Prime Cost in Production Accounting

Explore the concept of prime cost in production accounting through detailed statements and calculations. Learn how to calculate prime cost based on raw material purchases, direct wages, expenses, and more. The provided examples illustrate the breakdown of costs involved in producing goods or services, helping you comprehend the key components of prime cost calculation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Other interest and financing charges for production of goods / operations or service rendered (CAS -17) (Only Net) Interest on Bank Loan Cash Discount allowed on sales (to customers)

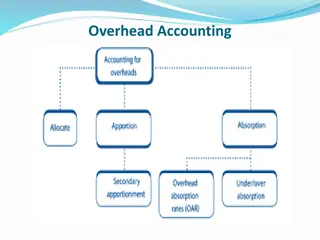

Total Cost Direct Cost Indirect Cost Direct Materials Indirect Materials Direct Expenses Indirect Expenses Direct Wages Indirect Wages Raw Materials First Head Forms of Material W-I-P -- Second Head (Factory Over Head) Finished Goods Third Head (Office Over Head)

Statement Showing Prime Cost Particulars Amount Total Opening Stock of Raw Materials 20,000 Add: Purchase of raw materials 1,05,000 Import Duty Carriage Inward Primary packing Materials 15,000 5,000 3,000 1,28,000 1,48,000 30,000 Less : Closing Stock of Raw Materials Raw Materials Consumed 1,18,000 Add : Productive Wages/ Direct Wages 95,000 Add: Direct Expenses Hire Charges on plant Other chargeable expenses 14,000 6,000 20,000 Prime Cost 2,33,000

2. Calculate Prime cost from the information given below. Purchase of raw materials- Rs. 50,000. Opening stock of raw materials- Rs.4,000. Closing stock of raw materials- Rs. 3000. Direct Wages- Rs. 16,000. Carriage/Freight inwards- Rs.2,000. Carriage outwards - Rs. 3,500. Direct expenses- Rs. 4,500. Indirect expenses- Rs.6,700. Duty on Purchase- Rs.250 Materials returned to suppliers (P/R)- Rs. 100 Material Sold- Rs. 250 Material Transferred to firm- Rs. 200 Scrap Sold Materials- Rs. 100 Loss by Fire Materials- Rs. 800 Calculation of Prime Cost.

Statement Showing Prime Cost Particulars Amount Total Opening Stock of Raw Materials 4,000 Add: Purchase of raw materials 50,000 Carriage Inward Duty on Purchase 2,000 250 56,250 Less : Material returned to suppliers (P/R) 100 Material Sold 250 Material Transferred to Firm Scrap Sold Materials 100 Loss by Fire Materials Closing Stock of Raw Materials 200 800 3,000 4,450 Raw Materials Consumed 51,800 Add : Productive Wages/ Direct Wages Add: Direct Expenses 16,000 4,500 Prime Cost 72,300

Direct material- Rs. 57,000 Direct wages- Rs. 28,500 Direct expenses Rs. 10,000 Factory rent & rates- Rs. 4,500 Indirect wages Rs. 5,000 Plant repairs & maintenance Rs.1,000 Plant depreciation- Rs. 1,250 Factory heating & lighting- Rs. 400 Factory manager s salary- Rs.2,000 Motive Charges- Rs. 4,600 Haulage- Rs. 3,500 Director Fees(Work/Factory)-Rs.1,500 Electricity Charges- Rs. 1,500 Fuel, Gas lubricants Etc- Rs. 1,000 Work Stationary- Rs 500 ESI-Rs. 600 Indirect Expenses- Rs. 700 Depreciation On Furniture Rs. 2,400 Water Supply_Rs. 1000 Drawing Office Salary- Rs 800 Office rent & rates- Rs. 500 Office Insurance- Rs. 700 Sundry office Expenses-Rs. 600 Office Salary- Rs.1,600 Director s remuneration(office)Rs.1,500 Telephone & postage- Rs. 200 Printing & stationery- Rs.100 Legal charges- Rs. 150 Counting House Salary-Rs. 900 Audit fees- Rs. 800 Bank Charges-Rs. 700 Advertisement- Rs. 1,500 Salesmen s salary- Rs. 2,500 Showroom rent- Rs. 500 Rent of Ware house- Rs. 500 Commission on Sales Rs. 1,920 Upkeep of Delivery Van-Rs. 600 Bad Debts- Rs. 200

