Understanding Policy Premiums and Benefits in Insurance

Policies in insurance involve premiums coming in along with investment income, while benefits like death and surrender are paid out. Expenses, taxes, and other factors impact the cash flow and accumulated earnings. Assumptions play a crucial role in pricing specific products, and various factors affect fund values in policies like UL. Calculations involve premium and interest crediting against expenses like cost of insurance and withdrawals. Comparing asset shares to cash surrender values is crucial for decision-making.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

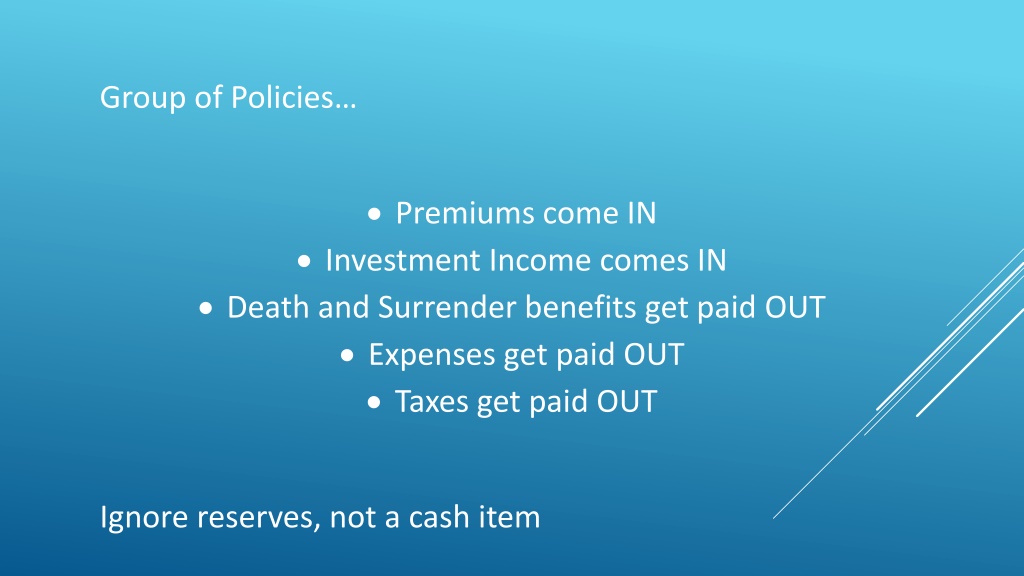

Group of Policies Premiums come IN Investment Income comes IN Death and Surrender benefits get paid OUT Expenses get paid OUT Taxes get paid OUT Ignore reserves, not a cash item

Year Premium Investment Benefits Other Expenses Taxes Cash Flow Commissions Accumulated Cash Flow Earnings 1 $2,840 (95) 82 2,414 2,106 (577) (1,280) (1,280) 2 $2,725 69 111 136 47 (315) 2,815 1,535

Assumptions: Earned rate on investments Lapse and mortality rates Expenses Tax rates Any other assumptions important in pricing your particular product

Factors impacting fund value on a UL policy Cost of Insurance rates expense charges crediting rates surrender charges.

Calculating fund value: Premium IN, Interest Crediting IN, Cost of Insurance OUT, Expense Charges OUT, Withdrawals OUT

Compare Projected asset shares, to Projected cash surrender values

ONE HOUR LATER

Nonguaranteed elements Cost of insurance rates Expense charges Crediting rates

ONE HOUR LATER

Illustrations: Basic Supplemental In Force

References: Code of Professional Conduct Qualification Standards NAIC Model Illustration Regulation ASOP 24, Compliance with the NAIC Life Insurance Illustration Model Regulation . ASOP 12, Risk Classification ASOP 23, Data Quality ASOP 41, Actuarial Communications ASOP 56, Modeling

Nonguaranteed elements Cost of insurance rates Expense charges Crediting rates A scale is a set of nonguaranteed elements

Disciplined Current Scale (DCS) keeps illustration actuary honest Nonguaranteed elements set in a specific way Assumptions: Earned rate on investments Lapse and mortality rates Expenses Tax rates

Disciplined Current Scale (DCS) more Use assumptions to project asset shares. Use assumptions and DCS nonguaranteed elements to project cash surrender values. If asset shares > cash surrender values at durations after 15 you pass the test. It is duration 20 and after for some joint life policies.

Currently Payable Scale How nonguaranteed elements currently set Illustrated Scale How nonguaranteed elements set in illustrations. Cannot exceed the lesser of the currently payable scale or the DCS. Simplest if three scales the same.