Challenges and Prospects of Establishing a Payment System in the West African Monetary Zone

The West African Monetary Zone (WAMZ) is striving to create a zonal payment and settlement system for cross-border transactions, aiming at economic integration for a common central bank and single currency. This initiative faces challenges but also holds promising prospects for regional financial integration. Key areas of focus include macroeconomic convergence, trade integration, financial infrastructure, and institutional capacity building within the WAMZ member countries. The journey towards a unified payment system within the region involves strategic pillars guiding the monetary integration process.

- West African Monetary Zone

- Payment System

- Financial Integration

- Regional Integration

- Economic Development

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

WEST AFRICAN MONETARY INSTITUTE WEST AFRICAN MONETARY INSTITUTE ESTABLISHING A PAYMENT SYSTEM WITHIN THE WEST ESTABLISHING A PAYMENT SYSTEM WITHIN THE WEST AFRICAN MONETARY ZONE AFRICAN MONETARY ZONE CHALLENGES AND PROSPECTS CHALLENGES AND PROSPECTS BEING PRESENTED AT BEING PRESENTED AT GHANA INSTITUTE OF MANAGEMENT AND PUBLIC GHANA INSTITUTE OF MANAGEMENT AND PUBLIC ADMINISTRATION (GIMPA) PUBLIC LECTURE SERIES ADMINISTRATION (GIMPA) PUBLIC LECTURE SERIES ACCRA, GHANA ACCRA, GHANA MARCH 14, 2019 MARCH 14, 2019 NGOZI E. EGBUNA (Ph.D.) NGOZI E. EGBUNA (Ph.D.) GENERAL, WEST AFRICAN MONETARY INSTITUTE DIRECTOR DIRECTOR- -GENERAL, WEST AFRICAN MONETARY INSTITUTE

OUTLINE 1. Introduction 2. WAMZ Payments System Development Project 3. Achievements 4. WAMZ Payment and Settlement System 5. Pan-African Payment and Settlement Platform 6. Challenges 7. Prospects 8. Conclusion 2

Background The WAMZ was established in 2000 and it comprises: The Gambia, Ghana, Guinea, Liberia and Sierra Leone The goal of the WAMZ was to implement activities including development of a zonal payment and settlement system for cross border transactions, among other activities leading to the establishment of a common central bank and introduction of a single currency 4

Background (Cont.) In 2005, the goal of the WAMZ was broaden to include economic integration; The Abuja Action Plan of 2009 approved a roadmap for the WAMZ Single Currency Project incorporating new structural benchmarks to facilitate WAMZ monetary integration process, culminating in to formulation of five strategic pillars to guide the WAMZ integration process 5

Background (Cont.) The strategic pillars are: Pillar I: Macroeconomic convergence, research and statistics Pillar II: Trade and regional integration Pillar III: Financial integration Pillar IV: Payment system infrastructure Pillar V: Institutional and capacity building 6

Background (Cont.) The Authority of Heads of State and Government of ECOWAS in 2014 adopted a Single-Track Approach to monetary union in West Africa and proposed the launch of a single currency by 2020 In view of this, the Institute is now responsible for managing and coordinating monetary integration activities within the WAMZ to enhance its effectiveness and serve as a platform for building consensus on and promoting economic integration, while ECOWAS Commission leads monetary integration process of the region 7

WAMZ PAYMENTS SYSTEM DEVELOPMENT PROJECT 8

What is the Payment? It is any system used to settle financial transactions through transfer of monetary value and includes the institutions, instruments, people, rules, procedures, standards and technologies that make such an exchange possible. 9

What is That? The WAMZ Payment System Development Project (WAMZ-PSDP), estimated at US$30 million was funded by the African Development Bank (AfDB). The project was launched in 2008. The establishment of a payment system in the WAMZ is in line with Pillar IV of the WAMZ Strategic Plan. 10

Objective The primary objective of the Project was to develop and automate the payment system infrastructure of The Gambia, Guinea, Liberia and Sierra Leone to the level already attained by Ghana and Nigeria. 11

Structure of the Project The project had 5 components, namely: Real Time Gross Settlement (RTGS) System Scriptless Securities Settlement (SSS) System Automated Clearing House (ACH) System Automated Cheque Processing (ACP) System Core Banking Application (CBA) 12

ACHIEVEMENTS 13

Preference for electronic payments The zone had witnessed a gradual shift from the dominance of cash and cheques to the preference for electronic payments and settlement in electronic products like ATM, POS, mobile money etc. 1200 1000 Volume of Transaction 000 800 600 400 200 0 2013 2014 2015 2016 2017 14

Cheque clearing time reduced The volume of cheques cleared have declined over the years, suggesting increased usage of electronic payments system Gambia Gambia 200 179.5 180 171.2 155.8 160 Volume of Cheques cleared 000 140.3 140 120 100 80 60 40 20 0 2015 2016 2017 2018 15

Increased digital transactions The wave of digital transactions is gradually spreading across the zone as more innovative channels continue to be developed by FinTechs in response to the opportunity offered by the success so far recorded in the WAMZ Payments System Development Project. 16

Enhanced financial inclusion The upgrade of the payment system infrastructure facilitated the successful launch of mobile money services in The Gambia thereby boosting financial inclusion 17

Increased usage of cheques In Guinea, the increase in the volume of cleared cheques was on account of confidence in the payment system infrastructure as transactions are settled through cheques rather than cash. 18

Increased usage of ATM and PoS In Liberia, the number of transactions using ATM and POS increased by 160 percent and 46 percent, respectively. 19

