Understanding Risk Factors in Building Asset Valuation and Damage Assessment

Explore various aspects of risk assessment in building asset valuation and damage prediction, covering topics such as stage-damage relationships, risk equations, sources of uncertainty, and first floor elevation considerations. Gain insights into the complexities of assessing and mitigating risks in

1 views • 24 slides

Expert Report on Valuation of Land for Logipol SA

Paul Sanderson, an experienced valuation expert, has been asked to prepare an expert report for Logipol SA regarding the valuation of land to be acquired for an extension of Metropolis Airport. His extensive experience includes advising on land acquisitions, negotiating compensation for rail systems

4 views • 20 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Understanding the Valuation of Goodwill in Business

Goodwill in business refers to the intangible value derived from the reputation, customer connections, and other advantages of a company that contribute to higher profits. Valuation of goodwill is crucial when selling a business, admitting new partners, amalgamating firms, or determining share value

2 views • 32 slides

Understanding Callable Bonds in Bond Investments

Callable bonds are a type of bond where the issuer reserves the right to redeem the bond at different times, potentially at different values. Investors face uncertainty about when the bond will be redeemed, but it can only be called at predetermined times. Common questions revolve around determining

0 views • 13 slides

Understanding Economic Value and Non-Market Valuation Methods

Economic value goes beyond the price paid, encompassing willingness to pay. Non-market valuation methods help estimate the true worth of goods and services. Misconceptions exist regarding economic value versus economic activity and cost. Valuation exercises aim to enhance societal well-being by unde

1 views • 59 slides

Understanding Real Estate Valuation and Market Value

Explore the concepts of real estate valuation, market value, and the methods used to determine the worth of properties. Learn about the importance of valuation in decision-making processes related to investments, financing, operations, and more. Understand how market value is derived based on probab

1 views • 62 slides

Understanding Suits Valuation Act 1887 and Its Purpose

The Suits Valuation Act 1887 serves to determine the jurisdiction of courts by valuing specific suits. Its purpose includes ensuring the proper forum, expediting justice, protecting rights, rectifying jurisdictional issues, and assigning relevant courts to each case. The act distinguishes between va

0 views • 24 slides

Valuation Frameworks and Preparing for IPO in Indian Life Insurance Industry

Explore the differences between embedded valuation frameworks used by listed insurers in India versus internal frameworks, along with discussions on strategic decisions for IPO readiness, reasons for high valuations, and comparability issues. Dive into calculating Embedded Value and strategic consid

1 views • 45 slides

Understanding the Wide Scope of Valuation in Business

Valuation is a complex process that involves various aspects such as economics, laws, human dimensions, and more. It goes beyond just numbers, incorporating knowledge from different disciplines to provide a comprehensive evaluation. This article delves into the key terms, domains, and importance of

1 views • 50 slides

Understanding Business Rates and Valuation for Masonic Halls

Explore the assessment process of Masonic Halls for business rates, including factors affecting value and a valuation example. Learn how to appeal online through the Valuation Office Agency. Detailed information on rateable values and how different areas within the building are assessed.

0 views • 12 slides

Understanding Impairment of Assets in IFRS for SMEs - 2019

This content discusses the Impairment of Assets in IFRS for SMEs, focusing on determining the true economic benefits of assets for accurate financial representation. It covers exceptions, impairment tests, inventory valuation, and recognizing valuation/impairment losses for inventory categories. A c

1 views • 23 slides

Understanding Goodwill Valuation in Business

Goodwill in business represents the intangible value of a company beyond its tangible assets. This article covers the meaning of goodwill, factors affecting its valuation, methods of valuation such as simple average profit method, and considerations before calculating average profits. An illustrativ

0 views • 13 slides

Overview of Valuation Requirements under Companies Act, 2013 & IBC 2016

This text provides insights into the valuation requirements stipulated by the Companies Act, 2013 and the Insolvency and Bankruptcy Code, 2016. It includes sections demanding valuation reports from registered valuers, such as for share capital issues, audit committee terms, director transactions, cr

0 views • 54 slides

Understanding Alkynes in Organic Chemistry

Alkynes are unsaturated hydrocarbons with at least one triple bond, following a molecular formula of CnH2n-2. This group of compounds is discussed in Chapter three, covering topics like structure, hybridization, common naming, physical properties, preparation, and reactions. The sp hybridization of

