Impact of Proposed Labour Codes on Employers and Compliance Structure

This content discusses the impact and evolving compliance structure under the Code on Wages, 2019, focusing on clauses related to minimum wages, payment of wages, and payment of bonus. It outlines key aspects like wage fixation, deductions from wages, eligibility for bonus, and computation of profits. The analysis by Dr. G. Manjunath delves into the changes affecting employers and the overall compliance framework.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

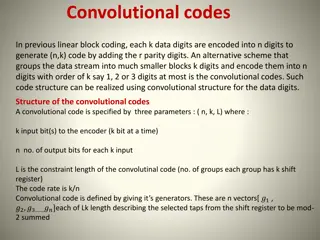

IMPACT OF PROPOSED LABOUR CODES ON EMPLOYERS & COMPLIANCE STRUCTURE 23rdAug 2019 Dr. G. MANJUNATH, KLS, PhD WELFARE COMMISSIONER GOVERNMENT OF KARNATAKA Email id: manju_alc@yahoo.co.in

IMPACT ON EMPLOYERS AND THE EVOLVING COMPLIANCE STRUCTURE UNDER UNDER THE CODE ON WAGES, 2019 THE CODE ON WAGES, 2019 THE CODE ON WAGES, 2019- - IMPACT ANALYSIS IMPACT ANALYSIS 10/8/2024 2

The Code on Wages, 2019 Arrangement of Clauses CHAPTER I PRELIMINARY CLAUSES 1 Short title, extent and commencement 2 Definitions 3 Prohibition of discrimination on ground of gender 4 Decision as to disputes with regard to same or similar nature of work CHAPTER II MINIMUM WAGES 5 Payment of minimum rate of wages 6 Fixation of minimum wages 7 Components of minimum wages 8 Procedure for fixing and revising minimum wages 9 Power of Central Government to fix floor wage 10/8/2024 3

Arrangement of Clauses 10 Wages of employee who works for less than normal working day 11 Wages for two or more classes of work 12 Minimum time rate wages for piece work 13 Fixing hours of work for normal working day 14 Wages for overtime work CHAPTER III PAYMENT OF WAGES 15 Mode of payment of Wages 16 Fixation of wage period 17 Time limit for payment of wages 18 Deductions which may be made from wages 19 Fines 20 Deductions for absence from duty 21 Deduction for damage or loss 10/8/2024 4

Arrangement of Clauses 22 Deductions for services rendered 23 Deductions for recovery of advances 24 Deductions for recovery of loans 25 Chapter not to apply to Government establishments CHAPTER IV PAYMENT OF BONUS 26 Eligibility for bonus, etc 27 Proportionate reduction in bonus in certain cases 28 Computation of number of working days 29 Disqualification for bonus 30 Establishments to include departments, undertaking, and braches 31 Payment of bonus out of allocable surplus 32 Computation of gross profits 10/8/2024 5

Arrangement of Clauses 33 Computation of available surplus 34 Sums deductible from gross profits 35 Calculation of direct tax payable by the employer 36 Set on and set off of allocable surplus 37 Adjustment of customary or interim bonus against bonus payable under this Code 38 Deduction of certain amounts from bonus payable 39 Time limit for payment of bonus 40 Application of this Chapter to establishments in public sector in certain cases 41 Non-applicability of this Chapter 10/8/2024 6

Arrangement of Clauses CHAPTER V ADVISORY BOARD 42 Central Advisory Board and State Advisory Board CHAPTER VI Payment of Dues, Claims and Audit 43 Responsibility for payment of various dues 44 Payment of various undisbursed dues in case of death of employee 45 Claims under Code and procedure thereof 46 Reference of disputes under this Code 47 Presumption about accuracy of balance sheet and profit and loss account of corporations and companies 48 Audit of accounts of employers, not being corporations or companies. 49 Appeal 50 Records, returns and notices. 10/8/2024 7

Arrangement of Clauses CHAPTER VII INSPECTOR-CUM-FACILITATOR 51 Appointment of I-CUM-F CHAPTER VIII OFFENCES AND PENALTIES 52 Cognizance of offences 53 Power of officeers of appropriate Government to impose penalty in certain cases 54 Penalties for offences 55 Offences by companies 56 Composition of offences 10/8/2024 8

Arrangement of Clauses CHAPTER IX MISCELLANEOUS 57 Bar of suits 58 Protection of action taken in good faith 59 Burden of proof 60 Contracting out 61 Effect of laws, agreements, etc, inconsistent with this Code 62 Delegation of powers 63 Exemption of employer from liability in certain cases 64 Protection against attachment of assets of employer with Government 65 Power of central Government to give directions 66 Saving 67 Power of appropriate Government to make rules 68 Power to remove difficulties 69 Repeal and savings 10/8/2024 9

Code on Wages vs. Repealed Enactments ACT DEFINITIONS SECTIONS SCHEDULES RULES FORMS/NOTIFIC ATIONS MW ACT (1948) 11 31 1 37 PW ACT (1936) 10 26 - 40 PB ACT (1965) 22 40 4 5 ER ACT (1976) 10 18 - 6 TOTAL 53 114 5 88 COW (2019) 26 69 - To be framed To be framed 10/8/2024 10

