Cost Of Production

Explore the concepts of production cost analysis, focusing on total fixed costs, total variable costs, total cost of production, average cost, and average fixed cost. Learn how these costs behave in the short run and their impact on a firm's operations.

1 views • 26 slides

FSS Escrow Calculation and Regulatory Updates Summary

Comprehensive overview of the new escrow calculation workbook, regulatory updates, and changes to the Final Rule for FSS escrow calculation. Key topics include FSS terminology, calculation examples, and important points for locally generated housing funds. The Final Rule changes include uncapped esc

4 views • 9 slides

Mushroom Production Profit Calculation and Business Models

Explore the profit calculation and business models for Paddy Straw Mushroom and Oyster Mushroom production. Learn about the capital investments needed, economics of production per bed, and potential profits. Discover the cost breakdown and quantities required for setting up a mushroom production bus

2 views • 5 slides

Comprehensive Cost Management Training Objectives

This detailed training agenda outlines a comprehensive program focusing on cost management, including an overview of cost management importance, cost object definition, cost assignment, analysis, and reporting. It covers topics such as understanding cost models, cost allocations, various types of an

4 views • 41 slides

Prime Cost in Production Accounting

Explore the concept of prime cost in production accounting through detailed statements and calculations. Learn how to calculate prime cost based on raw material purchases, direct wages, expenses, and more. The provided examples illustrate the breakdown of costs involved in producing goods or service

1 views • 20 slides

Cost-Benefit Analyses for Liquid Biopsy Studies: Understanding Health Economics and Decision Making

Health economics and decision making play a crucial role in evaluating the clinical utility and cost-effectiveness of liquid biopsies. Economic models such as cost-effectiveness analyses help in determining the incremental cost-effectiveness ratio (ICER) of interventions. Studies have shown varying

0 views • 23 slides

Academic Senate Resolutions and Low-Cost Thresholds in Higher Education

The Academic Senate addresses the adoption of open educational resources (OER) and low-cost materials to support academic freedom and compliance with legislative requirements. The resolution discusses the definition of low-cost resources and the variability among California Community Colleges in set

3 views • 9 slides

Simple Average Method in Cost Accounting

Simple Average Method, introduced by M. Vijayasekaram, is a technique used for inventory valuation and delivery cost calculation. It involves calculating the average unit cost by multiplying the total unit costs with the number of receiving instances. This method simplifies calculations and reduces

2 views • 5 slides

Cost Accounting Essentials

This overview delves into topics such as financial accounting, classification of accounts, cost ascertainment, and management accounting. It covers the meaning of cost, methods and techniques of costing, advantages and limitations of cost accounting systems, and essentials for a robust cost accounti

4 views • 27 slides

Project Cost Estimation: Methods and Factors

Project cost estimation involves valuing all monetary aspects necessary for planning, implementing, and monitoring a project. This includes various entrants such as preliminary investigation costs, design fees, construction expenses, and more. The purpose of cost estimation is to determine work volu

1 views • 44 slides

Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

1 views • 20 slides

FTES Calculation in California Community Colleges

California Community Colleges use Full-Time Equivalent Students (FTES) to allocate apportionment revenue based on student attendance. FTES calculation involves factors like clock hours, class hours, passing time/breaks, and multiple-hour classes. Understanding these components is essential for educa

2 views • 35 slides

Cost Control and Cost Reduction Strategies in Business: Understanding Implementation Challenges

Understanding the concepts of cost control and cost reduction is crucial for businesses, but implementing them can be challenging. This chapter explores the influencing factors for success in cost control and reduction, emphasizing the importance of cultural aspects, leadership, and management appro

2 views • 15 slides

Activity-Based Costing (ABC) in Cost Management

Activity-Based Costing (ABC) is a strategic costing method that allocates overhead costs to products based on activities. It offers benefits such as accurate cost allocation and identifying cost drivers but also has challenges due to increased complexity and customization. ABC differs from tradition

1 views • 15 slides

Analysis of Change in EAL Calculation Scenarios

In this analysis, Sanchir Dashnyam, the ERCOT Market Credit Manager, discusses the change in the EAL calculation formula, exploring different scenarios and their impacts on ERCOT markets. The scenarios involve adjustments to the application of RFAF against various parameters, aiming to optimize the

