The House System at Queen Mary's High School - Fostering Collaboration and Leadership Through Engaging Activities

The House system at Queen Mary's High School promotes collaboration, leadership, and community engagement through a variety of activities, competitions, and charitable initiatives. Named after influential female authors, the Houses instill values of sportsmanship, respect, and integrity. Students fr

6 views • 5 slides

New Audit Report Requirements for Charitable Institutions

CBDT has issued a new audit report form, 10B and 10BB, for charitable institutions, demanding extensive requirements from the assesses. The notification applies from April 1, 2023, emphasizing the need for improved accounting practices. The applicability of Form 10B and 10BB differs based on the ins

3 views • 84 slides

Understanding the 40% Retention Rule for Charitable Organizations in Kentucky

The 40% Retention Rule in Kentucky mandates that a charitable organization must retain at least 40% of the adjusted gross receipts from charitable gaming for its charitable purposes. This rule ensures that funds generated from gaming activities are primarily used for the organization's intended char

0 views • 16 slides

Understanding Charitable Giving: Strategies and Tools

Explore different ways to give effectively, beyond cash donations. Learn about appreciated asset donations, donor-advised funds, and qualified charitable distributions to maximize your impact while optimizing tax benefits for charitable giving.

0 views • 23 slides

Understanding Taxation and Assessment of Charitable Trusts

Explore the complexities and nuances of taxation and assessment for charitable trusts and institutions. Learn about key issues such as tax rates, income computation, tax audits, capital gains, registration surrender, and more. Discover the basic rules to follow, including exemptions, income categori

0 views • 46 slides

Recent Amendments in Charitable Trusts: A Comprehensive Overview

Recent amendments to charitable trusts, as outlined by CA Sudhir Baheti, cover important aspects such as registration sections, creating new trusts, and changes in Section 10(23C) of the Income Tax Act, 1961. The amendments impact income exemptions for educational institutions, application procedure

0 views • 40 slides

Faith and Giving at National Stadium: 2 Corinthians 8:1-16

Discover the theme of faith and generosity as explored in the sermon series at National Stadium on May 17-19, 2019, based on 2 Corinthians 8:1-16. The message delves into the grace and discipline of giving, emphasizing the example set by the churches of Macedonia and the sacrificial nature of giving

0 views • 12 slides

Understanding Charitable Giving Trends in the U.S.

Explore the trends and statistics of charitable giving in the U.S., covering topics such as individual giving, foundation contributions, bequest giving, corporate donations, and where the money flows. Delve into historical and current statistics to understand the factors influencing philanthropy in

1 views • 40 slides

JCFGM Executive Committee Meeting Summary and Reports April 25, 2022

The JCFGM Executive Committee meeting on April 25, 2022, covered various aspects including the mission statement, agenda items, funds and assets report, Life & Legacy Plus program details, Treasurer's report, and resolution related to Life & Legacy program participation. The meeting highlighted the

0 views • 11 slides

Public-Private Partnership in Water Conservation by Rhino Ark Charitable Trust

Established in 1989, Rhino Ark Charitable Trust focuses on sustainable solutions for mountain forest ecosystems and biodiversity conservation through public-private partnerships. With a key emphasis on water towers like Aberdare Range and Mt. Kenya, they aim to mitigate human-wildlife conflicts and

0 views • 11 slides

Insights from Donor Research and Supporter Focus

Uncover valuable insights from donor research and supporter focus in the charitable sector, highlighting the importance of understanding and engaging with donors effectively. Dive into qualitative interviews, quantitative surveys, and donor sentiments towards giving back and social responsibility. E

0 views • 12 slides

Asking for and Giving Directions Guide

This guide provides phrases for asking for directions such as finding a specific location, a library, stadium, or museum. It also includes expressions for inquiring about nearby facilities like cash machines or banks. Additionally, it offers useful phrases for giving directions, including indicating

0 views • 4 slides

Understanding High Net Worth Client Gift Planning and Philanthropy

Explore the role of trusted advisors in philanthropy, the disconnect between HNW clients and advisors, philanthropic motivations and assumptions, gift planning for the future, and how financial, social, and personal factors influence giving decisions. Gain insights into primary motivators such as do

1 views • 18 slides

Unveiling the Significance of Gifts in Wills and Pursuit of Immortality

Explore the profound impact of charitable gifts in wills on global legacies and the quest for eternal remembrance. Delve into the underlying motivations, the essence of legacy, and the critical need for greater awareness and action to encourage more people to leave charitable bequests in their wills

