Understanding the Economic Impacts of U.S. Airports

Investigating the role of airports in the national and local economy, this analysis delves into the economic contributions of the U.S. airport system. Examining factors such as changes in airport services, air cargo transportation, and air travel costs, the study aims to comprehend how airports affect the national economy through static and dynamic analyses, focusing on aspects like connectivity, air cargo, and airfare implications.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

PART 1 2

Distinguish between the role of airports in the national economy and local, regional and state airport economic impact reports. Estimate the national economic contribution of the U.S. airport system to the national economy Estimate how changes in airport services (nonstop flights, air cargo transported and cost of air travel) affect the national economy 3

Four questions were investigated to trace the impacts of U.S. airports on the national economy: What are the national economic impacts of U.S. airports? To what extent do improvements in national and international connectivity add to the national productivity of U.S. industries? What is the inter-relationship between air cargo and the U.S. industrial base? How do changes in domestic and international airfare effect the national economy? 4

The static analysis of the national economic impacts of airports reports the economic footprint of airports within the national economy. This is similar to traditional methods of accounting for economic impacts of airports or airport systems, except it does not include redistribution of economic effects within the United States. The dynamic analysis of connectivity estimates the growth in GDP resulting from a change in nonstop service among airports. Connectivity refers to the total resource costs in time and out-of-pocket expenditure to move between two places. The connectivity analysis estimates the economic impacts of cost changes due to changes in connectivity. The dynamic analysis of air cargo estimates the interrelationship between air cargo and industry productivity as measured by changes in GDP. The dynamic analysis of airfare traces the difference between what consumers are willing to pay for a good or service and what they actually pay. In the context of air service, the difference between willingness to pay for air service and what is actually spent leaves money in households wallets, and is available to be spent in the general economy on non-aviation goods and services. 5

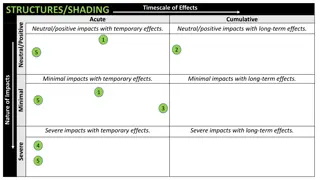

1 Determine How Changes in Airports/Aviation Affect U.S. Economy Assess Contribution of Airports to National Economy 2 DYNAMIC On- Airport Aviation Related Activity STATIC Connectivity Improved Connectivity by Nonstop Flights Relationship of Air Cargo and Industry Productivity Inflow of Income to the U.S. Due to Airports Sale of Exports to International Markets Spending by International Visitors in U.S. Economy 3 Airfares Lower Costs of Air Transportation as a Consumer Benefit 6

Dollar Measurement Definition Labor Income Compensation for work, including gross wages, salaries, proprietor income, employer provided benefits and taxes paid to governments on behalf of employees. Value Added/GDP The value added of a company or an industry consist of compensation of employees, taxes paid on production and imports, and gross operating surplus. Value added equals the difference between an industry s gross output and the cost of its intermediate inputs. Value added for companies across industries and across the U.S. is gross domestic product. Output Value added plus the cost of its intermediate inputs (including energy, raw materials, semi-finished goods, and services that are purchased from all sources). This is largely the value of sales or receipts and other operating income along with any inventory change. 7

PART 2 8

Analysis Direct Contribution Total Contribution (Including Direct, Indirect & Induced Multiplier Effects) Static Analysis U.S. Airports $247 Billion $768 Billion Dynamic Analyses 1% Increase in Nonstop Connectivity Among Airports $1.5 Billion $4 Billion 1% Increase in Air Cargo Transported (Weight) $742 Million $2.5 Billion 1% Reduction of Airfare for Personal Travelers $249 Million $700 Million The national contributions of 1% changes in connectivity and air cargo are estimates based on a sample of metropolitan regions 20 regions and should be considered illustrative. Values are in 2010 dollars. 9

1 Static contribution of U.S. Airports in the national economy Similar to airport, regional, and state economic impact studies Generally measures jobs, labor income, value added, and business sales (total output) generated by: airport administration, businesses and government agencies located on-airport, on-airport construction spending, off-airport spending by visiting passengers, the contribution to industry of providing air cargo services, and, at times, the impact of off-airport aeronautical industries. 10

