Theories of International Trade: Comparative Cost Theory and Absolute Cost Advantage

This content discusses the classical theories of international trade, focusing on Comparative Cost Theory and Absolute Cost Advantage introduced by economists like Adam Smith and David Ricardo. The assumptions, principles, and examples related to these theories are highlighted, emphasizing the concepts of specialization, gains from trade, and competitive advantage in global commerce.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

University of Mumbai Revised Syllabus for T.Y.B. Com Program: B. Com Course: Business Economics (Compulsory) Semester VI (As Per Credit Based Semester and Grading System with effect from 2014 2015)

SEMESTER VI Module I International Trade 1. Theories of International Trade: Comparative Cost Theory 2. Heckscher Ohlin Theory 3. Terms of Trade: Meaning & Types 4. Gains from Trade (with Offer Curves)

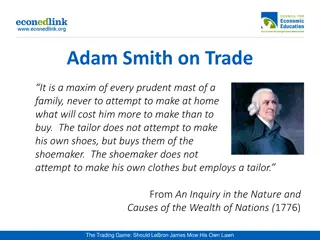

Theories of International Trade: Comparative Cost Theory The classical economists like Adam Smith and David Ricardo have made contributions to economic theory in general and to the theory of international trade in particular. Adam Smith has initiated discussion on the causes, basis and process of international trade and specialisation. Later, David Ricardo made further contributions to Smith s theory. the theoretical

Assumptions 1. Like any other economic theory the classical theory of international trade is based on certain assumptions. They are:- 2. A two country and two commodities model is assumed (2 x 2). In other words it assumes that two countries are trading with each other with two goods. 3. The labour theory of value is assumed, therefore the value of a commodity is measured in terms of labour hours required to produce that commodity. 4. Labour is regarded as the only factor of production. 5. All labours are homogeneous.

Assumptions 5. There is perfect mobility of labour with in the country and perfect immobility between the countries. 6. Existence of perfect competition in both commodity and factor market. 7. Full employment of labour is assumed. 8. Absence of transport cost. 9. Constant returns to scale. 10.Free trade exists between the countries.

Absolute Cost Advantage Adam Smith introduced the principle of absolute cost advantage to international specialisation and trade takes place so that the country s gain from the same. According to him a country should specialise in the production and export of that commodity in which it enjoys absolute cost advantage and should imports those goods in which it suffers an absolute cost disadvantage. demonstrate how

Absolute Cost Advantage Example This statement is explained with the help of following example. To produce one unit of commodity X and Y Domestic Exchange Ratio 1X:2Y 1X: Y Commodity Country X Y A B 20 hours 10 hours 10 hours 20 hours

Explanation of the Table Country A has an absolute advantage in the production of commodity Y and should therefore produce and export commodity Y. Since it suffers from an absolute disadvantage in the production of commodity X, it should only import the same from country B, since country B has an absolute advantage in the production of commodity X. Domestic exchange ratio: It can be seen that country A can produce 2 units of commodity Y for every 1 unit of commodity X. While country B produces only a unit of commodity Y for every unit of commodity X.

Comparative Cost Advantage David universally valid principle of comparative cost advantage as the basis of trade. According to him rather than the absolute cost advantage the true basis of trade is comparative advantage. According to him a country should specialise in the production of and export of that commodity in which it enjoys greater comparative advantage and leave the production of the other commodity to the other country. Ricardo offers a more practical and

Comparative Cost Advantage Example Ricardian argument is better understood from the following example. Commodity Domestic Exchange Ratio 1wine : 0.89cloth 1wine : 1.2cloth Country X Y Portugal England 80 hours 120 hours 90 hours 100 hours

Explanation of the Table The above table shows that an absolute advantage to Portugal in production of both the commodities and England has an absolute disadvantage in both lines of production. However, it can be seen that Portugal has a greater comparative advantage in the production of Wine and England has a smallercomparative disadvantage in the production of Cloth. Before trade starts between the two countries the domestic exchange ratio in Portugal is 1Wine = 0.89 Cloth. Therefore after trade Portugal will gain only if it secures more than 0.89 Cloth for every unit of Wine (1Wine).

Explanation of the Table Gains from International Trade: Suppose that the international exchange ratio is 1Wine = 1Cloth. Portugal will get (1 0.89) = 0.11Cloth more per unit of Wine from England. Similarly, England will save (1.2 1) = 0.2Cloth per unit of Wine imported. Thus, it is obvious that both countries gain from international trade.