0 views • 24 slides

Legacy Giving Made Easy for Your Parish

Legacy giving is a crucial way to support nonprofits and churches through planned giving techniques, ensuring their sustainability for the future. Learn about the importance of legacy gifts and how they can shape the long-term success and impact of organizations. Discover why legacy giving is vital

0 views • 14 slides

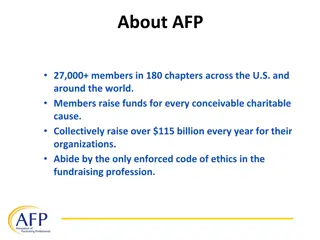

Overview of Association of Fundraising Professionals (AFP) and Charitable Act Impact

AFP comprises 27,000+ members across 180 chapters globally who raise over $115 billion annually for charitable causes. Members must adhere strictly to the AFP Code of Ethics, promoting honesty, integrity, and transparency in fundraising efforts. The Charitable Act (S.566/H.R.3435) aims to renew the

0 views • 5 slides

Championing Change Through Giving: The Inspiring Story of KARMAVEER and RIGHT every WRONG Founders

Dive into the impactful journey of the founders of KARMAVEER, RIGHT every WRONG, and Joy of Giving, who have redefined fundraising by emphasizing contribution over money. Their mission focuses on creating joy through giving and championing change to make a real difference in society, beyond just mak

0 views • 39 slides

The Joy of Giving: Insights from Philippians 4

Explore the significance of giving in Philippians 4 through verses highlighting the goodness of sharing, supporting, and engaging in ministry. Discover how financial giving aids in tangible assistance, alleviating hardships, and extending ministry reach beyond personal abilities. Witness the joy of

0 views • 23 slides

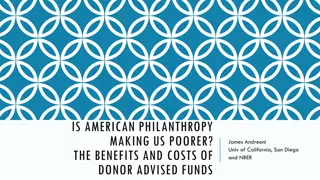

The Impact of Donor Advised Funds on American Philanthropy

The rise of Donor Advised Funds (DAFs) has reshaped charitable giving in America, with organizations like Fidelity Charitable dominating the landscape. DAFs play a significant role in charitable donations, accounting for over 10% of all giving. This growth has sparked discussions on the effectivenes

0 views • 57 slides

Learning about Prize-Giving Day at School

Explore a lesson on prize-giving day at school, where students learn about eminent achievements, outstanding performances, and the significance of ceremonies. Follow along as students discuss pictures, read about a prize-giving ceremony, and match words with their meanings. Engage in activities that

0 views • 15 slides

JCFGM Board of Trustees Meeting Summary - September 19, 2022

The JCFGM Board of Trustees Meeting on September 19, 2022, focused on promoting philanthropy and addressing charitable needs in the Jewish community and other charitable institutions. The agenda included reports from various committees, updates on funds and assets, a new Mitzvah Match Fund, contribu

0 views • 18 slides

Opportunities for Blessings: Tithing, Offering, and Sacrificial Thank Offering

The Scripture passage from Malachi 3:6-12 emphasizes the importance of tithing, offering, and sacrificial thank offering as opportunities for receiving blessings from God. It speaks of the consequences of robbing God in these areas and the promises of abundance and protection when faithful in giving

0 views • 6 slides

Determinants of Aid Giving: A Panel Analysis Insights

Delve into the landscape of aid giving through a comprehensive analysis of various types of aid, ranging from historical perspectives like the Marshall Plan to contemporary debates on aid effectiveness. Explore the complex dynamics of aid allocation, recipient responses, and the motivations behind a

0 views • 39 slides

Cultivating a Culture of Giving within GCI

Learn, teach, and embrace a culture of sharing and generous giving within GCI for the support of local ministry activities, congregations, and the national church. Encourage members to be known for their generosity and cheerful giving, aligning with the Christ-given mandate. Establish a clear vision

0 views • 12 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Overview of PG&E Planned Giving and Estates Activities 2019/2020

Explore a detailed snapshot of the Planned Giving & Estates activities for 2019/2020 at PG&E. The overview includes information on marketing materials, bequest cash trends, top states for bequest cash and new estates, relationships to Hadassah, and the average age at death of donors. Dive into the k

0 views • 9 slides

Understanding the Virtue of Charity in Islam

This lesson focuses on defining charity in Islam, listing types of charities, exploring the virtues of charity, and understanding the rewards of giving. Students will learn about compulsory and voluntary charities, the importance of giving in Islam, and the benefits of charity. The lesson also discu

0 views • 15 slides

Woodland Rotary Endowment - A Pillar of Service in Community

The Woodland Rotary Endowment is a charitable organization closely affiliated with the Rotary Club of Woodland, operating as a pillar of service within the community. Governed by a board of directors, it offers scholarships and charitable contributions while upholding the values of the Rotary Club.

