Legal Infrastructure for Asset Finance in Civil Law Jurisdictions

The Civil Code outlines obligations and guarantees in asset finance, with specific qualifications like lawful causes of preference and security trusts. Privileges and hypotecas play key roles in the legal system. Title transfer by way of security fosters integrated asset finance systems. The aviation industry underwent reforms in 2009-10, introducing transfer of title mechanisms for asset finance. Aircraft finance mirrors maritime finance, emphasizing high-value assets and international industry dynamics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

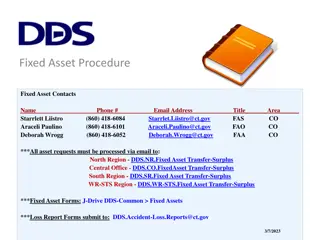

As a Civil Law country, our general law of obligations is codified in the Civil Code Art.1994: Whosoever has bound himself personally, is obliged to fulfil his obligation with all his property, present and future. Art.1995(1): The property of a debtor is the common guarantee of his creditors, all of whom have an equal right over such property tfenech@fff-legal.com www.fff-legal.com

Art. 1995 provides for 3 particular qualifications to the general rule, being: Lawful causes of preference; Transfer of property by way of security; or Transfer under a security trust in accordance with the Code tfenech@fff-legal.com www.fff-legal.com

Art. 1996: The lawful causes of preference are privileges, hypothecs and the benefit of the separation of estates. Arts. 1994 2095 proceed with setting out the legal infrastructure which provides for the establishment of privileges and hypothecs, of a general or special nature, and over all property or specific property. tfenech@fff-legal.com www.fff-legal.com

Art. 2095E deals with Security Trusts; Arts. 2095F-2095I regulate security by title transfer; tfenech@fff-legal.com www.fff-legal.com

Anglo-Saxon asset finance models, and the mortgage in particular, were seen as key to attracting ships to our flag; The same is true for the development of the aviation register; transfer of title by way of security is an interesting mechanism introduced as part of the aviation-driven reforms in 2009-10 that may be the key to having a more integrated system for asset finance going forward; tfenech@fff-legal.com www.fff-legal.com

Complex aircraft finance often shares many characteristics with maritime finance: assets of great value which can themselves be a significant aspect of the security to be provided; the intrinsically international nature of the industries; The importance of anglo-saxon legal notions for financiers; Ships and aircraft, like land, but unlike most other tangible moveable assets, require registration; tfenech@fff-legal.com www.fff-legal.com

Lord Justice Roskill Friendship [1978] 1 Lloyd sRep.369(CA): For advancing funds to one or more ship owning companies, a bank will typically take: a mortgage on the ship, and possibly also mortgages on other sister ships, by way of security for the loan; an assignment of any time charter; an assignment of insurance policies and P&I Club cover; in The Panglobal tfenech@fff-legal.com www.fff-legal.com

Permutations, refinements and variations of themainstreamtheme: Off-balance sheet financing (leasing); High yieldbond issues; Flotations and other capital markets transactions Others tfenech@fff-legal.com www.fff-legal.com

From Wikipedia: The three most common schemes for financing commercial aircraft are secured lending, operating leases and finance leases; However, there are other ways to finance aircraft acquisition: Operating leases and sale/leasebacks Export credit guaranteed loans Tax leases Manufacturer support Equipment Trust Certificates (ETCs) and Enhanced Equipment Trust Certificates (EETCs) tfenech@fff-legal.com www.fff-legal.com

The usual security structure for a loan in the shipping/aviation field comprises a number of elements: A mortgage of the asset (ship or aircraft); An assignment of earnings, rights and receivables; An assignment of insurances; Sometimes, a pledge on the shares of the company, or of other receivables; Special privileges on the ship or aircraft as applicable tfenech@fff-legal.com www.fff-legal.com

The letting or hiring of ships to merchants for the carriage of goods is historically described as a charterparty. The system was developed for operational objectives,not asset financing ones. Atthebasic level,when hired: for a periodoftime,it isa timecharter; For a point-to-pointvoyage,it isa voyagecharter; A Bareboat or demise charter is a time charter where the charterer takes responsibility for the crewing and maintenance of the ship (he is treated as the disponent owner ) tfenech@fff-legal.com www.fff-legal.com

Wet Lease or ACMI - Aircraft, Crew, Maintenance & Insurance Lessor provides ACMI, but lessee provides fuel, landing (etc) fees, crew HOTAC as well as local taxes. Otherwise rental is on block hours (choc off choc on), sometimes with guaranteed minimum block hours paid per month Damp lease (no crew) Crew normally must receive training from Lessor tfenech@fff-legal.com www.fff-legal.com

