CDS Training Summary January 2021: Security Marking Presentation

In the CDS Training Summary for January 2021, the focus is on navigating the CDS Volume 3 Tariff, covering declaration categories, data elements, procedure codes, additional information codes, document codes, and more. The training provides a step-by-step guide on using the CDS Tariff, Volume 3, for completing declarations effectively and efficiently.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

CDS Training Summary January 2021 | Security Marking | Presentation Title | 1 OFFICIAL

TrainingOverview Module 1: Navigating the CDS Volume 3 Tariff Module 2: Declaration Categories Module 3: Data Elements Module 4: Procedure and Additional Procedure Codes Module 5: Additional Information (AI) Codes Module 6: Document Codes and Waivers Module 7: How to complete a CDS declaration CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff Module Contents: Structure of the CDS Tariff, Volume 3 CDS Tariff, Volume 3, Import CDS Tariff, Volume 3, Export CDS Tariff, Volume 3, Inventory Import CDS Tariff, Volume 3, Inventory Export CDS Tariff, Volume 3, Guidance Sections CDS Tariff, Volume 3, Appendices Step-by-Step Guide to using the CDS Tariff, Volume 3 CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff Structure of the CDS Tariff, Volume 3: The CDS Volume 3 Tariff is split into two main sections, in the same way as the CHIEF Tariff: Guidance and Appendices: Each guidance area contains different guidance material depending on the type of movement/ declaration being made, including Guidance on how to submit declarations to CDS Data element completion guides Simplified procedure declaration guidance Appendices contain: Code lists Additional guidance on how to complete specific data elements, such as procedure codes Data sets tables CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff CDS Tariff, Volume 3, Import: The CDS Volume 3 Import Tariff is used for: Import standard customs declarations (aka full declarations on CHIEF) Import simplified declarations on an occasional basis (aka partial declarations on CHIEF, such as low value bulking) Import simplified declarations on a regular basis (aka simplified frontier declarations) Import supplementary declarations The Appendix 1 and 2 Procedure Codes and Additional Procedure Codes are also used for: C21i EIDR Notifications of Presentation (aka EIDR C21s) The CDS Volume 3 Import Tariff is not used for any other form of C21. CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff CDS Tariff, Volume 3, Export: The CDS Volume 3 Export Tariff is used for: Export standard customs declarations (aka full declarations on CHIEF) Export simplified declarations on an occasional basis (aka partial declarations on CHIEF, such as non-statistical goods) Export simplified declarations on a regular basis (aka pre-shipment advice) Export supplementary declarations The Appendix 1 and 2 Procedure Codes/ Additional Procedure Codes are also used for: C21e EIDR Notifications of Presentation (aka EIDR C21s) The CDS Volume 3 Export Tariff is not used for any other form of C21. CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff CDS Tariff, Volume 3, Inventory Import: The CDS Volume 3 Inventory Imports Tariff is used for: Import Customs Clearance Requests (CCRs) (aka C21s on CHIEF) Import EIDR Notifications of Presentations (EIDR releases) Inventory releases can only be used where: No written customs declaration is required (oral decs) or The goods are being cleared away from the border (e.g., ETSFs, onward transit movements, EIDR inland clearances) EIDR NOPs: Use the Procedure Codes and Additional Procedure Codes listed in the Import Tariff unless otherwise instructed. The data set and completion rules for the EIDR NOP are provided in the Inventory Tariff CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff CDS Tariff, Volume 3, Inventory Export: The CDS Volume 3 Inventory Exports Tariff is used for: Export Customs Clearance Requests (CCRs) (aka C21s on CHIEF) Export EIDR Notifications of Presentations (EIDR releases) Inventory releases can only be used where: No written customs declaration is required (e.g., oral decs/ EXS) or The goods are being cleared away from the border (e.g., indirect exports) EIDR NOPs: Use the Procedure Codes and Additional Procedure Codes listed in the Export Tariff unless otherwise instructed. The data set and completion rules for the EIDR NOP are provided in the Inventory Tariff CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff CDS Tariff, Volume 3, Guidance Sections: The Guidance Sections include: Navigation Guides for the CDS Volume 3 Tariff Guidance on accessing CDS and transaction types, such as amendments, cancellations and fallback Declaration Completion Guides a guide to each data element used and how to complete them Correlation matrices between the first 4-digits of each Procedure Code and the 3-digit Additional Procedure Codes that can be used with each Guidance on which Procedure Codes and Additional Procedure codes are permitted with simplified procedures Aggregation Rules for CFSP CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff CDS Tariff, Volume 3, Appendices Appendices 1, 2 and 21-23 are unique to each movement type (imports, exports, inventory releases): 1: 4- digit procedure codes 2: 3-digit additional procedure codes 21 23: data set tables for each Declaration Category Appendices 3 20 are combined appendices, providing code lists for certain data elements. Where the data element is used on more that one movement type, the same code list is used in all circumstances Ensure you use the CDS code lists as they are different from CHIEF CD S Tarif OFFICIAL f Trai

