Strategic Overview of SA Tourism and Its Impact on Policy Mandates

South Africa's tourism sector is guided by a mission to enhance tourism experiences and promote the country as a premier tourist and business events destination. The legislative mandate focuses on marketing strategies, service quality, stakeholder collaboration, and digital innovation. The impact on policy mandates, including the Economic Reconstruction and Recovery Plan, highlights the importance of tourism in the country's economic revival post-COVID-19.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

FY23/24 Annual Performance Plan FY23/24 Annual Performance Plan Presentation to Portfolio Committee on Tourism Presentation to Portfolio Committee on Tourism 23 May 2023 23 May 2023

Contents Contents LEGISLATIVE AND POLICY OVERVIEW LEGISLATIVE AND POLICY OVERVIEW 1 1 ENVIRONMENTAL ANALYSIS ENVIRONMENTAL ANALYSIS 2 2 MARKETING PRIORITISATION & INVESTMENT FRAMEWORK MARKETING PRIORITISATION & INVESTMENT FRAMEWORK 3 3 INTERNAL ENVIRONMENT INTERNAL ENVIRONMENT 4 4 PROGRAMMES, TARGETS & BUDGET ALLOCATION PROGRAMMES, TARGETS & BUDGET ALLOCATION 5 5 PROGRAMMES, TARGETS & BUDGET ALLOCATION PROGRAMMES, TARGETS & BUDGET ALLOCATION 6 6 2 2

Contents Contents STRATEGIC OVERVIEW OF SA TOURISM STRATEGIC OVERVIEW OF SA TOURISM 1 1 MARKETING PRIORITISATION & INVESTMENT FRAMEWORK MARKETING PRIORITISATION & INVESTMENT FRAMEWORK 2 2 ENVIRONMENTAL ANALYSIS ENVIRONMENTAL ANALYSIS 3 3 SA TOURISM s STRATEGY SA TOURISM s STRATEGY 4 4 PROGRAMMES, TARGETS & BUDGET ALLOCATION PROGRAMMES, TARGETS & BUDGET ALLOCATION 5 5 3 3

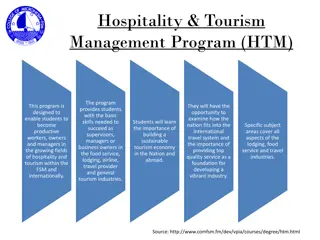

Strategic Overview of SA Tourism Strategic Overview of SA Tourism MISSION MISSION LEGISLATIVE MANDATE LEGISLATIVE MANDATE Marketing South Africa both internationally and domestically to increase the volume of tourists and the value they add to the economy by: The SA Tourism Board is a Schedule 3A public entity established in terms of Section 9 of the Tourism Act, Act 3 of 2014. Implementing an integrated tourism marketing strategy for South Africa Promoting South Africa as a world-class business events destination Facilitating the delivery of service-oriented, quality-assured tourism experiences Positioning SA Tourism as an industry thought leader Championing a digital outlook for the industry Enhancing stakeholder collaboration VISION VISION South Africa positioned as an exceptional tourist and business events destination that offers a value-for-money, quality tourist experience that is diverse and unique. participation and 4 4

Strategic Overview of SA Tourism Strategic Overview of SA Tourism IMPACT ON POLICY IMPACT ON POLICY MANDATES MANDATES POLICY MANDATES POLICY MANDATES White Paper on Development & Promotion of Tourism in SA, 1996 The Economic Economic Reconstruction operation in October 2020, is the country s plan for the overall recovery of the economy following the impact of the COVID-19 pandemic. Support tourism tourism recovery recovery and and growth growth is one of the eight priority interventions in the ERRP, emphasising reigniting demand, rejuvenating supply and building enabling capability across the tourism sector. Reconstruction and and Recovery Recovery Plan Plan (ERRP), (ERRP), which came into Support for for National Development Plan, 2030 Following the ERRP, the Tourism by Cabinet in April 2021. The role of SA Tourism as per the TSRP is to stimulate stimulate domestic domestic demand demand through through targeted targeted initiatives to to execute execute a a global global marketing marketing programme programme to to reignite Tourism Sector Sector Recovery Recovery Plan Plan (TSRP) (TSRP) was adopted National Tourism Sector Strategy, 2016-2026 initiatives and reignite international international demand and campaigns campaigns and demand. and Medium-Term Strategic Framework, 2019 - 2024 SA Tourism s policy mandate and in particular this Annual Performance Plan, has been aligned to the implementation requirements of the TSRP. 5 5

Contents Contents STRATEGIC OVERVIEW OF SA TOURISM STRATEGIC OVERVIEW OF SA TOURISM 1 1 MARKETING PRIORITISATION & INVESTMENT FRAMEWORK MARKETING PRIORITISATION & INVESTMENT FRAMEWORK 2 2 ENVIRONMENTAL ANALYSIS ENVIRONMENTAL ANALYSIS 3 3 SA TOURISM s STRATEGY SA TOURISM s STRATEGY 4 4 PROGRAMMES, TARGETS & BUDGET ALLOCATION PROGRAMMES, TARGETS & BUDGET ALLOCATION 5 5 6 6

Marketing Prioritisation & Investment Framework Marketing Prioritisation & Investment Framework In 2016/17, in partnership with the tourism industry, South African Tourism developed a Marketing and and Investment Investment Framework Framework (MPIF) that focused on: Marketing Prioritisation Prioritisation o Identifying markets, o Optimising marketing investments across the identified target markets, and o Distributing resources to help meet the set objectives. In early 2020, SA Tourism reviewed the MPIF, using 2019 as the base year. The framework is based on 33 variables related to performance, outlook, South Africa s ability to win in the market, return on past investments, and other criteria. The 2020 review did not only refresh the data, but included new indicators, such as the health index, cost of travel, and country stringency index in the model, in order to ensure a robust view of the current travel environment. The MPIF priority markets were overlayed with pertinent information related to countries rebound rates, and marketing investments were prioritised accordingly. The revised MPIF aims to: Support day-to-day decision-making through an enhanced view on increasing and tapping into short-term opportunities. Review and update the various parameters to ensure a robust view of the current business environment and market prioritisation. Transition key elements of the MPIF model to a power business intelligence environment, to enable easy access, navigation and usage. 7 7 7

