Variance Analysis and Standard Costing in Business

Explore the concepts of standard costs, budgeted costs, and variance analysis in business. Understand the importance of investigating variances and learn to calculate and interpret different types of variances like material price, labor efficiency, and overhead volume variances.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Actual v/s Budgeted Costs VARIANCE ANALYSIS

Session Objectives: Upon completion of this session, participants will be able to: Understand the concept of standard cost Establish and use standard costs Understand the process of variance analysis

Objectives (Continued) Learn to calculate and interpret the following: Material Price Variance (MPV) Material Efficiency Variance (MEV) Labor Rate Variance (LRV) Labor Efficiency Variance (LEV) Over-Head Controllable Variance (OHCV) Over-Head Volume Variance (OHVV)

What are Standard Costs? 1. Standard cost refers to expected costs under anticipated conditions. 2. Standard cost systems allow for comparison of standard versus actual costs. 3. Differences are referred to as standard cost variances. 4. Variances should be investigated if significant.

Standard Costs and Budgets 1. Standard cost is the standard cost of a single unit. 2. Budgeted cost is the cost, at standard, of the total number of budgeted units.

Development of Standard Costs 1. Standard costs are developed in a variety of ways: a. Specified by formulas or recipes. b. Developed from price lists provided by suppliers. c. Determined by time and motion studies conducted by industrial engineers. d. Developed from analyses of past data.

Perfection Versus Practical Standards Two schools of thought: 1. Perfection standards: developed under the assumption that no obstacles to the production process will be encountered. 2. Practical Standards: developed under the assumption that there will be occasional problems in the production process.

Perfection Versus Practical Standards: A Behavioral Issue PRACTICAL OR ATTAINABLE STANDARDS PERFECTION STANDARDS Can only be attained under near perfect conditions Tight as practical, but still are expected to be attained Peak efficiency Lowest possible input prices Best-quality material No disruption in production Occasional machine breakdowns Normal amounts of raw material waste

Perfection Versus Practical Standards: A Behavioral Issue Practical standards should be set at levels that are currently attainable with reasonable and efficient effort. Should we use practical standards or perfection standards?

Perfection Versus Practical Standards: A Behavioral Issue I agree. Perfection standards are unattainable and therefore discouraging to most employees.

Using Standard-Costing Systems for Control STANDARD COST a budget for the production of one unit of product or service ACTUAL COST used in the production of the product or service COST VARIANCE the difference between the actual cost and the standard cost

Using Standard-Costing Systems for Control This variance is unfavorable because the actual cost exceeds the standard cost. Standard Product Cost A standard cost variance is the amount by which an actual cost differs from the standard cost.

Management by Exception Managers focus on quantities and costs that exceed standards, a practice known as management by exception. Standard Amount Direct Material Direct Labor Type of Product Cost

A General Approach To Variance Analysis 1. Direct material: materials price and materials quantity variance (MPV & MQV). 2. Direct labor: labor rate and labor efficiency variance (LRV & LEV). 3. Overhead: overhead volume variance (OHVV) and overhead controllable variance (OHCV).

Material Variances 1. Differences between standard and actual material costs: a. Material price variance. b. Material quantity variance.

Material Price Variance 1. Material price variance:(AP SP) x AQp 2. (AP) = actual price per unit of material. 3. (SP) = standard price per unit of direct material. 3. (AQp) = actual quantity of material purchased. 4. Actual price > standard price: unfavorable. 5. Actual price < standard price: favorable.

Material Quantity Variance 1. Material quantity variance: (AQu SQ)SP 2. (AQu) = actual quantity of material used. 3. (SQ) = standard quantity of material allowed for actual number of units produced. 4. (SP) = standard price of material. 5. Actual quantity > standard quantity: unfavorable. 6. Actual quantity < standard quantity: favorable.

Direct Labor Variances 1. Differences between standard and actual direct labor costs: a. Labor rate variance. b. Labor efficiency variance.

Labor Rate Variance 1. Labor rate variance: (AR SR) x AH 2. (AR) = actual wage rate. 3. (SR) = standard wage rate. 4. (AH) = actual number of labor hours. 5. Actual rate > standard rate: unfavorable. 6. Actual rate < standard rate: favorable.