1 views • 20 slides

Understanding Ecosystem Valuation and Non-Market Techniques

Ecosystem valuation aims to assess user preferences for ecosystem goods and services, determining the economic value attached to nature's benefits. Ecosystems offer provisioning, regulating, cultural, and supporting services crucial for human well-being. Various non-market valuation techniques like

0 views • 5 slides

Exploring Growth and Opportunities in the Green Bond Markets

Delve into the burgeoning Chinese green bond market with insights on green bonds growth, sector allocations, Latin American issuance trends, sustainable investment needs in Latin America, China's green bond growth, and global green bond market size comparisons. Discover the significance of Green Pan

0 views • 14 slides

Comprehensive Overview of U.S. Department of the Interior's Appraisal and Valuation Services

The U.S. Department of the Interior (DOI) oversees the Appraisal and Valuation Services Office (AVSO), providing valuation services for Indian trust property and various agencies within the DOI. The AVSO was established under the DOI Secretarial Order 3363 in 2018. It manages Tribal Appraisal Progra

0 views • 9 slides

PAMAV Report 2022: Advancing Mineral Asset Valuation in Europe

Polish Association of Mineral Asset Valuators (PAMAV) has been actively involved in the harmonization of Polish and international mineral resource reporting and valuation systems. The association's main activities in 2021/2022 include updating the POLVAL Mineral Resources Valuation Code, expanding t

0 views • 5 slides

Arlington ISD Citizens Bond Oversight Committee Report August 2016

The Arlington ISD Citizens Bond Oversight Committee (CBOC) was established to provide transparency, enhance public confidence, provide findings and recommendations to the Board of Trustees, monitor progress of the 2014 Bond program, and find ways to maximize the bond's potential. The committee compr

0 views • 27 slides

Introduction to Valuation with Chris Young, Ph.D.

Join Chris Young, Ph.D., a leading expert in valuation, for an insightful session on the fundamentals of valuation, major components, and practical exercises. Explore topics ranging from economic consulting to recent industry activity and learn from Chris Young's extensive experience as a partner at

0 views • 52 slides

Northamptonshire Pension Fund 2013 Valuation Overview

The Northamptonshire Pension Fund 2013 Valuation Report discusses the implications for Academy employers, focusing on aspects like the triennial valuation, covenant, risks, DCLG/DfE guidance, and annual accounts. The report provides insights into the pensions landscape, fund details, and the valuati

0 views • 67 slides

Bonded Warehouse Facility and New Bond Process

Bonded warehouse facilities offer a convenient way for traders and industrialists to store goods without paying duties. The process involves applying for a new bond with specific requirements and inspections by officers. Necessary documents and approvals are essential to secure the bond premises, en

0 views • 31 slides

Valuation Practices in Bangladesh: Insights and Guidelines

Exploring the valuation practices in Bangladesh, this article covers the use of valuations by banks, insurance companies, government entities, and more. It highlights the guidelines set by the Bangladesh Securities and Exchange Commission and the role of International Valuation Standards in asset va

0 views • 28 slides

Understanding the Bond Market: Maturity, Yield, and Pricing

Financial markets facilitate borrowing and lending, influencing interest rates, stock prices, and bond prices. Bonds promise future payments in exchange for current prices, while stocks offer ownership rights and dividends. The bond market involves maturity dates, coupon rates, and yield to maturity

0 views • 17 slides

Understanding Callable Bonds and Bond Amortization

Callable bonds provide issuers with the right to redeem the bond before maturity under certain conditions. This article discusses the concept of callable bonds, bond amortization, premium bonds, discount bonds, and provides examples of calculating bond values based on specific scenarios.

