BACS Processing

Discover how BACS can revolutionize your payment processes by reducing cheque usage, saving time and costs, enhancing cash flow control, and streamlining reconciliation. Learn about setting up BACS parameters, email configurations, user numbers, and more to optimize your financial operations efficie

0 views • 26 slides

Boost Your Business with SMS gateway for transactions : A Overview

\"Discover how leveraging an SMS gateway for transactions can propel your business forward in this comprehensive overview. Explore the benefits of seamless communication, enhanced customer engagement, and streamlined transactions. Unlock the potential to boost sales, improve efficiency, and cultivat

1 views • 6 slides

Taxation and Reporting of Futures and Options (F&O) Transactions

Explore the taxation aspects and reporting requirements related to Futures and Options (F&O) transactions. Learn about the types of F&O transactions, relevant heads of income for reporting income/loss, and the provisions of Section 43(5) of the Income Tax Act, 1961, defining speculative tran

2 views • 24 slides

Database System Concurrency Control and Transactions Overview

Studying relational models, SQL, database system architecture, operator implementations, data layouts, and query optimization laid the foundation for advanced topics like Concurrency Control and Recovery. Discover how transactions group related actions, ACID properties ensure data integrity, and the

0 views • 57 slides

Delete Expense Transactions in QuickBooks Online?

Delete Expense Transactions in QuickBooks Online?\nKeeping clean books in QBO requires managing expenses effectively. This includes deleting unnecessary transactions. Confused about how? Don't worry! This guide simplifies the process. Learn when to delete, what to consider beforehand, and follow the

1 views • 3 slides

Taxation of F&O Transactions under Indian Income Tax Law

This content discusses the taxation of Futures and Options (F&O) transactions in India under the Income Tax Act of 1961. It covers the types of F&O transactions, relevant heads of income for reporting income or loss, and the provisions of Section 43(5) related to speculative transactions. The articl

1 views • 24 slides

Accounting for Independent Branches: Salient Features and Transactions

Independent branches maintain separate sets of accounts and carry out business transactions autonomously. The accounting system of an independent branch involves double entry bookkeeping, reconciliation of accounts between the branch and head office, and recording transactions like dispatch of goods

2 views • 10 slides

Legal Implications of the Digital Economy in Malawi

Explore the legal implications of the digital economy in Malawi as discussed at the ICAM Annual Lakeshore Conference. Topics include the Electronic Transactions and Cyber Security Act, principles of implementation, Malawi CERT, data privacy, and the significance of the digital economy in transformin

0 views • 44 slides

Essential Knowledge for Sales & Finance Transactions

Understanding the intricacies of titles in sales and finance transactions is crucial to avoid costly mistakes and ensure smooth processes. This guide highlights the importance of titles, handling trade-in packets, and managing drive-away transactions effectively. It emphasizes the significance of ve

0 views • 7 slides

UCPath vs KFS GL Reconciliation Tips & Audit Messages

Explore essential tips for reconciling UCPath and KFS GL transactions, including checking if transactions were posted, identifying period mismatches, and understanding audit messages in DOPE reports. Learn how to handle unposted transactions and recognize future or past period discrepancies to ensur

1 views • 10 slides

Texas Standard Electronic Transactions (TX.SET) Overview

Texas Standard Electronic Transactions (TX.SET) provide an interactive platform for various transactions involving ERCOT and non-ERCOT entities. The TX.SET Version 4.0 includes a range of transaction names and documents related to service orders, outages, invoices, customer information maintenance,

0 views • 33 slides

Blockchain Technology and Its Applications

Blockchain technology enables secure, decentralized transactions by utilizing open ledgers and cryptographic techniques. It eliminates the need for intermediaries, reduces fees, enhances privacy, and provides a permanent record of transactions. With a focus on concepts like open ledger, history, net

1 views • 35 slides

Compliance Obligations and PAN Requirements for Financial Transactions

This outreach program by the Directorate of Income Tax in Nagpur, in collaboration with the Nagpur Branch of WIRC of ICAI, focuses on effective compliance with Statement of Financial Transactions (SFT). It covers PAN compliance obligations, forms, and penalties for non-compliance related to specifie

1 views • 14 slides

Efficient Submission of Forms Solution via EDI Transactions

Streamlining the submission of Forms Solution to the Bureau through mandated EDI transactions. Claims adjusters must provide injured workers with a copy of the form. Key features include form generation via accepted EDI transactions, avoiding paper versions, and ensuring timely filing. Details on Ag