0 views • 12 slides

Cultivating a Culture of Faithfulness Through Generosity and Giving

Cultivating a culture of faithfulness involves embracing generosity, inspired by God's prescription to be open-hearted and charitable. Understanding that God is a great giver, exemplified by Jesus' sacrifice, motivates us to give as an expression of love. Recognizing God as a generous giver challeng

0 views • 12 slides

Reflections on Jesus Giving Himself for Us

The content explores the profound act of Jesus giving Himself for humanity, showcasing the sacrifices He made out of love. It discusses what His selfless act involved, encouraging reflection on whether we are similarly giving of ourselves to our families, fellow believers, and the Lord. The content

0 views • 4 slides

WVU Day of Giving Highlights and Results

WVU Day of Giving is a successful annual fundraising event where donors contribute towards various units at West Virginia University. The event showcases impressive fundraising totals, donor affiliations, online donations, donation source breakdown, top performing units, and participation in the Big

0 views • 9 slides

Reflections on Giving and Receiving

Reflect on the interconnected nature of giving and receiving in life, drawing inspiration from quotes about the law of giving, the power of generosity, and the importance of balance in various aspects of living. Explore the idea of reciprocity and the beauty of both giving and receiving in this coll

0 views • 9 slides

Developing a Strategic Planned Giving Program Workshop

Learn how to effectively establish and promote a planned giving program from scratch at the Hive Workshop on August 4, 2020. Discover strategies for identifying resources, securing initial gifts, and setting the stage for successful gift acceptance. Gain insights on defining planned giving, engaging

0 views • 15 slides

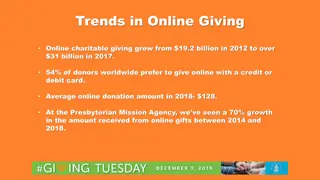

Online Giving Trends and Impact at the Presbyterian Mission Agency

Online charitable giving has seen significant growth in recent years, with online donations surpassing $31 billion in 2017. There has been a shift towards online giving, with donors preferring to use credit or debit cards. The Presbyterian Mission Agency has experienced a 70% increase in online gift

0 views • 4 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

Simplifying Church Giving: Online, Kiosk, and Mobile App Options

Streamline your church donations with multiple options: online giving form, lobby kiosk assistance, and a mobile app. Simply enter amount, select fund, provide payment details, personal info, and choose recurring giving. All generosity is an act of worship - make it easy and convenient.

0 views • 7 slides

Zonta Foundation for Women Report Summary June 2022 - July 2023

Zonta Foundation for Women Report highlights key giving statistics including Club Giving, Individual Giving, and Endowment Giving. Contributions to various funds are detailed, showing support for important causes. The report also mentions updates on ZFW Board decisions such as rebranding efforts and

0 views • 7 slides

Exploring Zakat, Khums, and Ethical Giving in Islam

Delve into the concepts of zakat and khums in Islam, examining the ethical value of obligatory giving and wealth purification. Compare these practices with modern humanitarian charity models, questioning the role of compulsory giving and its impact on community support. Explore the historical contex

0 views • 4 slides

JAGA Charitable Trust Inc. Financial Overview

JAGA Charitable Trust, Inc. has seen an increase in member contributions in 2023 YTD compared to 2022. The trust's income sources include community foundations, PGA Tour contributions, and various events. Investment strategy focuses on earning returns above 0.37% with low risk and liquidity. To incr

0 views • 5 slides

FPUA Charitable Contributions Overview

FPUA's Charitable Contributions Utility Advisory Committee focuses on supporting various organizations and initiatives that benefit the community. The process involves receiving sponsorship requests, evaluating impact potential, and providing financial support to organizations like Boys & Girls Club

0 views • 9 slides