International Air Cargo Off-Airport Spending of International Air Arrivals Net of Spending by U.S. Residents on International Travel On-Airport Transactions National Economic Impact of U.S. Airports NOT COUNTED: Civil Aviation Aircraft Manufacturing & Parts Domestic Air Cargo Off-Airport Spending of Domestic Air Visitors 11

Measures what airports add to the national economy: On-airport commerce 1. International cargo (brings income to the U.S. from other countries) 2. Spending of international visitors who arrive by air 3. Does not include flows between domestic (U.S.) airports, which redistributes impacts within the U.S.: Domestic air cargo are purchases and sales within the U.S. 1. Spending of domestic air visitors represent shifting of spending from one U.S. region to another 2. Also, does not include impacts of related off-airport aeronautics industries. 12

General managers 1% Statistical employees 2% Misc Categories & Other 10% General aircraft traffic handling employees 5% Airport operation workers 15% Cargo handling employees 6% Passenger/general services & administration 14% Maintenance employees 8% Transport related employees 14% Pilots & copilots 11% Passenger handling employees 14% 13

Visitor spending represents the net difference of spending by international travelers to the U.S. minus spending by U.S. residents traveling internationally Jobs Spending 2,731 TRAVEL ARRANGEMENT Retail, $6.8, 23% Lodging, $8.4, 29% 18,732 TRANSPORTATION Amusement/ entertainment, $3.3, 11% RETAIL 30,257 Food services and drinking places, $6.5, 22% ENTERTAINMENT 50,562 HOTEL 72,482 Travel agents, $0.4, 2% RESTAURANT 109,116 Local Surface Transportation, $1.6, 5% Domestic Air Transportation, $2.3, 8% 0 50,000 100,000 150,000 Jobs 14

Support Activities for Air Transportation, 159,000, 7% Air Transportation, 458,000, 21% International Air Cargo, 918,900, 42% State, Local and Federal Employment including TSA, 150,700, 7% International Visitor Spending, 314,100, 15% Non-Aeronautical Revenues, 87,300, 4% On Airport Construction, 84,200, 4% Total Direct Employment on National Economy = 2,172,200 15

Output Value Added (GDP) Labor Income/Profits 16

Economic Impact Source Jobs Labor Income Value Added Output 2,502,600 $144.9 Billion $242.0 Billion $448.9 Billion On-Airport Activities 518,400 $19.2 Billion $31.6 Billion $52.6 Billion International Visitor Spending 4,607,800 $288.4 Billion $494.8 Billion $1.096 Trillion International Air Cargo Total 7,628,800 $452.5 Billion $768.4 Billion $1.597 Trillion Total impacts include direct, and indirect and induced multiplier effects. Employment is rounded to the nearest 100, and dollars are in 2010 value Sources: BEA, Office of Travel and Tourism Industries of the U.S. Department of Commerce, BLS-CES, U.S. Census Bureau, U.S. Budget, FAA Form 127 & National Plan of Integrated Airport Systems (NPIAS) Report, ACI-NA, U.S. Department of Commerce data and other federal data assembled by IMPLAN. LLC. Calculations by EDR Group using 2012 National IMPLAN model. 17

5.8% 6.0% 4.9% 4.8% 5.0% 4.3% Percent of U.S. Economy 4.0% 3.0% 2.0% 1.0% 0.0% Employment Labor Income GDP Total Output Includes direct impacts & indirect and induced multiplier effects. Calculations based on national data sets and U.S. Bureau of Economic Analysis, using IMPLAN, LLC. 18

Assembled 1,000+ airport economic impact studies Studies varied by time, location, classification of airports & methodologies Objective was to compare this approach to the assembly of the preceding national databases for the 3,330 NPIAS airports Objective to estimate economic output generated on-airport 19

Independent Variables Considered NPIAS* Database (3,330 airports) Additional Data Socio-economic data per county/MSA** Income Poverty Population Per capita personal income Distress composite index (based on ARC) Employment/industry Airport Facility Descriptions Classification Runway length(s) Location Tower, etc. Aviation Activities Operations Enplanements *National Plan of Integrated Airport Systems Report, Federal Aviation Administration **The United States Office of Management and Budget designates metropolitan statistical areas (MSA) . Each MSA must have at least one urbanized area of 50,000 or more inhabitants. 20