0 views • 16 slides

Benefits of E-Banking and Its Impact on Customer Service

E-banking provides various benefits such as offering extra service channels, convenience, flexibility with online banking, reduction in cash transactions, self-inquiry facilities, remote and anytime banking, branch networking, and electronic data interchange. These benefits enhance customer service

0 views • 22 slides

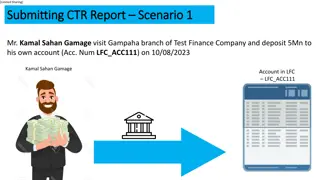

Financial Transactions Summary for Mr. Kamal Sahan Gamage

Mr. Kamal Sahan Gamage conducted two financial transactions at the Gampaha branch of Test Finance Company. On 10/08/2023, he deposited 5 million LKR into his account (LFC_ACC111). On 10/10/2022, he withdrew 1 million LKR via a cash cheque from the collection account (COL_ACC100). Both transactions w

0 views • 24 slides

High-Performance Transactions for Persistent Memories

Explore the optimization of transactions for persistent memories, focusing on ordering constraints, synchronous vs. deferred commit transactions, persistency models, and performance evaluation. The study aims to improve transaction performance in the presence of high persistent memory latencies by m

0 views • 26 slides

Building Effective Board Memos for City Transactions

Guidance on building a board memo for the Board of Estimates, a public board overseeing city transactions. Learn about the reviewing agencies involved, such as the Law Department, Dept. of Finance/BBMR, MWBOO, and Pre-Audits, and their roles in the approval process. Follow their guidelines to ensure

0 views • 18 slides

360 Control Manager & Cardholder Training Commercial Card Payment Solutions

Explore how 360 Control Manager provides an online Employee Expense Reporting tool for coding transactions related to the company's Visa business cards. Learn how to access the system, code transactions, split a transaction, add comments, attach receipts, and follow a 3-step process for coding, revi

0 views • 18 slides

Secure Electronic Transactions (SET)

Secure Electronic Transactions (SET) is an encryption and security specification designed to protect credit card transactions on the Internet. SET provides a secure way to utilize existing credit card payment infrastructure on open networks, such as the Internet, involving participants like clients,

1 views • 6 slides

Google Spanner: A Distributed Multiversion Database Overview

Represented at OSDI 2012 by Wilson Hsieh, Google Spanner is a globally distributed database system that offers general-purpose transactions and SQL query support. It features lock-free distributed read transactions, ensuring external consistency of distributed transactions. Spanner enables property

1 views • 27 slides

Optimizing Read-Only Transactions for Performance

Explore the nuances of performance-optimal read-only transactions in distributed storage systems. Focus on achieving high throughput and low latency while considering algorithmic properties and engineering factors. Learn how coordination overhead affects performance and strategies to design efficien

0 views • 42 slides

Ensuring Security and Trust in Online Transactions

Establishing trust and security is crucial for online transactions. Guidelines include verifying company legitimacy, safeguarding personal information, and using secure payment methods. In case of doubt, research the company and its reputation. Tips for secure transactions are highlighted, emphasizi

0 views • 6 slides

Simplifying Loan Transactions for Better Management

Explore the new functionality introduced for handling loan transactions easily, distinguishing between loan and lease agreements, and designating ownership effectively. Learn about different options for recording ownership changes and managing transactions seamlessly.

0 views • 27 slides

Financial Transactions and Budgetary Control Overview

The content delves into requirements and configuration management for general ledger teams, chart of accounts reporting, budget references, fund management, commitment control, and budgetary rules. It emphasizes the establishment of budgets at various levels of the account hierarchy and details the

0 views • 49 slides

Benefits and Process of Cashless Banking in Schools

Explore the advantages of cashless banking in educational institutions, including enhanced security, cost savings, and quicker transactions. Learn about electronic payments like BACS and CHAPS, how to set them up, process BACS payments, and considerations for BACS transactions. Discover the importan

0 views • 11 slides

Advanced Database Transactions and Recovery Concepts

Explore the key concepts of transactions and recovery in advanced databases. Topics include durability, input/output operations, expanded transactions, logging approaches, and log records. Learn about undo logging, redo logging, and undo/redo logging techniques for system crash recovery.