Normally adopted by leasing companies and banks: lessee puts aircraft on its AOC and provides aircraft registration, etc Operating lease: aircraft does not appear on the lessee s balance sheet Finance lease: Normally viewed as a purchase for accounting purposes Purchase option at end of lease for agreed price Lease payments are substantial percentage of market value of aircraft Lease term substantial percentage of aircraft s usable life tfenech@fff-legal.com www.fff-legal.com

Finance leasing represents a threshold that goes from off-balance sheet financing to debt financing, and vice versa Once they get on to the balance sheet, expensive assets remain important elements to help secure finance tfenech@fff-legal.com www.fff-legal.com

Security by title transfer Operational lease/charter mortgage Finance lease charge tfenech@fff-legal.com www.fff-legal.com

A Credit economy implies the need for confidence thatpayment obligations willbefulfilled Most systems have long developed specific methodologies and concepts, intended to give a creditor some securityinterest in property A method which provides for differentiation and prioritization in ranking betweencompeting rights But the system of one country is not necessarily recognized or enforceable in other countries and legal systems tfenech@fff-legal.com www.fff-legal.com

The problem is not so much the classic conflict of law issues of applicable law, etc., but the widely differing approaches of legal systems to security and title reservation rights; This traditionally created much uncertainty among financiers as to the efficacy of their rights; The result was a general inhibition to extend finance in large parts of the world, and a general increase in borrowing costs tfenech@fff-legal.com www.fff-legal.com

The 5 objectives according to Roy Goode: the creation of an international interest which will be recognized in all Contracting States Providing the creditor with a range of basic default remedies, and a means of speedy interim relief pending determination of a claim on the merits; an electronic international register of interests to give notice, and preserve priority against unregistered interests and the debtors insolvency administrator; Ensuring that the needs of the industry sector are met; Enhance credit rating of equipment receivables, thus reducing borrowing costs tfenech@fff-legal.com www.fff-legal.com

In ratifying the convention, Malta clearly sought to maximize confidence of secured creditors in our system; as a result of ratification, the Maltese domestic system is accompanied by the international system introduced by the Convention; Therefore to understand Maltese law in this area, one has to look at the domestic situation as well as the situation if the Convention mechanisms are harnessed; The problem of language: securityinterest as defined in the main text of the ARA, internationalinterest as defined in the 1st Schedule, etc tfenech@fff-legal.com www.fff-legal.com

This appears to be a possible way forward in terms of general asset finance, where Anglo- Saxon self-help mechanisms can possibly encourage financiers to become more active in such fields as motor vehicle finance, farming equipment finance and the like tfenech@fff-legal.com www.fff-legal.com

An interest in or some right against property of a debtor that is granted to a creditor to secure payment, or the performance of some obligation owed to that creditor; it may be created: By agreement, or Operation of law tfenech@fff-legal.com www.fff-legal.com

The provisions of law in this area are broadly identical in both the Merchant Shipping Act as well as the Aircraft RegistrationAct. [Ships and other vessels/aircraft] .......constitute a particular class of movables whereby they form separate and distinct assets within the estate of their owners for the security of actions and claims to which the [vessel/aircraft] is subject. In case of bankruptcy [of the owner of the ship][and, or insolvency of the owner of an aircraft], all actions and claims, to which the [ship/aircraft] may be subject, shall have preference, on the said [ship/aircraft], over all other debts of the estate . tfenech@fff-legal.com www.fff-legal.com

separation of estates for the security of actions and claims to which the ship/aircraft may be subject Therefore bankruptcy of the owner will not affect claimants who have relied on the security of the asset, since these claims will have priority. tfenech@fff-legal.com www.fff-legal.com

S. 37A(2) MSA: a ship shall include together with the hull, all equipment, machinery appurtenances or accessories belonging to the ship, which are on board or which have been temporarily removed therefrom; S.37B(3) MSA: separate items upon a vessel may themselves be subject to special privileges in accordance with the Civil Code and other tfenech@fff-legal.com www.fff-legal.com 27

For the purposes of providing security an aircraft comprises All data, manuals and technical records, and The airframe, all equipment, machinery and other appurtenances as accessories belonging to the aircraft, which are on board or which have been temporarily removed therefrom, and Any engines owned by the owner of the aircraft whether attached to the aircraft or not, as well as any replacement engines (designated for use on the aircraft and owned by the owner of the aircraft) but temporarily not attached to the aircraft tfenech@fff-legal.com www.fff-legal.com

Any security given to a third party over an aircraft by an airframe owner shall not extend to any engine (owned by a third party) attached to the airframe, notwithstanding that the engines may be specifically referred to in the mortgage, the NAR or elsewhere When an engine is attached to an aircraft owned by a different owner, there is no accession in terms of the Civil Code (Art. 573), and any security0n separate items on or in an aircraft may themselves be subject to special privileges in accordance with the Civil Code tfenech@fff-legal.com www.fff-legal.com