0 views • 12 slides

Understanding Bond Premiums and Their Impact on Financial Decision-Making

Bond premiums occur when bond prices increase in the secondary market due to a drop in market interest rates. They can be used for approved project costs, debt service, or reducing bond principal. Utilizing bond premiums wisely can lead to cost savings for taxpayers. Learn how bond premiums can affe

0 views • 5 slides

Understanding Bond Valuation Models and Yield Relationship

Explore the fundamentals of bond valuation, including the present value model and the yield model, to understand how bond prices are determined based on factors like market price, coupon payments, and yield to maturity. Learn about the price-yield curve, convexity, and how to calculate expected yiel

0 views • 25 slides

Bond Analysis and Valuation Techniques by Binam Ghimire

Explore the analysis and valuation of bonds in-depth with a focus on present value techniques, bond yields, and calculating future bond prices. Understand the process of pricing a bond by determining cash flows, coupon payments, and par value. Dive into the calculations involved in determining the p

0 views • 40 slides

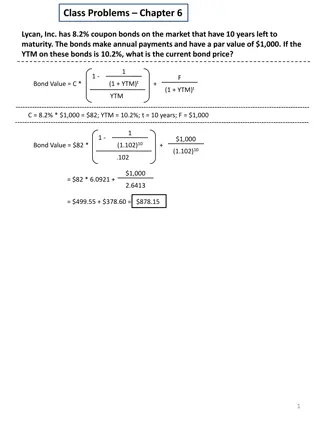

Bond Pricing and Yield Calculation Examples

The provided content illustrates calculations for bond pricing and yield in various scenarios. It covers topics such as determining current bond prices based on coupon rates, yield to maturity, and time to maturity. Additionally, it explores scenarios with different bond characteristics like annual

0 views • 5 slides

Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Not

0 views • 39 slides

Understanding Bond Valuation and Pricing

This informative content delves into valuing bonds, explaining concepts such as face value, coupon rates, and the relationship between bond prices and interest rates. It covers terminology, misconceptions about coupon rates, and provides examples to illustrate bond valuation calculations. The conten

0 views • 41 slides

Financial Management: Valuation of Long-Term Securities and Stock

This content covers various aspects of financial management, including bond valuation, preferred stock valuation, common stock valuation, dividend valuation models, and dividend growth patterns. It discusses topics such as face value, coupon rates, types of bonds, semiannual compounding, and factors

0 views • 21 slides

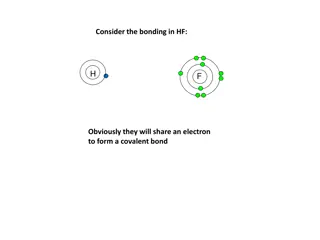

Understanding Bonding in HF Molecule

In HF bonding, hydrogen and fluorine share an electron to form a covalent bond. Fluorine, being more electronegative, attracts the bonding electrons more, resulting in a polar covalent bond. If hydrogen was less electronegative, the bonding electrons would shift further towards fluorine until an ion

0 views • 11 slides

Understanding Market Analysis and Valuation in Real Estate

Explore essential concepts in real estate market analysis and valuation, including the unitary valuation principle, net lease drugstore market trends, the importance of location, fee simple ownership, and leased fee valuations. Gain insights into the economic principles governing highest and best us

0 views • 65 slides

Understanding Valuation Principles for Natural Resource Assets

Valuation of natural resource assets involves linking physical and monetary accounts, considering factors like economic value, extraction costs, market prices, and alternative valuation approaches. Economic theory emphasizes market prices as a means of measurement, but natural resources often requir

0 views • 25 slides

Transformation of Valuation Services Office at DOI

In the process of appraisal, consolidation, and implementation overview at the Valuation Services Office within the Department of Interior (DOI), significant changes have been made to enhance efficiency and effectiveness. This includes the consolidation of appraisal services under a single entity, r

0 views • 15 slides

International Merchandise Trade Statistics (IMTS) Valuation Recommendations

IMTS provides key recommendations for valuing goods in international trade, emphasizing the adoption of the WTO Agreement on Customs Valuation. The use of FOB and CIF valuation methods, along with specific guidelines for special categories of goods, ensures a standardized basis for valuation that is

0 views • 8 slides

Understanding Bond Lengths and Strengths in Chemistry

Bond lengths represent the critical distance between bonded atoms for maximum stability, while bond strengths are measured through dissociation energy and average bond energy. Methods for measuring bond lengths include X-ray diffraction and spectroscopic methods, with bond energies reflecting the st

0 views • 38 slides

Valuation of Companies in Distress: Insights on IBC & Fair Valuation

This document delves into the intricacies of valuing distressed companies, focusing on the challenges, reasons for distress, impacts, and the valuation process under the IBC framework. It emphasizes the importance of specialized knowledge and adjustments required in valuations of distressed firms, h

0 views • 37 slides