Statement Of Cost Sheet Particulars Direct Materials Direct Wages Direct Expenses Amount Total 57,000 28,500 10,000 Prime Cost 95,500

Add: Factory Overhead Factory rent & rates 4,500 Indirect wages Plant repairs & maintenance Plant depreciation Factory heating & lighting Factory manager s salary Motive Charges 4,600 Haulage Director Fees (Work/Factory) Electricity Charges Fuel, Gas ,Lubricants Etc Indirect Expenses Depreciation On Furniture Water Supply Loose Tools Written Off Estimating Expenses Drawing Office Salary Work Stationary ESI 5,000 1,000 1,250 400 2,000 3,500 1,500 1,500 1,000 700 2,400 1000 500 700 800 500 600 33,450 Works/ Factory Cost 1,28,950

Add: Office & Administration overheads Office Salary Director s remuneration(Office) 1,500 Telephone & postage Printing & stationery Legal charges Office rent & rates Office Insurance Sundry office Expenses Counting House Salary Audit fees Bank Charges 1,600 200 100 150 500 700 600 900 800 700 7,750 Cost of Production 1,36,700

Add: Selling Overheads Advertisement Salesmen s salary Showroom rent Rent of Ware house Commission on Sales Upkeep of Delivery Van Bad Debts Depreciation of Delivery Van 1,500 2,500 500 500 1,920 600 200 400 8,120 COST Of Sales/Total Cost 1,36,700 Profit (1,40,00-1,36,700 ) 40,820 1,40,000 Sale

Statement Of Cost Sheet Particulars Direct Materials Direct Materials used Freight on materials purchased Amount Total 1,10,000 20,000 5,000 1,35,0000 Direct Labour Productive wages 30,000 Chargeable expenses 10,000 1,75,000 Prime Cost Add: Factory Overhead Materials used in factory Factory supervision expenses Factory Indirect expenses Depreciation on factory building Works/ Factory Cost 1,500 4,000 2,000 3,500 11,000 1,86,000

Add: Office & Administration overheads Materials used in office Administration Expenses Depreciation on Office building Cost of Production Add: Selling Overheads Materials used in selling the product Advertisement Bad Debt 2,500 3,000 1,500 7,000 1,93,000 3,000 2,000 1,500 6,500 1,99,500 Add: Distribution Overheads Depreciation on Delivery Van Salary to driver of delivery van COST Of Sales/Total Cost Profit @20% on cost 1,000 3,600 4,600 2,04,100 40,820 2,44,920 Sale

Particulars Direct material-purchased Direct material -Opening stock Direct material -Closing Stock Productive wages Direct Expenses Consumable stores Factory manager salary Unproductive wages Factory Overheads Work-in-progress: Opening stock Closing stock Office and administration overheads Opening stock of finished goods Closing stock of finished goods Selling and distribution overheads Amount 80000 20000 25000 22,000 5,000 4000 15000 7000 12,000 13,000 7,000 28,000 5000 10000 33,000 Company desires a margin of 20% profit on the cost of sales

Statement of Cost Sheet Particulars AmountTotal Direct Materials-Purchased Add : Opening Stock of Raw Materials 80,000 20,000 1,00,000 25,000 Less : Closing Stock of Raw Materials Materials Consume 75,000 22,000 5,000 1,02,000 Direct Wages Direct Expenses Prime Cost Add: Works OR Factory Overheads Consumable stores Factory manager salary Unproductive wages 4,000 15,000 7,000 12,000 38,000 Add : Opening Stock of WIP Less : Closing Stock of WIP 13,000 7,000 44,000 1,46,000 Factory / Works Cost

Factory / Works Cost 1,46,000 (Previous Page Balance) Add : Administration/Office overhead Cost of Production Add : Opening Stock of Finished Goods 28,000 1,74,000 5,000 1,79,000 10,000 Less : Closing Stock of Finished Goods Cost of goods Sold 1,69,000 Add :Selling and Distribution Overhead Cost of Sales/Total Cost Add : Profit @ 20% on cost of sales ( 2,020,000 X 20%) 33,000 2,02,000 40,400 242,400 Sales