Modern Theory of International Trade The modern theory begins where the classical theory ends. The classical theory is based on the premise that gains from trade accrue due to differences in cost. However, the theory does not provide any answers to why such cost differences arise. The modern theory developed by Heckscher and Ohlin attempts to explain why such cost differences rise and how country s can gain from international trade

Assumptions 1. There are two countries trading with each other in two commodities. (India and Japan trading in Car and Paddy) 2. There are two factors of production, labour and capital. (India is labour abundant while Japan is capital rich) 3. The commodities are classified according to their production functions i.e. capital intensive and labour intensive. ( Car is capital intensive product while paddy is the labour intensive commodity)

Assumptions 4. Production function of different commodities is identical in all countries. 5. There is existence of perfect competition in product and factor markets. 6. The factor units are homogeneous or equally efficient. 7. There is full employment of resources.

Chief Tenets of the Modern Theory 1. Differences in commodity prices are the immediate cause of international trade. 2. Commodity prices differ due to differences in factor prices. 3. Factor prices differ due to differences in factor endowments. 4. A country which is abundant in capital will have cheap capital while labour abundant country will have cheap labour. 5. It is the differences in factor endowments i.e. the ultimate basis international specialisation.

Statement of the Modern Theory According to this theory a country should specialize in the production of and export that commodity which requires more of its abundance and therefore cheap factor and should import production of which requires more of the scarce factor. In other words as per the example taken above India being laboured abundant will have lower cost of labour (wages) and should therefore produce and export paddy. Japan being capital abundant has low capital cost (interest) and should therefore produce and export cars. that commodity, the

Y F C P F Capital A D B F F L P Car C M 1 R 1P I ( Paddy ) I O X J J Labour S N T

Explanation of diagram FJ/FJ the factors price ratio in capital rich Japan FI/FI the factor price ratio in labour abundant India PP1 Iso-quant for Paddy CC1 Iso-quant for Car Paddy labour intensive product Car capital intensive product

Explanation of diagram Japan: The cost of producing a capital intensive product Car in capital rich country Japan is OB of capital and OS of labour. The tangency between CC1and FJ at point A indicates the same. Japan requires more labour i.e. OT but the same amount of capital OB for producing Paddy. This can be seen from the tangency at point D between PP1and FJ. Thus in Japan Car is more cheaply than Paddy.

Explanation of diagram India: India uses OP capital and ON labour for producing Cars while it requires only OR capital and the same amount of labour ON for producing Paddy. Thus, India can produce Paddy more cheaply than Cars. The above figure explain arguments that the capital rich country has a greater advantage in producing capital intensive commodity, while the labour rich country will gain by producing the labour intensive commodity. Hence, the international specialisation is determined by relative factor endowments. the Heckscher-Ohlin

Two criteria of Factor Abundance Physical Criteria: A country said to be capital abundant or labour scarce when the ratio of physical quantity of K to L is greater than that in another. Symbolically, KJ/LJ> KI/LI Price Criteria: Alternatively the comparison between the ratio of prices of the two factors interest (capital) and wages (labour) in the two countries can be indicated as follows: iJ/wJ< iI/wI Where i = interest w = wages

Criticism of the Theory 1. Unrealistic assumptions: Although the H-O theory intended to provide a better explanation of international trade by analysing its causes yet, like the Ricardian theory it is based on many unrealistic assumptions 2 country 2 commodity model, perfect competition, no transport cost etc. 2. Static in nature: The theory assumes that there is no change in production function thereby indicating a static nature. 3. Demand conditions neglected: According to the theory it is only the supply factor that determines production. In reality demand also plays a major role in deciding what is to be produced.

Criticism of the Theory 4. Leontief s Paradox: an empirical survey conducted by W.W. Leontief shows that a country likes U.S.A. was importing capital intensive products like cars and exporting labour intensive product like wheat. This observation came to be called as Leontief s paradox. 5. Other factors neglected: The theory considers only 2 factors, labour and capital. Others aspects such as technology, natural factors, different qualities of labour etc. are ignored.

Criticism of the Theory 6. Commodity prices neglected: According to the theory commodity prices depend on factor prices. Therefore the cause of international trade is difference in factor prices. Critics however point out that the demand for a factor is derived demand and not the other way round.

Terms of Trade: Meaning and Types The terms of trade refer to the rate at which the goods of one country exchange for the goods of another country. It is a measure of the purchasing power of exports of country in terms of its imports, and is expressed as the relation between export prices and import prices of its goods.

Terms of Trade: Meaning and Types A country may experience favourable or unfavourable terms of trade (ToT) Favourable ToT: When the export prices of a country rise relatively to its imports price, its ToT are said to have improved. Unfavourable ToT: When the import prices rise relatively to its export prices, its terms of trade are said to have worsened.

Terms of Trade: Types Jacob Viner and Meier have given the following types of terms of trade which are as follows: 1. Commodity or Net Barter Terms of Trade (NBTT): It is the ratio between the price of a country's exports goods and import goods. Symbolically, P P NBTT = = x m Where, NBTT = Net Barter Terms of Trade Px = Price of exports Pm = Price of imports To measure changes in the commodity terms of trade over a period, the ratio of the change in exports prices to the change in imports is taken.

