Camp In My Garden: A Platform for Collaborative Accommodation

Travelers are turning to collaborative economies for accommodation options beyond traditional hotels. Camp In My Garden is a pioneering online community for garden camping, offering individuals the opportunity to list their gardens as campsites or book unique accommodations. Embracing the concept of

1 views • 8 slides

The House System at Queen Mary's High School - Fostering Collaboration and Leadership Through Engaging Activities

The House system at Queen Mary's High School promotes collaboration, leadership, and community engagement through a variety of activities, competitions, and charitable initiatives. Named after influential female authors, the Houses instill values of sportsmanship, respect, and integrity. Students fr

6 views • 5 slides

Partner NNGO Capacity Strengthening. Basics in Procurement and Goods, Services and Works Receiving

This guide by Marin Tomas from International Medical Corps covers key areas for organizations handling funds, emphasizing efficient budget management, transparent procurement, and effective project implementation. It also outlines primary accountability areas for logistics, such as procurement, stor

0 views • 48 slides

Glen A. Wilson High School Girls Soccer Program Overview

Meet the coaching staff of Glen A. Wilson High School Girls Soccer program for the 2022-23 Winter Season. Learn about Coach Manuel Amezquita's experience and the program's agenda focusing on team spirit, schedules, roles, college exposure, and creating a positive team culture. Get insights into the

1 views • 24 slides

NOT-FOR- PROFIT MAKING CONCERN

Not-for-profit organizations, such as educational institutions, public hospitals, and charitable trusts, operate with the main objective of providing services rather than making profits. These organizations rely on various sources of funding like contributions, donations, and grants. Accounting for

4 views • 4 slides

Peoples Legal Centre Submissions on Electoral Matters Amendment Bill

Peoples Legal Centre's submissions on the Electoral Matters Amendment Bill focus on increasing access to justice, deepening democratic participation, and advocating for a just and equal South Africa. The main themes include amendments on donations to political parties, regulations for independent ca

2 views • 17 slides

Supreme Court Raps SBI For Not Sharing Complete Data On Electoral Bonds

Supreme Court Raps SBI For Not Sharing \"Complete Data\" On Electoral Bonds\n\nThe Supreme Court today came down hard on the State Bank of India for not sharing the complete data on electoral bonds, a scheme that allowed individuals and businesses to donate anonymously to political parties. The cour

2 views • 4 slides

New Audit Report Requirements for Charitable Institutions

CBDT has issued a new audit report form, 10B and 10BB, for charitable institutions, demanding extensive requirements from the assesses. The notification applies from April 1, 2023, emphasizing the need for improved accounting practices. The applicability of Form 10B and 10BB differs based on the ins

3 views • 84 slides

Qurbani Donation 2024 How Your Contribution Can Make a Difference

Are you looking to make a meaningful impact this Qurbani season? As Qurbani 2024 approaches, many individuals and families are seeking opportunities to fulfill their religious obligations and help those in need. One powerful way to do this is through Qurbani donations to charitable organizations.

2 views • 3 slides

One of the Best Hoarder Clearance in Ridge

Swifty Clearances provides the Best Hoarder Clearance in Ridge. They are your number 1 clearance company in Radlett. They have eco friendly disposal methods and recycling policies and support local charities with donations. They cover all of Hertfordshire and surrounding local areas, including local

0 views • 6 slides

Best Vegan Food in Hamilton East

Are you looking for the Best Vegan Food in Hamilton East? Then contact The Press Coffee and Book House. They love two things, Coffee and Books - they love them, and we sell them. Exceptionally roasted coffee and a quality selection of pre-loved books, sourced from book fairs, online markets, and fro

0 views • 6 slides

Understanding the 40% Retention Rule for Charitable Organizations in Kentucky

The 40% Retention Rule in Kentucky mandates that a charitable organization must retain at least 40% of the adjusted gross receipts from charitable gaming for its charitable purposes. This rule ensures that funds generated from gaming activities are primarily used for the organization's intended char

0 views • 16 slides

Importance of Philanthropy in Healthcare

Philanthropy plays a crucial role in healthcare, fostering partnerships between medical staff and grateful patients. Grateful patients and families contribute significantly to healthcare philanthropy, driving donations that support medical institutions and patient care. As healthcare costs rise and

3 views • 16 slides

Understanding Charitable Giving: Strategies and Tools

Explore different ways to give effectively, beyond cash donations. Learn about appreciated asset donations, donor-advised funds, and qualified charitable distributions to maximize your impact while optimizing tax benefits for charitable giving.

