Advisory Committee Meeting Summary for BSPTCL, BGCL & SLDC

The meeting discussed various topics including tariff petitions, business plans, network status, capacity additions, and cost optimizations for BSPTCL, BGCL, and SLDC in Bihar. Tariff projections, revenue requirements, transmission charges, and revenue surpluses were also analyzed and carried forward for future considerations as per regulations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

28-01-2022 State Advisory Committee Meeting Bihar State Power Transmission Company Limited (BSPTCL), Bihar Grid Company Ltd. (BGCL) & State Load Dispatch Centre (SLDC)

Agenda of the Meeting 1. Summary of the Tariff Petitions and Business Plan 2. Current Status of BSPTCL Network 3. Network Capacity Addition up to FY 2024-25 4. Cost of Intra-State Transmission and cost optimization 2

Summary of Tariff Petition of BSPTCL (All figures in Rs. Crore) Projected for MYT Control Period FY 2022-23 2023-24 98.00% 98.00% 3.50% 3.50% 1,243.27 1,117.89 1,513.04 1,703.14 226.23 252.64 62.69 72.12 80.12 84.21 11.44 11.44 285.24 323.7 488.28 577.09 379.58 439.67 19.91 22.89 Sl. No. Particulars True up for FY 2020-21 Approved in Tariff Order 98.00% 3.92% 440.35 1643.29 193.05 103.08 44.64 12.96 338.38 330.48 390.20 13.09 APR for FY 2021-22 Approved in TO dated 19.03.2021 98.00% 3.92% 505.75 1699.42 203.29 129.28 45.78 11.96 271.35 456.82 418.11 13.28 Claimed for FY 2020-21 99.62% 2.92% 1327.71 723.32 181.01* 109.03 43.97 11.44 227.83 354.27 328.73 11.77 APR for FY 2021-22 98.00% 3.92% 919.14 1363.50 200.07 118.36 45.92 11.44 253.39 413.52 330.47 12.35 FY FY 2024-25 98.00% 3.50% 649.88 1,903.87 285.06 82.72 89.15 11.44 367.4 676.35 507.95 26.31 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Availability Factor Intra-State Trans. Loss Capital Expenditure Capitalisation Employee Expense R&M Expense A&G Expense Holding Company expenses Return on Equity Depreciation Interest and Finance Charge on loan Interest on Working capital Incentive for transmission availability factor Incentive for loss reduction Add: Sharing of Losses/(Gains) on O&M expenses Add: Sharing of Losses/(Gains) on Interest on Working Capital Add: Sharing of Losses/(Gains) on Incentives on reduction in Transmission losses Add: Sharing of Losses/(Gains) on Incentives on Transmission Availability Factor Less: Non tariff income Aggregate Revenue Requirement (ARR) ((5 to 18)-19) Add: Revenue Gap/(Surplus) of Previous year Net Revenue requirement (20+21) Revenue from Transmission charges Net Revenue Gap / (Surplus) (22-23) 7.44 12.09 2.12 -7.85 17 -8.06 18 -4.96 19 20 21 22 23 24 133.70 1292.18 (421.28) 870.90 870.90 0.00 59.68 1209.13 (421.28) 787.85 870.90 (83.05) 108.39 1441.49 (310.81) 1130.68 1130.68 0.00 62.66 1322.85 (310.81) 1012.04 1130.68 (118.64) 65.8 69.09 1714.67 72.54 1973.84 1487.69 (97.19) 1390.51 1714.67 1973.84 - - *In the Petition BSPTCL claimed employee expenses as Rs. 181.01 Crore as per the norms of Regulations. Now, BSPTCL is submitting Terminal Benefits of Rs. 40.78 Crore in addition to normative employee expenses as per the Regulation 21.1 of BERC MYT Regulations, 2018. 4