0 views • 36 slides

Distributed Database Management and Transactions Overview

Explore the world of distributed database management and transactions with a focus on topics such as geo-distributed nature, replication, isolation among transactions, transaction recovery, and low-latency maintenance. Understand concepts like serializability, hops, and sequence number vectors in ma

0 views • 17 slides

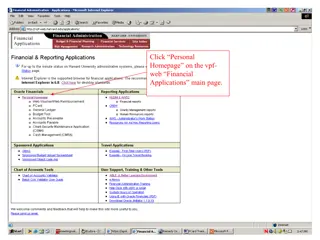

Guide to Reviewing Purchases and Transactions on the VPF Web Financial Application

This comprehensive guide provides step-by-step instructions on how to review purchases and transactions on the VPF Web Financial Application. From logging in to reviewing transactions and adding business purposes, this guide covers all aspects in detail with accompanying visuals.

0 views • 15 slides

Database Transactions in SQL

Database transactions in SQL ensure data integrity and consistency by allowing users to group SQL commands into atomic units that can be committed or rolled back as needed. Learn about the ACID properties of transactions, autocommit mode, and how to create and manage transactions effectively.

1 views • 29 slides

Overview of Redomiciliation Transactions and Section 7874 Implications

Section 7874 imposes restrictions on domestic corporations becoming owned by foreign entities with the same or similar shareholder base. It outlines tests triggering adverse consequences and discusses self-inversion transactions, tax considerations, and cross-border combinations. Notably, substantia

0 views • 8 slides

Database Transactions and Concurrency Control

This content delves into the world of database transactions, exploring concepts such as ACID properties, locking schedulers, anomalies in scheduling, and implementing transaction control mechanisms like Two Phase Locking. It covers the importance of maintaining atomicity, consistency, isolation, and

0 views • 36 slides

Foreign Exchange Management Act, 1999: Overview and Structure

The Foreign Exchange Management Act (FEMA) of 1999 replaced the Foreign Exchange Regulation Act (FERA) and empowers the Reserve Bank of India to regulate foreign exchange transactions. FEMA imposes restrictions on foreign exchange dealings and requires transactions to be conducted through authorized

4 views • 6 slides

Analysis of EAST Retention Impact on Interlibrary Loan Transactions

Analyzing the impact of retention commitments on Interlibrary Loan (ILL) transactions, this study delves into the circulation patterns of retained items, digital surrogates utilization, and speed of delivery considerations. Key findings include a significant proportion of transactions with retention

0 views • 11 slides

Taxation Guidelines for Share and Derivative Transactions by CA Mahavir Atal

Guidelines by CA Mahavir Atal regarding taxation of share and derivative transactions, including determining business income vs. capital gain, treatment of shares as stock-in-trade, maintaining separate portfolios, and the classification of transactions as either business or investment. The circular

0 views • 31 slides

Accounting Principles Lesson 2: Transactions and Financial Statements

Delve into the world of accounting as we explore transactions, double-entry bookkeeping, and the impact on financial statements. Learn how assets, liabilities, and equity interact through examples like Nathans Donut School's initial investments, equipment purchases, and cash earnings. Follow the jou

0 views • 18 slides

Enhancing Cloud Data Transactions with Deuteronomy

Deuteronomy aims to provide ACID transactions for cloud data, addressing the current limitations of transactions in cloud environments. The motivation, technical aspects, and implementation of Deuteronomy are discussed, highlighting the need for efficient transaction support across the cloud. Throug

0 views • 20 slides

Analysis of Dark Net Market Transactions Using JMP Pro 13g

Explore the world of dark net market transactions through detailed analysis using JMP Pro 13g. The study delves into data collection, methods used for analysis, findings on popular transactions and origins, as well as text analysis of item descriptions. Discover insights into the underground economy

0 views • 10 slides

Distributed Transactions in Spanner: Insights and Mechanisms

Spanner, a strictly serializable system, leverages TrueTime for timestamping to enforce the invariant between transactions. It ensures efficient read-only transactions and multi-shard transactions. Mechanisms like 2PL, 2PC, and (Multi)Paxos contribute to Spanner's fault tolerance and scalability. Le

0 views • 21 slides

Advancing Electronic Transactions and E-Commerce in Ethiopia

The state of electronic transactions in Ethiopia is evolving rapidly, with a focus on digital transformation and ICT adoption to bolster the economy. Initiatives include developing a digital strategy encompassing infrastructure, power, applications, and ecosystem support. Regulatory frameworks for e

0 views • 28 slides