Module 1: Navigating the CDS Volume 3 Tariff Step-by-Step Guide to using the CDS Tariff, Volume 3: When completing a CDS Customs Declaration, it is recommended that you use the Volume 3 Tariff sections in the following order: Identify the movement type Identify the Declaration Category data set Appendices 21 - 23 Volume 2 Tariff Tool CDS API Tariff Tool Commodity Code Appendix 1 Declaration Category table Index Lists Procedure Code Appendix 1 completion notes cross-references D.E. 1/10 1/11 Correlation Matrices Appendix 2: D.E. 1/10 and 1/11 Completion Notes Appendix 4 AI Code list AI Codes D.E. 1/10 and 1/11 Completion Notes Appendix 5 Document Code lists Document Codes D.E. 1/10 and 1/11 Completion Notes Declaration Completion Guides Completion Guides Appendices 3 20 Code lists for Code Lists CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories Module Contents: What are Declaration Categories? Why do they matter? How do you read them? Picking the right Declaration Category Declaration completion requirements Guidance on completing data elements Import, Export, Inventory Import and Inventory Export Declaration Categories CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories What are Declaration Categories? Declaration Categories are similar to different SAD (C88 ) copies. Each have a different purpose Declaration Categories are different data sets A Declaration Category identifies what data is required for the specific declaration type: Imports: H1 H5, I1 C&F and I1 B&E Exports: B1, B2, B4, C1 C&F and C1 B&E Import Customs Clearance Requests (CCRs): C21i and C21i EDIR NOP Export Customs Clearance Requests (CCRs): C21e and C21e EIDR NOP CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories Why do they matter? If the wrong Declaration Category is used, the data elements will be completed wrongly or the wrong data set used Declarations will fail validation and be rejected. Each Declaration Category: Is linked to a intended usage for the goods Has different data elements requirements Has different completion rules depending on the circumstances involved CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories How do you read them? Each Declaration Category follows the same format: Symbol Symbols in the cells - Symbol description Mandatory: data required by every Member State or data for which the UK has opted to mandate as always required Optional for economic operators: data that economic operators may decide to supply Dependant on Customs declaration scenario e.g. Procedure Code, Method of Payment etc. Data element required at the item level of the declaration of goods. The information entered at the item level of goods is valid only for the items of goods concerned Data element required at the header level of the declaration of goods. The information entered at the header level is valid for all declared items of goods Not Required A C D X Y NR SAD Box No. D.E No. Data Element (D.E) name Symbol Note 1/1 Declaration type A Y 1 1/2 Additional Declaration type A Y 1 1/3 Transit Declaration/Proof of customs status type NR 2/2 2/3 Additional information Documents produced, certificates and authorisations, additional references. D D X X [7] [7] 44 44 CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories Picking the right Declaration Category: Use Appendices 21 23 Index lists to identify the Declaration Category Required Identify: Type of movement: Import, Export, Customs Clearance Request (CCR) If a customs declaration is required to release the goods If EIDR is being used to release the goods: border versus designated premises The intended usage of the goods: special procedures or free circulation Whether Union goods will be going to or from a Special Fiscal Territory or Territory with which the EU has formed a Customs Union CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories Declaration completion requirements: Each Declaration Category has its own data set Check which data elements are mandatory, dependent, not required Some Declaration Categories require more data elements to be completed than others If a required data element is not completed, CDS will reject the declaration or Customs clearance Request (CCR) Check any notes shown against the data element to ensure you understand in what circumstances it may be required Ensure you use the correct Declaration Completion Guide for the Declaration Category CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories Guidance on completing data elements: Ensure you use the correct Declaration Completion Guide for the Declaration Category Ensure you identify if any specific rules apply for the data element for the Declaration Category being used Where no specific Declaration Category completion rules apply, use the All Declaration Category completion rules Ensure you complete the data elements using the Appendix 1 and Appendix 2 Guidance notes, alongside the main Declaration Completion Guides Some data elements completion rules are adapted according to the customs procedure being used, for example D.E. 1/2. CD S Tarif OFFICIAL f Trai