Annual Transmission Charges for FY 2022-23 (BSPTCL) Net Revenue Surplus of Rs. 83.05 Crore is arrived at after the Truing up for FY 2020-21 and total Revenue Surplus is Rs. 97.19 Crore including holding cost. Trued-up Revenue surplus of FY 2020-21 along with holding cost has been carried forward to the ARR of FY 2022-23 as per BERC Regulations Sl. No. 1 Net ARR considered for FY 2022-23 2 Add: Revenue Surplus of FY 2020-21 along with holding cost 3 Annual Transmission Charges for FY 2022-23 (1+2) 4 Total Maximum Projected Load (in MW) (Including Railway) 5 Projected Peak Load of DISCOMs (NBPDCL and SBPDCL) Annual Transmission Charges to be levied to NBPDCL and SBPDCL Monthly Transmission Charges to be levied to NBPDCL and SBPDCL 8 Total Contracted Capacity of Railways 9 Annual Transmission Charges to be levied to Railways 10 Monthly Transmission Charges to be levied to Railways FY 2022-23 (Rs. Crore) Particulars 1,487.69 (97.19) 1,390.51 7,154 7,054 1,371.07 6 114.26 7 100 19.44 1.62 Recovery of Transmission Charges is proposed from NBPDCL, SBPDCL and Railways based on the Projected Maximum Load during FY 2022-23 5

Approach adopted by BSPTCL Debt equity ratio for the projects capitalized under 12th Plan has been considered as 70:30. Debt equity ratio for the projects to be capitalized under 13th Plan has been considered as 80:20. Capitalization from ADB loan has been considered under debt as per the approach of the Commission. For True up, Actual Employee, A&G and R&M Expenses considered as per annual accounts and normative Employee, A&G and R&M Expenses have been arrived in accordance with the provisions of MYT Regulations, 2018. Depreciation has been claimed based on weighted average rate of 5.21% on opening GFA and 5.24% on addition during the year worked out on the basis of annual accounts of FY 2020-21. Interest on loan and IOWC have been computed as per Regulations Return on Equity computed at 10% (against the approved rate of 15.5% and 14%) of Average Equity grossed up by MAT rate of 17.47% ARR claimed in True-up of FY 2020-21 is Rs. 1,209.13 Crore For APR and ARR of the Control Period, Employee, A&G, R&M Expenses, IoWC have been considered as per norms prescribed in Regulations 6

Business Plan for FY 2022-23 to FY 2024-25 (BSPTCL) Sl. No. Particulars Projected for MYT Control Period FY 2023-24 FY FY 2022-23 2024-25 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Availability Factor Intra-State Trans. Loss Capital Expenditure Capitalisation Employee Expense R&M Expense A&G Expense Holding Company expenses Return on Equity Depreciation Interest and Finance Charge on loan Interest on Working capital Less: Non tariff income Aggregate Revenue Requirement (ARR) ((5 to 12)-13) Add: Revenue Gap/(Surplus) of Previous year Net Revenue requirement (14+15) 98.00% 3.50% 1,243.27 1,513.04 226.23 62.69 80.12 11.44 285.24 488.28 379.58 19.91 65.8 1487.69 (97.19) 1390.51 98.00% 3.50% 1,117.89 1,703.14 252.64 72.12 84.21 11.44 323.7 577.09 439.67 22.89 69.09 1714.67 98.00% 3.50% 649.88 1,903.87 285.06 82.72 89.15 11.44 367.4 676.35 507.95 26.31 72.54 1973.84 1714.67 1973.84 7

Highlights of Business Plan for FY 2022-23 to FY 2024-25 (BSPTCL) Performance Targets Capex and Capitalisation Proposed for the Control Period (Rs. Crore) Particulars FY 2022-23 FY 2023-24 FY 2024-25 Particulars FY 2022-23 FY 2023- FY 2024- 25 24 Ongoing Projects Transmission Losses 3.5% 3.5% 3.5% Capex 626.33 386.52 254.01 Capitalisation 1,281.81 1,035.14 774.91 New Projects Capex Particulars FY 2022-23 FY 2023- FY 2024- 25 616.93 731.37 395.87 24 Capitalisation 231.23 667.99 1128.96 Transmission System Availability Total 98% 98% 98% Capex 1,243.27 1,117.89 649.88 Capitalisation 1,513.04 1,703.14 1,903.87 Capital Investment has been proposed for the Control Period, which includes new projects as well as ongoing projects spilled over from pervious Control Period 8

