Risk Mitigation and Distribution in Trade Finance

Silja Calac and Paolo Carrozza discuss regulatory capital requirements, risk mitigation strategies in trade finance, and the impact of credit risk insurance on weighted assets. The comparison tables illustrate the benefits of insurance in reducing risk-weighted assets and regulatory capital.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Distribution and Risk Mitigation Distribution and Risk Mitigation Silja Calac, ITFA Board Member and Senior Underwriter, Swiss Re Corporate Solutions Silja Calac, ITFA Board Member and Senior Underwriter, Swiss Re Corporate Solutions Paolo Paolo Carrozza Carrozza, Chief Commercial Officer Middle East, Euler Hermes GCC , Chief Commercial Officer Middle East, Euler Hermes GCC Dubai, 13 February 2017 1

AGENDA Brief summary of the Regulatory Environment : Capital Requirements / Basel III Risk Mitigation and Distribution of Trade Assets: Different forms of risk mitigation Insurance: Various risk cover available for transaction banking / trade finance 2

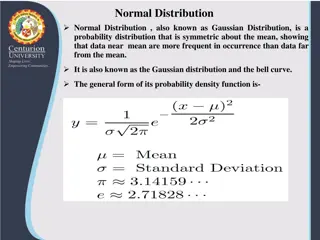

CAPITAL REQUIREMENTS UNDER STANDARD APPROACH lower rating in default no rating AA+AA BBB+ BBB- AAA- BBB AAA BB+ BB- AA- BB AA B+ A+ A+ B- A- B Corporate Customers 20% 50% 100% 150% 100% 150% Sovereigns 0% 20% 50% 100% 150% 100% 150% Bank's residence country 20% 50% 100% 150% 150% 100% Banks / Insurance 20% 50% 100% 150% 50% Retail 75% Commercial property 50 to 100%, to the discretion of local monetary authority 150% Private property 35% 150% 3

EFFECT OF CRI ON RWA $50M INSURANCE FROM AA RATED ENTITY RISK LOAN TO BB RATED CORPORATE OBLIGOR WEIGHTED ASSET VALUE OF BB LOAN $10M NET COMBINED RISK WEIGHTED ASSETS $50M LOAN NET AFTER INSURANCE $50M $100M $100M $100M $60M 4

RWA AND REGULATORY CAPITAL COMPARISON TABLE SHOWING LIKE-FOR-LIKE BENEFIT (BASE = 100) CAPITAL BENEFIT OF INSURANCE CAPITAL BENEFIT OF INSURANCE BANK LOAN TO A CORPORATE BANK LOAN TO A CORPORATE Corporate Loan Value Corporate Rating Basel Credit Step Corporate Risk Weighting Corp- orate RWA Reg Cap @ 10.5% Insurer rating Insurer Risk Weighting Insurer RWA RWA saving RWA RWA saving saving % % Reg cap saving Reg cap Reg cap saving saving % % 100 AA+ to AA- 1 20% 20 2.10 AA+ to AA- 20% 20 0 0.00 0% 0% 100 A+ to A- 2 50% 50 5.25 AA+ to AA- 20% 20 30 3.15 60% 60% 100 BBB+ to BB- 3,4 100% 100 10.50 AA+ to AA- A+ to A- 20% 50% 20 50 80 50 8.40 5.25 80% 50% 80% 50% 100 B+ and below 5,6 150% 150 15.75 AA+ to AA- A+ to A- 20% 50% 20 50 130 100 13.65 10.50 87% 67% 87% 67% 5

DISTRIBUTION CHANNELS OVERVIEW Relative simplicity and possibility of being undisclosed to original parties Relies on a fronting bank administering the transaction until maturity Risk Participations Also undisclosed and a complementary source of risk capacity Unfunded only, and minimum hold requirements Insurance Ongoing framework for individual transactions sold on a forfaiting basis Typically requires recognition of assignment/endorsement/transfer Forfaiting Agreements Equitable Assignment Care around perfection of assignment Assignment Frameworks Possible capital relief from selling first loss on a portfolio Difficult to achieve risk mitigation Synthetic Securitisations Collateralised Loan Obligations Comprehensive benefits from selling a vertical slice of portfolio Expensive to set up, diversity requirements preclude large single tickets Repackaging transactions for institutional/alternative investors Single transactions may not be profitable enough to cover cost Special Purpose Vehicles Sovereign / multilateral risk support for transactions Typically in the form of a guarantee only, and specific criteria have to be met ECAs / Multilaterals 6

