US Beer Market Trends 2023

The US beer market saw a decrease in total sales volume in 2022, with craft beer and import categories showing slight increases. Insights on consumer preferences, challenges faced by liquor store dealers, and the competitive landscape for craft beers are discussed. Mexican brands are driving import sales growth. Stay informed on the changing dynamics of the beer industry in the US.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Forced to Evolve By 2022 sales volume, the total US beer market decreased by 3.1%, with the craft category increasing a slight 0.1% and the import category increasing 2.8%. Total 2022 US beer sales from all channels were $115.4 billion. Information Resources Inc. (IRI) reported total U.S. beer sales at multi-outlets were $44.6 billion, increasing just 0.8%, for the 52 weeks ending 1/1/23. According to the US Census Bureau, Q1 2023 sales at beer, wine and liquor stores increased 2.7% YOY. Analysis from multiple industry sources concludes the traditional beer market will continue to shrink. Although alternatives, such as flavored malt beverages (FMBs) and hard seltzers, are also weak, they are more likely to compete with spirits and craft beers.

Americans Alcohol Consumption Insights According to Drizly s 2023 Consumer Trend Report, 23% of surveyed consumers will have increased interest in light lager beer for summer 2023; however, interest in hard seltzer will decrease by 4% to 21% and interest in hard alternatives will decrease by 2% to 14%. Inflation is causing almost 25% of consumers to drink more at home than at bars and restaurants during 2023 than 2022. 33% of Millennials will choose to drink at home. Of surveyed consumers, 46% said they will host backyard barbecues during summer 2023 and 14% will choose beer or a ready-to-drink (RTD) alcoholic beverage, with wine first at 35% and spirits second at 21%.

Independent Liquor Store Dealers Perspectives Alcoholic beverage dealers have been facing the same problems as many retailers. In the fall 2022 Drizly Retail Report, 43.8% of surveyed dealers said product shortages/supply chain issues would be their biggest challenge during 2023. Dealers also said inflation was changing their customers purchasing patterns: 46.8% of dealers said people are buying less expensive options than what they typically buy compared to just 18.9% of dealers who said their customers are not changing their habits. Dealers customers are their first source of what new brands to offer at 71%, followed by recommendations from distributors at 62%, research online/social media at 56%, data-driven sources (e.g., Nielsen) at 39% and talk to other retailers at 27%.

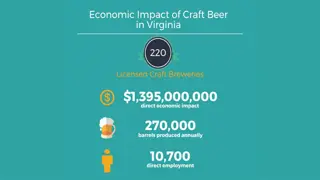

Craft Beers in Competitive Squeeze Many taprooms, like many restaurants and bars, closed due to the pandemic during 2020, which caused decreased sales in the craft beer category during 2021 and 2022, when dollar sales decreased 4.8%. Inflation may negatively affect the category during 2023. Competition is also a major challenge for craft beers as more local breweries and new taste trends are gaining market share from traditional breweries/brands. Retailers have allocated more shelf space to RTDs, beer seltzer, FMBs and non-beer RTDs. Despite the challenges, market analysts expect continued growth in the craft beer category as more brewers innovate with different ingredients and consumers want a larger selection, unique tastes and upscale brands.

Mexican Brands Drive Import Sales According to the National Beer Wholesalers Association s Beer Purchasers Index, the May 2023 index for imports was 75, four points more than the May 2022 index of 71. The index for all beer categories was 52. (An index of 50+ indicates volume is increasing.) Two trends increased total 2022 import beer sales by 6.6% YOY. First, consumers interest in more premium brands and the inflated US dollar has moderated the price of import brands so more Americans can afford and enjoy them. Imports of Mexican brands continue to be the major driver of increased sales for the category. As the Latinx American population increases, there is a bigger market for Mexican brands and more of the general population has become loyal customers of these brands.

The Non-Alcoholic Beer Trend Non-alcohol (NA) beer sales are a very small percentage of the total beer market, but weekly NA beer drinkers 21 and older have increased from 0.6% during April 2022 to 5.2% during April 2023, according to YouGov s 2023 non-alcoholic beer report. Interestingly, the increase in sales is mostly attributable to men, especially Millennials, fathers and households with higher incomes. Women are less attracted to NA beers. Often, NA beer drinkers choose the alternative to moderate their total alcohol intake. The YouGov report also revealed NA beer drinkers are more likely to follow tennis and swimming than beer drinkers and 27% follow football compared to 40% of beer drinkers. NA beer drinkers have a much greater interest in esports than beer drinkers.

Advertising Strategies Local alcoholic beverage retailers should feature displays of lower-cost options to help customers combat inflation, be prepared to explain why they may like the option as much as their regular brand and offer a summer weekend special for those options. Local retailers should consider creating more Spanish-language advertising messages to attract the increasing and more affluent Latinx Americans and maximize sales of Mexican import brands. Local retailers may be able to attract more NA beer drinkers, especially Millennial men, by advertising during tennis and esports events and broadcasts and creating more of a presence in the online esports world.

New Media Strategies With backyard barbecues and other occasions of top interest with Americans during 2023, local retailers can use social media to share tips about grilling and pairing beers with various types of menus. Based on the table at the bottom of page 1 of the Profiler, local retailers should incentivize more customers to create online reviews and increase store employee training so they can have more influence on customers beer choices. With continued interest in craft beers and new taste trends, taprooms can be more aggressive with social media posts, announcing new products, special offers and invitation-only tasting sessions.