Enhancing Security and Covenant Monitoring with DLT - Catalyst Trusteeship Limited

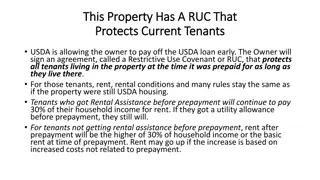

SEBI's circular on security creation and covenant monitoring for Non-Convertible Securities (NCS) aims to improve processes through Distributed Ledger Technology (DLT). The circular covers crucial aspects such as asset cover, charge creation, covenant monitoring, and more, applicable from 01.04.2022.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Catalyst Trusteeship Limited Security and Covenant Monitoring using Distributed Ledger Technology (DLT) Prepared by: Rakhi Kulkarni

Index Sr. No. Particulars 1 Introduction 2 Recording process of NCS on DLT 3 Contents of Circular 4 Timelines under Circular 5 Conclusion 6 Q & A

Introduction To strengthen the process of security creation & monitoring of security created, asset cover and covenants of Non-convertible securities (NCS) SEBI came out with the circular on 13.08.2021 SEBI based the circular on recommendations of working group which comprised of Officials of SEBI, Depositories, Stock Exchange & TAI Circular of 13.08.2021 is to be read with SEBI Circular dated 03.11.2020 on Creation of security in issuance of listed debt securities & Due Diligence of DTs and 12.11.2021 on Monitoring & Disclosures by DTs Circular is applicable to all entities who have listed their NCS or Issuers who propose to list their NCS, DTs, CRAs, RTAs and Depositories registered with SEBI Circular will come into effect from 01.04.2022

Introduction Circular is mainly divided into four parts and three Annexures Part A. Recording of information related to security creation, asset cover and covenants Part B. Periodic Monitoring of security cover, Asset Cover and Covenants Part C. Interest & Redemption payment Part D. Credit Rating Information Annexure A1- Registration of asset for initial Due Diligence Annexure A2- Manner of updation of charge creation details on system Annexure A3- Interest and Principal payment details

Recording of Start to end Process of NCS Security Creation Satisfaction of Charge Charge Creation DLT Covenant Monitoring Redemption Financial Monitoring

Recording of information related to security creation, asset cover and covenants Information regarding asset offered as security (Security creation /Security Cover) Recording of Charge creation and charge registration details on system Part A Modification of charge creation, registration details on the system Information Regarding Asset Cover Recording of Covenants in the system

PART A -Annexure A 1 Registration of assets for initial due diligence Details related to security offered Type and nature of security offered Value of security offered Asset description Documents related to existing encumbrance on assets/Security offered

PART A -Annexure A 2 Details related to charge created on the system as when applicable Mapping of unique IDs against multiple charge IDs by system Update charge information on Depository platform by issuer Facility by depository to update above information on multiple platforms

Timelines under Part A: Recording of information related to security creation, asset cover and covenants Particulars Details regarding proposed security Creation /Security Cover including asset details ,type of asset as per Annexure A1 Point no. 6.1 Timelines At the time of creation of temporary ISIN/ISIN * As per SEBI operational Circular dt.29.03.2022 dispensation is available till 01.07.2022 Before initiating issuance of temporary ISIN/ISIN Promptly after creation of charge Rectification of any discrepancy or additional record Details of Charge Created as per Annexure A2 (Sub registrar, ROC, Cersai, IU etc. Upload Due Diligence certificate provided by DT as per Annexure B of SEBI circular dt 03.11.2020 Modification of charge after approval of DT Asset Cover Details Entering Covenants in the system 6.3 7.1 7.3 Promptly after receipt of such certificate 8.1 9.1 10.1 Promptly after such modification At the time of creation of temporary ISIN/ISIN Within 5 working days from execution of DTD

Timelines under Part B:Periodic Monitoring of security cover, Asset Cover and Covenants Particulars Point No Timelines Submission of HY certificate by Statutory Auditor as per provision of (LODR regulations),2015 in format specified by SEBI 11 Within 45/60 days as applicable Uploading necessary and applicable documents, information to enable DTs for DD as per SEBI circular dated 12.11.2020 12 Parodically & Promptly

PART C -Annexure A 3 Interest and Principal payment details Information to be filled at the time of creation of temporary ISIN/ISIN Continuous updating information Interest payment Interest payment Redemption payment Redemption payment

Timelines under Part C: Interest & Redemption payment Particulars Point No. Timelines Information regarding Interest and Principal payments 14.1 At the time of creation of temporary ISIN/ISIN Status of payment of NCS as per format specified in Annexure A3 14.1 Within 1 working day of payment /redemption due date Release of Charge 16.1 After Redemption

Timelines under Part D : Credit Rating Information Particulars Credit Rating information including rating action, date of press release & hyperlink Point No 17 Timelines At the time of creation of temporary ISIN/ISIN * amended as per SEBI operational Circular dt.29.03.2022 . No specific timeline mentioned Within 3 working days from such notification In case of any discrepancy in Rating update correct information Any subsequent rating action including rating outlook, date of press release & hyperlink In case of any discrepancy in Rating update correct information 17 18 Within 1 working day 18 Within 2 working days from such notification As per SEBI operational Circular dt.29.03.2022 existing outstanding NCD issuances to be updated on DLT platform on or before 30.09.2022 and DT shall verify the same by 30.11.2022

Conclusion Availability of information to all stakeholders involved on one platform Easy exchange of information between Issuers and Intermediaries Depositories are creating linkage between data uploaded on the system to avoid duplication Depositories are to formulate the operational guidelines for DLT platform