Who is an Employer? Cl. 2(l). Employer means a person who employs one or more employees in his establishment either directly or through any person In case of CG/SG, the Head of the dept or the authority so specified; In case of local authority, the chief executive; In case of a factory, the occupier and the manager; In case of any other establishments, the person who has ultimate control over the affairs of the establishment and manager, or MD if such affairs is entrusted to them Contractor Legal representative of a deceased employer 10/8/2024 11

Substantial compliance under the Code Employer shall NOT employees on the ground of gender with regard to wages in respect of the same work or work of a similar nature done by any employee. Employer for the above purpose shall NOT reduce the rate of wages of any employee. Employer shall NOT make any discrimination on the ground of sex while recruiting any employee for the same work or work of similar nature and also in the conditions of employment. Exception 10/8/2024 discriminate among 12

Substantial compliance under the Code Employer shall NOT pay to any employee wages less than the minimum rate of wages notified by the appropriate Government. Employer shall pay overtime rate which is twice the normal rate of wages Employer shall pay all wages in current coin or currency notes or by cheque or by crediting the wages in the bank account of the employee or by electronic mode. Employer shall pay wages payable within two working days of removal, dismissal, retrenchment or resignation of an employee Govt. has powers to extend (Cl 17(3) 10/8/2024 13

Substantial compliance under the Code Employer may deduct from the wages of an employee only in accordance with the provisions of the code and only for the purposes mentioned. Employer shall NOT commit any default after deducting from the wages and not depositing in the account of the trust or Government fund Employer shall NOT impose any fine on any employee without the previous approval of the App Govt. or of such authority prescribed. (Cl. 19) 10/8/2024 14

Substantial compliance under the Code Employer shall PAY to every employee drawing the prescribed wages and who has put in at least 30 days of work an annual minimum bonus at the rate of 8.33% of the wages earned, whether or not the employer has any allocable surplus during the previous accounting year. Bonus payable under this code by an employer to his employees shall be paid by crediting it in the bank account within a period of eight months from the close of the accounting year. (Provi for time extension) Every Employer shall pay all amounts required to be paid under this Code to every employee employed by him. (43) 10/8/2024 15

Compliance of the order passed by authorities under the Code Employer shall comply with the directions issued by authorities if such employer has not audited his accounts within time stipulated (48(2) In case the authorities themselves direct for auditing of the accounts by auditors the incidental expenditure and the remuneration shall be paid by the employer 10/8/2024 16

Procedural compliance Every employer to whom this code applies shall maintain: A register containing the details of persons employed Muster roll Wages and such other details in the prescribed manner Display notice of the abstract of the code, category- wise wage rates of employees, wage period, day and date and time of payment of wages Issue wage slips in the manner prescribed The names and addresses of the Inspector-cum Facilitator having jurisdiction 10/8/2024 17

Provisions of Indian Penal Code, 1860 Any person required to produce any Documents and any information required by I-C-F shall be deemed to be legally bound to do so within the meaning of S. 175 & S. 176 of the IPC S. 175.Omission to produce document or electronic record to pubic servant by person legally bound to produce it. S. 176. Omission to give notice or information to public servant by person legally bound to give it. Further, S. 94 of Code of Criminal Procedure, 1973 is applicable under Cl 51(8) S. 94. Search of place suspected to contain stolen property, forged documents, etc- 10/8/2024 18

Penalties for offences under the Code Substantial violation of the code like paying less than the amount due to any employee under the provisions of this Code- Employer Punishable with fine up to Rs 50,000; Repeated offence within five years punishable with imprisonment for a term up to 3 months or with fine up to Rs one lakh; Contravenes any provision, rules, order made punishable with fine up to Rs 20,000; Repeated offence within five years punishable with imprisonment for a term up to one month or fine up to Rs 40,000 or with both; For Procedural violation of the provisions of the code For Non-maintenance or improper records, punishable with fine up to Rs 10,000 10/8/2024 19

Compounding of Offence under the Code An offence not being an substantial offence- the code provides for compounding of offence Gazetted Officer so appointed will have powers to levy a sum fifty percent of maximum fine provided for such offence No prosecution can be proceeded if an offence is been compounded and any pending procedure before any court, intimation has to be given by the Gazetted officer and the employer may be discharged 10/8/2024 20

Burden of Proof When a claim is made before any authority against the employer for: Non-payment of equal remuneration Non-payment of bonus Less payment of wages Less payment of bonus Making un-authorized deductions from the wages of an employee Then the burden of prove that the said dues have been paid shall be on the Employer. 10/8/2024 21

Exemption of employer from liability When an employer is charged with an offence under this Code: He is entitled under this code to make a complaint before the court against any other person whom he charges to be the actual offender. Employer then has to prove to the satisfaction of the court that- Due diligence was used by him to execute the code The other person committed the offence without his knowledge, consent or connivance However, employer will be examined on oath, examination of evidence and witnesses and cross-examination procedures shall be followed Thereafter, the employer shall be discharged from any liability under this code. 10/8/2024 22

THANKS Dr. G. MANJUNATH, KLS, Phd Welfare commissioner Government of Karnataka Email: manju_alc@yahoo.co.in Cell: 9341735662 10/8/2024 23