Drilling Fluids Market

In 2022, the global drilling fluids market accounted for USD 9.8 billion. This market is estimated to reach USD 16.1 billion in 2032 at a CAGR of 5.2% between 2023 and 2032. The global drilling fluids industry is a highly dynamic & competitive indust

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

Presentation Transcript

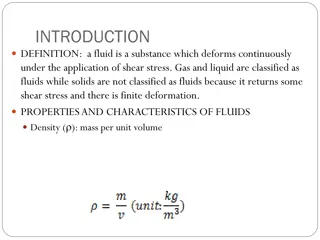

In 2022, the global drilling fluids market accounted for USD 9.8 billion. This market is estimated to reach USD 16.1 billion in 2032 at a CAGR of 5.2% between 2023 and 2032. The global drilling fluids industry is a highly dynamic & competitive industry that provides vital support to the oil exploration and production sector. Drilling fluids, or drilling muds, cool and lubricate drill bits, transport cuttings to the surface, and stabilize wellbores during drilling. The global oil & gas market drives demand for these fluids, especially with increased exploration and production activities. Water-based drilling fluids are the most common due to their low cost and environmental friendliness. Market Key Players National Oilwell Varco Schlumberger Limited Baker Hughes Incorporated Anchor Drilling Fluids USA, LLC Gumpro Drilling Fluids Pvt. Ltd. Halliburton Company CES Energy Solutions Corp Newpark Resources Inc Weatherford International Plc Other Key Players Click here for request a sample : https://market.us/report/drilling-fluids-market/request-sample/ Market Key Segments Based on Fluid Type Water-based Oil-based Synthetic Other Types

Based on Well Type Conventional Wells High-pressure High-Temperature Wells Based on Application Onshore Offshore Driving Factors The main driver of the drilling fluids market is the increasing demand for oil and gas, which boosts exploration and production activities. Technological advances have led to the development of high-performance, environmentally friendly drilling fluids. Growth is also fueled by rising offshore drilling activities and shale gas production, requiring complex operations. Additionally, strict environmental regulations push companies to seek eco-friendly drilling fluids. Restraining Factors The volatility of oil prices is a significant restraint, as low prices lead to reduced exploration and production, decreasing the demand for drilling fluids. The shift towards renewable energy sources may also limit market growth by reducing the need for oil and gas drilling. Environmental concerns and regulatory requirements pose further challenges if companies fail to develop compliant, eco-friendly drilling fluids. By Fluid Type Analysis Water-based drilling fluids dominate the market with a 52% share due to their cost-effectiveness and environmental friendliness. Oil-based fluids are used when water-based options are ineffective, offering excellent lubrication for difficult formations. Synthetic-based fluids provide improved environmental performance. By Well Type Analysis

High-pressure, high-temperature (HPHT) wells account for about 78% of the market. These wells, typically found in deep offshore reservoirs, require special drilling fluids capable of withstanding extreme conditions like high pressure, temperature, and salinity.