A charge on shipsand aircraft can be established by means of a mortgage, or by a special privilege; For aircraft only, an international interest can also becreated Certain privileged rights are also given to the creditor in the context of security interests A general hypothec under the Civil Code remains available, butthis attaches to all the assets of a debtor, including any aircraft such debtor may own Other mechanisms are specifically recognized which, while not constituting a charge, they greatly facilitate a creditor s life: Security by title transfer IDERA(aircraft only) Irrevocable De-registration & Export Request Authorisation Irrevocable powers of attorney in terms of Art 1887, Civil code Swift judicial relief pending final determination tfenech@fff-legal.com www.fff-legal.com

registered mortgages, special privileges, claims and actions to which a [vessel/aircraft] may be subject are not affected by the bankruptcy of the mortgagor or owner happening after the date of the mortgage or special privilege, orwhen the action or claim arose ARA: Even if the owner had the aircraft in his possession, order or disposition, or was the reputed owner thereof, at the commencement of the bankruptcy The secured claims will have priority on the ship/aircraft over all other debts claims or interests of any other creditors ARA: However, secured claimant must contribute to costs of winding up (including liquidator costs) where he participates in the liquidation proceedings, and is ordered to do so by the court, determining the extent of his liability tfenech@fff-legal.com www.fff-legal.com

Judicial sales and other enforcement actions instituted by a registered mortgagee or privileged creditor cannot be interrupted or hindered by any liquidator or curator or trustee of the owner for any cause other than a cause which could be set up by the owner; [to take note of slight differences in drafting, in the marine/aviation legislation. Is this significant? Can the more refined drafting in the ARA guide judges when interpreting the earlier MSA?] ARA: The same applies to action taken by a secured creditor against a conditional buyer or a lessee to terminate an agreement or take possession or control of an aircraft The provisions of the Companies Act relating to insolvency do NOT apply insofar as inconsistent with the MSA/ARA tfenech@fff-legal.com www.fff-legal.com

Inter-creditor agreements specifically recognized Art. 1996A, Civil Code: it shall be lawful for a creditor to agree to subordinate, waive or otherwise modify his rights of payment, enforcement, ranking and other similar rights to the rights of other creditors and any such agreement shall be binding on the parties to the contract, whether before or after the insolvency of any party to the contract This applies generally, but ARA expressly applies 1996A to inter-creditor agreements entered into by owners, lessors, lessees, creditors, mortgagees, holders of security interests and any other persons having an interest in or in relation to an aircraft tfenech@fff-legal.com www.fff-legal.com

Art. 28(6) ARA: Any hypothec or privilege whether general or over particular movables to which an aircraft may be subject under the provisions of the Civil Code shall not continue to attach to it when the aircraft is transferred to third parties No droit de suitein such case; tfenech@fff-legal.com www.fff-legal.com

Mortgages did not form part of our law prior to the incorporation of the Merchant Shipping Act in 1973; Now part of Maltese law only for the purpose of putting up a ship or an aircraft as security for a loan or debt. Successive and significant amendments were made to the MSA since 1988 with the aim of generally strengthening the mortgagee s position; The Aircraft Registration Act represents a significant milestone, not only in that aircraft mortgages are treated separately, but also because it introduces a number of innovations and changes in general approach; tfenech@fff-legal.com www.fff-legal.com

The term mortgage has not been substantively defined in our law One must thus refer to foreign sources, in addition to the MSA and ARA, to understand the mortgage in terms of its effects, and the chain of rights and duties it establishes As in many things, to understand the nature of something, one must start with how it developed. Hence the ship mortgage takes centre stage: Bowtle&McGuiness(TheLawofShipMortgages): a ship mortgage is merely one species of various forms of a consensual real security The modern UK ship mortgage is essentially statutory in nature, but it is a creation built upon the foundation both of the common law of mortgages as well as early statute law tfenech@fff-legal.com www.fff-legal.com

Bowtle&McGuiness: At the elementary level, it may be stated that in essence a mortgage is a transaction under which a debtor confers upon a creditor a proprietary interest in property of the debtor....it being intended that, by realisation or appropriation of that property interest the creditors will obtain the discharge of the debtor s liability to the creditors. The property interest so conferred is redeemable or the obligation to create it is defeasible in the event that the debtor discharges the liability in question At common law, the mortgage was seen to be a transfer of property made by a debtor to a creditor as security for performance. The mortgagor would normally remain in possession of the ship for his own benefit, and subject to any contractual limitations (normally expressed in a deedofcovenants )theshipcanbe employedfreely. Where default occurs in terms of the mortgage, the mortgagee may seizethe shipandsell it. tfenech@fff-legal.com www.fff-legal.com