Marketing Prioritisation & Investment Framework Marketing Prioritisation & Investment Framework 24 markets were prioritised and segmented into 16 growth and 8 defend markets, with an additional set of markets earmarked as watchlist . The 24 prioritised markets accounted for 92% of all international trips in 2019. GROWTH MARKETS GROWTH MARKETS DEFEND MARKETS DEFEND MARKETS WATCHLIST MARKETS WATCHLIST MARKETS Markets that hold considerable outbound potential. However, the share of South Africa in outbound has growth potential. These markets provide an ample opportunity to grow based on their size Service Model: Elevate South Africa s position in the market relative to long-haul competitors. Markets where South Africa holds a substantial market share and requires continued intervention to ensure arrivals. These markets hold both volume and value importance for South Africa. South African Tourism needs to maintain or defend its share. Service Model: Maintain the existing share in the markets outbound. Markets that hold reasonable outbound potential. However, the current share of South Africa in outbound is low. These markets provide an opportunity for nurturing and investing for future growth and need to be kept in the watchlist. Service Model: Elevate South Africa s position in the market relative to long-haul competitors. 8 8 8

Priority Source Markets Identified to Grow Tourism into Priority Source Markets Identified to Grow Tourism into South Africa, 2020 South Africa, 2020 - - 2025 2025 GROWTH MARKETS GROWTH MARKETS DEFEND MARKETS DEFEND MARKETS France Lesotho Germany Botswana Italy Swaziland Netherlands Namibia Russia Mozambique Spain Zimbabwe United Kingdom Zambia Brazil Malawi Canada USA Australia China India Japan Kenya Nigeria 9 9

Priority Source Markets Identified to Grow Tourism into Priority Source Markets Identified to Grow Tourism into South Africa, 2020 South Africa, 2020 - - 2025 2025 WATCHLIST MARKETS WATCHLIST MARKETS Europe Europe Switzerland Belgium Sweden Ireland Denmark Portugal Austria Norway Finland Turkey Asia Pacific Asia Pacific Singapore Malaysia UAE Americas Americas - Africa Air Africa Air DRC Tanzania Watchlist markets are key to monitor, as SA Tourism needs to protect its previous marketing investments. This seeks to build demand in second-tier markets that provide a pipeline for future growth, and that may diversify the portfolio of source countries to mitigate the risk of depending on only 24 markets to drive tourism recovery. New Zealand Argentina Ghana Angola Uganda Ethiopia 10 10

Contents Contents STRATEGIC STRATEGIC OVERVIEW OF SA TOURISM OVERVIEW OF SA TOURISM 1 1 MARKETING PRIORITISATION & INVESTMENT FRAMEWORK MARKETING PRIORITISATION & INVESTMENT FRAMEWORK 2 2 ENVIRONMENTAL ANALYSIS ENVIRONMENTAL ANALYSIS 3 3 SA TOURISM s STRATEGY SA TOURISM s STRATEGY 4 4 PROGRAMMES, TARGETS & BUDGET ALLOCATION PROGRAMMES, TARGETS & BUDGET ALLOCATION 5 5 11 11

Travel & Tourism Forecast 2022 to 2032 Travel & Tourism Forecast 2022 to 2032 The 2022 to 2032 longer-term forecast predicts that travel and tourism s contribution to the global economy is expected to grow at an average annual rate of 5.8%, which is more than double the 2.7% average annual growth rate estimated for the global economy. In the same period, the sector is forecasted to generate 126 million additional jobs. 12 12

Travel & Tourism Forecast 2022 to 2032 Travel & Tourism Forecast 2022 to 2032 UNWTO s forward-looking scenarios point to international arrivals reaching 55% to 70% of pre- pandemic levels in 2022. Results depend on evolving circumstances. These are mostly changing travel restrictions, ongoing inflation including high energy prices, the evolution of the war in Ukraine, as well as the health situation related to the pandemic. More recent challenges, such as staff shortages, severe airport congestion, flight delays and cancellations, could also impact international tourism numbers.Scenarios by region show Europe and Americas recording the best tourism results in 2022. International tourist arrivals in Europe could climb to 65% or 80% of 2019 levels in 2022, depending on various conditions, while the Americas could reach 63% to 76% of those levels. In Africa and the Middle East, arrivals could reach about 50% to 70% of pre-pandemic levels, while Asia and the Pacific could remain at 30% of 2019 levels in the best-case scenario, due to stricter policies and restrictions.This figure compares the contribution of travel and tourism to GDP against 2019. For instance, the sector s contribution to GDP in Europe was 47.1% below the pre-pandemic level in 2020, and the gap reduced to 32.3% below 2019 s level in 2021, showing a strong rebound. It is estimated that the sector s performance in Europe could surpass 2019 s level in 2024, when travel and tourism contribution to the region s GDP could reach 4.1% above the pre-pandemic amount. Asia-Pacific is forecasted to be the first region to revert to the 2019 scenario in 2023, while other regions are estimated to recover completely in 2024. In 2022, as travellers confidence improved, the global travel and tourism sector was estimated to hasten its pace of recovery to 43.7% compared to 2021 and add a further 10 million jobs. The sector is likely to return to pre-pandemic levels around the end of 2023. 13 13

Contents Contents STRATEGIC STRATEGIC OVERVIEW OF SA TOURISM OVERVIEW OF SA TOURISM 1 1 MARKETING PRIORITISATION & INVESTMENT FRAMEWORK MARKETING PRIORITISATION & INVESTMENT FRAMEWORK 2 2 ENVIRONMENTAL ANALYSIS ENVIRONMENTAL ANALYSIS 3 3 SA TOURISM s STRATEGY SA TOURISM s STRATEGY 4 4 PROGRAMMES, TARGETS & BUDGET ALLOCATION PROGRAMMES, TARGETS & BUDGET ALLOCATION 5 5 14 14

SA Tourisms Brand Design Architecture SA Tourism s Brand Design Architecture DESTINATION BRAND DESTINATION BRAND CORPORATE BRAND CORPORATE BRAND South Africa South African Tourism Entity of the Department of Tourism The leisure and business events destination PLATFORM BRAND PLATFORM BRAND Leisure Platform: Africa s Tourism Indaba Business Events Platform: Meetings Africa Excellence Platform: Lilizela Awards Quality Platform: Star Grading System Trade / Channel Brand: SA Specialist National Convention Bureau of South Africa 15 15