0 views • 7 slides

The Cost of Capital in Finance

The cost of capital is crucial for businesses to determine the average cost of their finance. The Weighted Average Cost of Capital (WACC) is used as a discount rate in financial calculations. It involves estimating the cost of each source of finance and calculating a weighted average. Additionally,

0 views • 14 slides

Multinational Cost of Capital

Multinational corporations determine their cost of capital based on the cost of debt and equity. The cost of debt includes the interest rate and credit risk premium, while the cost of equity reflects the risk premium investors demand. Estimating an MNC's cost of capital involves assessing these comp

4 views • 24 slides

Cost Accounting: Techniques and Processes

Cost accounting is a specialized branch of accounting that involves the accumulation, assignment, and control of costs. It encompasses techniques like ascertainment of costs, estimation of costs, and cost control to aid in decision-making. Cost accounting plays a crucial role in budgeting, standard

2 views • 11 slides

Factors Affecting the Amount of Depreciation in Asset Valuation

Depreciation in asset valuation depends on the cost, estimated useful life, and probable salvage value. The cost of an asset includes various expenses incurred to put it in working condition. Estimated net residual value is the expected sale value of the asset at the end of its useful life after ded

3 views • 5 slides

Assessment of Cost Recovery Methodology Alignment with General Assembly Resolution 67-226

This report assesses the consistency and alignment of the cost recovery methodology used by UNDP/UNFPA, UNICEF, and UN Women with General Assembly Resolution 67-226. Issues such as declining core funding, the need to avoid cross-subsidization, and the importance of full cost recovery are highlighted

1 views • 14 slides

Veterinary Prescription Cost Calculations

Learn how to calculate the cost of veterinary prescriptions based on total dosage, drug strength, and unit cost. Two scenarios are provided with detailed calculations for determining the total cost of the prescription. Understand how to convert units, calculate total dosage required, determine the n

0 views • 11 slides

Costs and Pricing for Your Business Training

This training session covers various aspects of cost identification, calculation, and pricing for businesses. Learn about different types of costs, how to calculate the cost of goods or services, pricing strategies, and classification of costs. Engage in group discussions, explore cost data, and und

0 views • 36 slides

Report on Effective Cost Recovery Rates by UNDP for 2014-2017

The joint report on cost recovery by UNDP for the years 2014-2017 provides detailed evidence and analysis of the effective average cost recovery rates, compliance with cost recovery policy, and calculations based on financial information. The report highlights contributions from various sources, inc

1 views • 23 slides

Introduction to Industrial Costing: Understanding Cost Types and Accounting Systems

Explore the fundamentals of industrial costing, including different cost types and accounting systems such as actual cost accounting, normal cost accounting, and standard cost accounting. Learn about cost data control, tasks of cost accounting, and the integration of cost type accounting in cost and

2 views • 24 slides

Overview of Benefit-Cost Analysis in Policy Decision Making

This chapter delves into benefit-cost analysis as an essential tool in policy evaluation. It outlines the steps involved in conducting a benefit-cost analysis, emphasizes the significance of defining and quantifying policy problems, and highlights the importance of identifying the seriousness of soc

0 views • 40 slides

Analyzing Telecom Network Cost in East Africa

This expert-level training workshop conducted in Arusha in 2013 delved into the country-by-country analysis of telecom network cost modeling in the East Africa region. The workshop covered topics such as regulatory frameworks, transparency, skills and resources, cost accounting, depreciation methods

0 views • 44 slides

Back-End Ocean Data Analysis Program for LCS Calculation

A program designed to automatically retrieve ocean data over an eight-day period and compute Lagrangian Coherent Structures (LCS) on a daily basis. The generated data can then be plotted to visualize the LCS patterns in the ocean. Motivated by guiding fluid flows, the program can aid in predicting t

0 views • 11 slides

Efficiency Enhancement in PHITS: Variance Reduction Techniques for Particle and Heavy Ion Transport

Explore techniques for improving calculation efficiency in the PHITS Multi-Purpose Particle and Heavy Ion Transport code system. Topics covered include neutron deep penetration calculation, effective dose calculation, and use of variance reduction techniques to enhance Monte Carlo simulation efficie

