Activity-Based Costing (ABC) in Cost Management

Activity-Based Costing (ABC) is a strategic costing method that allocates overhead costs to products based on activities. It offers benefits such as accurate cost allocation and identifying cost drivers but also has challenges due to increased complexity and customization. ABC differs from traditional costing methods like Absorption Costing by linking costs to activities accurately. Elements like activity cost pools and cost drivers play a crucial role in ABC implementation. The method involves identifying activities, estimating cost pools, determining cost drivers, calculating cost driver rates, and charging overheads to products.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

3 Activity Based Costing Chapter

Chapter Content ABC Benefits and problems Rationale Elements Method Conditions

Why are traditional OARs less reliable? Increased complexity of operation More customisation, more variety in range of overheads Increased percentage of overhead costs Reduced significance of labour More automation and computerisation Less volume related costs Smaller batches, non-homogenous products, non-volume related costs e.g. order handling, scheduling costs, quality control

Activity Based Costing (ABC) Absorption costing Charges overheads to products based on a hourly absorption rate No relation between overhead charged to a product and the product s consumption of overheads ABC Charges overheads to products on a causal basis using cost drivers

Absorption Costing Service Departments Production Departments Product Lines Stage 1 Stage 2 Assigning Costs Using Measures of Service Usage Allocating Costs Using a Measure of Volume

Activity Based Costing Service Departments and Factory Overhead Activity Cost Pools Product Lines Stage 1 Stage 2 Assigning Costs of Individual Activities Allocation of Costs Driver Rates

Elements of ABC Activity cost pool: An activity that incurs cost. Costs are linked to the activity accurately and from the activity to the cost unit. Knowledge of the activity is key to the application of ABC.

Elements of ABC Cost driver: This is the causal link between the activity and the cost unit. Cost drivers describe exactly how the production of units incur costs within the activity. The overhead is linked to the cost unit using a cost driver rate.

ABC Method 1. Identify activities 2. Estimate cost pools 3. Identify cost drivers 4. Calculate Cost Driver Rate = Total Cost of Activity Cost Driver Units 5. Charge overheads to products via cost driver rates

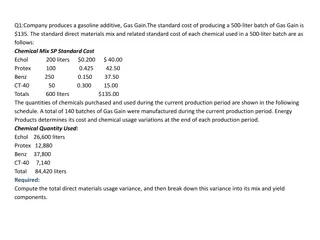

Example RS has recently introduced an activity based costing system. RS manufactures two products, details of which are given below: Budgeted production per annum (units) Batch size (units) Machine set-ups per batch Processing time per unit (minutes) Product R Product S 80,000 100 3 3 60,000 50 3 5 The budgeted annual costs for two activities are as follows: Machine set-up $180,000 Processing $108,000 Required: The budgeted processing cost per unit of Product R is: A $0.20 B $0.51 C $0.60 D $0.45

Favourable Conditions For ABC Production overheads are high relative to direct costs. Complex products or services Diversity in the product range. Diversity of overhead resource input to products. Consumption of overhead resources is not driven primarily by volume.

Benefits of ABC More accurate product line costs. More flexible the approach can analyse costs by processes, areas of managerial responsibility and customers. ABC avoids the problem of cost absorption on an inappropriate basis. Can be applied beyond production Provides meaningful financial (periodic cost driver rates) and non- financial (periodic cost driver volumes) measures. Improves cost estimation by accurate identification and understanding of cost behaviour. Leads to better cost control and pricing decisions

Limitations ABC information is historic and internally orientated and therefore lacks direct relevance for future strategic decisions. Practical problems such as cost driver selection. More expensive than traditional absorption costing as it requires more detailed information and analysis. Some arbitrary cost allocation may still be necessary