Summary of SLDC Tariff Petition (All figures in Rs. Crore) FY2020-21 (Actual) FY 2021-22 (Estimated) Projections for the Control Period Approved in Tariff Order dated 20.03.2020 Approved in Tariff Order dated 19.03.2021 Claimed for true up for FY 2020-21 FY FY FY Sl. No. Particulars APR for FY 2021-22 2022-23 2023-24 2024-25 1 2 3 4 5 6 7 8 9 Capital Expenditure Capitalisation Employee Cost R&M expenses A&G expenses Depreciation Interest on loan capital Interest on working capital Return on Equity Less: Sharing of Gains / Losses Less :Non Tariff Income Net ARR Sub-total (3 to 11) Less: Trued-up revenue gap / (surplus) of earlier years including carrying cost 7.39 10.59 4.23 0.08 0.62 1.46 0.24 0.13 0.30 5.45 8.22 6.21 0.01 0.26 0.24 0.20 0.15 0.23 -0.10 0.41 6.80 2.12 2.12 5.66 0.37 0.35 2.50 0.30 0.15 0.44 2.37 2.37 6.58 0.73 0.27 2.47 0.36 0.17 0.53 0.45 0.45 6.98 1.52 0.28 2.84 0.24 0.23 0.61 0.04 0.04 7.40 1.73 0.29 2.90 0.08 0.25 0.62 0.00 0.00 7.84 2.38 0.31 2.44 0.00 0.26 0.62 10 11 12 0.12 6.94 0.21 9.57 0.29 10.82 0.29 12.41 0.29 12.99 0.29 13.57 13 0.61 0.61 0.56 0.56 (0.16) 14 15 16 Total Annual Revenue Requirement (12+13) Less: SLDC charges Revenue Gap/(Surplus) (14-15) 7.55 7.55 0.00 7.41 7.55 (0.14) 10.13 10.13 0.00 11.38 10.13 1.25 12.25 12.25 12.99 13.57 - 9

Approach adopted by SLDC Employee, A&G and R&M Expenses considered as per actual expenses Depreciation has been claimed based on Annual Accounts Interest on loan, ROE and IOWC have been computed as per Regulations ARR claimed in True-up of FY 2020-21 is Rs. 6.80 Crore BERC vide Tariff Order dated 20th March 2020 approved Annual SLDC charges for FY 2020-21 as Rs. 7.55 Crore which included ARR of Rs. 6.94 Crore for FY 2020-21 and revenue gap of Rs. 0.61 for FY 2018-19 SLDC collected revenue of Rs. 7.55 Crore as approved during FY 2020-21 Revenue Surplus of Rs. 0.14 Crore is derived based on ARR claimed and Revenue earned during FY 2020-21 Employee, A&G and R&M Expenses computed as per Regulations AMC cost for SAMAST Phase 1 & 2 considered in R&M Expenses Depreciation claimed at average rate of 26.26% RoE computed at 15.50% of Average Equity grossed up by MAT rate of 17.47% Interest on loan & IOWC claimed as per Regulations 10

Annual SLDC Charges (All figures in Rs. Crore) Sl. No. FY 2020-21 (Rs. Crore) (0.14) (0.006) Net Revenue Surplus of Rs. 0.14 Crore is arrived at in the Truing up for FY 2020-21 Particulars 1 2 Revenue Gap/(Surplus) in True Up of 2020-21 Interest for FY 2020-21 [(SBI MCLR 7.05%+1.5%) @8.55%] for 6 months Interest for FY 2021-22 [(SBI MCLR 7.00%+1.5%) @8.50%] for 1 year Interest for FY 2022-23 [(SBI MCLR 7.00%+1.5%) @8.50%] for 6 months Total Revenue Gap/(Surplus) with holding cost Trued-up Revenue Surplus of FY 2020-21 along with holding cost has been carried forward to the ARR of FY 2022-23 as per BERC Regulations 3 (0.012) SLDC proposes to recover SLDC Charges of Rs. 12.25 Crore from all users of SLDC in FY 2022-23 as per direction of BERC. 4 (0.006) 5 (0.16) Sharing of SLDC charges are proposed to be based on the Contracted capacity of the individual users of Transmission System. Sl. No. 1 2 FY 2022-23 (Rs. Crore) 12.41 (0.16) Particulars Net ARR considered for FY 2022-23 Revenue gap of FY 2020-21 with holding cost Annual SLDC Operating Charges for FY 2022-23 (1+2) Monthly SLDC Operating Charge for FY 2022- 23 3 12.25 1.02 4

