Cost Of Production

Explore the concepts of production cost analysis, focusing on total fixed costs, total variable costs, total cost of production, average cost, and average fixed cost. Learn how these costs behave in the short run and their impact on a firm's operations.

0 views • 26 slides

Understanding Unit Cost Methodology Training for Area Agencies on Aging

This training provides an overview of cost allocation principles and the Unit Cost Methodology (UCM) through video sessions and practical applications using UCM spreadsheets. It covers federal regulations, the operation of UCM, and the importance of cost allocation in federally funded programs. The

2 views • 33 slides

Understanding Apportionment in Veterans Benefits

The concept of apportionment in veterans benefits involves the direct payment of a dependent's portion of VA benefits to a spouse, child, or dependent parent when certain conditions are met. This process ensures that dependents receive their entitled share of the benefits. However, there are specifi

0 views • 9 slides

State Taxation of Partnerships - Issues and Implications

The project work group outlines a comprehensive approach to addressing various issues related to state taxation of partnerships. Key topics include operating income, nexus, federal conformity, sale of partnership interests, administrative and enforcement issues, and conformity implications for multi

0 views • 18 slides

Comprehensive Cost Management Training Objectives

This detailed training agenda outlines a comprehensive program focusing on cost management, including an overview of cost management importance, cost object definition, cost assignment, analysis, and reporting. It covers topics such as understanding cost models, cost allocations, various types of an

2 views • 41 slides

Cost-Benefit Analyses for Liquid Biopsy Studies: Understanding Health Economics and Decision Making

Health economics and decision making play a crucial role in evaluating the clinical utility and cost-effectiveness of liquid biopsies. Economic models such as cost-effectiveness analyses help in determining the incremental cost-effectiveness ratio (ICER) of interventions. Studies have shown varying

0 views • 23 slides

Academic Senate Resolutions and Low-Cost Thresholds in Higher Education

The Academic Senate addresses the adoption of open educational resources (OER) and low-cost materials to support academic freedom and compliance with legislative requirements. The resolution discusses the definition of low-cost resources and the variability among California Community Colleges in set

2 views • 9 slides

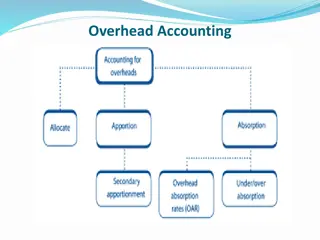

Cost Allocation, Apportionment, and Absorption in Accounting

Cost allocation involves charging identifiable costs to specific cost centers or units, while cost apportionment distributes costs that cannot be directly identified among various departments. This process is crucial for managing overheads effectively in accounting practices. Dr. B. N. Shinde discus

1 views • 16 slides

Understanding Cost Accounting Essentials

This overview delves into topics such as financial accounting, classification of accounts, cost ascertainment, and management accounting. It covers the meaning of cost, methods and techniques of costing, advantages and limitations of cost accounting systems, and essentials for a robust cost accounti

4 views • 27 slides

Project Cost Estimation: Methods and Factors

Project cost estimation involves valuing all monetary aspects necessary for planning, implementing, and monitoring a project. This includes various entrants such as preliminary investigation costs, design fees, construction expenses, and more. The purpose of cost estimation is to determine work volu

1 views • 44 slides

Understanding Overhead Accounting and Allocation Process

Overhead accounting involves allocating and apportioning overhead costs to different departments or cost centers in a company. This process includes dividing cost centers into production and service departments, assigning overhead costs accurately, and distributing common overhead costs proportionat

0 views • 18 slides

Understanding Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

0 views • 20 slides

Understanding Cost Accounting Fundamentals

Cost accounting involves determining the expenses incurred for producing goods or services, providing crucial information for decision-making, planning, and control. It aims to classify, record, allocate expenses accurately, presenting data for effective management guidance. Through cost classificat

0 views • 7 slides

Cost Control and Cost Reduction Strategies in Business: Understanding Implementation Challenges

Understanding the concepts of cost control and cost reduction is crucial for businesses, but implementing them can be challenging. This chapter explores the influencing factors for success in cost control and reduction, emphasizing the importance of cultural aspects, leadership, and management appro

1 views • 15 slides

Understanding Activity-Based Costing (ABC) in Cost Management

Activity-Based Costing (ABC) is a strategic costing method that allocates overhead costs to products based on activities. It offers benefits such as accurate cost allocation and identifying cost drivers but also has challenges due to increased complexity and customization. ABC differs from tradition

1 views • 15 slides

Understanding Management Accounting and Cost Accounting

Management accounting involves planning, organizing, and controlling human efforts to achieve organizational goals, while cost accounting focuses on determining the cost of products and services. The objective of cost accounting includes cost analysis, reduction, and decision-making support.

