PAYMENTS TO STUDENTS GUIDE

William and Mary makes various payments to students for tuition, research, and other activities. This guide covers types of student payments, tax implications, student definitions, employee student status, payment timing, and processing procedures.

1 views • 32 slides

Campus Operations Meeting Highlights: November 13th, 2023

Explore the key agenda items discussed at the Campus Operations Meeting on November 13th, 2023, including updates on new travel management services partnerships, payments to individuals, and guidelines for honorarium payments. Learn about the formal announcement of Collegiate Travel Planners, value-

0 views • 45 slides

Rise Up, Step Up, Speak Up - Department of Personnel Management Regional Workshop

Explore the Department of Personnel Management's initiatives on offline payments, key policy directives, types of offline payments, and the process at the directorate level. Learn about genuine claims, final entitlements, and the significance of offline payments in public service reforms.

0 views • 12 slides

Understanding Amendment in Section 43B for MSME Presented by CA Naman Maloo

The recent amendment in Section 43B of the Income Tax Act introduces a new clause (h) focusing on payments to Micro and Small Enterprises (MSMEs). Payments to MSMEs must adhere to the time limits prescribed in the MSMED Act of 2006 for deductions to be allowed. This change emphasizes timely payments

0 views • 29 slides

What is ACH Processing and how does it work?

Automated Clearing House (ACH) payments are electronic payments made through the ACH network, an extensive U.S. financial transaction network that processes large volumes of credit and debit transactions in batches. ACH payment services are known for their cost-effectiveness and efficiency, facilita

1 views • 4 slides

Convenient Ways to Pay Your Bill at Thomas Jefferson University

Discover easy methods to pay your bills at Thomas Jefferson University, including online payments, mail-in options, and in-person payments. Various payment modes such as debit cards, credit cards, and e-checks are accepted, ensuring a hassle-free experience. Follow step-by-step instructions for onli

1 views • 26 slides

Streamlining Payment Process for Covid-19 Vaccination Programme

The Price Per Dose (PPD) payment mechanism simplifies and accelerates the payment process for Covid-19 vaccination providers and organizations. By automating payment processing based on vaccination records, it eliminates the need for manual invoicing, ensuring swift and accurate payments. To start P

4 views • 17 slides

Enhancing Public Transparency in Physician Financial Relationships through Open Payments Program

The Open Payments Program ensures transparency in the healthcare industry by requiring manufacturers to report payments made to physicians and teaching hospitals. This disclosure program aims to promote accountability and a transparent healthcare system. Key terms include Reporting Entities (manufac

0 views • 30 slides

Understanding Annuities: Types and Examples

An annuity is a series of equal payments made at regular intervals, with examples including mortgages, car loans, and student loan payments. Different types of annuities include simple and general annuities, ordinary annuities, deferred annuities, perpetuities, and annuities certain. Learn to comput

0 views • 31 slides

Understanding Fractions: Basic Concepts and Operations

This comprehensive guide covers the fundamentals of fractions, including simplest forms, improper fractions, mixed numbers, and operations like addition and subtraction. Learn how to express fractions in their simplest form, convert improper fractions to mixed numbers, and perform arithmetic operati

0 views • 19 slides

Overview of State Whistleblower Act in Washington State

The State Whistleblower Act in Washington State, governed by the Revised Code of Washington (RCW) 42.40, provides a mechanism for state employees to report improper governmental actions. The Act aims to encourage whistleblowers to come forward, prohibits retaliation, and authorizes remedies for viol

0 views • 28 slides

Understanding Balance of Payments: Components and Significance

Balance of Payments (BOP) is a comprehensive account of a country's economic transactions with other nations in a given period. It includes receipts and payments for goods, services, assets, and more. BOP consists of the current account, capital account, and official reserve account. The current acc

3 views • 25 slides

Understanding Digital Payments: Process and Security

Digital payments revolutionize the way transactions are conducted by enabling cashless transfers between payers and payees through various modes like banking cards, mobile wallets, and internet banking. This article delves into the concept of digital payments, different modes available, the pros and

0 views • 19 slides

Understanding Criminal Justice Incentive Pay (CJIP) Program in Florida

The Criminal Justice Incentive Pay (CJIP) Program in Florida, established in 1977 and amended in 1980 and 1981, aims to provide extra salary payments to investigators, law enforcement, and correctional officers for pursuing educational and career development activities beyond job requirements. CJIP

