Insights on Premium Egg Consumers and Market Trends

Selected survey slides reveal intriguing data on premium egg consumers, indicating high consumption frequency, willingness to pay higher prices for humane treatment, and regional variations in interest. The data also highlights concerns about Salmonella, consumer brand preferences, and preferred egg characteristics such as cage-free, organic, and non-GMO.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Egg Characteristics: Selected survey slides By: Joseph Berglind JVB jvberglind@gmail.com

Im the project manager for market research at a small food manufacturer. These selected slides show some interesting data insights and trends related to premium egg consumers. 60% of egg buyers consume eggs at least a few times a week. This is one the reasons why higher eggs prices had such a tremendous impact. People are willing to purchase eggs at higher prices for characteristics related to humane treatment, such as free-range or cage-free. A consumer s location is a surprisingly divisive factor in premium egg consumers. A part of the data in this deck was used in consumer identification research, as well as to gauge attitudes and behaviors among egg consumers. All responses are pared down and edited for client privacy. Please message me for any additional details/information. JVB jvberglind@gmail.com

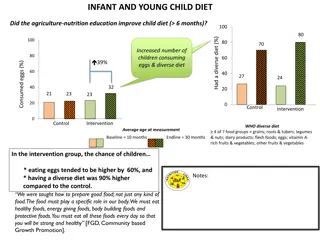

Respondent Regional Data (Single select) - Premium egg buyers are more likely to live on the coasts. Mountain and Midwest region residents possess less interest in premium eggs. South Atlantic 20% West North Coast 15% Northeast 14% -Regional data of respondents provided insight about where premium egg buyers live. Mid 13% Atlantic Eastern North Central 12% -Data shown is from a pared down sample via filtering questions about egg usage. Regions not listed provided negligible participants to the survey. West South Coast 10% Eastern South Central 9% Midwest 6% JVB jvberglind@gmail.com

Salmonella Concern Rating (5 point- scale) 5: Extremely concerned about Salmonella 11% - Example of a filtering question used in our survey. Question was on a 1-5 scale. 4: Somewhat concerned 26% - Participants who marked 1 were immediately removed from the survey. 3: Reasonably concerned 39% - Participants in the 2-3 range were marked for further filtering. 2: Minimally concerned 15% 1: Not concerned about Salmonella - Participants who marked 4-5 were considered ideal consumer bases. 9% JVB jvberglind@gmail.com

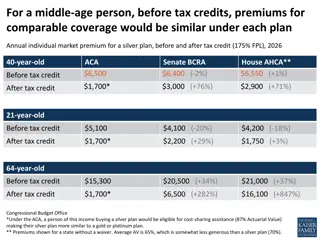

Store brand buyers are least likely to be concerned about egg characteristics. Consumer Egg Brand Preferences (Multi-select) 60% 49% 48% 50% These brands consist of consumers that care the most about egg characteristics. 42% 41% 40% Other generally consists of person owning chickens, or regional brands 34% 30% 24% 22% 21% 19% 19% 20% 11% 10% 0% Percent Happy Egg Eggland's Best Store Brand Organic Valley Local Brand Land of Lakes 365 Nest Fresh Vital Farms Farmers Hen Other JVB jvberglind@gmail.com

Preferred Consumer Egg Characteristics (Multi-Select) Brown is an outlier; there is no trend. This is a summation of what characteristics consumers look for or prefer when purchasing eggs. Respondents who marked Cage Free and Free Range usually both codes were selected together. - Organic and Non-GMO. Follow this trend - Local is also paired with the above characteristics as well but appears with no other discernible pattern. Least Expensive stands on its own; respondents who checked this generally did not mark other characteristics - These five are the most frequently marked attributes and they also are likely to appear with a respondent marking all of them. JVB jvberglind@gmail.com

- This data on how participants prepare eggs for consumption reveals the leading preparation is hard boiled (68%). - Baking is the only category in which consumers who selected it were likely to not select any other preparations. Consumer Egg Cook Methods (Multi-select) 80% 70% 60% 50% 40% 68% 30% 50% 43% 42% 20% 40% 32% 30% 10% 17% 15% 15% 0% Percent Hard Boiled Baking Sunnyside Over Easy Over Medium Poach Soft Boiled Other (Mostly Scrambled) Coddle Over Hard JVB jvberglind@gmail.com

Weekly Consumption of Eggs (Single select) - 60% of egg buyers consume eggs at least a few times as week. Less than once a week, 13% Daily, 19% - Less than once a week users are most likely to use eggs solely for baking. Once a week, 27% - Stratifying data allowed for identification of our target consumer. A few times a week, 41% JVB jvberglind@gmail.com