Terms of Trade: Types 2. Gross Barter Terms of Trade (GBTT): It is the ratio between the quantities of a country's imports and exports. Symbolically, m Q Q GBTT = = x Where, Qm = quantities of imports Qx = quantities of exports The higher the ratio between quantities of imports and exports, the better the gross terms of trade.

Terms of Trade: Types 3. Income Terms of Trade (YTT): It is the net barter terms of trade of a country multiplied by its export volume index. Symbolically, P Index of Exports Pr ice Export Quantity = = = = = = X YTT NBTT Q Q x x P Index of Im ort p Pr ice m The income terms of trade is called the capacity to import. In other words, a rise in the index of income terms of trade implies that a country can import more goods in exchange for its exports.

Terms of Trade: Types 4. Single Factoral Terms of Trade (SFTT): It is calculated by multiplying the commodity terms of trade index by an index of productivity changes in domestic export industries. Symbolically, P F NBTT SFTT = = = = X F x x P m Where, Fx = Productivity index of export industries. It show that a country's factoral terms of trade improves as productivity improves in its export industries.

Terms of Trade: Types 5. Double Factoral Terms of Trade (DFTT): It takes into account productivity changes both in the domestic export sector and the foreign export sector producing the country's imports. Symbolically, F NBTT DFTT = = = = P F x X x F P F m m m Where, Fx = Export productivity index Fm = Import productivity index A rise in the index of DFTT of a country means that the productive efficiency of the factors producing exports has increased relatively to the factors producing imports in the other country.

Terms of Trade: Types 6. Real Cost Terms of Trade (RCTT): It is used to measure the real gain from international trade. It is calculated by multiplying the single factoral terms of trade with the reciprocal of an index of the amount of disutility per unit of productive resources used in producing export commodities. Symbolically, P = = = = X RCTT SFTT R F R x x x P m Where, Rx = Index of the amount of disutility per unit of productive resources used in producing export commodities.

Terms of Trade: Types 7. Utility Terms of Trade (UTT): This index measures "changes in the disutility of producing a unit of exports and changes in the relative satisfactions yielded by imports, and the domestic products foregone as the result of export production." It is calculated by multiplying the real cost terms of trade with an index of the relative average utility of imports and of domestic commodities foregone. u = average utility a = domestic commodities whose consumption is foregone to use resources for export production U U U m m u = = 0 1 U a a 1 0

Terms of Trade: Types where, u = index of relative utility of imports and domestically foregone commodities. Thus, the utility terms of trade can be expressed as: P = = = = X UTT RCTT u F R u x x P m

Gains from Trade (with Offer Curves) J.S. Mill analysed the gains as well as the distribution of the gains from international trade in terms of his theory of reciprocal demand. According to Mill, it is reciprocal demand that determines terms of trade which, in turn, determine the distribution of gains from trade of each country. The term 'terms of trade' refers to the barter terms of trade between the two countries i.e., the ratio of the quantity of imports for a given quantity of exports of a country.

Examples Unit of Labour = 2 Hours Commodity Domestic Exchange Ratio 1X:1Y 1X:1.33Y Country X 10 6 Y A B 10 8 For example, in country A, 2 units of labour produce 10 units of X and 10 units of Y, while in country B the same labour produce 6X and 8Y. The domestic exchange ratio (or domestic terms of trade) in country A is 1X = 1Y, and in country B, 1X = 1.33Y. This mean that one unit of X can be exchanged with one unit of Y in country A or 1.33 units of Y in country B. Thus the terms of trade between the two countries will lie between 1X or 1Y or 1.33Y.

Gains from Trade (with Offer Curves) However, the actual exchange ratio will depend upon reciprocal demand, i.e., "the relative strength and elasticity of demand of the two trading countries for each other's product in terms of their own product." If A's demand for commodity Y is more intense (inelastic), then the terms of trade will be nearer to 1X = 1Y. The terms of trade will move in favour of B and against country A. B will gain more and A less. On the other hand, if A's demand for commodity Y is less intense (more elastic), then the terms of trade will be nearer to 1X = 1.33Y. The terms of trade will move in favour of A and against B. A will gain more and B less.

Q Marshall-Edgeworth offer curves R A T B Com mod Y ity E P S O K X Com mod ity

Gains from Trade (with Offer Curves) In the above diagram, OA = offer curve of country A OB = offer curve of country B. OP = domestic constant cost ratios of producing X in country A OQ= domestic constant cost ratios of producing Y in B However, the actual terms of trade are settled at E, the point of intersection of OA and OB. The line OT represents equilibrium terms of trade at E

Gains from Trade (with Offer Curves) The cost ratio within country A is KS unit of Y : OK units of X. But it gets KE units of Y through trade. SE units of Y is therefore, its gain. The cost ratio within country B is KR units of Y : OK units of X. But it imports OK units of X from country A in exchange for only KE units of Y. ER units of Y is its gain. Thus both countries gain by entering into trade.