Understanding Robo Advisors: Pros, Cons, and How They Work

Robo advisors are digital financial advisers that provide online advice and portfolio management using algorithms, reducing costs for both companies and customers. They offer low fees, easy access, and 24/7 monitoring, but lack personalization and in-person interaction. Learn more about how they operate and their benefits in various markets like the USA, UK, and Canada.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

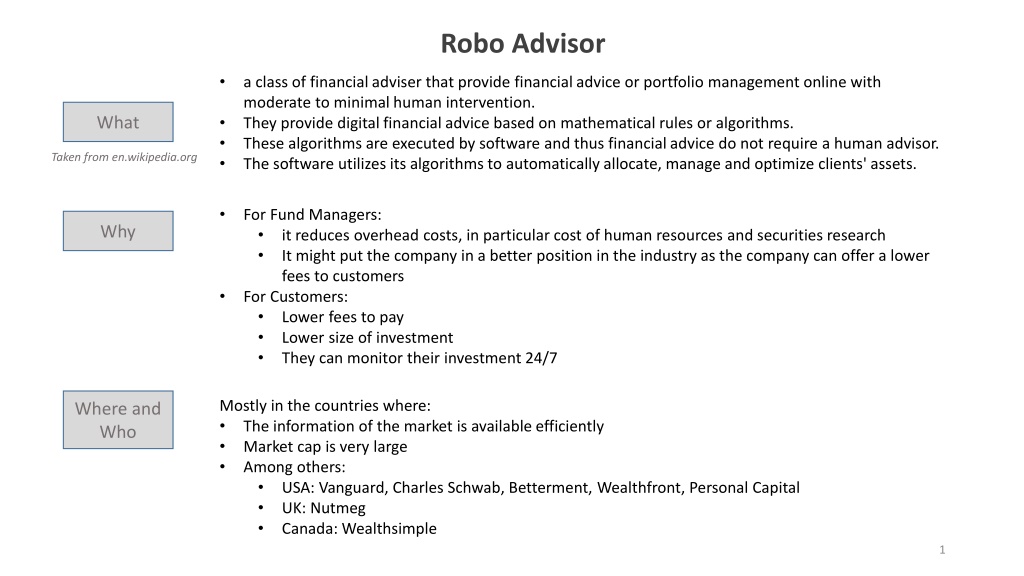

Robo Advisor a class of financial adviser that provide financial advice or portfolio management online with moderate to minimal human intervention. They provide digital financial advice based on mathematical rules or algorithms. These algorithms are executed by software and thus financial advice do not require a human advisor. The software utilizes its algorithms to automatically allocate, manage and optimize clients' assets. What Taken from en.wikipedia.org For Fund Managers: it reduces overhead costs, in particular cost of human resources and securities research It might put the company in a better position in the industry as the company can offer a lower fees to customers For Customers: Lower fees to pay Lower size of investment They can monitor their investment 24/7 Why Mostly in the countries where: The information of the market is available efficiently Market cap is very large Among others: USA: Vanguard, Charles Schwab, Betterment, Wealthfront, Personal Capital UK: Nutmeg Canada: Wealthsimple Where and Who 1

Robo Advisor Pros Cons It is not personalized Low Fees No face to face meeting Easy to transact Can only be implemented in an efficient market Can be monitored 24/7 Easy access for lower networth Low minimum balance 2

Robo Advisor How It Works 1. Customer fills KYC, Customers Profile, Financial Goals, Monthly Income and Expenses, tenor of investment in Robo provider website 2. The provider analyse (automatically) the customers profile and investment goals, and propose asset allocation to customer 3. Upon customer s confirmation re the asset allocation, the Robo provider asks the customer to open a dedicated bank account and investment account 4. Start investing 3