RISK MITIGATION TECHNIQUES The new industry focus on risk mitigation => development of a new investor base for trade finance : Risk Participation Structures Source: SIBOS 2011 Citi presentation 7

RISK PARTICIPATION A way of transferring economic risk & rewards without transferring legal title Two types: unfunded (risk) and funded Unfunded (risk) participation (essentially a guarantee) 2. Sells 50% risk participation 1. $100m loan Underlying obligor Grantor Participant 3. Defaults on $10m repayment instalment 4. Pays share of defaulted amount - $5m Funded participation (essentially a back-to-back limited recourse loan) 2. Participant with 50% participation pays share of utilised amount - $50m 1. Utilisation of $100m loan Underlying obligor Participant Grantor 3. Repays $10m instalment 4. Pays share of repaid amount - $5m 8

BAFT MRPA http://www.baft.org/policy/document-library 9

INTRODUCTION: WHY INSURANCE? The insurance market grew materially over the last 20 years as a consequence of growth in Emerging Market investments as well as political risk events (Argentina, Asian Debt crises, ..) and an increase in banks acceptance of the benefits of using insurance. Overall market size is estimated at over $2.0-2.5bn annual premium and growing. Main placement hubs are London, Zurich, New York, Singapore. Whereas the cover is unfunded the key value proposition of the insurance market is that it typically does not compete directly with the banks and is confidential. Key benefits of using insurance are: Alternative distribution channel Opportunity to sell down on a private/confidential basis, complementary with or as an alternative to traditional loan syndication. Provides a straight forward mechanism for sell down of club or bi-lateral transactions. Additional capacity On risks where you have reached internal credit limits (counterparty/country). To write a larger share of transactions (obtaining better pricing or league table status) in the knowledge that you can sell down to insurer. Capital management If cover is unconditional typically capital relief under Basel II/III on transactions, potentially enhancing return on capital committed to a transaction (specifically if advanced approach is used). Manage concentrations against counterparties, sub-sectors, geographies etc. 10

RISK COVER FOR TRANSACTION BANKING Insurance Market Solutions Trade Credit Insurance Financial Guaranty Risk Political Risk Insurance Surety Participation Consumer Loan Insurance, Mortgage Indemnity, "Credit Enhancement" Confiscation, Currency Inconvertibility, Contract Frustration, Political Violence Domestic Credit Insurance Documentary Trade Finance Construction, Supply, Customs Performance, Bonds Typical Products Export Credit Insurance Commodity Trade Finance Specialized Surety Companies and Multiline Insurers Credit Insurance Companies (Mono- and Multiliners) Multiline insurers, Export Credit Agencies, Lloyd s Syndicates Specialized Insurers, Export Credit Agencies Typical Providers Banks, Insurers Typical Clients Large Small / medium sized Corporates Banks, Lenders, Investors Banks Banks, Construction Companies Commodity Traders larger Corporates Page 11 11

CREDIT RISK INSURANCE Cover: Non-payment of a debt or a financial obligation Credit Risk Insurance CRI covering a wide range of financial obligations loans, guarantees, documentary credits Short Term Trade Credit Insurance TCI covering accounts receivable Non-payment caused by 3 Perils : Confiscation/Expropriation, War/Political Violence and Inconvertibility Political Risk Insurance PRI covering loans, guarantees, projects parent company lending 12

INSURING CLAUSE - SAMPLES Typical insurance policy language for a bank CRI policy: The Insurer shall pay Compensation on the Claim Settlement Date to the Insured for the Insured Loss caused by the failure or refusal of the Borrower, for any reason, to pay Insured Principal due under the Insured Loan Agreement, provided that the Date of Loss occurs during the Policy Period. Typical insurance policy language for a corporate TCI policy: In consideration of the payment of the Premium, subject to and in reliance upon the statements made to the Insurers by the Insured and in strict accordance with the Policy Schedule and endorsements made as part of the Policy and its terms and conditions, the Insurer agrees to indemnify the Insured for the Insured Percentage of Loss in excess of the Deductible, provided that the Date of Loss occurs during the Policy Period, incurred in connection with Eligible Shipments and caused directly by Insolvency or Default, up to the applicable Limits of Liability. Typical insurance policy language for a Lenders Form policy: The Insurer shall be liable and shall pay Compensation to the Insured, subject to the terms and conditions set forth in this Insurance Policy, for the Insured Percentage of the Insured s Loss caused by the following Political Risk Events: Expropriation and/or War on Land, Terrorism, Political Violence and/or Currency Inconvertibility and for which the Date of Loss occurs during the Policy Period. 13