0 views • 12 slides

Accounting Entries in Hire Purchase System for Credit Purchase with Interest Method

In the Credit Purchase with Interest Method of Hire Purchase System, assets acquired on hire purchase basis are treated as acquired on outright credit basis with interest. This method involves initial entries for recording the asset acquisition, down payments, interest on outstanding balance, instal

0 views • 10 slides

Efficient Billing and Collection Management System for Educational Institutions

Streamline your educational institution's billing and collection process with the Integrated National Education Information System (iNEIS) for managing clinic sessions, payments, generating reports, and handling reversals efficiently. Utilize the online help resources for manual calculations, revers

0 views • 61 slides

Manage Student Invoicing and Payment in iNEISTM Training Slides

Training slides for managing student invoices, billing, collection, fee charging procedures (automatic and manual), correcting fees, collecting payments, reversing incorrect payments, and handling excess payments or refunds in the Integrated National Education Information System (iNEISTM).

0 views • 9 slides

Strategies for Reducing Improper Payments in Government Programs

Explore key aspects of reducing improper payments in government programs, including an overview of the issue, components of the Executive Order, collaboration efforts, and statistics on payment errors. Learn about stakeholder roles, milestones, guidance, state involvement, and steps taken to incenti

0 views • 14 slides

Enhancing Payment Accuracy with GOVerify Business Center

The GOVerify Business Center initiative, established through an Executive Order, aims to reduce improper payments in Federal programs by enhancing payment accuracy and efficiency. This includes thorough eligibility verification before fund release and utilizing databases like the Do Not Pay List. Th

0 views • 6 slides

Understanding Move Related Payments and Expenses

Explore the intricate world of move-related payments and expenses categorized by numbers (10, 20, 30, 40, 50). From fixed rate move payments to direct loss payments and ineligible moving expenses, grasp the details of items, inventories, and costs involved in relocations. Delve into the nuances of p

2 views • 52 slides

Financial Management Training Highlights

This content showcases key aspects of financial management training sessions conducted by the USDA Office of the Chief Financial Officer. It covers topics such as CAP Goal 9 - Getting Payments Right, Payment Integrity, and definitions of improper payments. The sessions emphasize stewardship of taxpa

0 views • 16 slides

Understanding Marketing Assistance Loans (MAL) and Loan Deficiency Payments (LDP) for Farmers

Farmers can benefit from Marketing Assistance Loans (MAL) and Loan Deficiency Payments (LDP) to manage cash flow and ensure price floors for their harvested grain. MAL offers low-interest loans while LDP provides payments if prices fall below a certain level, offering financial support during challe

0 views • 39 slides

Understanding U.S. Physician Payment Sunshine Act

The U.S. Physician Payment Sunshine Act mandates transparency in reporting payments and transfers of value from pharmaceutical, biologics, and medical device manufacturers to U.S. physicians and teaching hospitals. Reporting requirements include details like recipient information, payment amounts, a

0 views • 9 slides

Troubleshooting Heywood Cases in SEM Models

In structural equation modeling (SEM), encountering improper solutions like negative variance parameters and non-positive definite covariance matrices is common. These issues can lead to untrustworthy results and affect the standard errors of estimates. This segment provides insights on recognizing

0 views • 25 slides

Understanding Direct Payments in Adult Social Services

Direct payments offer individuals receiving support from social services the freedom to manage and purchase their care services, promoting independence and choice. The Care Act 2014 and Mental Capacity Act 2005 are key legislations supporting individuals with care needs. Direct payments empower indi

0 views • 15 slides

Invoice Processing at National Institutes of Health Office of Financial Management

The Commercial Accounts Branch at NIH's Office of Financial Management handles invoice processing efficiently to ensure timely payments to vendors. They manage various types of invoices, address improper submissions, and facilitate the payment approval process. Vendors' reasons for delayed payments

0 views • 10 slides

Efficient Accounts Payable Processes and Procedures

Streamline your accounts payable functions with detailed guidelines on vendor invoices, payments, cabinet level approvals, handling of independent contractors, and managing invoices for direct payments. Learn about the essential steps, requirements, and best practices to ensure timely and accurate p

