Impact of NVIDIA Stock Surge on Mutual Funds and Passive Funds Exposure

NVIDIA's stock surged by 16% following strong financial performance, impacting various mutual funds and passive funds. Mutual funds like Motilal Oswal, Mirae, and Franklin have significant exposure to NVIDIA, while non-broad-based passive funds also hold substantial positions. The exposure of broad-

4 views • 10 slides

Budget Basics for Department Chairs - Understanding Funds and Processes

This document provides essential information on budget basics for department chairs, covering topics such as types of funds (state and auxiliary), fiscal authority, budget reconciliation, procard and purchasing procedures, and timeline for budget processes. It outlines different funds like General F

0 views • 18 slides

Maximum Price Calculation for Callable Bond with Annual Yield Requirement

A 20-year callable bond example is provided with a $1000 face value and 3% annual coupons, callable at different redemption values over specific years. The task is to determine the maximum price a buyer should pay to achieve a minimum annual yield of 5%. The calculation involves identifying the time

0 views • 33 slides

Understanding Callable Bonds in Bond Investments

Callable bonds are a type of bond where the issuer reserves the right to redeem the bond at different times, potentially at different values. Investors face uncertainty about when the bond will be redeemed, but it can only be called at predetermined times. Common questions revolve around determining

0 views • 13 slides

Granny's Tree Climbing - A Poetic Adventure by Ruskin Bond

In this whimsical poem by Ruskin Bond, we are introduced to Granny, a sprightly sixty-two-year-old who defies convention by indulging in her lifelong passion for tree climbing. Despite admonishments from her family, Granny remains steadfast in her joy as she embarks on a delightful tree-climbing esc

0 views • 19 slides

Bringing Up Kari: A Tale of Compassion and Bond Between a Boy and an Elephant

Revolving around a young elephant named Kari and a nine-year-old boy, this heartwarming story explores the strong bond they share. Through adventures and challenges, the narrator teaches Kari valuable skills, nurturing a deep connection built on compassion and understanding. As Kari grows, so does t

0 views • 7 slides

Fund Accounting Entities and Definitions Explained

Explore the world of fund accounting entities and definitions, including the roles of various funds such as General Fund, Debt Service Funds, Capital Projects Funds, Food and Community Service Funds, Custodial Fund, and Trust Funds. Learn about the unique characteristics and regulations that govern

0 views • 39 slides

Exploring the Human-Animal Bond in Veterinary Medicine

Delve into the significance of the human-animal bond in veterinary medicine, highlighting the mutually beneficial relationship between animals and humans over time. Understand how this bond has evolved, the role of veterinary assistants in fostering this connection, and the changing dynamics of huma

0 views • 26 slides

Understanding Mutual Funds: A Comprehensive Guide

This presentation provides an educational overview of mutual funds, covering topics such as what mutual funds are, how to invest in them, the structure of mutual funds, the role of Asset Management Companies (AMCs), and how mutual funds work. It also explores the classification of mutual funds, inve

0 views • 24 slides

Understanding Alkynes in Organic Chemistry

Alkynes are unsaturated hydrocarbons with at least one triple bond, following a molecular formula of CnH2n-2. This group of compounds is discussed in Chapter three, covering topics like structure, hybridization, common naming, physical properties, preparation, and reactions. The sp hybridization of

1 views • 20 slides

Managing Student Extracurricular Funds in School System

Student extracurricular funds play a critical role in supporting organized student activities beyond the regular curriculum. Trustees have the authority to establish and manage these funds following specific guidelines outlined in the regulatory framework. The funds are meant to benefit students, an

0 views • 56 slides

Exploring Growth and Opportunities in the Green Bond Markets

Delve into the burgeoning Chinese green bond market with insights on green bonds growth, sector allocations, Latin American issuance trends, sustainable investment needs in Latin America, China's green bond growth, and global green bond market size comparisons. Discover the significance of Green Pan

0 views • 14 slides

Maximizing Title IV Part A Funds for Well-Rounded Education

The Title IV Part A program focuses on providing well-rounded education opportunities to students. Districts receiving over $30,000 must conduct a needs assessment and allocate at least 20% of funds for well-rounded activities. Funds can be maximized by collaborating with outside organizations such

0 views • 18 slides

Understanding Fund Codes and Types at Southern Oregon University

Fund codes at Southern Oregon University categorize money sources and restrictions. General Funds support academic programs, while Agency Funds are for individual benefits. Internal Service Funds serve departments, Designated Funds are isolated operations, and Auxiliary Funds support non-instruction

