Resident Educator Program Orientation

This orientation program provides information on the Ohio Resident Educator Program, including topics such as teacher residency and induction programs, mentoring principles, and the Resident Educator Summative Assessment (RESA). It also discusses the different types of Resident Educator Licenses and

1 views • 26 slides

Best Residential assisted living homes in San Pedro

A choice is made by the prospective resident as to the size and location of the apartment. An application is filled out with the prospective resident. Harbor Terrace requires a fully refundable fee to hold the desired studio or one-bedroom apartment for 30 days. Upon move in, this amount is applied

1 views • 3 slides

Toolkit to better understand the ACGME Resident survey

The ACGME Resident Survey is an annual tool designed to capture residents' clinical, educational, and learning environment experiences. It aids in program accreditation and improvement by providing confidential aggregate data. Residents are encouraged to answer honestly as it does not impact program

0 views • 25 slides

Tower Hamlets Annual Resident Survey 2023 Results Overview

The Tower Hamlets Annual Resident Survey 2023 provides insights into residents' feedback and opinions on various aspects. Conducted by MEL Research, the survey aims to capture a representative sample of residents in Tower Hamlets, highlighting statistical significance and methodology details. The su

1 views • 32 slides

Resident Panel Meeting Highlights and Progress Update

The Resident Panel on March 22, 2023, covered various crucial topics including the DLUHC Make Things Right campaign, actions taken post the Rochdale inquest, knowledge and information management, and engagement with residents on emerging issues like damp and mould. The meeting showcased updates on c

2 views • 29 slides

Becoming a Resident at Harbor Terrace Retirement in San Pedro

Feel free to schedule a tour or see our brochure. We make it easy to get a better idea of what Harbor Terrace in San Pedro is all about. Our staff is ready to help you discuss the process of becoming a resident, our floor plans, services and all the amenities we have to offer. Harbor Terrace is idea

3 views • 4 slides

Journey to Forever: Navigating Spousal Sponsorship in Canada!

Spousal Sponsorship Canada refers to a process whereby a Canadian citizen or permanent resident sponsors their spouse or common-law partner to become a permanent resident of Canada. This sponsorship program is designed to reunite families by allowing eligible spouses or partners of Canadian citizens

2 views • 8 slides

Achieve Your Canadian Dream Together: The Ultimate Spousal Sponsorship Guide!

Spousal Sponsorship Canada refers to a program facilitated by the Canadian government where a Canadian citizen or permanent resident can sponsor their spouse or partner from another country to become a permanent resident of Canada.

4 views • 10 slides

Roles and Responsibilities of Resident Assistants in College Communities

Resident Assistants (RAs) are student leaders appointed by colleges to enhance the support network for residents. They promote community development, enforce policies, respond to emergencies, and maintain a safe residential environment. Successful RAs possess qualities like social maturity, adaptabi

0 views • 14 slides

City of Ontario 2021 Resident Satisfaction Survey Results

The City of Ontario 2021 Resident Satisfaction Survey indicates that over three-fourths of residents rate Ontario as an excellent or good place to live. The survey covers various aspects including demographics, rating of the city as a place to live, perception of the city's direction, and residents'

0 views • 36 slides

Prairie View A&M New Student Orientation & Tuition Plans

Prairie View A&M welcomes new students to choose between a guaranteed tuition & fee plan and a variable rate plan. Students will be assigned cohort groups based on admission terms. The guaranteed plan locks in rates for 5 years, offering financial stability. Resident and non-resident fee breakdowns

0 views • 33 slides

The Aliens Have Landed: A Strange Encounter in Verse

In this quirky poem by Kenn Nesbitt, the arrival of aliens is described in vivid detail, portraying them as grotesque creatures with tentacles, weird machine heads, and bodies resembling cauliflower. The poetic verses highlight the aliens' peculiar features and humorous depiction, culminating in a s

0 views • 7 slides

Greensboro Housing Authority Resident Advisory Board Meeting FY2022 Agency Plan Overview

The Agency Plan serves as a detailed roadmap outlining Greensboro Housing Authority's policies, programs, operations, and strategies to meet local housing needs and goals. It includes components such as the Admissions & Continued Occupancy Policy (ACOP) and the Housing Choice Voucher Program Adminis