Labor Efficiency Variance 1. Labor efficiency variance: (AH SH) x SR 2. (AH) = actual number of hours worked. 3. (SH) = standard number of hours allowed for actual number of units produced. 4. (SR) = standard labor wage rate. 5. Actual hours > standard hours: unfavorable. 6. Actual hours < standard hours: favorable.

Overhead Variances 1. Differences between overhead applied to inventory at actual overhead costs: a. Controllable overhead variance. b. Overhead volume variance.

Standard Costs Let s use the concepts of the general model to calculate standard cost variances, starting with direct material.

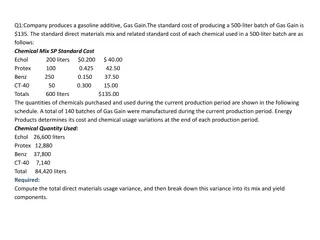

Material Variances Koala Camp Gear Company in Melbourne, Australia has the following direct material standard to manufacture one Tree Line tent: 12 square meters per tent at $8.00 per square meter Last month Koala purchased 40,000 square meters at $8.15 per square meter and used 36,400 square meters to make 3,000 tents.

Material Variances We calculate material variances using formulas: MPV = AQP(AP SP) MPV = 40,000 sqm. ($8.15 $8.00) MPV = $6,000 Unfavorable MQV = SP(AQU SQ) MQV = $8.00(36,400 sqm. 36,000 sqm.) MQV = $3,200 Unfavorable

Standard Costs Now let s calculate standard cost variances for direct labor.

Labor Variances Koala has the following direct labor standard to manufacture one Tree Line tent: 2 standard hours per tent at $18.00 per direct labor hour Last month 5,900 direct labor hours were worked at $19.00 per hour to make 3,000 tents.

Labor Variances We calculate labor variances using formulas: LRV = AH(AR - SR) LRV = 5,900 hrs($19.00 - $18.00) LRV = $5,900 Unfavorable LEV = SR(AH - SH) LEV = $18.00(5,900 hrs - 6,000 hrs) LEV = $1,800 Favorable

CALCULATION OF OVERHEAD VARIANCES SWC, Inc. uses standard costs to value its inventories. Overhead costs follow: Budget Variable overhead Fixed overhead TOTAL OH Units produced Calculate the overhead variances. Actual $525,500 $328,750 $527,000 $329,375 $856,375 $854,250 15,500 15,000

FORMULA APPROACH OVERHEAD CONTROLLABLE = OVERHEAD - OVERHEAD FOR VARIANCE (OHCV) ACTUAL FLEXIBLE BUDGETED ACTUAL PRODUCTION (FLEX) Overhead Controllable Variance (OHCV) = $854,250 - [$329,375 + (15,000 units $34*)] = $854,250 - $839,375 = $14,875 (U) FLEX = BUDGETED FMOH + (BUDGETED VMOH / UNIT) * (ACTUAL UNITS) *$527,000 15,500 units = $34 per unit = BUDGETED VMOH / UNIT

OVERHEAD FLEXIBLE BUDGETED VOLUME = OVERHEAD FOR ACTUAL - VARIANCE PRODUCTION (FLEX) OVERHEAD APPLIED USING STANDARD OVERHEAD RATE (PRORATED) Overhead Volume Variance (OHVV) = $839,375 - (15,000 units $55.25*) = $839,375 - $828,750 = $10,625 (U) PRORATED = (BUDGETED MOH RATE PER UNIT) * (ACTUAL UNITS) *$856,375 15,500 units = $55.25 per unit = BUDGETED MOH RATE PER UNIT

Labor Efficiency Variance A Closer Look Poorly trained workers Poor quality materials Unfavorable Efficiency Variance Poor supervision of workers Poorly maintained equipment

Management By Exception 1. Investigation of standard cost variances is a costly activity 2. Management must decide which variances to investigate. 3. Most managers practice management by exception. 4. What is exceptional? Usually an absolute dollar amount or a percentage dollar amount.