Summary of BGCL Tariff Petition (All figures in Rs. Crore) Projected for MYT control period True up for FY 2020-21 APR for FY 2021-22 Approved in TO dated 12.03.2021 98.00% 2.00% 360.88 867.43 4.78 15.4 3.22 181.92 236.19 3.82 103.83 claimed for FY 2020-21 Sl. No. Particulars APR for FY 2021-22 Approved in TO dated 20.03.2020 FY 2022-23 FY 2023-24 FY 2024-25 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Availability Factor Intra-State Trans. Loss Capital Expenditure Capitalisation Employee Expense R&M Expense A&G Expense Depreciation Interest and Finance Charges Interest on Working capital Return on Equity Contingency reserve Incentive for transmission availability factor Incentive for Transmission loss reduction Add: Sharing of Gains /(Losses) Less: Non tariff income ARR ((5 to 15)-16) Add: Revenue Gap/(Surplus) of Previous year Net Revenue requirement (17+18) Revenue from Transmission charges Net Revenue Gap / (Surplus) (19+20) 98.00% 2.00% 156.09 1717.82 9.41 12.43 3.93 162.27 214.48 4.04 110.68 99.76% 1.27% 1116.17 299.19 11.29 20.46 7.68 95.40 131.88 2.61 78.11 4.72 2.56 2.48 (1.74) 17.42 98.00% 2.00% 134.28 1506.53 11.97 14.73 7.87 150.01 193.23 3.31 115.52 6.98 98.00% 2% 57.64 363.52 12.69 25.71 8.06 187.19 252.52 4.43 154.25 18.64 98.00% 2% 98.00% 2% - - - - 13.45 28.36 8.25 193.28 247.93 4.45 161.78 19.55 14.25 28.36 8.45 193.28 228.16 4.18 161.78 19.55 3.73 7.45 17.42 17.42 17.42 17.42 513.51 -53.32 460.20 460.20 0.00 338.05 (53.32) 284.73 460.20 (175.46) 541.71 -89.09 452.62 452.62 0.00 486.19 646.07 (205.35) 440.72 659.63 640.59 486.19 452.62 34.07 659.63 640.59 12

Key Highlights of Tariff Petition (BSPTCL) BSPTCL has claimed lower RoE, at the rate of 10% in the Truing-up of FY 2019-20 (previous year), Truing-up for FY 2020-21, APR for FY 2021-22 and ARR for the Control Period from FY 2022-23 to FY 2024-25, instead of 15.5% on assets capitalized after 01.04.2015 and instead of 14.00% on assets capitalised before 01.04.2015 in order to pass on benefits to consumers of the State. Total cumulative benefits of Rs. 865.94 Crore passed on to the consumers. (All figures in Rs. Crore) Previous Year Particulars True Up APR Control Period FY 2022- 23 (RoE) FY 2019-20 FY 2020-21 FY 2021-22 FY 2023-24 FY 2024-25 RoE (@15.50% and 14%) RoE (@10%) Difference (Rs. Crore) Total Difference (Rs. Crore) 289.69 346.31 385.94 435.30 494.91 562.65 191.30 227.83 253.39 285.24 323.70 367.40 98.39 118.48 132.54 150.06 171.21 195.25 865.94

Key Highlights of Tariff Petition (BSPTCL) (contd.) BSPTCL has decided not to claim DPS from DISCOMs until DISCOMs become financially viable and the resultant benefit is passed onto the consumer. Particulars Total Outstanding arrears as on 31.03.2021 (Rs. Crore) Total Outstanding arrears as on 31.03.2020 (Rs. Crore) Average Outstanding (Rs. Crore) Delayed Payment Surcharge as per Regulations Delayed Payment Surcharge chargeable to DISCOMs (Rs. Crore) Amount 2252.84 1592.99 1922.92 15% 288.44

Current Available Network Capacity (BSPTCL+BGCL) As on Date Transmission Capacity Sl. No. GSS Voltage Level Number of GSS* Nil 28 126 400/220 kV 220/132 kV 132/33 kV Nil Peak Demand met in FY 1 2 10900 MVA 2020-21 was in lower side 16240 MVA/ 12900 MW than the previous years * Out of 154 GSS, 8 GSS belongs to BGCL because of outage of Status and milestone achieved with latest EPS Sl. Data description 1 Peak demand (19TH EPS) (MW) 2 Peak demand met (Actual) (MW) 3 Connected Load for DISCOM 4 Available capacity at 220/132 kV in MVA 5 Available capacity at 132/33 kV in MVA 6 Available capacity at 132/33 kV in MW 7 Available capacity at 132/33 kV in MW (70% Loading)* 2020-21 6016 5938 20723.11 10100 15890 12712 8898.4 2021-22 6576 6647 23376.14 10900 16240 12900 9030 DMTCL 400kV substation and Amnor GSS. If the above systems were available, then 300-350 MW load would have increased in FY 2020-21. *when a line or Transformer gets more than 70% loaded it is considered to be violation of n-1 criteria of planning