Module 2: Declaration Categories Import, Export, Inventory Import and Inventory Export Declaration Categories: Declaration Category Movement Type Usage Imports H1 Declaration for release for free circulation and special procedure: specific use (end use) Imports H2 Special procedure: storage (customs warehousing) Imports H3 Special procedure: specific use (temporary admission) Imports H4 Special procedure: processing (inward processing) Imports H5 Declaration for the introduction of goods in the context of trade with special fiscal territories Imports I1 B&E Import simplified declaration on an occasional basis (D.E. 1/2 codes B&E) Imports I1 C&F Import simplified declaration with regular use (D.E. 1/2 codes C&F) Exports B1 Export Standard Declaration or Re-export Standard Declaration Exports B2 Special Procedures Declaration for Outward Processing Declaration for dispatch of goods to a Special Fiscal Territory or Territory with which the EU has formed a Customs Union Exports B4 Exports C1 B&E Export or Re-export Simplified Declaration on an occasional basis (D.E. 1/2 codes C&F) Exports C1 C&F Export or Re-export Simplified Declaration with regular use (D.E. 1/2 codes C&F) Inventory Releases C21i (Air) Port Customs Clearance Request Imports (Air) Port Customs Clearance Request Imports released using Entry in Declarants Records (EIDR) where the C21 is also used to provide the Notification of Presentation (NOP). Inventory Releases C21i EIDR NOP Inventory Releases C21e (Air) Port Customs Clearance Request - Exports (Air) Port Customs Clearance Request Exports released using Entry in Declarants Records (EIDR) where the C21 is also used to provide the Notification of Presentation (NOP). Inventory Releases C21e EIDR NOP CD S Tarif OFFICIAL f Trai

Module 3: Data Elements Module Contents: Data element groups Data element completion requirements Key changes from CHIEF CD S Tarif OFFICIAL f Trai

Module 3: Data Elements Data element groups: Within the Union Customs Code (Reg. No. (EU) 952/2013 (UCC)) the declaration data elements are grouped into sections: Group Description 1 Message Information (including Procedure Codes) References of Messages, Document, Certificates and Authorisations Parties Valuation Information and Taxes Dates, Times, Periods, Places, Countries and Regions Goods Identification Transport Information (Modes, Means and Equipment) Other Data Elements (Statistical Data, Guarantees and Tariff Related Data) 2 3 4 5 6 7 8 D.E. are numbered according to their data element group, e.g., parties begin with a 3 CD S Tarif OFFICIAL f Trai

Module 3: Data Elements Data element completion requirements: Check you are using the correct Declaration Completion Guide for the movement type Ensure you identify any Declaration Category specific completion rules and review these prior to using the All Declaration Category completion rules The Appendix 1 and Appendix 2 Completion notes must be used alongside the main Declaration Category Completion Guide The data element completion requirements stipulate: When a data element is required Which rules are dependent on circumstances Header versus item Format Code lists where required CD S Tarif OFFICIAL f Trai