0 views • 23 slides

Understanding Taxation and Donations Upon Death

Explore the basics of taxation upon death, including deemed disposition of assets, available exceptions, and planning strategies to reduce tax liabilities. Dive into pre and post-2015 donation regulations, rollovers between spouses, and estate freeze techniques. Gain insights into the legalities sur

0 views • 20 slides

Understanding Taxation and Assessment of Charitable Trusts

Explore the complexities and nuances of taxation and assessment for charitable trusts and institutions. Learn about key issues such as tax rates, income computation, tax audits, capital gains, registration surrender, and more. Discover the basic rules to follow, including exemptions, income categori

0 views • 46 slides

Recent Amendments in Charitable Trusts: A Comprehensive Overview

Recent amendments to charitable trusts, as outlined by CA Sudhir Baheti, cover important aspects such as registration sections, creating new trusts, and changes in Section 10(23C) of the Income Tax Act, 1961. The amendments impact income exemptions for educational institutions, application procedure

0 views • 40 slides

Hinduism Flourishing in the Pandyan Empire

Hinduism flourished during the period of the Pandyan Empire, with rulers giving extensive donations to Saiva and Vaishnava temples. They provided endowments for temple renovation and maintenance. Notable rulers like Maravarman Sundara Pandyan and Jatavarman Sundara Pandiya contributed significantly

0 views • 18 slides

UTEP Cares 2019: Making a Difference Together

UTEP Cares 2019 initiative, led by Shafik Dharamsi and Nicole Aguilar, aims to increase participation and donations through the SECC campaign. In 2018, UTEP employees raised a significant amount, emphasizing student involvement. The SECC Committee encourages student engagement and generosity, offeri

1 views • 8 slides

QOVF Giving Tuesday Group Competition Information

QOVF is hosting a competition for groups to raise the highest dollar donations by December 6th, 2018. The group with the most donations will receive a $500 matching donation to their funds. Support the mission of QOVF to provide comforting quilts to armed service members and veterans touched by war.

0 views • 16 slides

Understanding Charitable Giving Trends in the U.S.

Explore the trends and statistics of charitable giving in the U.S., covering topics such as individual giving, foundation contributions, bequest giving, corporate donations, and where the money flows. Delve into historical and current statistics to understand the factors influencing philanthropy in

1 views • 40 slides

JCFGM Executive Committee Meeting Summary and Reports April 25, 2022

The JCFGM Executive Committee meeting on April 25, 2022, covered various aspects including the mission statement, agenda items, funds and assets report, Life & Legacy Plus program details, Treasurer's report, and resolution related to Life & Legacy program participation. The meeting highlighted the

0 views • 11 slides

Public-Private Partnership in Water Conservation by Rhino Ark Charitable Trust

Established in 1989, Rhino Ark Charitable Trust focuses on sustainable solutions for mountain forest ecosystems and biodiversity conservation through public-private partnerships. With a key emphasis on water towers like Aberdare Range and Mt. Kenya, they aim to mitigate human-wildlife conflicts and

0 views • 11 slides

Efficient Management of Donations at Donation Bank

Donation Bank is a non-profit organization that collects gifts from private individuals. Gifts need to be certified for tax deduction purposes and attributed to specific projects. Donors receive acknowledgements and certificates for their contributions. The organization maintains archives for person

0 views • 19 slides

Unveiling the Significance of Gifts in Wills and Pursuit of Immortality

Explore the profound impact of charitable gifts in wills on global legacies and the quest for eternal remembrance. Delve into the underlying motivations, the essence of legacy, and the critical need for greater awareness and action to encourage more people to leave charitable bequests in their wills

0 views • 24 slides

Modernizing Organ Donation Laws: The Uniform Anatomical Gift Act of 2006

The Uniform Anatomical Gift Act (UAGA) of 2006 aims to enhance the donation process by introducing new definitions, emphasizing personal autonomy, and providing clearer rules. It addresses the need for uniformity, updates to reflect current practices, and modernizes the Act to ensure a smoother orga

