Introduction to Different Methods of Costing

Costing is a crucial technique for businesses to ascertain their costs, regardless of being in manufacturing, merchandizing, or service provision. This article explores various methods of costing such as job order costing, batch costing, contract costing, process costing, and service costing. Job order costing is suitable for unique products like feature films, aircraft manufacture, and research projects where costs are accumulated for each specific job. The accumulation of costs under job order costing includes direct material cost and direct labor cost, emphasizing the importance of tracking expenses accurately.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

In this session we shall cover What is costing ? Different methods of costing Job order costing Batch costing Contract costing Process costing Service costing

Different methods of costing Costing is a technique and process of ascertaining cost . Costing is not limited to manufacturing firms. Even the merchandizing firms as well as service providers ascertain their cost of making the product or service available Different methods of costing include: Job order costing Batch costing Contract costing Process costing Service costing

Job order costing Product is not meant for mass market It is for a specific customer and is of one off type The volume of production is low Costs are accumulated and unit costs calculated for each job Detailed records are kept of a flow of costs for each job on a JOB COST SHEET Example: Feature film production Aircraft manufacture Research projects Contracts in consulting and architecture firms etc.

Accumulation of costs under Job order costing Direct material cost: As raw materials are needed for the production process, they are transferred from the warehouse to the production department If purchased specifically for a particular job, priced using specific identification method If drawn from regular stock, valued using FIFO, LIFO or Weighted average method To authorize release of materials, the production department supervisor completes a material requisition form and presents it to the warehouse supervisor Wastage of material (normal): If normal to the job: cost booked to the job If normal to the process: treated as overhead

Accumulation of costs under Job order costing Direct labour cost: Based on time records filled out by employees A time record is a form that records the time spent by an employee on each job Time spent on each job is multiplied by the employee s wage rate Any time spent by employee on maintenance or general clean up etc. would be treated as a overhead Overtime premium should be booked to the job only if work is done during overtime hours at the request of the customer for early delivery If done to cope up with general rise in production activity in a cost center, treated as an overhead If done to meet exigencies abnormal in nature, not considered as part of product cost Rectification costs: If identifiable with a particular job, charged to job If as a result of general workmanship being sub standard, treated as an overhead If abnormal in nature, not considered as part of product cost

Accumulation of costs under Job order costing Overhead costs: Charged to the job by applying some predetermined rate These include: costs of indirect material, indirect labour, utility costs, depreciation, rent, electricity bills etc. Such costs often bear no obvious relationship with each individual job units but must be incurred for production to take place and product to be sold to the customer finally Predetermined overhead rate: Some measure of productive activity is chosen as the cost driver (base) for overhead application Examples: direct labour hours, direct labour cost, machine hours, area, horse power of machines, light points etc. Predetermined overhead rate = Budgeted overhead cost Budgeted units of cost driver

Example Job costing system Jupiter Corporation manufactures home security devices. The following data is obtained from the books for the year ended 31 Dec 2012: (in Rs 00) Direct material . 90,000 Direct wages ............. 75,000 Factory overheads .. 45,000 Administration overheads . 42,000 Selling and distribution overheads .. 52,500 Profit ..60900 Prepare a Cost sheet indicating Prime cost, Works cost, Production cost, Cost of sales and sales value. In 2013, factory received an order for a number of jobs. It is estimated that direct material required will be Rs 1,20,00,000 and direct labour will cost Rs 75,00,000. What should be the price of these jobs if factory intends to earn the same rate of profit on sales assuming that the selling and distribution overheads have gone up by 15%? The factory recovers factory overheads as a percentage of direct wages, and administration and selling and distribution overheads as a percentage of works cost based on the cost rates prevailing in the previous year.

Example Job costing system COST SHEET FOR THE YEAR ENDED 31 DEC 2012 (Rs 00s) Direct material Direct labour 90000 75000 165000 45000 60% of direct wages PRIME COST Add: Factory overheads 20% of works cost WORKS COST 210000 Add: Administration overheads 42000 25% of works cost COST OF PRODUCTION 252000 Add: Selling and distribution overheads 52500 COST OF SALES 304500 1/5 of cost Add: Profit 60900 SALES VALUE 365400