0 views • 33 slides

Understanding the Cost of Capital in Finance

The cost of capital is crucial for businesses to determine the average cost of their finance. The Weighted Average Cost of Capital (WACC) is used as a discount rate in financial calculations. It involves estimating the cost of each source of finance and calculating a weighted average. Additionally,

0 views • 14 slides

Understanding Multinational Cost of Capital

Multinational corporations determine their cost of capital based on the cost of debt and equity. The cost of debt includes the interest rate and credit risk premium, while the cost of equity reflects the risk premium investors demand. Estimating an MNC's cost of capital involves assessing these comp

0 views • 24 slides

Understanding Cost Accounting: Techniques and Processes

Cost accounting is a specialized branch of accounting that involves the accumulation, assignment, and control of costs. It encompasses techniques like ascertainment of costs, estimation of costs, and cost control to aid in decision-making. Cost accounting plays a crucial role in budgeting, standard

2 views • 11 slides

Factors Affecting the Amount of Depreciation in Asset Valuation

Depreciation in asset valuation depends on the cost, estimated useful life, and probable salvage value. The cost of an asset includes various expenses incurred to put it in working condition. Estimated net residual value is the expected sale value of the asset at the end of its useful life after ded

2 views • 5 slides

Assessment of Cost Recovery Methodology Alignment with General Assembly Resolution 67-226

This report assesses the consistency and alignment of the cost recovery methodology used by UNDP/UNFPA, UNICEF, and UN Women with General Assembly Resolution 67-226. Issues such as declining core funding, the need to avoid cross-subsidization, and the importance of full cost recovery are highlighted

0 views • 14 slides

Veterinary Prescription Cost Calculations

Learn how to calculate the cost of veterinary prescriptions based on total dosage, drug strength, and unit cost. Two scenarios are provided with detailed calculations for determining the total cost of the prescription. Understand how to convert units, calculate total dosage required, determine the n

0 views • 11 slides

Understanding Overhead Costs in Accounting

Overhead costs are supplementary expenses that cannot be easily allocated to specific cost objects. This includes indirect materials, labor, and expenses. Accounting and control of overheads involve steps like classification, codification, collection, allocation, apportionment, absorption, under/ove

1 views • 17 slides

Understanding Overhead Allocation in Financial Accounting

Overhead in accounting refers to expenses incurred in production or providing services that cannot be directly traced to specific products or departments. This involves classifying overhead based on function, element, and behavior, as well as allocating, apportioning, and absorbing overhead costs in

0 views • 13 slides

Report on Effective Cost Recovery Rates by UNDP for 2014-2017

The joint report on cost recovery by UNDP for the years 2014-2017 provides detailed evidence and analysis of the effective average cost recovery rates, compliance with cost recovery policy, and calculations based on financial information. The report highlights contributions from various sources, inc

1 views • 23 slides

Introduction to Industrial Costing: Understanding Cost Types and Accounting Systems

Explore the fundamentals of industrial costing, including different cost types and accounting systems such as actual cost accounting, normal cost accounting, and standard cost accounting. Learn about cost data control, tasks of cost accounting, and the integration of cost type accounting in cost and

1 views • 24 slides

Understanding Marginal Analysis in Economic Decision-Making

Marginal analysis involves comparing Marginal Benefit with Marginal Cost to determine the optimal quantity for an activity. If Marginal Benefit is greater than Marginal Cost, there is a Net Marginal Benefit; if it's less, there's a Net Marginal Cost. The principle helps weigh costs and benefits befo