0 views • 14 slides

Overview of Association of Fundraising Professionals (AFP) and Charitable Act Impact

AFP comprises 27,000+ members across 180 chapters globally who raise over $115 billion annually for charitable causes. Members must adhere strictly to the AFP Code of Ethics, promoting honesty, integrity, and transparency in fundraising efforts. The Charitable Act (S.566/H.R.3435) aims to renew the

0 views • 5 slides

Political Party Funding Act 2018 Overview

The Political Party Funding Act of 2018 in South Africa aims to enhance multi-party democracy by regulating the funding and donations to political parties. It establishes the Multi-Party Democracy Fund funded by private sources, alongside the existing Represented Political Party Fund. The Act prohib

0 views • 17 slides

Understanding Political Party Funding Act of 2018

The Political Party Funding Act of 2018 regulates the funding of political parties in South Africa, ensuring equitable and proportional funding for parties participating in national and provincial legislatures. The Act defines various terms such as donations, foreign persons, and political parties,

0 views • 42 slides

The Impact of Donor Advised Funds on American Philanthropy

The rise of Donor Advised Funds (DAFs) has reshaped charitable giving in America, with organizations like Fidelity Charitable dominating the landscape. DAFs play a significant role in charitable donations, accounting for over 10% of all giving. This growth has sparked discussions on the effectivenes

0 views • 57 slides

Wisconsin National Guard Foundation, Inc.: Supporting Wisconsin National Guard Families

Wisconsin National Guard Foundation, Inc. is a charitable foundation established in 2021 to provide scholarships, grants, and professional development opportunities for Wisconsin National Guard families. The foundation aims to increase public awareness of the vital role played by the Wisconsin Natio

1 views • 7 slides

JCFGM Board of Trustees Meeting Summary - September 19, 2022

The JCFGM Board of Trustees Meeting on September 19, 2022, focused on promoting philanthropy and addressing charitable needs in the Jewish community and other charitable institutions. The agenda included reports from various committees, updates on funds and assets, a new Mitzvah Match Fund, contribu

0 views • 18 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Woodland Rotary Endowment - A Pillar of Service in Community

The Woodland Rotary Endowment is a charitable organization closely affiliated with the Rotary Club of Woodland, operating as a pillar of service within the community. Governed by a board of directors, it offers scholarships and charitable contributions while upholding the values of the Rotary Club.

0 views • 12 slides

Understanding the Art Bonus Tax Credit for Cultural Support

The Art Bonus tax credit in Italy encourages individuals and businesses to support cultural heritage through charitable donations, providing a tax credit of 65%. This initiative aims to not only fund cultural institutions but also strengthen the bond between citizens and their heritage, driving soci

0 views • 10 slides

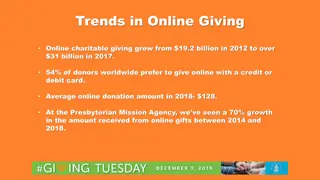

Online Giving Trends and Impact at the Presbyterian Mission Agency

Online charitable giving has seen significant growth in recent years, with online donations surpassing $31 billion in 2017. There has been a shift towards online giving, with donors preferring to use credit or debit cards. The Presbyterian Mission Agency has experienced a 70% increase in online gift

0 views • 4 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

JAGA Charitable Trust Inc. Financial Overview

JAGA Charitable Trust, Inc. has seen an increase in member contributions in 2023 YTD compared to 2022. The trust's income sources include community foundations, PGA Tour contributions, and various events. Investment strategy focuses on earning returns above 0.37% with low risk and liquidity. To incr

0 views • 5 slides

Financial Overview 2020: Funds Collected, Spent, Scholarships Given, and Ending Balance

In 2020, a total of 3.3 million RSD was collected from members, with notable contributions from various entities. The funds were spent on various expenses including scholarships, office materials, web hosting, accounting services, and donations. Scholarships were awarded to several individuals. The

0 views • 9 slides

FPUA Charitable Contributions Overview

FPUA's Charitable Contributions Utility Advisory Committee focuses on supporting various organizations and initiatives that benefit the community. The process involves receiving sponsorship requests, evaluating impact potential, and providing financial support to organizations like Boys & Girls Club

0 views • 9 slides