Example Job costing system JOB COST SHEET FOR 2013 (Rs 00s) Direct material Direct labour 120000 75000 195000 45000 PRIME COST Add: Factory overheads (60% of Direct labour) WORKS COST 240000 Add: Administration overheads (20% of Works cost) 48000 COST OF PRODUCTION 288000 Add: Selling and distribution overheads (28.75% of Works cost) 69000 COST OF SALES 357000 Add: Profit (1/5 of cost) 71400 SALES VALUE 428400 25% + (15% of 25%)

Batch costing It is a modified form of Job costing The term batch refers to a lot in which the articles are to be manufactured It is thus, also known as Lotcosting Examples It is used in case of pharmaceutical industries, readymade garment factories, components of television sets, watches etc. The costing procedure is quite similar to job costing except that the batch becomes the cost unit instead of a job Cost / unit is ascertained by dividing the total cost of the batch with the number of units produced in that batch Also, since each batch consists of a number of units, the determination of Optimalquantity to constitute an economical batch assumes importance companies manufacturing

Contract costing It is a special form of job costing Where big jobs are involved, requiring considerable length of time to complete and comprising activities to be done outside the factory premises, the system of contract costing is employed This system is common with construction companies, ship builders etc., who undertake definite contracts The price agreed up to be paid by the contractee to the contractor is called the CONTRACT PRICE A separate CONTRACT ACCOUNT is maintained Debited with all the direct and indirect expenses related to the contract Credited with the total contract price payable on completion of the contract The balance, if any, represents profit / loss, which is transferred to the P&L A/c

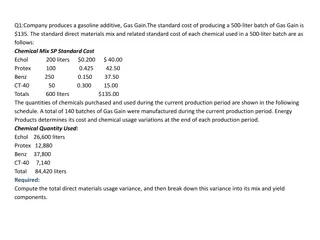

Process costing In a business where a product passes through different stages of production, each distinct and well defined, process costing system is used Used by companies that produce large numbers of identical units Production of a standard product continues for a long period without interruption There is no need to trace the costs of specific batches as products in different batches are identical Where there are more than one process, cost of each process is accumulated and output of one process is transferred to the next process. More than one product may emerge at the end of different processes Joint product: two or more products separated in the course of processing each having a sufficiently high saleable value to merit recognition as the main product By product: product recovered incidentally in the course of manufacturing the main product, having a value low in comparison with the value of the main product Example: Production of chemicals, gasoline, fertilizers, electricity, textiles etc.

Example Process costing TT Auto Fab manufactures aluminum parts for automobile industry. A unit of the final product passes through three distinct processes molding (Process 1), assembly (Process 2) and finishing (Process 3) before it is completed. The following information is available for the operations: Total Process 1 Process 2 Process3 Material 5625 2600 2000 1025 Direct wages 7330 2250 3680 1400 Production overheads 7330 500 units @ Rs 4/unit were introduced in Process 1. Production overheads are absorbed as a % of direct wages. The actual output and normal loss of respective processes are: Output units Normal loss of input Value of scrap/ unit Process 1 450 10% 2 Process 2 340 20% 4 Process 3 270 25% 5 There is no stock or WIP in any process. Show the three Process a/cs.

Example Process costing Process account Particulars Units Cost/unit Amount Particulars Units Cost/unit Amount

Example Process costing Process 1 account Particulars Units Cost/unit Amount Particulars Units Cost/unit Amount Units purchased 500 4 2000 Normal loss (10% of 500) Process 2 a/c 50 2 100 Material 2600 450 20 9000 Direct wages Overheads 2250 2250 500 9100 500 9100 9000/450 = 20

Example Process costing Process 2 account Particulars Units Cost/unit Amount Particulars Units Cost/unit Amount Process 1 a/c 450 20 9000 Normal loss (20% of 450) 90 4 360 Material 2000 Process 3 a/c 340 50 17000 Direct wages 3680 Abnormal loss 20 50 1000 Overheads 3680 450 18360 450 18360 (18000/360)

Example Process costing Process 3 account Particulars Units Cost/unit Amount Particulars Units Cost/unit Amount Process 2 a/c 340 50 17000 Normal loss (25% of 340) 85 5 425 Material 1025 Finished goods 270 80 21600 Direct wages 1400 (21600/270) (22025-425) Overheads 1400 Abnormal gain 15 80 1200 355 22025 355 22025

Distinction between Job costing and Process costing Basis Job costing Process costing