0 views • 16 slides

Arlington ISD Citizens Bond Oversight Committee Report August 2016

The Arlington ISD Citizens Bond Oversight Committee (CBOC) was established to provide transparency, enhance public confidence, provide findings and recommendations to the Board of Trustees, monitor progress of the 2014 Bond program, and find ways to maximize the bond's potential. The committee compr

0 views • 27 slides

Bonded Warehouse Facility and New Bond Process

Bonded warehouse facilities offer a convenient way for traders and industrialists to store goods without paying duties. The process involves applying for a new bond with specific requirements and inspections by officers. Necessary documents and approvals are essential to secure the bond premises, en

0 views • 31 slides

Understanding Polarity in Covalent Bonds

The difference between a polar molecule and a nonpolar molecule lies in the distribution of electrons. A polar molecule has an asymmetric electron distribution due to a significant difference in electronegativity, while a nonpolar molecule has a symmetric electron distribution. You can predict polar

0 views • 15 slides

Understanding the Bond Market: Maturity, Yield, and Pricing

Financial markets facilitate borrowing and lending, influencing interest rates, stock prices, and bond prices. Bonds promise future payments in exchange for current prices, while stocks offer ownership rights and dividends. The bond market involves maturity dates, coupon rates, and yield to maturity

0 views • 17 slides

Understanding Callable Bonds and Bond Amortization

Callable bonds provide issuers with the right to redeem the bond before maturity under certain conditions. This article discusses the concept of callable bonds, bond amortization, premium bonds, discount bonds, and provides examples of calculating bond values based on specific scenarios.

0 views • 12 slides

Understanding the 2021 Bond Election Process

In the November 2021 bond election, voters approved funds for construction, repairs, and renovations of facilities within specific legal criteria. The tax rate is set by combining Maintenance & Operations (M&O) and Interest & Sinking (I&S) funds. The process involved discussions on safety, growth, f

0 views • 22 slides

Overview of Compensation Funds in France and Germany

Prof. Dr. Jonas Knetsch from the University of Reunion Island explores the topic of compensation funds in France and Germany, highlighting the diversity and classification of these funds. The presentation covers various groups of compensation funds, including those for traffic accidents, medical inc

0 views • 23 slides

Understanding Fund Accounting in School Districts

Explore the world of fund accounting in school districts through an in-depth look at different fund types, their definitions, and the regulations governing them. Learn about the unique characteristics of instructional funds, debt service funds, capital projects funds, food and community service fund

0 views • 36 slides

Understanding Bond Premiums and Their Impact on Financial Decision-Making

Bond premiums occur when bond prices increase in the secondary market due to a drop in market interest rates. They can be used for approved project costs, debt service, or reducing bond principal. Utilizing bond premiums wisely can lead to cost savings for taxpayers. Learn how bond premiums can affe

0 views • 5 slides

Exploring the Legacy of James Bond: 60 Years, 27 Films, and Countless Adventures

James Bond, the iconic British spy character, has been portrayed by various actors over the past 60 years in a total of 27 films. From Sean Connery to Daniel Craig, the character has evolved while maintaining his charm and mystery. The latest film, "No Time to Die," continues the legacy with action-

0 views • 11 slides

Determinants of Liquidity in the South African Bond Market

The presentation explores the determinants of liquidity in the South African bond market, emphasizing its importance for economic stability and growth. It discusses the significance of market liquidity, impacts of illiquidity, and compares the efficiency of the South African bond market with others

0 views • 24 slides

Understanding Bond Valuation Models and Yield Relationship

Explore the fundamentals of bond valuation, including the present value model and the yield model, to understand how bond prices are determined based on factors like market price, coupon payments, and yield to maturity. Learn about the price-yield curve, convexity, and how to calculate expected yiel

0 views • 25 slides

Understanding Elderly Bond Property Compliance in Oregon

Oregon Housing and Community Services (OHCS) issues tax-exempt bonds for the development of housing for low-income elderly and disabled individuals. Bond properties must meet program requirements to maintain compliance and avoid risks to bond series and credit ratings. OHCS plays a vital role in mon

0 views • 57 slides

Lowell Joint School District Bond Feasibility Survey Findings

The conducted survey by Dr. Timothy McLarney aimed to determine the feasibility of a bond measure for the Lowell Joint School District. The study focused on gathering community input to create a measure aligned with priorities, with an emphasis on education quality, crime reduction, job creation, an