Integrated Marketing Strategy Integrated Marketing Strategy Marketing Marketing by 21 million arrivals by 2030; consistently monitor performance against the CAGR in order to adjust tactics to deliver on the ERRP & TSRP. by numbers numbers: demonstrate performance against the policy goal of 1 1 The Marketing Mandate The Marketing Mandate SAT SAT is is a a double demonstrate the socio-economic impact of tourism sector performance in relation to its contribution to economic growth, job creation and reducing inequality. double- -digit digit GDP GDP contributor contributor to to the the South South African African economy economy (NDP) (NDP): 2 2 Economic Impact Story Economic Impact Story SAT SAT consistently consistently obtains Operation Clean Audit will seek to improve our audit outcome in relation to human capital, performance information, IT, SCM, AFS and financial health of the entity. obtains an an unqualified unqualified / / clean clean audit audit (license (license to to operate) operate): 3 3 Corporate Compliance Story Corporate Compliance Story SAT is the best public service entity to work for in South Africa (culture) SAT is the best public service entity to work for in South Africa (culture): improve the state of the entity from a culture and operational perspective so that it becomes the best public service organisation to work for. 4 4 The Best Place to Work Story The Best Place to Work Story 16 16

Integrated Marketing Strategy Integrated Marketing Strategy Value chain partners achieve their goals better when partnering with SAT Value chain partners achieve their goals better when partnering with SAT: working as a collective to mitigate the barriers impacting tourism. Concerted efforts are required to work as one tourism collective including public and private sector partners. 5 5 The Profit Story The Profit Story SA SA is is world destination marketing and conversion efforts must be amplified so that destination SA becomes the number 1 long-haul destination in the world by 2030 with bigger brand strength share versus our competitors. world- -leading leading in in the the tourism tourism propositions propositions it it markets markets to to the the world world: 6 6 Destination Exceptionalism Story Destination Exceptionalism Story South South African African citizens must be elevated to ensure that destination SA becomes the number 1 most visited country by Africans in Africa. Focus on increasing visitor spend and a land arrivals volume strategy. citizens are are the the bedrock bedrock of of the the tourism tourism economy economy of of SA SA: efforts 7 7 Domestic Tourism Story Domestic Tourism Story 17 17

Contents Contents STRATEGIC STRATEGIC OVERVIEW OF SA TOURISM OVERVIEW OF SA TOURISM 1 1 MARKETING PRIORITISATION & INVESTMENT FRAMEWORK MARKETING PRIORITISATION & INVESTMENT FRAMEWORK 2 2 ENVIRONMENTAL ANALYSIS ENVIRONMENTAL ANALYSIS 3 3 SA TOURISM s STRATEGY SA TOURISM s STRATEGY 4 4 PROGRAMMES, TARGETS & BUDGET ALLOCATION PROGRAMMES, TARGETS & BUDGET ALLOCATION 5 5 18 18

Programme Purpose Programme Purpose Business Units Business Units Programme 1: Programme 1: Corporate Support Corporate Support Governance, Risk, Compliance and Company Secretariat o Internal Audit To provide effective support services to the organisation, as well as ensure compliance with statutory requirements, and o o Finance and Supply Chain Management o Human Capital o To ensure strategy development and integration with business performance monitoring, governance, and evaluation. o Information Communication and Technology (ICT) o Office of the Chief Executive Officer including Strategic Planning, Evaluation and Programme Management o Jobs To Be Done In 2023/24 Jobs To Be Done In 2023/24 Operation Clean Audit Revenue enhancement & Cost Optimisation Transformation 19 19

Programme 1 Programme 1 QUARTERLY TARGETS QUARTERLY TARGETS Q2 Q2 Jul - - Sep 2023 Sep 2023 Implementation of the recommendations from the FY2022/23 Risk Management Maturity Assessment Report 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Implementation of the recommendations from the FY2022/23 Risk Management Maturity Assessment Report Jul Oct Oct - - Dec 2023 Implementation of the recommendations from the FY2022/23 Risk Management Maturity Assessment Report Conduct FY2023/24 risk management maturity assessment Jan Jan - - Mar 2024 Conclude the implementation of the recommendations from the FY2022/23 Risk Management Maturity Assessment Report Improved risk maturity level up by one level from the prior assessment 2.1.1. Improved risk maturity level 2.1. Governance and 2.1. Governance and internal control internal control 2.1.2. Corporate Compliance Campaign (Operation Clean Audit) implemented FY2023/24 Corporate Compliance Campaign (Operation Clean Audit) implemented Implement the Quarter 1 milestones in Corporate Compliance Campaign Implement the Quarter 2 milestones in Corporate Compliance Campaign Implement the Quarter 3 milestones in Corporate Compliance Campaign Implement the Quarter 4 milestones in Corporate Compliance Campaign 2.1.3. Percentage implementation of valid internal and external audit recommendations 100% implementation of valid audit recommendations 25% implementation of valid audit recommendations 50% implementation of valid audit recommendations 75% implementation of valid audit recommendations 100% implementation of valid audit recommendations 20 20

QUARTERLY TARGETS QUARTERLY TARGETS Q2 Q2 Jul - - Sep 2023 Sep 2023 100% 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET Q1 Q1 Jun 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Apr Apr - - Jun 2023 100% Jul Oct Oct - - Dec 2023 100% Jan Jan - - Mar 2024 100% 2.2.1. Percentage payment of compliant invoices within 30 days from date of receipt 100% payment of compliant invoices within 30 days from date of receipt 6 SCM ethics and integrity initiatives implemented 2.2.2. Number of initiatives to promote integrity and ethical conduct in supply chain management (SCM) implemented as per Section 57 of the PFMA Implement in Quarter 1: Implement in Quarter 2: Implement in Quarter 3: Implement in Quarter 4: 1. Letters confirming budget allocation and related accountability issued to Business Unit Managers 4. Monitoring of non-compliance to SCM policies and procedures 2. Capability building for procurement committees 4. Monitoring of non-compliance to SCM policies and procedures 2.2. Financial 2.2. Financial management management 5. Conduct organisation-wide training on Ethics in the Public Service 4. Monitoring of non-compliance to SCM policies and procedures 6. Conduct organisation wide PFMA training 2. Capability building for procurement committees 3. Create awareness organisation-wide on SCM code of conduct 21 21