0 views • 12 slides

Understanding Residential Status for Income Tax Purposes

Tax is levied on the total income of an individual based on their residential status as per the Income-tax Act, 1961. The Act classifies assessable persons into Ordinary Resident, Resident but not Ordinarily Resident, and Non-Resident. Residential status is determined by the physical presence of an

0 views • 26 slides

Wiltshire Extra Care Housing Resident Co-production Session

Welcome to the Wiltshire Extra Care Housing Resident Co-production Session where the focus is on discussing a new support model for extra care. The session includes introductions, presentations, breakout groups for sharing ideas, and receiving feedback on the proposed approach to co-production. Join

1 views • 23 slides

Understanding Normal Human Microbiota and Its Role in Health

Normal human microbiota refers to the microorganisms residing on our skin and mucous membranes, playing vital roles in digestion, immunity, and protection against pathogens. They are categorized into resident and transient groups, with resident flora aiding in maintaining health by synthesizing nutr

0 views • 28 slides

Preventing and Responding to Resident-to-Resident Mistreatment in Long-Term Care Facilities

Resident-to-resident mistreatment (RRM) in long-term care settings can cause physical and psychological distress to residents. This presentation covers the definition of RRM, practical solutions for prevention, the importance of individualized care, and reporting procedures. Examples of RRM include

0 views • 27 slides

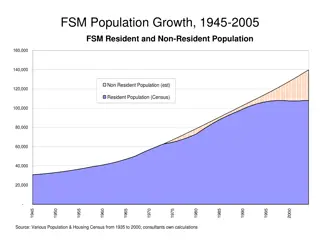

Economic and Demographic Trends in Federated States of Micronesia (1945-2004)

Population growth, employment trends, educational attainment, fishing enterprise profits, tourism statistics, subsistence economy share, and agricultural exports in Federated States of Micronesia between 1945 to 2004. The data covers resident and non-resident populations, employment in FSM and abroa

0 views • 9 slides

Overview of Tax Reform for Acceleration and Inclusion (TRAIN) Income Tax Regulations

Detailed briefing on the provisions of RA 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) law, specifically focusing on the revised income tax rates for individual citizens and resident aliens of the Philippines for the years 2018-2022 and beyond. The summary includes upda

0 views • 74 slides

Long-Term Care Regulation Provider Meeting Overview 2016

Long-term care regulation provider meeting in 2016 covered key scenarios like releasing or refusing readmission of residents, inability to meet resident needs, improved resident health, safety and health concerns, resident payment failures, and facility closure. Documentation requirements from physi

0 views • 23 slides

Admission, Transfer, and Discharge Guidelines for Virtual Resident Family Action Council

Explore essential information on admission procedures, rights, services, and practitioner affiliations for Virtual Resident Family Action Council members. Understand the materials you should receive, refund and bed hold policies, assessments, and resident rights. Be informed before signing any agree

0 views • 52 slides

Maximizing Resident Engagement through Appreciation

Learn how to enhance resident and family councils by maximizing engagement through appreciation, active listening, and fostering positive changes. Explore the importance of creating a supportive environment for residents in nursing homes, and discover effective strategies to improve quality of life.

0 views • 16 slides

Effective Feedback Strategies for Resident Teachers

Effective feedback is critical for the growth of resident teachers. This guide covers types of feedback, why it's important, what makes feedback effective, behaviorally anchored rating scales, models for giving feedback, and key tips for delivering feedback successfully.

0 views • 14 slides

Understanding the ACGME Resident Survey: Insights and Guidelines

The ACGME Resident Survey is conducted annually to gather confidential data on residents' clinical and educational experiences. The survey aids in program accreditation and identifies areas for improvement. Answer honestly as it does not impact accreditation. The survey covers experiences from July

0 views • 27 slides

New Student/Resident IT Orientation & Requirements 2024

As a new student or resident at Emory School of Medicine, it is mandatory to own a laptop meeting or exceeding SOMITS minimum IT requirements. This includes specific specifications for memory, storage, operating system, and CPU. Devices must be no more than four years old, and students must refresh

0 views • 10 slides

Understanding Access to Healthcare in Northern Ireland

Access to healthcare services in Northern Ireland is crucial for the well-being of residents and eligible visitors. Family Practitioner Services play a significant role in providing advice, training, and verification for entitlement to publicly funded healthcare. The main legislation, including the

0 views • 19 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Graduate Student Tax Reporting & Financial Support Overview