0 views • 24 slides

GAO Cost and Schedule Assessment Guides: Enhancing Government Accountability

The Government Accountability Office (GAO) plays a crucial role in supporting Congress to fulfill its responsibilities by improving federal government performance and ensuring accountability. The GAO Cost Estimating and Assessment Guide outlines criteria for assessing cost estimates, and the Reliabl

0 views • 19 slides

Comprehensive Guide to Project Cost Management

This module delves into the essential aspects of project cost management, outlining key processes like planning, estimating, budgeting, and control. By learning to recognize the significance of cost management, develop precise cost estimates, and manage project costs efficiently, you can align your

0 views • 18 slides

Overview of Calculation Tools for Mitigation Data Analysis Program under UNFCCC Secretariat

This content discusses various calculation tools used in the Mitigation Data Analysis program of the UNFCCC Secretariat. It includes tools for GHG projections, financial support, and their integration into Country briefs to facilitate accurate data presentation and reduce workload during reviews. De

0 views • 7 slides

Managing Summer Cost Share for Faculty with 9-Month Appointments

Explore the process of setting up and monitoring summer cost share for faculty with 9-month appointments. Learn why cost share for summer may not display on the FEC, how GCA establishes cost share using the Cost Share Module, and how departments should adjust the FEC to reflect summer cost share acc

1 views • 15 slides

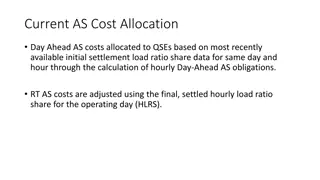

Cost Allocation Strategies for Ancillary Services in Electricity Markets

Cost allocation for Ancillary Services (AS) in the electricity market involves distributing costs to Qualified Scheduling Entities (QSEs) based on load ratio share data. Two options are presented: one calculates separate hourly Real-Time Co-optimized Load (RCL) and Non-RCL Load Ratio Share (LRS) for

0 views • 5 slides

Joint UNDP, UNFPA, UNICEF, UN Women Executive Boards Cost Recovery Briefing

Briefing on cost recovery for the joint Executive Boards of UNDP, UNFPA, UNICEF, and UN Women, covering topics such as feedback on cost recovery, role of core resources, cost recovery models using a LEGO approach, harmonization efforts, guidance for Executive Boards, and next steps towards proposing

1 views • 42 slides

Cost Calculation and Inventory Analysis for Manufacturing Companies

This content delves into the calculation of various costs and inventory data for manufacturing companies based on specific scenarios and information provided. It covers topics like direct materials inventory, manufacturing overhead costs, labor costs, finished goods inventory, and more, offering a d

0 views • 20 slides

Income Tax Calculation and Salary Calculation

This educational content covers various aspects of income tax calculation, including taxable rates, personal allowances, and calculations for different salary levels. It explains how to determine weekly, monthly, and annual salaries and provides examples of income tax calculations for different inco

0 views • 23 slides

Inflation and CPI Calculation

Learn about inflation and the Consumer Price Index (CPI) calculation process. Inflation is the rise in the overall price level in an economy, impacting the cost of living. CPI measures the cost of goods and services purchased by an average consumer to track changes in the cost of living over time. T

0 views • 39 slides

Defense Cost Reporting and Systems Overview

Defense Cost Analysis and Reporting Systems (CSDR) provide the cost community with essential data for developing independent cost estimates within major defense acquisition programs. The Defense Automated Cost Information Management System (DACIMS) offers instant access to historical cost informatio

0 views • 19 slides

Importance of Cost Accounting in Business Management

Cost accounting plays a crucial role in modern business environments where cost effectiveness and quality consciousness are vital for success. This branch of accounting helps in planning, controlling, and determining the costs of products or services, providing essential data for efficient managemen

1 views • 6 slides

Standard Costing Labour Variances Calculation at Jamal Mohamed College

The content presents a detailed calculation of labour cost variances, rate variances, efficiency variances, and mix variances using standard labour hours and rates for the production of Article A at Jamal Mohamed College's Research Department of Commerce. The calculations are broken down for skilled

0 views • 7 slides