Excludes off-airport visitor spending and cargo impacts Labor Income Value Added Basis of Analysis Jobs Output Method 1Aggregated 2.5 $145 billion $242 billion $449 billion Databases million Regression Analyses 2.9 $164 billion $261 billion $471 billion Method 2 million On-airport impacts are validated by the regression analysis 21

Dynamic: if changes at airports occur, the consequence will be increases in national productivity across U.S. industry sectors. The Effects of Three Potential Changes Are Explored: Strengthening connections among U.S. airports and between U.S. and international airports 1. Increasing air cargo transported through U.S. airports 2. Decreasing airfares for personal travelers 3. 22

1. Connectivity of Airports 2. Inter-relationship of air cargo and industry productivity 3. Impacts of changes in air travel costs ELEMENT EFFECT ECONOMIC IMPACTS Initial from Analysis Subsequent Modeling 23

2 Connectivity Improved connectivity has direct effects (costs and time) and can have indirect effects, for example, by increasing accessible market size and reducing costs in the supply chain. 24

Two or More Daily Nonstop Domestic Flights International Nonstop Destinations Domestic Nonstop Destinations Percent of the World GDP Served Daily Five or More Daily Nonstop Domestic Flights Airline Hubs Served-Domestic International Nonstop Departures Percent of the World GDP Served Nonstop Domestic Nonstop Departures Percent of the World GDP Served Twice or More Daily Number of Airlines Note: 18 connectivity variables were analyzed. The table above shows the variables that proved significant for one or more industries. 25

Code/ Multi- Airport Region SF Bay Chicago ATL CVG STL PIT RDU DEN Phoenix SLC Boston PHL DTW SAN PDX TPA MCI TUL SAT BNA Airports in Multi-Airport Regions SFO, OAK, SJC ORD, MDW Airport/Region San Francisco Bay Area Chicago metropolitan region Hartsfield-Jackson Atlanta International Airport Cincinnati/Northern Kentucky International Airport Lambert-St. Louis International Airport Pittsburgh International Airport Raleigh-Durham International Airport Denver International Airport Phoenix metropolitan region Salt Lake City International Airport Boston metropolitan region Philadelphia International Airport Detroit Metropolitan Wayne County Airport San Diego International Airport Portland International Airport Tampa International Airport Kansas City International Airport Tulsa International Airport San Antonio International Airport Nashville International Airport PHX, AZA BOS, MHT, PVD 26

NAICS Code Sector 31-33 42 Manufacturing Wholesale Trade Information Finance and Insurance Real Estate and Renting and Leasing Professional, Scientific, and Technical Services Management of Companies and Enterprises 51 52 53 54 55 56 Administrative Support, Waste Management & Remediation Services 71 72 Arts, Entertainments, and Recreation Accommodation and Food Services Other: Agriculture, Forestry, Fishing & Hunting; Mining, Quarrying, and Oil & Gas Extraction; Utilities; Retail Trade; Transportation & Warehousing; Educational Services; Health Care and Social Assistance; Other Services; and Public Administration 11, 21, 22, 44-45, 48- 49, 61, 62, 81 and 92 27

Example of Findings: Dollars in 2010 Millions of GDP Generated by 1% Increases in the 3 connectivity variables shown Airline Hubs Served- Domestic Domestic Nonstop Departures Number of Airlines Industry Manufacturing Wholesale Trade Information Finance & Insurance Real Estate, Rental & Leasing Professional Scientific & Technical Services Management of Companies & Enterprises Administration & Support Waste Management Services Art, Entertainment & Recreation Accommodation & Food Services Other** Total $158 $43 $85 $51 $24 $226 $151 $95 $57 $112 $8 $11 $3 $0.1 $3 $453 $201 $374 ** Other represents the aggregation of 9 economic sectors shown on Slide 27. 28

