Challenges and Solutions in Eurozone Monetary Policymaking

Addressing the issues within the Eurozone monetary policy framework, the article explores concerns related to fiscal soundness, output gaps, and the role of countries like Germany. It emphasizes the need for tailored approaches, fiscal discipline, and potential reforms to achieve stability and growth in the region.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Monetary Policy and Fiscal Soundness: Do we Have a German Problem? Charles Wyplosz The Graduate Institute, Geneva and CEPR 57thAnnual Conference of the Italian Economic Association Milan, 22ndOctober 2016

The immediate concern May Eurozone countries have not recovered The ECB is fighting below-target inflation and high unemployment Fiscal policies are pro-cyclical Germany has recovered

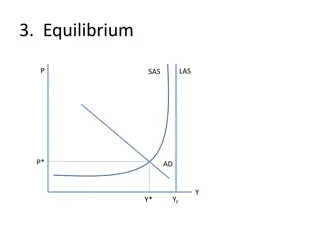

Output gaps (% potential GDP) Lost ouptut: 17% of GDP

Germany and the Eurozone Stability Pact in abbeyance Highly correlated Highly uncorrelated Source: European Commission

The problem One size does not fit all ECB cannot please all Useless appeals to Courts This is when fiscal policy must be used But fiscal space is limited where gaps are large We need think how the Eurozone can/should function

Possible answers Germany does not need a fiscal expansion True, no reason to raise public indebtedness Countries in difficulty have only themselves to blame True: lack of reforms, perennial fiscal indiscipline But fixing these will make things worse in the short run Time to play by existing rules The moral hazard view What if rules are bad? Time to review them

The money/fiscal connection The German fear ECB will never exit because of existing debts Inflation The German solution Wait until output gaps close Meanwhile: reform and reduce deficits and debts Can we do better?

Can we do better? Some principles ECB cares about Eurozone as a whole Monetary policy to remain expansionary Exit when needed Governments must prepare and deal with excessive debts Many solutions (ESBies, blue/red bonds, PADRE) Adapt policy mix to national conditions Germany: easy money/tight fiscal Large-gap countries: easy money/easy fiscal Stability and Growth Pact in abbeyance Deal with moral hazard: reinstate no-bailout

The underlying issue Monetary policy has fiscal characteristics Open market operations absorb public debts Interest rates affect budgets (and redistribute incomes) Ultimately, money backed by taxpayers The asset side of central banks The answer monetary dominance can never be absolute Fiscal policy mismanagement forces central banks to act Banks need a lender of last resort, states too These issues are ignored

Conclusion: a reminder Inflation in Germany 1956-2015 8? Bundesbank? ECB? Average? Bundesbank? Average? ECB? 7? 6? 5? 4? 3.1% 3? 2? 1,4% 1? 0? 1959? 1965? 1968? 1971? 1977? 1989? 1995? 1998? 2001? 2007? 1956? 1962? 1974? 1980? 1983? 1986? 1992? 2004? 2010? 2013? -1? Source: OECD