Exploring the Carbon Credit Market for Agriculture, Forestry, and Land Use

The Carbon Credit Market for agriculture, forestry, and land use was valued at $ 4,776.6 million in 2022, and $6,283.0 million in 2023, which is growing at a CAGR of 31.49% and will reach $ 97,100.4 million by 2033 during the forecast period 2023-2033.

- Carbon Credit Market

- Carbon Credit Industry

- Carbon Credit Market Report

- Carbon Credit Market Research

- Agriculture

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

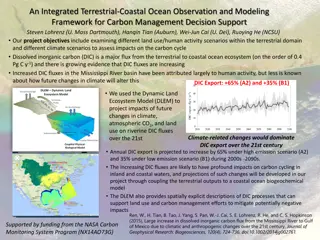

Exploring the Carbon Credit Market for Agriculture, Forestry, and Land Use | BIS Research The global push towards sustainability and climate action has catalyzed the growth of the carbon credit market, particularly within the sectors of agriculture, forestry, and land use. As the world grapples with the urgent need to reduce greenhouse gas emissions, these sectors offer significant opportunities to mitigate climate change while promoting economic development and environmental stewardship. Understanding Carbon Credits Carbon Credits are tradable certificates that represent the reduction or removal of one metric ton of carbon dioxide (CO2) or its equivalent in other greenhouse gasses. These credits are generated through various activities that sequester carbon or reduce emissions. In the context of agriculture, forestry, and land use, carbon credits are typically earned through practices such as reforestation, afforestation, sustainable land management, soil carbon sequestration, and the adoption of conservation agriculture. Key Market Dynamics According to BIS Research, the Carbon Credit Market for agriculture, forestry, and land use was valued at $ 4,776.6 million in 2022, and $6,283.0 million in 2023, which is growing at a CAGR of 31.49% and will reach $ 97,100.4 million by 2033 during the forecast period 2023-2033. Several factors are driving the growth of the carbon credit market in agriculture, forestry, and land use: Global Climate Agreements: International agreements like the Paris Agreement target reducing global greenhouse gas emissions Countries and companies invest in carbon credits to meet these targets and achieve net-zero emissions

Corporate Sustainability Goals: Corporations commit to carbon neutrality and use carbon credits to offset unavoidable emissions Agricultural and forestry sectors provide viable carbon credits due to natural carbon sequestration Government Incentives and Policies: Governments implement policies and incentives to encourage carbon offset projects Subsidies, grants, and tax breaks for sustainable agricultural and forestry practices boost the market Consumer Demand for Sustainability: Growing consumer awareness and demand for sustainable products drive companies to invest in carbon credits Support for sustainable practices in supply chains increases due to consumer pressure Carbon Credit Industry Segmentation Segmentation by Application: Removal Project Avoidance Project Combination Project Segmentation by Project Type: Forestry and Land Use o REDD+ o ARR o IFM Agriculture Segmentation by Credit Type: Voluntary Carbon Credits Compliance Carbon Credits Segmentation by Region: North America Europe Asia-Pacific Rest-of-the-World Want to excel in this industry? Request for a FREE Sample Report (PDF) on Carbon Credit Market Research for Agriculture, Forestry, and Land Use. Market Challenges and Opportunities Market Challenges: Verification and Monitoring Market Volatility Additionality and Permanence Access to Finance Market Opportunities: Technological Innovation Integration with Sustainable Development Goals (SDGs) Expansion of Voluntary Markets Capacity Building and Education

Future Market Prospects The future of the carbon credit market for agriculture, forestry, and land use looks promising, with several trends likely to shape its trajectory: Strengthening of Regulatory Frameworks: The development of more robust and standardized regulatory frameworks will enhance the credibility and scalability of carbon credit markets. Private Sector Engagement: Increasing private sector engagement and investment in carbon offset projects will drive market growth and innovation. Collaboration and Partnerships: Collaborative efforts between governments, NGOs, corporations, and local communities will be essential to scale up successful carbon sequestration initiatives. Focus on Co-Benefits: Projects that deliver multiple co-benefits, such as improved livelihoods, ecosystem restoration, and climate resilience, will gain more traction and support. Conclusion The Carbon Credit Industry for Agriculture, Forestry, and Land Use is poised for significant growth, driven by global climate commitments, corporate sustainability goals, government policies, and consumer demand for sustainability. By addressing challenges related to verification, market volatility, additionality, and finance, and leveraging opportunities in technological innovation, voluntary markets, and capacity building, the potential of carbon credits can be fully realized. This market not only offers a pathway to mitigate climate change but also promotes sustainable development and environmental stewardship, setting new standards for global sustainability efforts.