Module 3: Data Elements Key changes from CHIEF: New data elements introduced that had no equivalent CHIEF box CHIEF CPCs single 7-digit code, CDS Codes now split into 2 data elements: D.E. 1/10: 4-digit Procedure Code, D.E. 1/11: 3-digit Additional Procedure Codes Box 44 data now re-homed in their own data elements Valuation data now included in the declaration (no. D.V.1 (C105) forms used) Additions and deductions all included on declaration Parties details split into multiple data elements New code lists associated with specific data elements CD S Tarif OFFICIAL f Trai

Module 4: Procedure and Additional Procedure Codes Module Contents: CHIEF v CDS Procedure Codes Step-by-Step Guide Declaration movement types and Procedure Codes Declaration Categories and Procedure Codes Procedure Codes series Picking a Procedure Code Procedure Code to Additional Procedure Code correlation Union Additional Procedure Codes National Additional Procedure Codes CD S Tarif OFFICIAL f Trai

Module 4: Procedure Codes CHIEF v CDS Procedure Codes: Under CHIEF a customs procedure code was 7-digits long The CHIEF CPC only ever had one meaning Under CDS the procedure codes and additional procedure codes are split into two parts Most 4-digit codes in D.E. 1/10 are the same under CDS except End use Entry from a Special Fiscal territory New 01 series introduced Some Procedure Code series codes are not used by UK. 3-digit codes in D.E. 1/11 have a single meaning that does not change regardless of which 4-digit D.E. 1/10 codes they are used with CD S Tarif OFFICIAL f Trai

Module 4: Procedure Codes Step-by-Step Guide Import Export Inventory Release (Customs Clearance Request (CCR)) Type of Movement e.g., H1, Declaration for release for free circulation and special procedure: specific use (end use) e.g., B4, Declaration for dispatch of goods to a Special Fiscal Territory or Territory with which the EU has formed a Customs Union. e.g., C21i, Customs Clearance Request for inventory releases - imports Declaration Category e.g., H1 allows 01, 07, 40, 42, 44, 61 e.g., B4 allows 10, 11, 23, 31 e.g., C21i allows 00 02 00 09 Procedure Code Series e.g., H1, Requested procedure 40: Release to Free Circulation e.g., B4, re-export of non-Union goods following a special procedure e.g., C21i, movements/transfers of goods between locations Requested Procedure e.g., 40 series allows: 4000, 4051, 4053, 4054, 4071, 4078 e.g., 31 series allows: 3151, 3153, 3154, 3171, 3178 e.g., 0007 Procedure Code List e.g. 4071 allows C01-C04, C06-C61, E01, E02, F15, F21, F22, F45, 000, 1BN, 1CL, 1DP, 1ES, 1MO, 1NC, 1NN, 1NO, 1NP, 1NV, 1PF, 1RC, 1RE, 1RV, 1TO, 1VW, 1XT, 1XW, 2DP. e.g., 3153 allows F75, D01 D13, D15 D30, D51 e.g., 0007 allows 000; 15F; 71M; 72M; 73N; 74A 1/10 - 1/11 Matrix Union codes start with a letter and must be declared first Check all allowable Union codes first to ensure all applicable codes are identified Do not stop when the first code is found as a second or third may be required, e.g., most C series codes require either F45 or 1RV in order to get customs duty and import VAT Union Codes 000 may only be used when you have checked that absolutely no other 1/11 code applies National codes start with a number and must be declared after all Union codes Check all allowable national codes to ensure all applicable codes are identified Do not stop when the first code is found as extra codes may be required, e.g., 1CG combined with a.n.other code where controlled goods are released to FC National Codes OFFICIAL

Module 4: Procedure Codes Import: Standard declaration (A&D) Simplified declaration regular use (C&F) Simplified declaration occasional use (B&E) Supplementary Declaration (Y&Z) Export Standard declaration (A&D) Simplified declaration regular use (C&F) Simplified declaration occasional use (B&E) Supplementary Declaration (Y&Z) Inventory Release (Customs Clearance Request (CCR)) C21i (J&K) C21i EIDR NOP (J&K) C21e (J&K) C21e EIDR NOP (J&K) Type of Movement CD S Tarif OFFICIAL f Trai

