Understanding Economic and Monetary Policies in Korea and Worldwide

This course provides an insightful exploration of major policy issues related to money, banking, and financial development globally and in Korea. It covers the goals and conduct of economic and monetary policies, the impact of money on economies, financial stability, and responses to depression and deflation. The evaluation includes mid and final exams, with bonus points for attendance and participation. Major references include works by Mishkin and Moon. Lectures delve into topics such as the objectives of economic policy and macroeconomic policy goals like stabilization and price stability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Financial Development: A Bird s Eye View Woosik Moon

Course Outline The goal of this course is to understand the major policy issues of money and banking in Korea and World from a historical and comparative perspective. To this end, this course addresses the following five issues. 1. What is the goal of economic and monetary policies? 2. How does money affect the economy? 3. How is a monetary policy conducted? 4. How is financial stability achieved? 5. What are the monetary policies under depression and deflation? Trying to answer these questions, this course is intended to find appropriate solutions for preventing pathological phenomena such as inflation, deflation, depression and financial crises.

Grading The evaluation will be as follows: -Mid-exam 45% -Final exam 45% -Attendance, Participation and Cooperation: a bonus of 10%

Major References Mishkin, F. S (2010). The Economics of Money, Banking and Financial Markets 9thed. Woosik Moon (2018), A Study of Monetary Policy (In Korean)

What is the economic policy? Generally it refers to the action of state or government to affect the economic performance of a nation. Precisely, it refers to the action of state that defines the economic and social objectives and use appropriate instruments to attain these objectives. What are then the objectives of economic policy? Growth Redistribution Stability

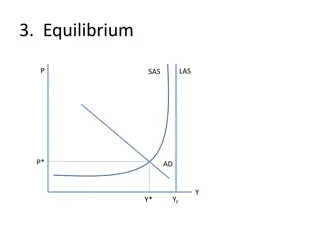

What is the goal of macroeconomic policy? - Stabilization - Started with the birth of Keynesian economics. - fiscal and monetary policies: Central bank, along with national tax system, is the essential economic institution supporting nation-state. The goals of monetary policy defined in the act of central bank - Price Stability - Employment or output stability - Financial Stability

Price stability: inflation rate growing at less than 2% Growth stability (or employment) Trend vs cyclical Financial stability: output loss (IMF world economic outlook)

Lecture 2-4. How does money affect economy?

Evolution of Money What is money? (See Mishkin, chap 3) -Commodity money -Paper money (fiduciary money) -Digital money (See Bank for International Settlements (2015), Digital Currencies, Committee on Payment and Market Infrastructures, November) At the beginning, the quantity of money: limited vs unlimited Later, how the paper money is issued: government credit vs private credit.

Money and Inflation Value of money and Definition of inflation (See Mishkin, chap. 24) Quantity Theory of Money: -Money stock to be controlled by government. -Money affects goods in general. Origins of Inflationary Monetary Policy -Budget Deficit -Hyperinflation -Accommodative Monetary Policy

Money, interest and output Money and business cycle (See Mishkin, chap.23) The transmission channels of monetary policy Interest rate change (bond price) Asset market view (stock price and real estate price) Exchange rate change (foreign asset price) Credit view

Phillips Curve and Credibility Checkout of the validity of Phillips curve (See Blanchard, Macroeconomics (6thed.), chap. 8 and chap. 22) Time inconsistency and rules vs discretion

Lecture 5-8 How is a monetary policy conducted?

Structure and governance of central bank Structure of central bank (See Mishkin, chap 13) Relation between central bank and government: independence or accountability?

Determination of money stock Definition of money (See Mishkin, chap. 14) Central bank controls its money and thereby the money of commercial banks Money creation and money supply process

Monetary policy strategy and Inflation targeting Inflation targeting (See Mishkin, chap. 16) From money targeting to inflation targeting

Determination of interest rates and yield curve De-coupling between money stock and interest rate. (See Mishkin. chap. 5-6 and Friedman, Benjamin and Kenneth N. Kuttner (2011), Implementation of Monetary Policy: How Do Central Banks Set Interest Rates?, Handbook of Monetary Economics, Vol. 3B, chap. 24) Central bank controls short-term rates and thereby long-term rates.

Instruments of Monetary policy See Mishkin, chap. 15. Changes in the Reserve Requirement Lending Open market operation

Supervision and Regulation Finance from micro-economic perspective (See Mishkin, chap. 11) Financial Instability and Stabilization Micro-stabilization

Handling Financial crises Analysis of Financial Crisis Korea and Asian Financial Crises (See Moon, Woosik (2000), "The Causes of the Korean Currency Crisis: Policy Mistakes Reexamined," Korea Review of Applied Economics, June, and *Moon, Woosik (2011), Two crises, two remedies and two consequences: Impacts on Korean Labor Market, THE INDIAN JOURNAL OF INDUSTRIAL RELATIONS, April) Subprime mortgage crisis and global financial crisis (See Alan Blinder (2013), After the Music Stopped)

Basel and Macro-stabilization See Turalay Ken (2016), Macro-prudential regulation: history, theory and policy, BIS papers, No 86 Global financial crisis and its impact on major countries Basle Capital Regulation and G20 Macro-stabilization in Korea - Handling Household Debts - Handling International Capital Flows (Swap and 3 sets of regulations for assuring financial stability)

Lecture 12. Unconventional monetary policy and the future of central banking

QE and forward guidance (See Bernanke, Ben S. and Vincent R. Reinhart (2004), Conducting Monetary Policy at Very Low Short- Term Interest Rates, AER, May) Deflation and Monetary Policy (See Shirakawa, Masaaki (2012), Demographic Changes and Macroeconomic Performance: Japanese Experiences, Opening Remark at 2012 BOJ-IMES Conference hosted by the Institute for Monetary and Economic Studies, the Bank of Japan, May, and Bernanke, Ben S.(1999) Japanese Monetary Policy: A Case of Self-Induced Paralysis?) Negative interest rates (See Santor. E. et al. (2016) A New Era of Central Banking: Unconventional Monetary Policies, Bank of Canada Review, Spring)