Challenges and Opportunities for Reforms of Non-Oil Revenues Administration in South Sudan

The presentation highlights the reliance on oil revenues in South Sudan and the need for reforms in non-oil revenue administration. It discusses sources of non-oil revenue, factors hindering revenue mobilization, and opportunities for reforms to diversify the economy. The objectives of non-oil reven

3 views • 23 slides

Enhancing Domestic Revenue Mobilization in South Sudan: NRA Initiatives

The presentation by Hon. Athian Ding Athian, NRA Commissioner General, at the 1st National Economic Conference in South Sudan focused on the National Revenue Authority's mandate, strategic plan, revenue performance, and policy options for boosting non-oil revenue. The NRA aims to achieve a Tax-to-GD

1 views • 21 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

0 views • 7 slides

Multivariate Analysis

Explore the key concepts of marginal, conditional, and joint probability in multivariate analysis, as well as the notion of independence and Bayes' Theorem. Learn how these probabilities relate to each other and the importance of handling differences in joint and marginal probabilities.

5 views • 43 slides

How to get Small Marginal Farmer Certificate in Tamil Nadu

The Marginal Farmer Certificate is issued by the Tahsildar\/Deputy Tahsildar in the Taluk to farmers who own up to 2.5 acres. This certificate allows them to avail of subsidy programs for micro-irrigation and water management. Farmers with more than five acres do not need certificates to access thes

2 views • 5 slides

An Introduction to Cargo Revenue Management

\nIn the bustling world of air cargo, where efficiency and profitability are paramount, Cargo Revenue Management (CRM) emerges as a pivotal strategy for airlines and logistics companies. This intricate process involves the optimization of cargo space to maximize revenue, ensuring that every inch of

3 views • 5 slides

Revenue Management Systems (RMS) for Cargo

In the competitive and dynamic world of cargo transportation, optimizing revenue is crucial for the sustainability and growth of businesses. Revenue Management Systems (RMS) for cargo have emerged as vital tools in this endeavor, leveraging advanced technology to enhance profitability. This blog pro

1 views • 7 slides

Revenue Management for Air Cargo by Revenue Technology Services

Revenue management for air cargo is a crucial aspect of modern logistics, aimed at maximizing revenue through effective planning and strategic pricing. Revenue Technology Services (RTS) offers innovative cargo solutions designed to optimize the use of air cargo space, enhance operational efficiency,

1 views • 6 slides

Collaborative Planning in Cargo Revenue Management

In today's fast-paced and competitive logistics industry, effective cargo revenue management is crucial for maximizing profitability and ensuring operational efficiency. Revenue Technology Services (RTS) has been at the forefront of providing innovative solutions for the cargo industry, emphasizing

1 views • 6 slides

Compliance and Regulatory Considerations in Cargo Revenue Management

Cargo revenue management is an intricate balancing act that involves maximizing revenue while managing the capacity and pricing of cargo space. For companies like Revenue Technology Service (RTS), the key to successful cargo revenue management lies not only in optimizing these factors but also in en

1 views • 5 slides

Training and Development for Cargo Revenue Managers

In today's fast-paced and ever-evolving business environment, the role of a cargo revenue manager is more critical than ever. The field of cargo revenue management is a dynamic and complex area that requires professionals to stay updated with the latest industry trends, technologies, and strategies.

1 views • 6 slides

Advanced Analytics for Cargo Revenue Enhancement

In the fast-evolving world of logistics and transportation, optimizing revenue streams is crucial for maintaining competitive advantage. One of the most effective ways to achieve this is through advanced analytics. Leveraging sophisticated data analysis techniques, revenue technology services can tr

1 views • 5 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

Virgin Islands Police Department Revenue Estimation Conference Highlights

The Virgin Islands Police Department held a revenue estimating conference on March 14, 2023, led by Commissioner Ray Martinez. The event discussed current fees for various services provided by the department, revenue generation and projections over fiscal years, annual revenues and projections, as w