Module 4: Procedure Codes e.g., H1, Declaration for release for free circulation and special procedure: specific use (end use) e.g., B4, Declaration for dispatch of goods to a Special Fiscal Territory or Territory with which the EU has formed a Customs Union. e.g., C21i, Customs Clearance Request for inventory releases - imports Declaration Category CD S Tarif OFFICIAL f Trai

Module 4: Procedure Codes Declaration categories and Procedure Codes: Unlike CHIEF, a different declaration category is needed depending on: The type of declaration/ movement you are making (import, export, inventory release) The Procedure you intend to use Each declaration category has is own completion rules and data set Supplementary Declarations are completed using the standard H1- H5 and B1, B2 and B4 data sets You cannot complete the declaration until you identify which declaration category is appropriate to your type of movement, intended usage of the goods Appendix 21 Import Declarations Appendix 22 Export Declarations Appendix 23 Inventory Releases (Customs Clearance Requests aka C21) CD S Tarif OFFICIAL f Trai

Module 4: Procedure Codes Declaration Categories and Procedure Codes: Imports Declaration Category Declaration Title Allowable Requested Procedure Codes (Digits 1 and 2) 01, 07, 40, 42, 44, 61 Declaration for release for free circulation and special procedure: specific use (end use) Special procedure: storage (customs warehousing) H1 71 H2 Special procedure: specific use (temporary admission) 53 H3 Special procedure: processing (Inward Processing (IP)) 51 H4 Declaration for the introduction of goods in the context of trade with special fiscal territories Import Simplified Declaration with regular use (D.E.1/2 Codes C&F) 01, 07, 40, 42, 44, 51, 53, 61, 40, 42, 61 H5 I1 C&F 71 Import Simplified Declaration on an occasional basis (D.E.1/2 B&E) 40, 44 Customs Clearance Request for inventory releases imports released using EIDR I1 B&E C21i EIDR NOP 40, 44, 51, 53, 61, 71 OFFICIAL

Module 4: Procedure Codes Declaration Categories and Procedure Codes: Exports Declaration Category Declaration Title Allowable Requested Procedure Codes (Digits 1 and 2) 10, 11, 23, 31 Export Standard Declaration or Re-export Standard Declaration B1 Special Procedures Declaration for Outward Processing 21, 22 B2 Declaration for dispatch of goods to a Special Fiscal Territory or Territory with which the EU has formed a Customs Union. 10, 11, 23, 31 B4 Export or Re-export Simplified Declaration with regular use (D.E.1/2 Codes C&F) Export or Re-export Simplified Declaration on an occasional basis (D.E.1/2 B&E) Customs Clearance Request for inventory releases exports released using EIDR 10, 11, 23, 31 C1 C&F C1 B&E 10 10, 23, 31 C21e EIDR NOP OFFICIAL

Module 4: Procedure Codes Declaration Categories and Procedure Codes: Customs Clearance Requests (CCR) Declaration Category Declaration Title Allowable Requested Procedure Codes (Digits 1 and 2) Customs Clearance Request for inventory releases - imports 00 02 00 09 C21i Customs Clearance Request for inventory releases imports released using EIDR Customs Clearance Request for inventory releases - exports 40, 44, 51, 53, 61, 71 C21i EIDR NOP C21e 00 12 00 19 Customs Clearance Request for inventory releases exports released using EIDR 10, 23, 31 C21e EIDR NOP OFFICIAL

Module 4: Procedure Codes Identifying the right procedure code series: Each Declaration Category stipulates which series are allowed A Procedure Code may not be used with a Declaration Category unless specifically allowed (e.g., H2 only allows 71 series) Each Procedure Code is made up of 4-digits The first and second digits indicate the Requested Procedure: the customs procedure to which the goods are being entered. The third and fourth digits indicate the Previous Procedure: the customs procedure from which the goods are being removed. To note: RGR may not always follow this rule 00 as the third and fourth digits indicate that the goods have not been subject to any previous procedure. The D.E. 1/10 Requested and Previous Procedure Codes may be found in separate series according to the first two characters of the code (the Requested Procedure) OFFICIAL

Module 4: Procedure Codes e.g., 40 series allows: 4000, 4051, 4053, 4054, 4071, 4078 e.g., 31 series allows: 3151, 3153, 3154, 3171, 3178 e.g., 0007 Procedure Code List OFFICIAL

