Strategies for Reducing Improper Payments in Government Programs

Explore key aspects of reducing improper payments in government programs, including an overview of the issue, components of the Executive Order, collaboration efforts, and statistics on payment errors. Learn about stakeholder roles, milestones, guidance, state involvement, and steps taken to incentivize compliance and enhance transparency. Discover how partnerships between Federal, State, and local entities are vital in addressing this challenge.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Reducing Improper Payments UI Integrity Conference April 20th, 2010 1

Agenda Introduction of the Executive Order Components of the Executive Order Stakeholder roles and responsibilities Executive Order milestones Guidance Guidance overview Major questions addressed in guidance Sections that states may be interested in Work Groups Description of work groups and issue areas Role of states and state agencies Next Steps Questions and resources 2

Collaboration Strengthening partnerships between Federal, State, and local governments and agencies. Partner4Solutions.gov has been established to gather best practices to improve program integrity. 3

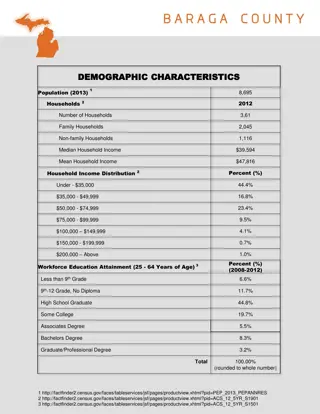

Improper Payments Overview Landscape Statistics Payment errors have been steadily increasing since 2004 when Federal agencies first began measuring and reporting payment errors. The increase is the result of: More programs measuring error More thorough measurement methodologies Increases in total Federal outlays FY 2009 improper payments are approximately ~$100 billion Represent ~$30 billion increase versus FY 2008, driven primarily by more stringent measurement and increased expenditures Approximately 90% of the errors are in 12 of the 72 programs measured (6 agencies) The Medicare, Medicaid, EITC and Unemployment Insurance programs each have over $10 billion in improper payments The President issued Executive Order #13520, Reducing Improper Payments on November 20, 2009. 4

Components of the Executive Order Incentives for Compliance Transparency Agency Accountability Financial incentives for States to build better systems to identify and reduce errors State audits to focus on error reduction versus compliance Contractors charged damages for improperly invoicing the government Accountable Senate- confirmed appointees for high-priority programs Inspector generals review: Error payments over certain thresh-hold amounts Measurement plans and reduction targets Agency forensic auditing pursued Required sharing of eligibility information among programs and agencies Quarterly reporting of high-dollar improper payments High-priority programs designated (programs with largest amount of error) More frequent measurement and reporting Improper payment dashboard High dollar errors/fraud Assessment of performance versus planned targets Publicly available Central website for reporting waste, fraud, and abuse 5

Stakeholders Identify high-priority programs Issue government-wide E.O. guidance Establish annual or semi-annual program performance targets Establish working groups Publish Improper Payments dashboard Publish website for reporting Improper Payments Recommend actions to the President to reduce improper payments by improving information sharing Monitor agency progress and advise Controller on key issues and decisions Submit a report on high-dollar improper payments and planned actions Provide IG with report on measurement methodology and plans for meeting reduction targets Accountable Official OMB Treasury Consult the working groups, on measurements, single audits, incentives and accountability Consult Treasury on the internet dashboard and waste, fraud, and abuse website; and for recommendations on improving information sharing Consult CFOC on internal controls recommendations Consult Treasury/OMB on actions designed to reduce improper payments by improving information sharing Consult CFOC on recommendations to agencies about new internal control techniques Consult Treasury with legal issues associated with website data sharing CIGIE DOJ 6

Executive Order Milestones 12/18/09 2/18/10 5/19/10 Establish working groups Issue government-wide guidance to agencies Establish annual or semi-annual reduction targets Publish dashboard Submit recommendations on: Improving measurements Strengthening internal control measures Improving information sharing Enhancing contractor accountability Shifting focus of single audits to improper payments Improving incentives and accountability Agency submits first quarterly report on high-dollar improper payments Agency provides IG with report on error methodology and plans for meeting targets 7

Guidance Overview OMB issued implementing guidance for Executive Order 13520 - March 22, 2010 The guidance is: Drafted in a Question and Answer format Separated into several sections: General questions Improper payments reporting Reporting deliverables 8

Major Questions Addressed in Guidance Although many questions are addressed in the guidance, the highlights include instructions on: Specifying responsibilities for agency accountable officials; Determining the programs subject to the EO (i.e., high- priority programs); Defining supplemental measures and targets for high- priority programs; Establishing reporting requirements under the EO; and Establishing procedures to identify entities with outstanding improper payments. 9

Guidance Sections of Interest to State UI Officials A few sections that may interest State UI community include: Measures of access requirements; More frequent supplemental measures ; and Posting additional information on the web. 10

Work Groups Work Group (Section of E.O) Deliverables Issue Guidance --2(a)(iii) IP Guidance in OMB A-123 App. C Improve Measures of Access - 2(a)(iv) Dashboard for program access and measurement Publish Dashboard on Website - 2(b) & 2(c) IP Website Refine Measurements to Focus on High- Dollar or High-Risk Errors - 3(d) Forensic tools to measure & detect IP Improve Information Sharing - 3(e) Sources and ways to share payments info Enhance Contractor Accountability - 4(a) Contractors causes & remedies for IP Shift Focus of Single Audits to Improper Payments - 4(b) Modifications to SA process for effectiveness Explore Incentives for State and Local Governments - 4(c) Administrative actions through OMB Circulars and program guidance 11

Work Group Collaboration Interagency work groups: Being lead by agency representatives; Sharing best practices from different agencies and programs; and Bridging silos State involvement in several work groups, including: Measuring program access; Improving data sharing; Single audit requirements; and Incentives for state and local governments 12

Next Steps 5/19 Work groups to issue recommendations 5/19 Website launch Which recommendations will be pursued? Payment Recapture Audits 13

Questions and Resources Joe Pika: jpika@omb.eop.gov or 202-395-1040 OMB s improper payments website with EO, guidance, and other materials: http://www.whitehouse.gov/omb/financial_fia_improper/ 14