0 views • 9 slides

Understanding Colorado Oil and Gas Revenue Suspense and Royalty Payments

Explore key insights into the management of oil and gas revenue suspense and royalty payments in Colorado, including legal perspectives on escheatment, ownership titles, royalty payment regulations, and fiduciary duties. Gain clarity on issues such as holding funds due to probate, the suspension of

0 views • 35 slides

EPCA Forum 2023: European Payments & Regulations Conference in Riga

EPCA Forum 2023, scheduled for October in Riga, will focus on European payments and regulations. The event features key topics like scheme connectivity, iDEAL and EPI developments, traditional banking challenges, payment service regulations, and competition in acquiring. Attendees can expect insight

0 views • 6 slides

Benefits and Process of Cashless Banking in Schools

Explore the advantages of cashless banking in educational institutions, including enhanced security, cost savings, and quicker transactions. Learn about electronic payments like BACS and CHAPS, how to set them up, process BACS payments, and considerations for BACS transactions. Discover the importan

0 views • 11 slides

Direct Payments & Social Care Investigations Workshop Overview

Explore the key areas covered in the Direct Payments & Social Care Investigations Workshop, focusing on Direct Payments, social care fraud, applications, counter-fraud work, investigations, and overcoming cultural resistance. Delve into the risks associated with social care fraud and learn about the

0 views • 28 slides

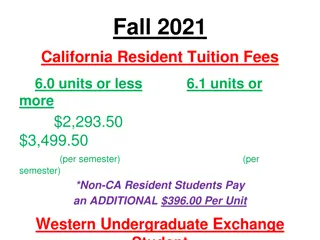

CSUEB Fall 2021 Tuition Fees and Payment Information

The Fall 2021 tuition fees for California resident students at CSU East Bay range from $2,293.50 to $3,499.50 per semester for 6.0 units or less. Non-CA resident students pay an additional $396.00 per unit. The installment plan includes three payments with deadlines, and late fees apply for missed p

0 views • 11 slides

Understanding the State Whistleblower Act: Reporting Improper Governmental Actions

The State Whistleblower Act, enacted in 1982 and amended in 1999 and 2008, provides a platform for state employees to report improper governmental actions. It aims to encourage reporting and prohibits retaliation against whistleblowers. Improper actions include gross waste of resources, violations o

0 views • 25 slides

Understanding Improper Payment Rate Calculation Process

Dive into the detailed process of calculating improper payment rates, including the thorough approval process, focusing on projected dollars in error, and analyzing error trends. Learn about determining weights, calculating projected dollars, and adding up projected improper payments in different st

0 views • 17 slides

Understanding IRS Form 1099-DIV and Reporting Dividend Payments

Form 1099-DIV is used to report dividend payments, including distributions like capital gains and liquidation distributions. It explains when dividends are included in income, the instances where clarity may be needed, substitute payments in lieu of dividends, and unusual instances such as delayed d

0 views • 24 slides

Guidelines for Research Incentive Payments in Sponsored Projects

Research incentive payments play a crucial role in encouraging participation in research projects. This involves providing individuals with incentives such as cash or gift cards. However, it is essential to adhere to IRS reporting requirements, track incentives carefully, and comply with institution

0 views • 7 slides

Incentive Payments and Distribution in County Highway Management

The information provided outlines the purpose, process, and factors involved in incentive payments for appointing licensed superintendents to manage road or street programs in counties. It details the conditional duties of appointed county highway superintendents and factors determining the amount o

0 views • 18 slides

Medicaid and CHIP Payment Error Rate Measurement (PERM) Program Overview

The Payment Error Rate Measurement (PERM) program is an initiative by CMS to estimate improper payments in Medicaid and CHIP annually. Sampling is used to measure the true improper payment rate. The program operates under final regulations, reviewing payments made in Reporting Year 2021. The goal is

0 views • 56 slides

Organic Farming Support Program Overview

This overview highlights the Environmental Farming Scheme's support for organic farming, including conversion and management options, eligibility criteria, payment rates, and digressive payments. The scheme aims to increase biodiversity, improve soil quality, enhance water quality, and promote clima

0 views • 13 slides

Albania National Retail Payments Strategy 2018-2023

Albania's National Retail Payments Strategy (NRPS) aims to enhance retail payments by expanding access to accounts and promoting electronic payments. The strategy focuses on legal and regulatory aspects, competition, governance, transparency, efficiency, and consumer protection. The vision is to cre

0 views • 9 slides