Management by Exception Take the time to investigate only significant cost variances. What is significant? Depends on the Size of the Organization Depends on the Production Process Depends on the Type of the Organization

Variance Analysis Cycle Take corrective actions Identify questions Receive explanations Conduct next period s operations Analyze variances Prepare standard cost performance report Begin

Significance of Cost Variances: When to Follow Up How does a manager know when to follow up on a cost variance and when to ignore it? Size of Variance Absolute Amount Relative Amount ?

Significance of Cost Variances Size of variance Dollar amount Percentage of standard Recurring variances Trends Controllability Favorable variances Costs and benefits of investigation What clues help me to determine the variances that I should investigate?

Significance of Cost Variances: When to Follow Up Larger variances, in dollar amount or as a percentage of the standard, are investigated first. How do I know which variances to investigate? We could use a rule of thumb such as: investigate all variances that are over $10,000 or over 10 percent of the standard cost.

Significance of Cost Variances: When to Follow Up What about recurring variances? Percentage of Standard Cost 6.0% 6.4% 3.2% 6.2% MONTH September October November December VARIANCE $6,000 F 6,400 F 3,200 F 6,200 F None of the variances are greater than $10,000 or 10% for any one month, but they should be investigated because of they have continued for several months.

Significance of Cost Variances: When to Follow Up What about trends? Percentage of Standard Cost 0.25% 0.84% 4.0% 9.3% MONTH September October November December VARIANCE $ 250 U 840 U 4,000 U 9,300 U None of the variances are greater than $10,000 or 10% for any one month, but they should be investigated because of the unfavorable trend.

Significance of Cost Variances: When to Follow Up Controllability A manager is more likely to investigate a variance that is controllable by someone in the organization than one that is not. Favorable Variances It is as important to investigate significant favorable variances as well as significant unfavorable variances. Cost and Benefits of Investigation The decision whether to investigate a variance is a cost - benefit decision

Statistical Analysis Warning signals for investigation Favorable Limit Desired Value Unfavorable Limit 1 2 3 4 5 6 7 8 9 Variance Measurements

Behavioral Effects Of Standard Costing Standard costs, budgets, and variances are used to evaluate the performance of individuals and departments. They can profoundly influence behavior when they are used to determine salary increases, bonuses, and promotions. 16-43

Which Managers Influence Cost Variances? Direct-material price variance The purchasing manager Get the best prices available for purchased goods and services through skillful purchasing practices Direct-material quantity variance Skillful supervision and motivation of production employees, coupled with the careful use and handling of materials, contribute to minimal waste The production supervisor Direct-labor rate variance The production supervisor Generally results from using a different mix of employees than that anticipated when the standards were set Direct-labor efficiency variance The production supervisor Motivating employees toward production goals and effective work schedules improves efficiency

Quick Review Question #1 1. What does an unfavorable overhead volume variance mean? a. Overhead costs are out of control. b. Overhead costs are under control. c. Production was greater than anticipated. d. Production was less than anticipated.

Quick Review Answer #1 1. What does an unfavorable overhead volume variance mean? a. Overhead costs are out of control. b. Overhead costs are under control. c. Production was greater than anticipated. d. Production was less than anticipated.

Quick Review Question #2 2. Standard material costs per unit are $3.50. Actual costs per unit are $3.80 Actual quantity is 3,000. Standard quantity is 2,800. Material price variance is: a. $900 favorable b. $900 unfavorable c. $700 favorable d. $700 unfavorable

Quick Review Answer #2 2. Standard material costs per unit are $3.50. Actual costs per unit are $3.80 Actual quantity is 3,000. Standard quantity is 2,800. Material price variance is: a. $900 favorable b. $900 unfavorable c. $700 favorable d. $700 unfavorable

Quick Review Question #3 2. Standard material costs per unit are $3.50. Actual costs per unit are $3.80 Actual quantity is 3,000. Standard quantity is 2,800. Material quantity variance is: a. $900 favorable b. $900 unfavorable c. $700 favorable d. $700 unfavorable

Quick Review Answer #3 2. Standard material costs per unit are $3.50. Actual costs per unit are $3.80 Actual quantity is 3,000. Standard quantity is 2,800. Material quantity variance is: a. $900 favorable b. $900 unfavorable c. $700 favorable d. $700 unfavorable