Airline Hubs Served- Domestic Two or More Daily Nonstop Domestic Flights Five or More Daily Nonstop Domestic Flights % World GDP Served Nonstop % World GDP Served Daily Domestic Nonstop Departures Domestic Nonstop Destinations International Nonstop Departures International Nonstop Destinations Number of Airlines Industry Manufacturing Wholesale Trade Information Finance & Insurance Real Estate, Rental & Leasing Professional Scientific & Technical Services Management of Companies & Enterprises Administration & Support Waste Management Services Art, Entertainment & Recreation $158 $43 $85 $51 $123 $30 $356 $172 $38 $23 $64 $6 $41 $34 $24 $226 $19 $99 $39 $42 $151 $95 $176 $180 $49 $236 $57 $112 $82 $153 $8 $26 $7 $18 $16 $11 $33 $23 $95 $51 $3 $4 $7 $14 Accommodation & Food Services Other** Total $0 $20 $19 $3 $453 $272 $686 $100 $683 $95 $361 $201 $374 $654 $119 $192 $68 Note: Impacts on each industry sector vary according to connectivity variable. ** Other represents the aggregation of 9 economic sectors shown on Slide 27. 29

Labor Income Value Added Variable Jobs Output Number of Airlines Domestic Nonstop Departures Airline Hubs Served-Domestic Domestic Nonstop Destinations Two or More Daily Nonstop Domestic Flights Five or More Daily Nonstop Domestic Flights International Nonstop Departures International Nonstop Destinations % of World GDP Served Nonstop % of the World GDP Served Daily % of the World GDP Served Two or More Daily 7,500 9,900 7,600 17,400 19,200 1,900 4,400 17,500 2,300 9,100 2,800 $471 $614 $493 $963 $1,161 $106 $267 $949 $108 $517 $176 $1,725 $2,025 $1,340 $3,030 $4,455 $336 $689 $3,240 $247 $1,291 $635 $794 $1,118 $831 $1,676 $2,135 $221 $429 $1,742 $156 $807 $291 Note: Jobs rounded to the nearest 100. Values in 2010 dollars (millions). Direct employment, labor income, output and all spinoff impacts calculated using IMPLAN, LLC. 30

National extrapolation is for illustrative purposes to show order of magnitude effects Total Direct and Multiplier Effects Direct Effects Impacts based on 1% increase in the connectivity variables below Jobs Value Added Jobs Value Added Number of Airlines Domestic Nonstop Departures Airline Hubs Served-Domestic Domestic Nonstop Destinations Two or More Daily Nonstop Domestic Flights Five or More Daily Nonstop Domestic Flights International Nonstop Departures International Nonstop Destinations % of World GDP Served Nonstop % of the World GDP Served Daily % of the World GDP Served Two or More Daily Mean Impacts of All Variables 5,600 13,300 12,400 29,600 17,200 3,400 8,200 27,500 5,600 18,500 2,100 13,036 $862 $1,944 $1,605 $2,944 $2,806 $511 $824 $2,931 $292 $1,553 $305 $1,507 32,200 42,500 32,600 74,700 82,400 8,200 18,900 75,100 9,900 39,000 12,000 38,864 $3,407 $4,797 $3,566 $7,192 $9,161 $948 $1,841 $7,475 $669 $3,463 $1,249 $3,979 Note: Jobs rounded to the nearest 100. Values in 2010 dollars (millions). Calculations based on the value added previously presented. The basis of the extrapolation is that the national GDP is 4.3 times the aggregate GDP of the 20 regions tested. 31

3 Air cargo differs significantly from passenger travel Key airports are different (cargo hubs, gateways) Shipping cost is more important than connectivity Current logistics network provides almost universal coverage Approach Developed a time series analysis relating changes in air cargo to changes in manufacturing and wholesale industry productivity (for the years 1995, 2000, 2005, and 2010) Explaining changes to industry productivity reflected by the amount of air cargo handled 32