Adequacy of network capacity in the light of 19th EPS at State Level (24x7) Year-wise projections from 2019-20 to 2026-27 (as per 19th EPS) Sl. Data description 2019-20 5308 2020-21 6016 2021-22 6766 2022-23 7054 2023-24 7521 2024-25 8003 2025-26 8681 2026-27 9308 1 Peak demand (19TH EPS) in MW 2 Peak demand met (Actual) in MW 5891 5938 6647 - - - - - 3 Connected Load for DISCOM 18059.47 20723.11 23376.14 - - - - - Available capacity at 400/220 kV (BGCL+BSPTCL) in MVA 4 0 0 0 2000 3000 3000 3000 3000 Available capacity at 220/132 kV (BSPTCL+BGCL) in MVA 5 8960 10100 10900 13240 13640 13640 13640 13640 Available capacity at 132/33 kV (BSPTCL+BGCL) in MVA 6 14440 15890 16240 17650 18850 19180 19180 19180 Available capacity at 132/33 kV (BSPTCL+BGCL) in MW 7 11552 12712 12900 14120 15080 15344 15344 15344 Available capacity at 132/33 kV(BSPTCL+BGCL) in MW (80% Loading) as per planning criteria Available capacity at 132/33 kV(BSPTCL+BGCL) in MW (70% Loading) to avoid overloading 8 9241.6 10170 10320 11296 12064 12275 12275 12275 9 8086.4 8898.4 9030 9884 10556 10741 10741 10741

Load v/s Transformation Capacity of BSPTCL A B C D E F G H Load as per 19th EPS by DISCOM(M W) 90% of E (As per planning criteria of CEA) Peak demand met (MW) % increase in Peak Demand Available capacity at 132/33 KV (MW) Ratio of E/C Ratio of G/C Particulars FY 2019-20 1.73 5308 5891 11% 11232 1.92 10109 2020-21* 1.81 6016 5938 - 12712 2.01 11441 2021-22* 1.69 6576 6647 1% 12900 1.87 11610 *For FY 2020-21 demand met is lesser due to COVID-19 and subsequent lockdown

Intra-State Transmission Charges (BSPTCL & BGCL) (All figures in Rs. Crore) Previous Year True up APR Control Period Particulars FY 2017-18 FY 2018-19 FY 2019-20 FY 2020-21 FY 2021-22 FY 2022-23 FY 2023-24 FY 2024-25 450.4 845.94 ARR of BSPTCL 1002.32 787.85 1012.04 1390.51 1714.67 1973.84 ARR of BGCL 102.85 230.94 207.84 284.73 486.19 440.72 659.63 640.59 553.25 1076.28 1210.16 1072.58 1498.23 1831.23 2374.3 2614.43 Total ARR to be Recovered Energy Required at State Transmission periphery (MU) 24877.2 25824.51 31230.87 35,450.19 37,332.10 38,391.95 42,554.75 42,554.75 Transmission Charges per Unit (Rs./Unit) 0.22 0.42 0.39 0.30 0.40 0.48 0.56 0.61 For FY 2020-21 and onwards, Energy requirement at State transmission periphery has been taken from energy balance of SBPDCL and NBPDCL from their respective Tariff Petitions. Transmission Tariff in Bihar compares reasonably with that in other States

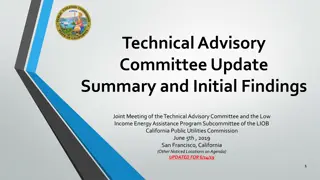

Comparison of Transmission Charges of States for FY 2020-21 Transmission Tariff (Rs./kWh) 0.70 0.62 0.60 0.50 0.40 0.36 0.35 0.32 0.30 0.28 0.30 0.25 0.24 0.20 0.10 0.00 Uttar Pradesh Punjab Gujarat Rajasthan Chattisgarh Assam Madhya Pradesh Bihar

Cost Optimization Transmission infrastructure requirement should not be judged on cost optimization principle. Transmission capacity is augmented to cater to the future energy requirement of the State. Transmission Utilities act as an enabler in the State. Transmission Licensees follow the guidelines of CEA while planning transmission network. All the schemes are approved by the Government of Bihar. BSPTCL awards projects through competitive bidding only. All capex requirement is approved by BOD after multi-level scrutiny.

Thank you 23