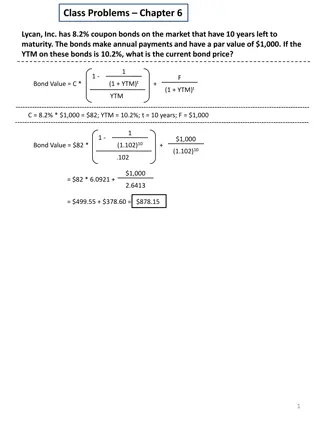

Maximum Price Calculation for Callable Bond with Annual Yield Requirement

A 20-year callable bond example is provided with a $1000 face value and 3% annual coupons, callable at different redemption values over specific years. The task is to determine the maximum price a buyer should pay to achieve a minimum annual yield of 5%. The calculation involves identifying the time at which the bond is called and the corresponding price required to meet the desired yield rate. Various scenarios are presented to illustrate the price adjustments as the redemption value remains constant.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

SOA Exam FM Module 3 Section 7 Callable Bond Examples

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%.

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) 10 11 12

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 11 12

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?11|+ 1000?11= 833.87 11 12

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?11|+ 1000?11= 833.87 11 12 NOTE: The prices will systematically increase or decrease (decrease in this problem) when the redemption value remains the same.

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?11|+ 1000?11= 833.87 11 12 NOTE: The prices will systematically increase or decrease (decrease in this problem) when the redemption value remains the same. Therefore, we only need to check endpoints for the same redemption values.

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 14 15 17 18 20

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?14|+ 1000?14= 802.03 14 15 17 18 20

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?14|+ 1000?14= 802.03 14 ? = 30?15|+ 1075?15= 828.48 15 17 18 20

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?14|+ 1000?14= 802.03 14 ? = 30?15|+ 1075?15= 828.48 15 ? = 30?17|+ 1075?17= 807.24 17 18 20

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?14|+ 1000?14= 802.03 14 ? = 30?15|+ 1075?15= 828.48 15 ? = 30?17|+ 1075?17= 807.24 17 ? = 30?18|+ 1125?18= 818.15 18 20

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?14|+ 1000?14= 802.03 14 ? = 30?15|+ 1075?15= 828.48 15 ? = 30?17|+ 1075?17= 807.24 17 ? = 30?18|+ 1125?18= 818.15 18 ? = 30?20|+ 1125?20= 797.87 20

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. Time at which bond is called ? Price in order to receive desired yield rate ?(?) = ?(?.??) ? = 30?10|+ 1000?10= 845.57 10 ? = 30?14|+ 1000?14= 802.03 14 ? = 30?15|+ 1075?15= 828.48 15 ? = 30?17|+ 1075?17= 807.24 17 ? = 30?18|+ 1125?18= 818.15 18 ? = 30?20|+ 1125?20= 797.87 20 Answer:? = 797.87

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. You buy the bond for 797.87. Determine the yield if the bond is redeemed at the end of year 16.

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. You buy the bond for 797.87. Determine the yield if the bond is redeemed at the end of year 16. 797.87 = 30?16|+ 1075?16

Example 1 A 1000 face value 20-year callable bond with 3% annual coupons can be redeemed according to the following schedule: 1000 at the end of years 10 through 14 1075 at the end of years 15 through 17 1125 at the end of years 18 through 20 Determine the maximum price a buyer should pay in order to earn an annual yield of at least 5%. You buy the bond for 797.87. Determine the yield if the bond is redeemed at the end of year 16. 797.87 = 30?16|+ 1075?16 ? = 5.204%

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ????

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 14 16 18 20

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 14 16 18 20 There is no redemption value stated or implied.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 14 16 18 20 There is no redemption value stated or implied. For all bond problems, when this is the case, assume the bond is redeemable at par.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 14 16 18 20 There is no redemption value stated or implied. For all bond problems, when this is the case, assume the bond is redeemable at par.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 16 18 20 There is no redemption value stated or implied. For all bond problems, when this is the case, assume the bond is redeemable at par.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?16|+ 1000?16 ? = 3.58% 16 18 20 There is no redemption value stated or implied. For all bond problems, when this is the case, assume the bond is redeemable at par.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?16|+ 1000?16 ? = 3.58% 16 18 20 There is no redemption value stated or implied. For all bond problems, when this is the case, assume the bond is redeemable at par. NOTE: The interest rates will systematically increase or decrease (increase in this problem) when the redemption value remains the same.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?16|+ 1000?16 ? = 3.58% 16 18 20 There is no redemption value stated or implied. For all bond problems, when this is the case, assume the bond is redeemable at par. NOTE: The interest rates will systematically increase or decrease (increase in this problem) when the redemption value remains the same. Therefore, we only need to check endpoints for the same redemption values.

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 20

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?20|+ 1000?20 ? = 3.64% 20

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?20|+ 1000?20 ? = 3.64% 20 Answer: ? = 3.54%

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?20|+ 1000?20 ? = 3.64% 20 Answer: ? = 3.54% (????)

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?20|+ 1000?20 ? = 3.64% 20 ???? = 1.03542 1 = 7.21% Answer: ? = 3.54% ????

Example 2 A 1000 face value 10-year callable bond with 8% semiannual coupons is bought for 1050. The bond can be redeemed at the end of any year starting with year 7. Determine the minimum annual yield for this bond. Time at which bond is called ? Yield rate to produce the given price ?: ?(?) = ???? 1050 = 40?14|+ 1000?14 ? = 3.54% 14 1050 = 40?20|+ 1000?20 ? = 3.64% 20 ???? = 1.03542 1 = 7.21% Answer: ? = 3.54% ????