Labor Income Value Added Impact Type Jobs Output Direct Effect 1,200 $94 M $490 M $173 M Total Spinoff (multiplier) Effect 4,100 $228 M $769 M $411 M Total Effect 5,300 $321 M $1,259 M $583 M Note: Dollars in $2010 Millions Note: Jobs rounded to the nearest 100. Values in 2010 dollars (millions). Direct employment, labor income, output and all spinoff impacts calculated using IMPLAN, LLC. 33

National extrapolation is for illustrative purposes to show order of magnitude effects Direct Impacts for manufacturing and wholesale trade industry sectors: $742 million in direct value added 5,100 direct jobs Total impacts, including multiplier effects: $2.5 billion in value added 23,000 jobs 34

4 1% drop in airfare represents about $2 per domestic ticket and $7 per international ticket Consumer surplus is the difference between what travelers are willing to pay and what they actually pay for air travel Market Domestic International TOTAL Change in Consumer Surplus $506 $310 $815 National economic impacts based on $815 million of additional consumer surplus Impact Type Jobs Labor Income Output Value Added Direct Effect Multiplier Effect Total Effect 1,400 4,400 5,800 $162 $223 $385 $553 $728 $1,281 $249 $408 $657 Note: Jobs are rounded to the nearest 100. Dollars are in 2010 value using 2012 national model from IMPLAN, LLC. 35

PART 3 36

The multiple approaches carried out in ACRP Project 03- 28 are complementary in understanding the economic impacts of airports to the national economy: The economic impact analysis is a snapshot of the economic contribution of airports at a given moment The dynamic analyses estimate how national economic impacts of airports will change if: (1) connectivity between airports and regions; (2) air cargo tonnage; and/or (3) the cost of airfare change. 37

Direct Impacts ($ values in millions) Value Added $247,424 Activity Jobs Labor Income Output Economic Impact of U.S. Airports Changes in Economic Impacts Generated by: 1% Improvement of Connectivity Variables 1% Increase of Air Cargo Tonnage 1% Decrease in Air Fares 2,172,200 $147,642 $637,002 13,000 5,100 1,400 $795 $403 $162 $3,043 $2,103 $553 $1,507 $742 $249 Total Impacts Including Direct plus Economic Multipliers ($ values as noted) Labor Income Value Added Activity Jobs Output Economic Impact of U.S. Airports Changes in Economic Impacts Generated by: 1% Improvement of Connectivity Variables 1% Increase of Air Cargo Tonnage 1% Decrease in Airfares 7,628,900 $452.5 Billion $1.6 Trillion $768.4 Billion 38,900 22,700 5,800 $2.3 Billion $1.4 Billion $0.4 Billion $7.4 Billion $5.4 Billion $1.3 Billion $4.o Billion $2.5 Billion $0.7 Billion Notes: Direct and total impacts of connectivity reflect the mean average of all 11 connectivity variables All values are in 2010 dollars. Jobs are rounded to the nearest 100. Total impacts include estimates of direct, indirect, and induced impact. National extrapolation for connectivity and cargo is for illustrative purposes to show order of magnitude effects. Calculations used IMPLAN, LLC national model, Version 3, 2012. 38

Economic Development Research Group, Inc. Dr. David Gillen, University of British Columbia ICF International Kramer aerotek Mead & Hunt, Inc. Cover photographs courtesy of Mead & Hunt 39

Part 4 40

Inputs: Labor, Capital,* Materials, Services AIRPORT SERVICES Generates Economic Impacts Passenger, Cargo, & Aircraft Handled For businesses, the sale of air transportation services for travel and cargo transport support production and sales of products and services by U.S. companies and industries. AIRLINE SERVICES Business Air Travel & Air Cargo Shipments Personal Air Travel For personal travel, the final product produced and sold is transportation. FINAL DEMAND FOR AIR TRAVEL INTERMEDIATE DEMAND FOR AIR TRANSPORTATION Air Transportation Input Other Inputs OTHER ECONOMIC SECTORS FINAL DEMAND FOR OTHER GOODS & SERVICES *Includes construction