Ever since the 17th Century, a statutory registration system for ships was introduced in the UK. The English regime governing the creation of ship mortgages is essentially built upon this registration regime. The instrument creating a mortgage must be in the prescribed form, as must a transfer or discharge of such a registered mortgage. not necessary for the mortgagee to acquire possession of the ship for the mortgage to come into effect. non-compliance with statutory requirements may prejudice enforcement, eg with respect to third parties. tfenech@fff-legal.com www.fff-legal.com

The mortgage was created by a transfer of title to the mortgagee under a bill of sale, which was registered with an annotation that the transfer was not absolute but by way of mortgage. The mortgage was also noted by endorsement on the certificate of registry of ship. A statutory form of mortgage was only introduced in the Merchant Shipping Act of 1854. tfenech@fff-legal.com www.fff-legal.com

This modified and departed from the common law conception of mortgage as a security interest arising in the form of conditional conveyanceof title, without specifying its precise legal nature The form of mortgage set out in the schedule however stated clearly that the security which was conveyed created a right in rem by way of security There was no longer a notional transfer of legal title to the ship, but the mortgage became astatutory from of charge MSA 1894 did not change things, and the Malta MSA of 1973 was clearly modeled on this,andfollowed it veryclosely tfenech@fff-legal.com www.fff-legal.com

Bowtle &McGuinness define the modern English ship mortgageas: a form of security by or under a contract that confers an interest in the property subject to it ..that is annulled upon the performance of some agreed obligation usually the payment of a debt with or without interest. The terms mortgage and charge are used almost interchangeably. This practice is most clearly evident in the case of present-day ship mortgages, in which these two types of security have been fused into a single type of security interest. For all practical purposes, there is little difference between the two classes of security, and while they are conceptually different in their origins, they have now become subsumed into a hybrid form of security. tfenech@fff-legal.com www.fff-legal.com

The position of a mortgagee and mortgagor under the modern legislative framework was discussed in ex parte North Brisbane Finance & Insurance Pty Ltd [1983] 2Qd.R.684 at p.688 (re corresponding provisions of Australian Shipping Registration Act 1981): Section 40 confers on the mortgagee of a ship the status of holder of a statutory charge by way of security, not that of a legal owner of the ship as in the case of a mortgagee under the general law. It is in that context that Section 41 confers on the ship s mortgagee a power absolutely to dispose of the ship and to give effectual receipts in respect of the disposal. Without that power, a mortgagee of a ship would have to look elsewhere, and probably to the Court, for assistance in selling a ship of which he was not the owner tfenech@fff-legal.com www.fff-legal.com

In Maritime Law 4thEd.1995: A mortgage could be said to be any charge by way of lien on any property for securing money or money s worth. It is the creation of a charge or encumbrance in favour of the lender of money by the person wishing to borrow. It is the essence of a mortgage that it is something more than a mere personal covenant. tfenech@fff-legal.com www.fff-legal.com 44

Chorley&Giles,Shipping Law (8th ed.1987): A mortgage is a charge or encumbrance which the borrower of money, the mortgagor, creates in favour of the lender, the mortgagee. The latter thereby obtains a hold on the property mortgaged, which prevents the general creditors of the owner from selling the ship in satisfaction of their claims. It also enables the mortgagee to recoup himself for the mortgagor s failure to repay the loan, or the interest on it, by selling the ship or taking possession of her tfenech@fff-legal.com www.fff-legal.com 45

Iain Goldrein, Ship Sale & Purchase 1993: A mortgage is: a transfer of property, or an interest in property, as security for a debt, usually a loan. tfenech@fff-legal.com www.fff-legal.com 46

A mortgage is a security transaction and is a form of real security. It is a transfer of property or an interest in property as security for a debt. The essential feature of a mortgage is that it is only a security transaction; the property is redeemable by the mortgagor upon satisfaction of the debt which it secures, but on the other hand the property is realisable by the mortgagee if it is not. The mortgagee acquires a right by a mortgage to the ownership of property in a certain event, namely on default of payment of principal and interest. From the standpoint of the mortgagor, whereas every mortgage implies a right of redemption so too does it imply a debt, and a personal obligation to repay it. tfenech@fff-legal.com www.fff-legal.com

The difference betweeen mortgage and Outright sale: mortgage takes place by way of security only Pledge: possession and an ancillary power of sale, while the mortgagee actually has title to the goods, subject to mortgagor s rightto redemption pledgee s security is dependant upon Charge: meet a debt or obligation, but its efficacy does not lie in possession, nor does property therein pass to the chargee. Enforcement of the security is by wayof judicial process. property subject to a charge is appropriated to tfenech@fff-legal.com www.fff-legal.com

The ARA follows the MSA which itself followed the British legislative model since 1854 Nodefinition, but clear separation of estates Must be in prescribed form an interesting mixture of Continental and Anglo- Saxon notions, which in some sense anticipates the approach introduced by Cape Town for aircraft tfenech@fff-legal.com www.fff-legal.com