QUARTERLY TARGETS QUARTERLY TARGETS Q2 Q2 Jul - - Sep 2023 Sep 2023 Develop and approve Policy to execute Budget Optimisation Strategy 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET Q1 Q1 Jun 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Apr Apr - - Jun 2023 Approve Budget Optimisation Strategy Jul Oct Oct - - Dec 2023 Develop implementation plan to execute Budget Optimisation Strategy and Policy Execute implementation plan Jan Jan - - Mar 2024 Execute implementation plan 2.3.1. Budget Optimisation Strategy developed Finalised Budget Optimisation Strategy 2.3. Revenue 2.3. Revenue enhancement and cost enhancement and cost optimisation optimisation 22 22

QUARTERLY TARGETS QUARTERLY TARGETS Q2 Q2 Jul - - Sep 2023 Sep 2023 Implement the action plan 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET Q1 Q1 Jun 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Apr Apr - - Jun 2023 Develop action plan to address issues arising from the prior year s staff engagement assessment Jul Oct Oct - - Dec 2023 Implement the action plan Jan Jan - - Mar 2024 Conduct staff engagement assessment to determine staff engagement score Table staff engagement score survey report with ExCo 2.4.1. Staff engagement score 3.13 Staff engagement score 2.4.2. Implementation of Employment Equity (EE) Plan: 2.4.2.1. Percentage of women in SA Tourism 2.4.2.2. Percentage of women in senior and top management positions in SA Tourism 2.4.2.3. Percentage of people with disabilities employed in SA Tourism 2.4.2.4. Maintain at least 60% Black people (Africans, Coloureds, and Indians across all occupational levels) 2.4.3. Labour Turnover (LTO) as % of average headcount 2.4.4. Vacancies as % of staff establishment 60% 60% 60% 60% 60% 50% 50% 50% 50% 50% 2.4. Human capital 2.4. Human capital management and management and development development 2% 2% 2% 2% 2% 60% 60% 60% 60% 60% <8% <8% <8% <8% <8% <8% <8% <8% <8% <8% 23 23

QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Implement the Quarter 1 deliverables of the FY2023/24 roadmap of the ICT Governance Framework Jul Jul - - Sep 2023 Implement the Quarter 2 deliverables of the FY2023/24 roadmap of the ICT Governance Framework Oct Oct - - Dec 2023 Implement the Quarter 3 deliverables of the FY2023/24 roadmap of the ICT Governance Framework Jan Jan - - Mar 2024 Implement the Quarter 4 deliverables of the FY2023/24 roadmap of the ICT Governance Framework Develop the FY2024/25 roadmap for ICT Governance Framework 2.5.1. ICT Governance Framework implemented FY2023/24 roadmap for ICT Governance Framework implemented 2.5. ICT Governance and 2.5. ICT Governance and internal controls internal controls 24 24

Programme Purpose Programme Purpose Business Units Business Units Programme 2: Programme 2: Business Enablement Business Enablement To enhance collaboration with various stakeholders, and o DigiTech o Data Analytics and Strategic Insights o To provide centralised tourism intelligence to support evidence-based decision-making. o Industry and Government Relations o Jobs to be done in 2023/24 Best Company to Work For o Digital Transformation o MPIF Review o Corporate Brand o 25 25

Programme 2 Programme 2 QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Implement the Quarter 1 milestones as per the Year 2 Roadmap of the Integrated Digital and Analytics Operating Framework Jul Jul - - Sep 2023 Implement the Quarter 2 milestones as per the Year 2 Roadmap of the Integrated Digital and Analytics Operating Framework International Leisure Brand Tracker Global Fieldwork Report Departure Survey Fieldwork Report Domestic Tourism Survey Fieldwork Report Business Events Brand Equity Survey Fieldwork Report Domestic Leisure Brand Tracker Fieldwork Report Oct Oct - - Dec 2023 Implement the Quarter 3 milestones as per the Year 2 Roadmap of the Integrated Digital and Analytics Operating Framework International Leisure Brand Tracker Global Fieldwork Report Departure Survey Fieldwork Report Domestic Tourism Survey Fieldwork Report Business Events Brand Equity Survey Fieldwork Report - Jan Jan - - Mar 2024 Implement the Quarter 4 milestones as per the Year 2 Roadmap of the Integrated Digital and Analytics Operating Framework International Leisure Brand Tracker Global Fieldwork Report Departure Survey Fieldwork Report Domestic Tourism Survey Fieldwork Report Business Events Brand Equity Survey Fieldwork Report Domestic Leisure Brand Tracker Fieldwork Report 2.6.1. Integrated Digital and Analytics Operating Framework annual roadmap implemented Implementation of Year 2 Roadmap of the Integrated Digital and Analytics Operating Framework 2.6. Integrated Digital 2.6. Integrated Digital and Analytics Operating and Analytics Operating Framework Framework 2.7.1. Number of tourism information tracking surveys completed 5 tourism information tracking surveys completed - Departure Survey Fieldwork Report Domestic Tourism Survey Fieldwork Report - 2.7. Tourism information 2.7. Tourism information gathering gathering - 26 26

Programme 2 Programme 2 QUARTERLY TARGETS QUARTERLY TARGETS OUTPUT OUTPUT INDICATORS INDICATORS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 1 Quarterly Trend Analysis Report 2 thought leadership pieces published Jul Jul - - Sep 2023 1 Quarterly Trend Analysis Report 2 thought leadership pieces published 1 Tourism Statistics And Performance Report Oct Oct - - Dec 2023 1 Quarterly Trend Analysis Report 2 thought leadership pieces published 1 Tourism Statistics And Performance Report Jan Jan - - Mar 2024 1 Quarterly Trend Analysis Report 2 thought leadership pieces published 1 Tourism Statistics And Performance Report 2.8. Tourism trends 2.8. Tourism trends analysis analysis 2.9. Tourism 2.9. Tourism thought leadership leadership 2.8.1. Number of trend analysis reports 2.9.1. Number of thought leadership pieces published 2.10.1. Number of Tourism Statistics And Performance Reports 4 Quarterly Trend Analysis Reports 8 thought leadership pieces published 4 Tourism Statistics And Performance Reports thought 2.10. Tourism 2.10. Tourism research research 1 Tourism Statistics And Performance Report 27 27