0 views • 15 slides

Exploring the World of Cherries and Ruskin Bond

Delve into the fascinating world of cherries and acclaimed Indian author Ruskin Bond. Learn about the rich cultivation of cherries in the northern regions of India, particularly in Jammu and Kashmir. Discover key details about Ruskin Bond's life and literary achievements, including his extensive bod

0 views • 8 slides

Offshore Renminbi Bond Markets: Achievements and Challenges

The article discusses the achievements and challenges of the offshore Renminbi bond markets, highlighting the role of foreign currency debt in public debt management, the development of the RMB market, examples of sovereign issuances, and the practice and goals of international FX. It covers the evo

0 views • 7 slides

Possibilities for Venture Capital Funds in Republic of Serbia

The paper discusses the differences between investment funds, venture capital funds, and private equity, the determinants influencing the development of these funds, and the current state of venture capital in Serbia. It also touches upon legal regulations impacting these funds and explores various

0 views • 10 slides

Understanding Bond Markets: Insights from Dr. Lakshmi Kalyanaraman

Explore the world of bond markets through Dr. Lakshmi Kalyanaraman's perspective. Learn about bond instruments, issuers, market classifications, and associated risks. Discover the dynamics of Treasury notes and bonds in financing national debt and their unique characteristics such as default risk, i

0 views • 37 slides

Bond Analysis and Valuation Techniques by Binam Ghimire

Explore the analysis and valuation of bonds in-depth with a focus on present value techniques, bond yields, and calculating future bond prices. Understand the process of pricing a bond by determining cash flows, coupon payments, and par value. Dive into the calculations involved in determining the p

0 views • 40 slides

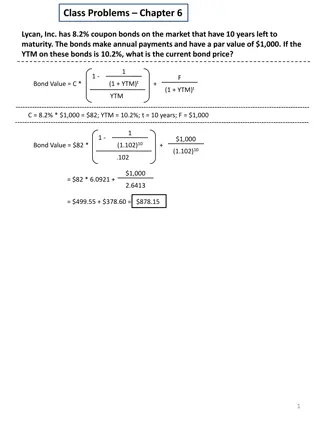

Bond Pricing and Yield Calculation Examples

The provided content illustrates calculations for bond pricing and yield in various scenarios. It covers topics such as determining current bond prices based on coupon rates, yield to maturity, and time to maturity. Additionally, it explores scenarios with different bond characteristics like annual

0 views • 5 slides

Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Not

0 views • 39 slides

Understanding Bond Valuation and Pricing

This informative content delves into valuing bonds, explaining concepts such as face value, coupon rates, and the relationship between bond prices and interest rates. It covers terminology, misconceptions about coupon rates, and provides examples to illustrate bond valuation calculations. The conten

0 views • 41 slides

Understanding Bond Basics for Investing Success

Explore the fundamental concepts of bonds and learn how market rates impact bond prices, guiding you through making informed investment decisions. Discover the relationship between interest rates and bond values, essential for navigating the world of public funds investing.

0 views • 30 slides

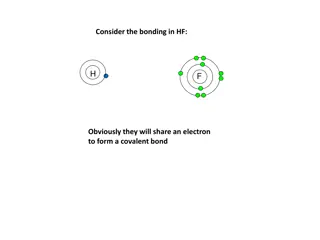

Understanding Bonding in HF Molecule

In HF bonding, hydrogen and fluorine share an electron to form a covalent bond. Fluorine, being more electronegative, attracts the bonding electrons more, resulting in a polar covalent bond. If hydrogen was less electronegative, the bonding electrons would shift further towards fluorine until an ion

0 views • 11 slides

Management of Funds from the 2010 Deepwater Horizon Oil Spill in Texas

Texas has access to funds from the Deepwater Horizon Oil Spill through the Gulf Environmental Benefit Fund, Natural Resource Damage Assessment, and the RESTORE Act. The National Fish and Wildlife Foundation allocates funds for Texas projects, while BP provides funding for early restoration projects.

0 views • 33 slides

Understanding Bond Lengths and Strengths in Chemistry

Bond lengths represent the critical distance between bonded atoms for maximum stability, while bond strengths are measured through dissociation energy and average bond energy. Methods for measuring bond lengths include X-ray diffraction and spectroscopic methods, with bond energies reflecting the st

0 views • 38 slides