This document provides information on tax reporting for graduate student payments at the School of Medicine & Dentistry, including details on fellowships, assistantships, and tax obligations for non-resident aliens. It covers job codes, tax treaties, necessary documentation, and withholding requirem

0 views • 34 slides

Enhancing Resident Retention Strategies for Property Managers

Explore the importance of resident retention, key components of successful programs, reasons for move-outs, and ways to improve retention rates. Learn how to create a welcoming environment, utilize customer service, enhance maintenance follow-ups, and boost resident satisfaction to stabilize propert

0 views • 15 slides

Understanding U.S. Graduate Student Tax Reporting for Fellowships and Assistantships

U.S. Graduate Student Tax Information Session for U.S. students and resident aliens covers tax reporting rules for fellowships and assistantships. It discusses taxable and non-taxable aspects based on expenditure categories. Tips on accessing and utilizing tax-related documents are provided.

0 views • 63 slides

Tax Reporting Guidelines for Graduate Students in the US - March 2020

This document provides tax reporting guidelines for US citizens, permanent residents, and resident aliens who receive fellowship or assistantship payments. It explains the tax implications of these payments, detailing what is considered taxable and non-taxable income. The document also outlines the

0 views • 44 slides

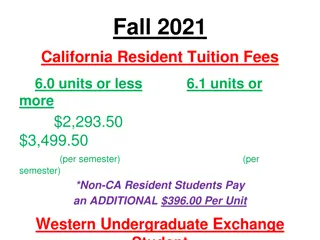

CSUEB Fall 2021 Tuition Fees and Payment Information

The Fall 2021 tuition fees for California resident students at CSU East Bay range from $2,293.50 to $3,499.50 per semester for 6.0 units or less. Non-CA resident students pay an additional $396.00 per unit. The installment plan includes three payments with deadlines, and late fees apply for missed p

0 views • 11 slides

Graduate Non-Resident Tuition Exception Form Overview

Explore the Graduate Non-Resident Tuition Exception Form, an online tool for submitting requests for non-resident tuition waivers. This comprehensive guide covers the form's structure, pre-populated sections, requester and student information input, funding request details, and the submission proces

0 views • 23 slides

Managing Combative Residents in Long-Term Care

Residents in long-term care facilities may exhibit combative behaviors due to underlying psychiatric conditions, cognitive impairment, or dementia. This aggression poses challenges for both staff and other residents. Caregiver training is crucial for identifying triggers and managing combative episo

0 views • 17 slides

Understanding Hawaii State Tax Workshop for Nonresident Aliens

This overview delves into the nuances of Hawaii state tax regulations, focusing on key differences and similarities with federal tax laws. It covers residency classifications, filing requirements, domicile establishment, and the criteria for Hawaii residents for tax purposes. Whether you are a domic

0 views • 20 slides

Understanding Illegal Aliens and Immigration Policy in the United States

The concept of illegal aliens in the United States dates back to the 1798 Alien and Sedition Acts. While U.S. law differentiates between aliens and immigrants, there is no explicit definition of "illegal alien." The Immigration Acts of the 1920s led to the emergence of illegal immigration as a signi

0 views • 6 slides

Exploring Aliens: From Beliefs to Imagination

Delve into a thought-provoking journey discussing the existence of aliens, from popular beliefs to creative imagination. Engage in activities ranging from brainstorming famous alien depictions in media to drawing your own interpretation. Reflect on the idea of interacting with aliens and ponder thei

0 views • 12 slides

Understanding U.S. Tax Information for Foreign Students

Foreign students in the United States must navigate complex tax regulations based on their residency status. This includes distinctions between resident and nonresident aliens for tax purposes, income tax withholding requirements, types of taxable income, and considerations for student compensation

0 views • 16 slides

Transforming Long-Term Care: Resident-Directed Culture Change

The content discusses the crucial shift towards resident-directed care in long-term care facilities through culture change practices, emphasizing person-first language, resident empowerment, and system improvements. It explores the philosophy, practices, and language adaptations necessary to enhance

0 views • 31 slides

Third Party Lending Overview 2020

This overview provides insights into third-party lending in 2020, featuring details on wholesale and correspondent portfolio lending, Axos Bank's corporate profile and focus areas, jumbo/super jumbo loans, non-resident alien loans, asset depletion, cross-collateralization, and more. The content cove

0 views • 25 slides