Infrastructure upgrade In Sierra Leone, the payment system infrastructure set the stage for the smooth implementation of electronic payment platforms such as ATM, POS and mobile money services. 20

Outcome The Project was successfully completed in 2016 and functioning efficiently in all the beneficiary Member States. The completion of the project paved the way for the interlinking of the Member States RTGS for cross- border transactions. This necessitated the establishment of a framework for Zonal payment system, the WAMZ Payment and Settlement System (WAMZPSS). 21

WAMZ PAYMENT AND SETTLEMENT SYSTEM (WAMZPSS) 22

Background Following the completion of the PSDP, the need for the inter-linkage of the various RTGS in the Zone arose. To this end, WAMI intended to undertake a project to connect all the RTGS of Member States through a SWIFT platform to facilitate smooth transfers and payments of funds in real time in order to enhance trade among WAMZ countries. 23

Objective The objective of the project is to inter-link the various wholesale and retail payments and settlement systems of the WAMZ in order to facilitate market integration through cross-border trade and serve as a platform for quoting and trading in local currencies of Member States. 24

Expected benefit The project would support, through integrated Payments and Settlement System (PSS), the broadening and deepening of the financial sector by establishing a single market in financial services among the WAMZ Member States, with a view to providing a wide range of financial services to all at competitive prices. 25

Status Due to lack of funding, this project has been put on hold. In the interim, WAMI and Afreximbank decided to collaborate for the achievement of their shared goal of introducing an efficient payment system. 26

PAN PAN- -AFRICAN AFRICAN PAYMENT AND PAYMENT AND SETTLEMENT SETTLEMENT PLATFORM (PAPSP) PLATFORM (PAPSP) 27

Background To this end, WAMI, in consultation with the Central Banks of the Member States of the WAMZ, and in partnership with Afreximbank, have taken giant strides to pilot the Afreximbank led Pan African Payments and Settlement Platform (PAPSP) in the WAMZ countries. 28

Objective The PAPSP is being designed to create a payment and settlement platform with Afreximbank as clearing and settlement agent with the participating CBs as co-Clearing and Settlement agents. The PAPSP is expected to be test run in the second quarter of 2019. 29

Highlights of PAPSP PAPSP is a central financial infrastructure for the economic and financial integration of Africa. PAPSP is a centralized payment and settlement infrastructure for intra-African payments only. PAPSP will operate independently of domestic payment systems PAPSP payments will be in local currency PAPSP defines a common framework for transacting, clearing and settling cross-border transactions, including operating rules, business practices and standards, participation requirements and funding schemes, among others 30

CHALLENGES 31

Lack of funding lack of funding has impeded the implementation of the WAMZPSS. The estimated cost of the full implementation of the WAMZPSS is US$5 million. The challenge in mobilizing funds led to the collaboration with Afreximbank for the PAPSP as a plausible alternative to the WAMZPSS; 32

Skills constraints The need to garner and maintain skilled staff cannot be overemphasised. There is a need to improve the skills of staffs in IT and payment system to be able to adequately meet the ever-changing technology in payments 33

Cyber insecurity There is the issue of cyber security as the cyberspace becomes increasingly susceptible and prone to hackers. These and other issues like identity management are key challenges in the payment system development in the WAMZ. 34

PROSPECTS 35

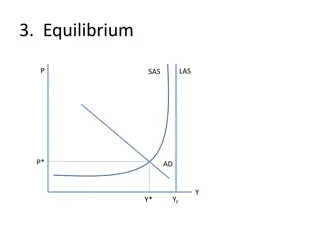

Financial inclusion There is potential for greater financial inclusion, job creation and ultimately economic development 36

Quoting and trading in WAMZ national currencies Quoting and trading in WAMZ national currencies using the integrated payment system platform could be enhanced with the backing of the monetary authorities 37

Boost in intra-WAMZ trade With the low level of intra-WAMZ trade relative to the rest of the world estimated at 1.1 percent in2017, this initiative is expected to improve trade in the Zone. Intra-WAMZ trade could be boosted due to efficient payments system Intra Intra- -WAMZ Trade Relative to the Rest WAMZ Trade Relative to the Rest of the World of the World 3 2.5 2 Percent 1.5 1 0.5 0 2013 2014 2015 2016 2017 38

Increased economic growth digital payments would lead to greater economic growth, growth in international e-commerce and aid in social and financial inclusion 39

Boost to tax administration digital payments have enhanced efficiency in tax administration by minimising human contact and accurate capturing of tax transaction details 40

Indirect formalization of the informal sector digital payment platforms present opportunity to indirectly formalise the informal sector by enhancing the ease of meeting tax obligations 41

Lower risks Virtually all payments by economic agents within the WAMZ would be done electronically eliminating the risks associated with carrying cash; 42

Enhanced financial supervision The adoption of a harmonized legal and regulatory framework would form the basis to supervise the activities of FinTechs to ensure that participants in e- commerce are protected and that innovations in payments do not affect financial stability in the zone. 43

CONCLUSION 44

Following the successful implementation of a modernised national payments system, the next stage is the development of an integrated regional wholesale and retail payment and settlement systems that will strengthen the efficiency of cross-border funds transfers within the six WAMZ countries; as well as strengthening of the financial sector regulatory and oversight framework. The Afreximbank-led Pan-African payment and settlement platform, using WAMZ as pilot, is expected to go-live in the second quarter of 2019, and would thereafter be rollover to the rest of Africa 45

THANK YOU 46