1 views • 10 slides

Understanding the Law of Equi-Marginal Utility in Economics

Law of Equi-Marginal Utility, propounded by Hermann Heinrich Gossen, explains how consumers distribute their income among different goods to maximize satisfaction. It involves equalizing the marginal utility per unit of money spent across various goods. The law is based on the assumptions of rationa

0 views • 8 slides

Understanding Equilibrium in Perfect Competition Markets

Perfect competition in economics refers to a situation where numerous buyers and sellers are involved in trading identical goods freely, with full market knowledge and no government restrictions. Key characteristics include a large number of buyers and sellers, homogeneous products, free entry and e

1 views • 14 slides

Understanding Utility: Marginal vs. Total Utility

Utility in economics is the satisfaction derived from consuming goods or services. Marginal utility measures the change in total utility as consumption increases, whereas total utility is the sum of satisfaction obtained from consuming different units of a commodity. Consumers aim to maximize total

2 views • 11 slides

Understanding Utility: Meaning, Concept, and Law of Diminishing Marginal Utility

Utility is the satisfaction or well-being a consumer derives from consuming goods or services. Total utility is the sum of satisfactions, while marginal utility is the additional satisfaction from one more unit consumed. Utility can be measured and ranked but not numerically. The Law of Diminishing

3 views • 9 slides

Understanding Revenue Concepts in Different Market Conditions

Explore revenue concepts like Total Revenue (TR), Marginal Revenue (MR), and Average Revenue (AR) along with elasticity of demand in various market structures such as perfect competition, monopoly, monopolistic competition, and oligopoly. Learn about short and long-run equilibrium conditions and the

0 views • 21 slides

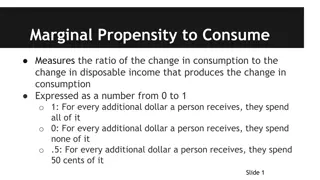

Understanding Marginal Propensity to Consume and Save

Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS) measure the ratios of change in consumption and saving to change in disposable income respectively. The relationship between MPC and MPS shows that they equal 1 when combined, with the remainder being saved. The multiplier ef

7 views • 5 slides

County Government Revenue Sources and Allocation in Kenya

The county government revenue in Kenya is sourced from various avenues such as property rates, entertainment taxes, and service charges. Equitable share forms a significant part of this revenue, allocated based on a formula developed by the Commission on Revenue Allocation. The funds given through t

0 views • 14 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

Revenue synergy

,\n\nI'm excited to introduce Revenue Synergy's exceptional revenue cycle management and medical billing services. As the top medical billing company in the US, we offer innovative solutions that optimize your revenue cycle and enhance financial performance. Our team ensures precise billing, minimiz

0 views • 5 slides

Analysis of 2021 Marginal Generation Costs for San Diego Gas & Electric

The analysis presents the 2021 Marginal Generation Costs methodology filed by San Diego Gas & Electric in April 2016 for the Time-of-Use (TOU) OIR Workshop. It includes forecasts for Marginal Energy Costs (MEC) and Marginal Generation Capacity Costs (MGCC) for the calendar year 2021, based on market

0 views • 6 slides

ALA FY 2017 Financial Report Summary

ALA's FY 2017 financial report highlights total revenues, expenses, net operating revenue, revenue sources, general fund summary, and detailed revenue and expense breakdowns. Revenues amounted to $48,808,627 with net revenue of $314,944. Key revenue sources included dues, contributions, grants, and

1 views • 16 slides

Understanding Marginal Analysis in Economic Decision-Making

Marginal analysis involves comparing Marginal Benefit with Marginal Cost to determine the optimal quantity for an activity. If Marginal Benefit is greater than Marginal Cost, there is a Net Marginal Benefit; if it's less, there's a Net Marginal Cost. The principle helps weigh costs and benefits befo

0 views • 14 slides

Alisal Union School District 2021-2022 Budget Workshop Overview

The Alisal Union School District held a budget workshop to review revenue projections, expenditure projections, enrollment and staffing projections, additional federal and state funding, and supplemental and concentration expenditures. The workshop highlighted revenue sources, including local contro