Module 4: Procedure Codes Identify the 4-digit code: Once you have identified which Procedure Code Series are permitted for the Declaration Category: Procedures Codes are found in Appendix 1 of the CDS Volume 3 Tariff Appendix 1 has a contents list for each Movement Type (Imports, Exports, Inventory Releases (CCR)) These contents lists show every 4-digit code that can be used on CDS These are listed by Procedure Code Series Review all codes under the correct Requested Procedure to ensure you identify the correct Procedure Code to be used The full guidance notes for the code must be read to ensure it is the correct code to use OFFICIAL

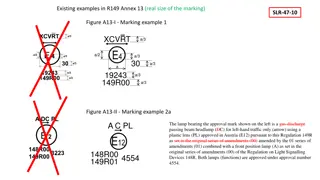

Module 4: Procedure Codes 1/10 to 1/11 Correlation A matrix is provided for each Declaration/ Movement Type The matrix show which 1/10 codes can be used with which 1/11 codes and vice versa A04 10 07 10 40 10 42 10 44 11 00 Y 1/11 10 07 10 40 10 42 10 44 11 00 1/11 A04 Y This information is also shown in each 1/10 s and 1/11 s guidance notes If a 1/11 code is not shown against a 1/10 code, it cannot be used and vice versa The CFSP Exclusions list also needs to be checked to ensure any restrictions on the use of SDP or EIDR are identified Even if a 1/10 allows EIDR, if the required 1/11 prohibits EIDR it cannot be used OFFICIAL

Module 4: Procedure Codes Selecting the 1/11 codes required: Appendix 2 has a contents list for each Movement Type (Imports, Exports, Inventory Releases (CCR)) These contents lists show every 3-digit code that can be used on CDS These are listed by Additional Procedure Code Series for each movement type, e.g., 1 series for import, export, inventory import and inventory export releases The contents list give a short title for each code to help you identify if it may apply to your circumstances Read the contents list for every code the matrix says may be used Do not stop at the first code you find that seems to fit as multiple codes may be required Once possibilities are identified from the contents list the full guidance notes for the code must be read to ensure it is the correct code to use OFFICIAL

Module 4: Procedure Codes Union codes start with a letter and must be declared first Check all allowable Union codes first to ensure all applicable codes are identified Do not stop when the first code is found as a second or third may be required, e.g., most C series codes require either F45 or 1RV in order to get customs duty and import VAT Union Codes CD S Tarif OFFICIAL f Trai

Module 4: Procedure Codes Union 1/11 Codes The conditions and restrictions for use must be read to ensure you are eligible to use the code Union Codes take precedence over National Codes National Codes must only be used where no Union Codes apply Multiple Union Codes may be required to cover the full circumstances of the goods: E.g., most C series codes will require a second code or only customs duty relief will be granted If the goods are coming from or going to a special territory, either F15, 15F, F75 or 75F will always required regardless of any other 1/11 codes being used A mix of Union and National Codes may be required. Union codes always being declared first OFFICIAL

Module 4: Procedure Codes 000 may only be used when you have checked that absolutely no other 1/11 code applies National codes start with a number and must be declared after all Union codes Check all allowable national codes to ensure all applicable codes are identified Do not stop when the first code is found as extra codes may be required, e.g., 1CG combined with a.n.other code where controlled goods are released to FC National Codes CD S Tarif OFFICIAL f Trai

Module 4: Procedure Codes National 1/11 Codes: The conditions and restrictions for use must be read to ensure you are eligible to use the code National Codes must only be used where no Union Codes apply Multiple National Codes may be required to cover the full circumstances of the goods: E.g., wherever controlled drugs or goods are declared to a special procedure using SDP, either 2CD or 2CG is required regardless of any other codes which may apply 000 may only be used after it has been determined that absolutely no other code applies OFFICIAL

Module 5: Additional Information (AI) Codes Module Contents: CHIEF versus CDS AI codes What are AI Codes used for? Step-by-Step Guide to completing an AI Statement Example AI statements CD S Tarif OFFICIAL f Trai