0 views • 14 slides

Overview of Benefit-Cost Analysis in Policy Decision Making

This chapter delves into benefit-cost analysis as an essential tool in policy evaluation. It outlines the steps involved in conducting a benefit-cost analysis, emphasizes the significance of defining and quantifying policy problems, and highlights the importance of identifying the seriousness of soc

0 views • 40 slides

Analyzing Telecom Network Cost in East Africa

This expert-level training workshop conducted in Arusha in 2013 delved into the country-by-country analysis of telecom network cost modeling in the East Africa region. The workshop covered topics such as regulatory frameworks, transparency, skills and resources, cost accounting, depreciation methods

0 views • 44 slides

Understanding Cost Concepts and Classifications for Effective Management

Explore the definition of cost, various cost classifications, elements of cost, and the preparation of cost sheets for managerial use. Delve into fixed and variable costs with examples from manufacturing jeans, highlighting the importance of managing costs in organizational operations.

1 views • 92 slides

GAO Cost and Schedule Assessment Guides: Enhancing Government Accountability

The Government Accountability Office (GAO) plays a crucial role in supporting Congress to fulfill its responsibilities by improving federal government performance and ensuring accountability. The GAO Cost Estimating and Assessment Guide outlines criteria for assessing cost estimates, and the Reliabl

0 views • 19 slides

Comprehensive Guide to Project Cost Management

This module delves into the essential aspects of project cost management, outlining key processes like planning, estimating, budgeting, and control. By learning to recognize the significance of cost management, develop precise cost estimates, and manage project costs efficiently, you can align your

0 views • 18 slides

Understanding Treatment of Profits and Reserves in Holding Companies

The treatment of profits and reserves in holding companies when acquiring shares in subsidiary companies is essential for understanding the apportionment of pre-acquisition and post-acquisition profits. This involves distinguishing between capital profits and revenue profits, calculating the cost of

0 views • 8 slides

Managing Summer Cost Share for Faculty with 9-Month Appointments

Explore the process of setting up and monitoring summer cost share for faculty with 9-month appointments. Learn why cost share for summer may not display on the FEC, how GCA establishes cost share using the Cost Share Module, and how departments should adjust the FEC to reflect summer cost share acc

0 views • 15 slides

City of Bethlehem Department of Water and Sewer - 2024 Proposed Sewer Rate Increase and Fund Overview

Bethlehem's Sewer System, managed by the City's Department of Water and Sewer, includes a Wastewater Treatment Plant, collection systems, and agreements with tributary municipalities. Sewer billing is done directly for City and Hanover Township customers, with rates set by ordinance. Tributaries are

0 views • 10 slides

Joint UNDP, UNFPA, UNICEF, UN Women Executive Boards Cost Recovery Briefing

Briefing on cost recovery for the joint Executive Boards of UNDP, UNFPA, UNICEF, and UN Women, covering topics such as feedback on cost recovery, role of core resources, cost recovery models using a LEGO approach, harmonization efforts, guidance for Executive Boards, and next steps towards proposing

0 views • 42 slides

Principles of ADS-B Cost Apportionment and Service Arrangements

Understanding the principles of cost apportionment in ADS-B systems is crucial for effective service arrangements. The general user-pay principle dictates that the owner ANSP bears the installation and maintenance costs if the ADS-B ground station serves their needs solely. However, when providing s

0 views • 21 slides

Understanding Factory Overheads and Allocation Methods

Explore the concept of factory overheads, treatment of special items, absorption methods, allocation, apportionment, and more. Learn about the classification of overheads, steps in distribution, computation of absorption rates, and practical application in cost accounting. Discover different methods

0 views • 11 slides

Defense Cost Reporting and Systems Overview

Defense Cost Analysis and Reporting Systems (CSDR) provide the cost community with essential data for developing independent cost estimates within major defense acquisition programs. The Defense Automated Cost Information Management System (DACIMS) offers instant access to historical cost informatio

0 views • 19 slides

Importance of Cost Accounting in Business Management

Cost accounting plays a crucial role in modern business environments where cost effectiveness and quality consciousness are vital for success. This branch of accounting helps in planning, controlling, and determining the costs of products or services, providing essential data for efficient managemen

0 views • 6 slides