2 views • 26 slides

Maximizing Profit in a Corn Production Scenario

In a perfectly competitive labor market producing corn, we aim to determine the optimal number of farmworkers to hire for profit maximization. By comparing the Marginal Revenue Product and Marginal Factor Cost, we analyze the additional corn production with each added worker. Through step-by-step ca

0 views • 12 slides

Optimizing Labor for Profit in a Competitive Market

Understanding the profit-maximizing quantity of labor in a competitive market for corn production. Analyzing the relationship between marginal revenue product and marginal factor cost to determine the ideal number of farmworkers to hire for maximum profits. A step-by-step mathematical calculation pr

0 views • 11 slides

Understanding Competitive Factor Market in Labor Economics

A competitive factor market involves a large number of sellers and buyers of a factor of production, like labor. With no single entity influencing prices, each acts as a price taker. The demand for factors depends on firms' output levels and input costs, leading to derived demands. Profitability of

0 views • 43 slides

Understanding Revenue Limits and Calculation Process in School Financial Management

This educational material covers topics such as revenue limits, the components within revenue limits, what falls outside of the revenue limit, and a four-step process for revenue limit calculation in the context of school financial management. It includes detailed information on the regulation of re

0 views • 34 slides

Understanding Monopolies in Economics

Monopolies are considered inefficient because they can earn long-term profits. In a monopoly equilibrium, the relationship between price, marginal revenue, and marginal cost differs. Natural monopolies can supply goods at lower costs. Compared to perfectly competitive firms, monopolies charge higher

0 views • 14 slides

Understanding Revenue Requirements for Non-program Food Sales

Non-program food revenue plays a crucial role in school food service operations. Schools need to ensure that the revenue from non-program food sales meets a specified proportion to cover costs effectively. Failure to comply may result in corrective action during reviews by the state agency. To meet

0 views • 9 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Understanding Profit Maximization and Revenue Concepts in Economics

Explore the concepts of profit maximization, revenue generation, and marginal analysis in economics. Learn how to define profit, calculate total revenue and cost, and understand marginal revenue. Discover the significance of marginal value of product and its impact on business decision-making.

0 views • 60 slides

Analysis of State Budget Trends by John Gilbert - Nov. 1, 2020

This comprehensive analysis by John Gilbert, a Budget and Revenue Analyst, delves into the multiyear trend of state budget outlook, general revenue fund trends, sources, growth, and projections. The analysis includes comparisons between revenue and expenditures, trend-based revenue projections, grow

0 views • 5 slides

The Economics and Politics of Foreign Aid and Domestic Revenue Mobilization

This study explores the relationship between foreign aid, taxation, and domestic revenue mobilization, highlighting the impact of aid on tax/GDP ratios and the constraints faced in revenue systems. It discusses how aid influences policy choices, accountability, and bureaucratic costs, impacting reve

0 views • 25 slides

Understanding Revenue Recognition Guidelines under LKAS 18

LKAS 18 provides guidelines on how to recognize revenue from various sources like sale of goods, rendering services, interest, royalties, and dividends. Revenue recognition is based on specific conditions being met, such as transfer of risks and rewards of ownership, reliable measurement of revenue,

0 views • 26 slides

Understanding Marginal Productivity in Health Economics

Learn about the concept of marginal productivity in health economics, the difference between average and marginal productivity, and how it applies to the productivity of medical care. Discover examples of how productivity changes along the extensive margin in specific medical interventions like scre

0 views • 30 slides

Overview of Exchequer Returns for End-Q1 2023

The Exchequer Returns for End-Q1 2023, as reported by John McCarthy, Chief Economist of the Department of Finance, indicate a year-on-year increase in total revenue, driven by growth in tax revenue. However, non-tax revenue decreased significantly. Expenditure also saw a notable rise, particularly i

0 views • 12 slides