QUARTERLY TARGETS QUARTERLY TARGETS OUTPUT OUTPUT INDICATORS INDICATORS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Develop the improvement plan on the basis of the FY2022/23 South African Tourism Corporate Brand Index Implement the Quarter 1 improvement actions from the FY2022/23 South African Tourism Corporate Brand Index Conduct the Best Company to Work for Survey, or equivalent, for SA Tourism, to determine the organisation s baseline rating Jul Jul - - Sep 2023 Implement the Quarter 2 improvement actions from the FY2022/23 South African Tourism Corporate Brand Index Oct Oct - - Dec 2023 Implement the Quarter 3 improvement actions from the FY2022/23 South African Tourism Corporate Brand Index Jan Jan - - Mar 2024 Conduct FY2023/24 survey, reflecting 72.24 South African Tourism Corporate Brand Index 2.11. Stakeholder 2.11. Stakeholder management management 2.11.1. South African Tourism Corporate Brand Index 72.24 South African Tourism Corporate Brand Index 2.12. 2.12. Organisational Organisational environment environment 2.12.1 Rating of SA Tourism in the Best Company to Work for Survey, or equivalent Determine SA Tourism s organisational baseline rating in the Best Company to Work for Survey, or equivalent Develop plan of action to improve rating Implement improvement action plan Implement improvement action plan 28 28

QUARTERLY TARGETS QUARTERLY TARGETS OUTPUT OUTPUT INDICATORS INDICATORS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Develop and approve FY2023/24 Global PR and Communications Annual Plan Implement the Quarter 1 milestones as per the FY2023/24 Global PR and Communications Plan Jul Jul - - Sep 2023 Implement the Quarter 2 milestones as per the FY2023/24 Global PR and Communications Plan Oct Oct - - Dec 2023 Implement the Quarter 3 milestones as per the FY2023/24 Global PR and Communications Plan Jan Jan - - Mar 2024 Implement the Quarter 4 milestones as per the FY2023/24 Global PR and Communications Plan 2.13. Global PR and 2.13. Global PR and communications communications 2.13.1. Annual Global PR and Communications Plan implemented FY2023/24 Global PR and Communications Plan implemented 29 29

Programme Purpose Programme Purpose Business Units Business Units Programme 3: Programme 3: Leisure Tourism Marketing Leisure Tourism Marketing Brand and Marketing o To create demand through travel acquisition and growing brand equity for South Africa as a leisure and business events destination in identified markets. o Tourism Execution o Global Trade o Jobs To Be Done in 2023/24 Jobs To Be Done in 2023/24 Economic Impact (Leisure) o Arrivals and spend from all MPIF markets o Brand o Campaigns o Growing emerging segments o Domestic o Value Chain Management (including Airlift) o 30 30

Programme 3 Programme 3 QUARTERLY TARGETS QUARTERLY TARGETS Q2 Q2 Jul - - Sep 2023 Sep 2023 Implement Quarter 2 milestones of FY2023/24 Global Tourism Brand Campaign Plan 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Finalise the FY2023/24 Global Tourism Brand Campaign Plan Jul Oct Oct - - Dec 2023 Implement Quarter 3 milestones of FY2023/24 Global Tourism Brand Campaign Plan Jan Jan - - Mar 2024 Implement Quarter 4 milestones of FY2023/24 Global Tourism Brand Campaign Plan 1.1.1. Global tourism brand campaign implemented FY2023/24 Global Tourism Brand Campaign Plan implemented 1.1. Global tourism 1.1. Global tourism brand campaign brand campaign Launch Live Again 2.0 at Africa s Travel Indaba 2 global tourism campaigns localised in South Africa 3 global tourism campaigns localised in South Africa 1 global tourism campaign localised in South Africa - - 2 global brand collaborations and/or partnerships secured 2 global brand collaborations and/or partnerships secured Roll-out of collaborations and/or partnerships Roll-out of collaborations and/or partnerships Roll-out of collaborations and/or partnerships Close-out Report on each collaboration and/or partnership outlining learnings and ROI 31 31

QUARTERLY TARGETS QUARTERLY TARGETS Q2 Q2 Jul - - Sep 2023 Sep 2023 Execute campaign for each hub Campaign progress report per hub 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET Q1 Q1 Jun 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Apr Apr - - Jun 2023 Develop the annual localised campaign concept and implementation plan for each hub, as follows: Americas: 2 North America 1 South America 1 Asia and Australasia: 4 India 1 China 1 Japan 1 Australia 1 Europe: 4 UK 1 South Europe 1 North Europe 1 Central Europe 1 Embassy Liaison: 1 Jul Oct Oct - - Dec 2023 Execute campaign for each hub Campaign progress report per hub Jan Jan - - Mar 2024 Execute campaign for each hub Close out report and evaluate ROI per campaign per hub 1.1.2. Number of localised brand campaigns implemented in support of the Global Tourism Brand Campaign 11 localised brand campaigns implemented 1.1. Global tourism brand 1.1. Global tourism brand campaign campaign 32 32

QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Develop the annual Africa localised campaign concept and implementation plan Develop 360 West Africa and Central, East and Land Africa brand campaigns 1 & 2 concepts - Jul Jul - - Sep 2023 Implement 360 West Africa and Central, East and Land Africa markets campaigns 1 & 2 Campaigns 1 & 2 progress reports Oct Oct - - Dec 2023 Campaigns 1 & 2 close-out reports Jan Jan - - Mar 2024 Campaign 3 close- out report 1.2. Regional (Africa) 1.2. Regional (Africa) Tourism Campaign Tourism Campaign 1.2.1. Number of regional seasonal campaigns implemented 4 regional seasonal campaigns implemented Implement a 360 Central, East and Land Africa markets campaign 3 Implement a 360 West Africa and Central, East and Land Africa markets Campaign 4 Campaign 4 progress report Develop 360 West Africa and Central, East and Land Africa markets brand campaign 3 concepts - Campaign 3 progress report - Develop 360 West Africa and Central, East and Land Africa markets brand campaign 4 concepts - 33 33

QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Develop and approve annual seasonal campaign and implementation Plan Develop and approve the Sho t Left Travel Week Campaign Concept Jul Jul - - Sep 2023 Implement Sho t Left Travel Week Campaign Oct Oct - - Dec 2023 Sho t Left Travel Week Campaign close-out report Jan Jan - - Mar 2024 Sho t Left Summer Deal Driven Campaign close-out report Implement Sho t Left Easter Deal Driven Campaign 1.3. Domestic tourism 1.3. Domestic tourism campaign campaign 1.3.1. Number of domestic seasonal campaigns implemented 3 domestic seasonal campaigns implemented: 1. Sho t Left Travel Week Campaign Develop and approve the Sho t Left Summer Deals Driven Campaign Concept - Implement Sho t Left Summer Deal Driven Campaign 2. Summer Deal Driven Campaign 3. Easter Deal Driven Campaign - Develop and approve Sho t Left Easter Deals Driven Campaign concept Sho t Left Easter Deal Driven Campaign progress report 34 34

QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Implement 24 distribution channel initiatives Jul Jul - - Sep 2023 Implement 25 distribution channel initiatives Oct Oct - - Dec 2023 Implement 26 distribution channel initiatives Jan Jan - - Mar 2024 Implement 26 distribution channel initiatives 1.4. Global brand affinity 1.4. Global brand affinity initiatives initiatives 1.4.1. Number of distribution channel initiatives implemented in market 1.5.1. Global Trade Programme implemented 101 distribution channel initiatives implemented in market 1.5. Global Trade 1.5. Global Trade programme programme FY2023/24 Global Trade Plan implemented Implement the Quarter 1 milestones of FY2023/24 Global Trade Plan Implement the Quarter 1 milestones of the Global Advocacy Programme 1 quarterly tourism economic impact communication activity Implement the Quarter 2 milestones of FY2023/24 Global Trade Plan Implement the Quarter 2 milestones of the Global Advocacy Programme 1 quarterly tourism economic impact communication activity Implement the Quarter 3 milestones of FY2023/24 Global Trade Plan Implement the Quarter 3 milestones of the Global Advocacy Programme 1 quarterly tourism economic impact communication activity Implement the Quarter 4 milestones of FY2023/24 Global Trade Plan Implement the Quarter 4 milestones of the Global Advocacy Programme 1 quarterly tourism economic impact communication activity 1.6. Global Advocacy 1.6. Global Advocacy Programme Programme 1.6.1. Annual Global Advocacy Programme implemented FY2023/24 Global Advocacy Programme implemented 1.7. Tourism economic 1.7. Tourism economic impact communication impact communication 1.7.1 Number of quarterly tourism economic impact communication activities 4 quarterly tourism economic impact communication activities 35 35

Programme Purpose Programme Purpose Business Units Business Units Programme 4: Programme 4: Business Events Business Events Business Development and Support Services o Meetings, Incentives, Conferences and Trade Exhibitions (MICE) Sales o To grow the nation s business events industry. o Strategic Events and Platforms o Jobs to be done in 2023/24 Jobs to be done in 2023/24 Economic Impact Story (Business Events) o Bidding o Exhibitions o Market Access o Brand o 36 36

Programme 4 Programme 4 QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Approved Domestic B2B Campaign Plan Jul Jul - - Sep 2023 Implement Quarter 2 milestones in approved Domestic B2B Campaign Plan Implement Quarter 2 milestones in approved Global B2B Campaign Plan 30 bid submissions Oct Oct - - Dec 2023 Implement Quarter 3 milestones in approved Domestic B2B Campaign Plan Implement Quarter 3 milestones in approved Global B2B Campaign Plan 15 bid submissions Jan Jan - - Mar 2024 Implement Quarter 4 milestones in approved Domestic B2B Campaign Plan Implement Quarter 4 milestones in approved Global B2B Campaign Plan 15 bid submissions 1.8.1. Number of B2B brand campaigns implemented 1 Domestic B2B Campaign implemented 1.8. Business to Business 1.8. Business to Business (B2B) brand campaign (B2B) brand campaign 1 Global B2B Campaign implemented Approved Global B2B Campaign Plan 1.9.1. Number of bid submissions 1.9.2. Number of business events hosted in Villages, Townships and Small Dorpies (VTSDs) 1.9.3. Number of business events bidding impact reports 93 bid submissions 33 bid submissions 5 business events hosted in VTSDs 1 business event hosted in VTSD 2 business events hosted in VTSDs 1 business event hosted in VTSDs 1 business event hosted in VTSDs 1.9. 1.9. Business Events Business Events bidding platform bidding platform 4 business events bidding impact reports Quarter 1 Business Events Bidding Impact Report Quarter 2 Business Events Bidding Impact Report Quarter 3 Business Events Bidding Impact Report Quarter 4 Business Events Bidding Impact Report 37 37

QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 Hosting of Africa's Travel Indaba 2023 Re-Imagined Jul Jul - - Sep 2023 Post-Show Economic Impact Study briefing Oct Oct - - Dec 2023 Planning for Africa s Travel Indaba 2024 Re-Imagined - Communication Strategy formulation Planning for Meetings Africa 2024 Re- Imagined and opening of registration Jan Jan - - Mar 2024 Planning for Africa s Travel Indaba 2024 Re-Imagined and opening of registration 1.10.1. Africa s Travel Indaba (ATI) hosted Hosting of Africa's Travel Indaba 2023 Re-Imagined 1.10.2. Meetings Africa (MA) hosted Hosting of Meetings Africa 2024 Re- Imagined Post-Show Economic Impact Study briefing Planning for Meetings Africa 2024 Re-Imagined Communication Strategy formulation Plan for IMEX America, IBTM and WTM Hosting of Meetings Africa 2024 Re- Imagined 1.10. Strategic platforms 1.10. Strategic platforms 1.10.3 Number of International Strategic Platforms participated in 6 international strategic platforms participated in Plan for and participate at 2 international strategic platforms: ATM and IMEX Frankfurt Participate at 3 international strategic platforms: IMEX America, IBTM and WTM Plan for and participate at 1 international strategic platform: ITB Berlin 38 38

