121% -4% 18-34 $57 $103 82% 0% 35-44 $69 $149 117% 25% 45-54 $67 $215 223% 72% 55-64 $69 $272 294% 96% 65 + $76 $296 288% 96% $61 $168 177% 57% Overall Source: Kaiser Family Foundation Kaiser Family Foundation. Premiums under the Senate Better Care Reconciliation Act, Jun 26 2017 http://www.kff.org/health- reform/issue-brief/premiums-under-the-senate-better-care-reconciliation-act/

States with older, lower-income, rural populations would see average premiums more than 100% higher under the BCRA than current law Percent Difference in Average Monthly Silver Premiums After Tax Credits under BCRA vs. ACA, 2020 Alabama 164% Alaska 142% Oklahoma 140% South Dakota 111% West Virginia 108% US Average 74% Washington 33% DC 22% Vermont 21% Mass. 14% New York 12% 0% 20% 40% 60% 80% 100% 120% 140% 160% 180% Kaiser Family Foundation. Premiums under the Senate Better Care Reconciliation Act, Jun 26 2017 http://www.kff.org/health- reform/issue-brief/premiums-under-the-senate-better-care-reconciliation-act/

Some states would see higher average premium increases than others under the Senate BCRA Percent Difference in Average Monthly Silver Premiums After Tax Credits under BCRA vs. ACA, 2020 164% 74% 12% NM NY ND VT NH AR CT TX TN RI VA NV HI NE CA NC AK NJ CO MO ME AZ MN MD WV AL MA DC WA WY MT LA IN OH OR DE MI WI MS ID IA OK IL US SC GA PA SD UT FL KY KS Kaiser Family Foundation. Premiums under the Senate Better Care Reconciliation Act, Jun 26 2017 http://www.kff.org/health- reform/issue-brief/premiums-under-the-senate-better-care-reconciliation-act/

Average Deductible in Marketplace Plans with Combined Medical and Prescription Drug Deductibles, 2017 $7,000 $6,105 Silver Plans with Cost-Sharing Reductions for Lower-Income Enrollees $6,000 $5,000 $4,000 $3,609 $2,904 $3,000 $2,000 $809 $1,000 $255 $0 Bronze Silver Income 200-250% of Poverty (73% AV) 150-200% of Poverty (87% AV) 150% of Poverty or Below (94% AV) (60% Actuarial Value) Income Over 250% of Poverty (70% AV) Source: Kaiser Family Foundation analysis of data from Healthcare.gov. Note: Under the ACA, people purchasing silver plans on- exchange who have incomes below 250% of the poverty level (about $30,000 for a single individual or $60,000 for a family of four) receive reduced cost-sharing, meaning their plans have lower deductibles. Typically, silver plans have an actuarial value of 70%, meaning that on average the plan pays 70% of the cost of covered benefits for a standard population of enrollees, with the remaining 30% of total costs being covered by the enrollees in the form of deductibles, copayments, and coinsurance.