Module 5: Additional Information (AI) Codes CHIEF versus CDS AI codes: CHIEF CDS AI codes at header or item level New AI codes created in CDS that cannot be used on CHIEF AI codes at item level only Some CHIEF AI codes cannot be used in CDS CHIEF AI codes still valid Uses same AI code as CHIEF but has a different meaning on CDS National AI code replaced by a Union Code CHIEF CPC replaced by an AI code on CDS National AI code on CHIEF Information declared to CHIEF as a CPC CD S Tarif OFFICIAL f Trai

Module 5: Additional Information (AI) Codes What are AI codes used for? D.E. 2/2 is used to provide any additional information that is required in order to process the customs declaration or customs clearance request (CCR). The information is declared using a specific code followed by the required additional information. The codes used help the customs authorities identify what information is being provided and why. The types of Additional Information (AI) required in this data element may include : Relationships between different parties (people) involved in the declaration Specific processes intended to be carried out on the goods whilst under customs control Names and addresses of other parties or premises involved CD S Tarif OFFICIAL f Trai

Module 5: Additional Information (AI) Codes Step-by-Step Guide to completing an AI Statement: Mandatory AI codes must always be declared Dependent AI codes check circumstances when required D.E. 1/10 Codes Mandatory AI codes must always be declared Dependent AI codes check circumstances when required D.E. 1/11 Codes Review full list to identify other codes: authorisations, parties, preference Appendix 4 Where D.E. 1/10 or D.E. 1/11 stipulate different completion rules for the AI statement, they take precedence over Appendix 4 rules Union Codes must always be declared first (start with a number) Precedence Enter the AI code followed by the required statement/ information Statements CD S Tarif OFFICIAL f Trai

Module 5: Additional Information (AI) Codes Example AI Statements: Code 00100 00400 30500 GEN27 GEN49 OVR01 PAR01 WHSRP Statement Discharge of simplified authorisation Exporter GB000074 Art Galleries R Us London Road London E17 6BQ 12345/9 Mr J Bloggs +44207 123456 Duty override claimed outward processing Incorporates ivory or tortoise shell EUR CD S Tarif OFFICIAL f Trai

Module 6: Document Codes and Waivers Module Contents: CHIEF versus CDS Volume 2 Tariff What are document codes used for? Identifying document codes Identifying document waiver codes Identifying document status codes Identifying document code licence types Step-by Step Guide to declaring a document code Example document code declarations CD S Tarif OFFICIAL f Trai

Module 6: Document Codes and Waivers CHIEF versus CDS Volume 2 Tariff: CHIEF Box 44 Document CHIEF compatible codes based on UK Trade Tariff Volume 2 CDS D.E. 2/3 and 8/7 CDS Compatible codes based on CIRCA TARIC files and UK Tariff component measures Codes live on CHIEF no longer used in CDS Details to be declared on CDS to be completed using Appendix 1, 2 and 5A instructions Look up codes on CDS API Tariff Tool New codes used on CDS not yet set up on CHIEF Codes on CHIEF have different completion instructions from CDS Look up codes and measures on UK Trade Tariff, Volume 2 CD S Tarif OFFICIAL f Trai

Module 6: Document Codes and Waivers What are document codes used for? A document code, with a reference number or other details to be declared is used to provide: Authorisation decision numbers Licence reference numbers and quantities where required Preference certificates and quantities where required Veterinary or Health Certificates and quantities where required Invoices Other commercial documents, such as packing lists CD S Tarif OFFICIAL f Trai

Module 6: Document Codes and Waivers Identifying document codes: Use the UK Trade Tariff/ API Tariff Tool to: Identify the correct commodity code Select Import or Export measures Check Conditions that apply to the goods Identify Document codes that are required or waiver codes that may apply Use Appendix 5A to look up the document code and see what details are to be declared for each code Review all other document codes in Appendix 5A to see if other document codes apply, such as commercial or authorisation codes Review procedure code and additional procedure code in Appendices 1 and 2 for document codes required by customs procedure or use Identify any other authorisations being used to declare the goods CD S Tarif OFFICIAL f Trai