Programme Purpose Programme Purpose Business Units Business Units Programme 5: Programme 5: Tourist Experience Tourist Experience Quality Assurance and Development o To ensure the delivery of quality assured tourist/visitor experiences, which are diverse, unique, and enriched. o Visitor Experience o Brand Experience o Jobs to be done in 2023/24 Destination Story Product Experience Quality (including BQV, TIP) 39 39

Programme 5 Programme 5 QUARTERLY TARGETS QUARTERLY TARGETS 2023/24 ANNUAL 2023/24 ANNUAL TARGET TARGET OUTPUT OUTPUT OUTPUT INDICATORS OUTPUT INDICATORS Q1 Q1 Jun 2023 Q2 Q2 Sep 2023 Q3 Q3 Dec 2023 Q4 Q4 Mar 2024 Apr Apr - - Jun 2023 1 356 Jul Jul - - Sep 2023 2 713 Oct Oct - - Dec 2023 4 070 Jan Jan - - Mar 2024 5 462 1.11.1. Number of graded establishments 5 462 graded establishments 1.11. Quality assured 1.11. Quality assured visitor services visitor services 1.11.2. Reviewed grading model and TGCSA value proposition implemented Implementation of FY2023/24 milestones in the grading model and TGCSA Value Proposition Roadmap Product proposition developed Implement Quarter 1 milestones in the grading model and TGCSA Value Proposition Roadmap Develop Product Proposition Implement Quarter 2 milestones in the grading model and TGCSA Value Proposition Roadmap - Implement Quarter 3 milestones in the grading model and TGCSA Value Proposition Roadmap - Implement Quarter 4 milestones in the grading model and TGCSA Value Proposition Roadmap - 1.12. Destination 1.12. Destination proposition proposition enhancement enhancement 1.12.1. Product proposition implemented Product Proposition Roadmap implemented - Develop Product Proposition Roadmap Implement Quarter 3 milestones of Product Proposition Roadmap - Implement Quarter 4 milestones of Product Proposition Roadmap - 1.13. Quality Assurance 1.13. Quality Assurance in Tourism Value Chain in Tourism Value Chain 1.13.1. Three-Year Tourism Value Chain and Barrier Strategy implemented Three-Year Tourism Value Chain Strategy developed Three-Year Tourism Value Chain Strategy Roadmap developed Develop Three-Year Tourism Value Chain Strategy - Approve Three-Year Tourism Value Chain Strategy - - Develop Three-Year Tourism Value Chain Strategy Roadmap 40 40

FIVE FIVE- -YEAR STRATEGIC PLAN 2020 YEAR STRATEGIC PLAN 2020 - - 2025 2025 SUB SUB- -OUTCOME OUTCOME INTRODUCED INTRODUCED AMENDMENT TO OUTCOME FIVE AMENDMENT TO OUTCOME FIVE- -YEAR TARGETS YEAR TARGETS Baseline Baseline OUTCOME OUTCOME NOTE ON AMENDMENT NOTE ON AMENDMENT Five Five- -year target year target Outcome indicator Outcome indicator (2019/20) (2019/20) (By March 2025) (By March 2025) 43.2 10.3 million Destination brand strength Progress towards doubling international tourist arrivals to 21 million by 2030 (SONA 2019) Rand value of international tourist spend Number of domestic holiday trips 39.9 10.3 million No change No change R90.7 billion R86.7 billion Target adjusted downwards from R90,. billion Target adjusted upwards from 7,1 million Target adjusted upwards from R17.3 billion No change 1. Demand creation 7.1 million 10.8 million Rand value of domestic holiday direct spend Number of international business events hosted Seasonality of tourist arrivals R17.3 billion R33.5 billion 230 111 (cumulative 2020/21-2024/25) 1.0% 1. Increase the tourism 1. Increase the tourism sector s contribution to sector s contribution to inclusive economic growth inclusive economic growth 1.3% Target adjusted downwards from 1.3% Target adjusted downwards from 20% No change Geographic spread of international tourist arrivals Geographic spread of domestic tourist arrivals Net promoter score 20% 13.9% 8% 8% 2. Demand fulfilment 91% - Target removed from Five- Year Strategic Plan and moved to Annual Operational Plan No change Number of SMME businesses supported 182 1 096 (cumulative 2020/21-2024/25) 41 41

FIVE FIVE- -YEAR STRATEGIC PLAN 2020 YEAR STRATEGIC PLAN 2020 - - 2025 2025 SUB SUB- -OUTCOME OUTCOME INTRODUCED INTRODUCED AMENDMENT TO OUTCOME FIVE AMENDMENT TO OUTCOME FIVE- -YEAR TARGETS YEAR TARGETS Baseline Baseline OUTCOME OUTCOME NOTE ON AMENDMENT NOTE ON AMENDMENT Five Five- -year target year target Outcome indicator Outcome indicator (2019/20) (2019/20) (By March 2025) (By March 2025) 1. Relevant tourism intelligence and digital ecosystem - - - - 2. Achieve good corporate 2. Achieve good corporate and cooperative governance and cooperative governance South African Tourism Corporate Brand Index New indicator 74.24 South African Tourism Corporate Brand Index Unqualified audit outcome maintained 5-year target introduced, based on findings of baseline study in 2021/22 No change 2. Improved corporate reputation External audit outcome Unqualified audit outcome 42 42

Projected Projected Revenue Revenue for for 2023 2023/ /24 24 MTEF MTEF Revenue Revenue 2019/20 2019/20 2020/21 2020/21 2021/22 2021/22 2022/23 2022/23 2023/24 2023/24 2024/25 2024/25 2025/26 2025/26 Special Special Adjustment Adjustment s s Revised Revised Budget Budget (R 000) (R 000) Audited Audited Audited Audited Audited Audited Approved Approved Estimate Estimate Estimate Estimate Estimate Estimate DT allocation DT allocation 1,256,523 438,306 1,297,038 1,329,206 0 1,329,206 1,344,672 1,405,061 1,468,008 TOMSA levies TOMSA levies 133,304 0 50,000 52,400 0 52,400 53,972 56,395 59,102 Indaba Meetings Africa Indaba Meetings Africa and other exhibitions and other exhibitions 110,189 680 33,498 33,757 0 33,757 34,372 35,927 37,652 Grading fees Grading fees 23,164 0 12,239 12,826 0 12,826 13,210 13,804 14,467 Sundry revenue Sundry revenue 22,498 0 24,847 27,389 0 27,389 28,608 29,881 31,315 TOTAL TOTAL 1,545,678 1,545,678 438,986 438,986 1,417,622 1,417,622 1,455,578 1,455,578 0 1,455,578 1,455,578 1,474,834 1,474,834 1,541,068 1,541,068 1,610,544 1,610,544 The TOMSA levies are subject to TBCSA releasing the funds 43 43