Explanatory Variables Classification Results All else constant, an additional 5,000 domestic connecting enplanements per year would be associated with an estimated $2.3 million dollars of direct airport revenue. Connecting enplanements Large Hubs Domestic commercial operations at medium hubs All else constant, an additional 5,000 commercial operations at a medium hub airport would generate approximately $2.1 million. For small hub airports, an additional 100 domestic connecting enplanements would yield an additional$1.97 million of revenue. Medium and Small Hubs Domestic connecting enplanements at small hubs Regressions based on NPIAS data base of 3,330 airports, aviation facilities and activities, regional socio-economic data and 1,013 economic impact studies 43

Explanatory Variables Classification Results Number of domestic enplanements; All else constant, an additional 100 domestic enplanements at a non-hub primary airport would be associated with a $0.13 million increase in direct revenue. Additionally, a 1,000-foot increase in runway length would be associated with a $0.66 million increase in direct revenue. Non-hub Primary Airports Maximum runway length A reliever airport with a 1,000-foot increased runway length would, on average, tend to contribute to a $0.025 million increase in direct revenues. This interpretation can also be applied to reliever and commercial services airports by swapping out the parameter estimates. Additionally, general aviation airports experiencing an additional 1,000 general aviation (itinerant plus local) operations would see an additional $912 of direct revenue. It would be reasonable to expect direct revenues of $0.86 million dollars for a general aviation airport with a maximum airport runway length of 4,000 feet and 10,000 general aviation operations. Non-primary Commercial Service Airports, Relievers and General Aviation Airports Maximum runway length at GA airports, relievers and commercial service airports GA operations at GA airports 44

Real GDP will increase if productivity in the economy increases Q = ( , ) f inputs technology Production Function: Multifactor Productivity (MFP) is the change in output(s) due to the change in inputs. In this analysis, to estimate impacts of improved connectivity, output is Real GDP, and inputs are changes in airport connectivity as well as other standard inputs such as labor. To estimate impacts from increased air cargo, output is Real GDP, and inputs are changes in enplaned and deplaned cargo tonnage. 45

Select a representative sample of 20 Regions (MSAs) and 26 Airports Assemble data on change in Multi-factor Productivity (MFP) for each region in 1995, 2000, 2005 and 2010: Nonstop Flight Pattern (O-Ds, frequency) for sample airports Regional Economic Data (GRP, investment, labor) MFP By Industry (BLS) Among the 26 sample airports and between the 26 airports & 15 major international markets 46

Calculated Elasticities of Airport MFP Analysis Elasticity (average) 0.0915 0.0375 0.0284 0.0259 0.0258 0.0254 0.0182 0.0169 0.0164 0.0161 0.0160 Relative Weight 1.00 0.41 0.31 0.28 0.28 0.28 0.20 0.18 0.18 0.18 0.17 Connectivity Measure Rank Two or More Daily Nonstop Domestic Flights International Nonstop Destinations Domestic Nonstop Destinations Percent of the World GDP Served Daily Five or More Daily Nonstop Domestic Flights Airline Hubs Served-Domestic International Nonstop Departures Percent of the World GDP Served Nonstop Domestic Nonstop Departures Percent of the World GDP Served Twice or More Daily Number of Airlines 1 2 3 4 5 6 7 8 9 10 11 Interpretation: For every 1% increase of destinations served by Two or More Daily Nonstop Domestic Flights, GDP will increase by .000915 on average (1% * .0915). 47

Change in price leads to change in quantity demanded and in consumer surplus Change in spending on air travel (measured by the change in consumer surplus) frees up money for other consumption The increased spending on other goods and services contributes to economic growth 48

1% drop in airfare represents about $2 per domestic ticket and $7 per international, which is expected to create an aggregate of $991 million in passenger welfare Market Domestic International TOTAL Change in Consumer Surplus Total Induced Air Travel Expenditure $506 $310 $815 $671 $320 $991 National economic impacts based on $991 million of induced travel expenditure and $815 million of additional consumer surplus (dollars in millions) Impact Type Jobs Labor Income Output Value Added Direct Effect Multiplier Effect Total Effect 1,400 4,400 5,800 $162 $223 $385 $553 $728 $1,281 $249 $408 $657 Note: Jobs are rounded to the nearest 100. Values are in 2010 dollars using 2012 national model from IMPLAN, LLC. 49