Distinction between Job costing and Process costing Basis Job costing Process costing Cost computation Cost is computed for each job separately Cost is computed for each process over a specified period of time

Distinction between Job costing and Process costing Basis Job costing Process costing Cost computation Cost is computed for each job separately Cost is computed for each process over a specified period of time Cost unit The cost unit is a job The cost unit is a process

Distinction between Job costing and Process costing Basis Job costing Process costing Cost computation Cost is computed for each job separately Cost is computed for each process over a specified period of time Cost unit The cost unit is a job The cost unit is a process Nature Each job may be different and production is not continuous The process in each case is the same and production continuous is

Distinction between Job costing and Process costing Basis Job costing Process costing Cost computation Cost is computed for each job separately Cost is computed for each process over a specified period of time Cost unit The cost unit is a job The cost unit is a process Nature Each job may be different and production is not continuous The process in each case is the same and production continuous is Supervision & control Greater supervision & control by management is required Less supervision & control is required as the WIP gets standardized

Distinction between Job costing and Process costing Basis Job costing Process costing Cost computation Cost is computed for each job separately Cost is computed for each process over a specified period of time Cost unit The cost unit is a job The cost unit is a process Nature Each job may be different and production is not continuous The process in each case is the same and production continuous is Supervision & control Greater supervision & control by management is required Less supervision & control is required as the WIP gets standardized Completion of job It is necessary for computation of cost of the job Here completion of entire job is not awaited. The cost/unit is computed by dividing total cost by the process output units

Distinction between Job costing and Process costing Basis Job costing Process costing Cost computation Cost is computed for each job separately Cost is computed for each process over a specified period of time Cost unit The cost unit is a job The cost unit is a process Nature Each job may be different and production is not continuous The process in each case is the same and production continuous is Supervision & control Greater supervision & control by management is required Less supervision & control is required as the WIP gets standardized Completion of job It is necessary for computation of cost of the job Here completion of entire job is not awaited. The cost/unit is computed by dividing total cost by the process output units Orders A job is executed against a specific order This is not necessary in case of a process

Service costing Also known as Operatingcosting It is a method of cost ascertainment in such undertakings which are engaged in providing services The cost of providing such service is called operatingcost

Cost unit used in service costing Cost unit Simple cost unit Composite cost unit

Simple cost unit Undertaking Cost unit

Simple cost unit Undertaking Cost unit Transport

Simple cost unit Undertaking Cost unit Transport Per km or Per mile

Simple cost unit Undertaking Cost unit Transport Per km or Per mile Water works

Simple cost unit Undertaking Cost unit Transport Per km or Per mile Water works Per 1000 litres

Simple cost unit Undertaking Cost unit Transport Per km or Per mile Water works Per 1000 litres Municipality

Simple cost unit Undertaking Cost unit Transport Per km or Per mile Water works Per 1000 litres Municipality Per km of road maintained

Simple cost unit Undertaking Cost unit Transport Per km or Per mile Water works Per 1000 litres Municipality Per km of road maintained Canteen

Simple cost unit Undertaking Cost unit Transport Per km or Per mile Water works Per 1000 litres Municipality Per km of road maintained Canteen Per meal or Per dish

Composite cost unit Undertaking Cost unit

Composite cost unit Undertaking Cost unit Transport

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital Per bed per day

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital Per bed per day Hotel

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital Per bed per day Hotel Per room per day

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital Per bed per day Hotel Per room per day Cinema

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital Per bed per day Hotel Per room per day Cinema Per seat per show

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital Per bed per day Hotel Per room per day Cinema Per seat per show Electricity

Composite cost unit Undertaking Cost unit Transport Per passenger km or Per tonne km Hospital Per bed per day Hotel Per room per day Cinema Per seat per show Electricity Per kilowatt hour

Service costing Transport costing Objective can be: To fix the rates of carriage of goods / passengers To decide the hire charges for vehicles on hire To determine the cost of using vehicles owned vs. cost of using vehicles hired To estimate the cost of maintenance Cost unit can be: For passenger transport passenger km. For goods transport tonne km.

Example A Delhi Jaipur transport company runs 4 buses between two towns which are 240 kms apart. The seating capacity of each bus is 50 passengers and actual passengers carried are 80% of seating capacity. All 4 buses run on 25 days in a month and each bus makes one round trip per day. Calculate the passenger km for the month.

Example Cost unit : passenger kms