Projected Projected Expenditure Expenditure for for 2023 2023/ /24 24 MTEF MTEF 2019/20 2019/20 2020/21 2020/21 2021/22 2021/22 2022/23 2022/23 2023/24 2023/24 2024/25 2024/25 2025/26 2025/26 Approved Approved Bud Bud Special Special Adjustments Adjustments Audited Audited Audited Audited Audited Audited Revised Budget Revised Budget Budget Budget Budget Budget Budget Budget Name of the Programme Name of the Programme (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) (R 000) 1 1 Corporate Support Corporate Support 15 219 111 344 154 768 154 769 0 154 769 161 718 168 979 177 090 2 2 Business Enablement Business Enablement 79 059 39 841 80 985 84 621 0 84 621 88 421 92 391 96 826 3 3 Leisure Tourism Marketing Leisure Tourism Marketing 948 603 382 469 1 051 113 1 072 614 0 1 072 614 1 074 674 1 122 941 1 172 346 4 4 Business Events Business Events 178 855 30 836 88 259 92 222 0 92 222 96 363 100 689 105 522 5 5 Tourist Experience Tourist Experience 77 021 34 487 49 147 51 354 0 51 354 53 659 56 069 58 760 Total Total 1 298 757 1 298 757 598 977 598 977 1 424 272 1 424 272 1 455 579 1 455 579 0 0 1 455 578 1 455 578 1 474 834 1 474 834 1 541 068 1 541 068 1 610 544 1 610 544 44 44

Economic Economic Classification Classification for for 2023 2023/ /24 24 MTEF MTEF 2023 2023- -24 ESTIMATED BUDGET 24 ESTIMATED BUDGET PER ECONOMIC CLASSIFICATION PER ECONOMIC CLASSIFICATION Compensation of Employees Compensation of Employees Capital Expenditure Capital Expenditure Other Goods and Services Other Goods and Services Media Production Activations Hosting Capabilities Research Other Goods and Services TOTAL APP APPROVED BUDGET TOTAL APP APPROVED BUDGET ANALYSIS OF GOODS AND SERVICES ANALYSIS OF GOODS AND SERVICES R 246 192 780,00 R 246 192 780,00 R 17 727 000,00 R 17 727 000,00 R 1 210 914 220,00 R 1 210 914 220,00 R 490 876 000,00 R 69 937 300,00 R 242 182 844,00 R 72 654 853,20 R 133 200 564,20 R 36 327 426,60 R 165 735 232,00 R 1 474 834 000,00 R 1 474 834 000,00 Other Goods and Services 14% Research 3% Media 40% Capabilities 11% Hosting 6% Production 6% Activations 20% 45 45

Calendar of Key Events Calendar of Key Events April April May May June June July July August August September September October October November November December December January January February February March March Programme 1 Submissio n of Annual Report to DT Tabling of Annual Report Submissi on of Draft APP to DT Submissio n of APP to DT Tabling of APP Programme 2 Programme 3 Tourism Month Tourism Day Ministerial Roadshows Launch of Summer Campaign Programme 4 Africa s Travel Indaba Meetings Africa Programme 5 46

Thank You. Thank You.

Abbreviations & Acronyms Abbreviations & Acronyms APP APP Annual Performance Plan FY FY Financial Year ATI ATI Africa s Travel Indaba GDP GDP Gross Domestic Product ATM ATM Arabian Travel Market ICT ICT Information and Communication Technology BEE BEE Black Economic Empowerment JMIC JMIC Joint Meeting Industry Council B B- -BBEE BBEE Broad-Based Black Economic Empowerment KPI KPI Key Performance Indicator B2B B2B Business to Business LTO LTO Labour Turnover CEO CEO Chief Executive Officer MPIF MPIF Marketing Prioritisation and Investment Framework COO COO Chief Operations Officer MTEF MTEF Medium Term Expenditure Framework COVID COVID- -19 19 Corona Virus Disease, 2019 MTSF MTSF Medium-Term Strategic Framework Meetings, Incentives, Conferences and Trade Exhibitions Memorandum of Agreement/Understanding CSI CSI Corporate Social Investment MICE MICE DT DT Department of Tourism MOA/U MOA/U DigiTech DigiTech Digital Technology NDP NDP National Development Plan ERRP ERRP Economic Reconstruction and Recovery Plan NTSS NTSS National Tourism Sector Strategy 2016-2026 EAP EAP Economically Active Population N/A N/A Not Applicable EE EE Employment Equity PlanCon PlanCon Planning Conference EEA EEA Employment Equity Act PCO PCO Professional Conference Organiser ExCo ExCo Executive Management Committee PFMA PFMA Public Finance Management Act 48 48

Abbreviations & Acronyms Abbreviations & Acronyms PR PR Public Relations TQiT TQiT Total Quality in Tourism Q Q Quarter TDM TDM Tourism Decision Metrics Tourism Grading Council of South Africa Tourism Marketing South Africa ROI ROI Return on Investment TGCSA TGCSA SME SME Small and Medium-sized Enterprise TOMSA TOMSA SMME SMME Small, Medium, and Micro Enterprises TSRP TSRP Tourism Sector Recovery Plan SAA SAA South African Airways South African National Convention Bureau South African Tourism Specific, Measurable, Achievable, Realistic and Time-bound State of the Nation Address UK UK United Kingdom SANCB SANCB UN UN United Nations United Nations World Tourism Organisation United States of America SA Tourism SA Tourism UNWTO UNWTO SMART SMART USA USA SONA SONA UGC UGC User-generated Content SCM SCM Supply Chain Management Sustainable Development Goal (United Nations, 2015) VTSDs VTSDs Villages, Towns and Small Dorpies SDG SDG WTTC WTTC World Travel and Tourism Council 49 49

undefined

undefined