Beer Market Insights: 2019 Dollar Sales Up Despite Decrease in Shipments

2019 saw a positive increase in off-premise beer dollar sales amidst a slight drop in total beer shipments. The market displayed varied trends with imports, craft beers, and domestic brands experiencing different trajectories. The impact of the coronavirus pandemic has further reshaped the beer industry by affecting on-premise sales significantly. The competition continues to evolve, pushing traditional brands to adapt to changing consumer preferences.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Fewer Barrels Roll, But 2019 Dollar Sales Increase Starting with the good news: The market research firm IRI reported off-premise beer dollar sales increased 5.2% to $37.2 billion for the 52 weeks ending 12/29/19. These included multi-outlet and convenience stores (grocery, drug, mass-merchandisers and military). The overall increase was attributed to increased sales in the seven segments of the larger beer category: imports, domestic sub-premiums, craft, flavored malt beverages (FMBs), domestic super premiums, non- alcoholic and assorted. The bad news is total 2019 beer shipments (165,499,000) as measured by barrels was 0.8% less than 2018, and the decrease was only that small because November and December 2019 shipments increased YOY, 0.9% and 4.7%, respectively.

Coronavirus Impacts On-Premise and Off-Premise Sales Differently With most states ordering the closing of on-premise establishments, such as bars, restaurants, etc., the spigot for beer (and all alcohol and food) has stopped entirely. On-premise represents approximately 20% of the annual total US beer volume. As indicated above, the off-premise sector did well during 2019, but it has been doing even better during the coronavirus outbreak. Nielsen data reveals total beer sales increased 14% for the week ending 3/14/20, as customers were increasing their stock of 24-can packs. According to a March 2020 survey from the Brewers Association, 90.9% of craft beer breweries said their businesses had been severely impacted because of the closure of their taprooms, which accounts for approximately one-third of all production volume.

Traditional Domestic Brands Battle Growing Competition As the beer market continues to fragment, and with the increasing popularity of craft, hard seltzer and FMB brands, total dollar sales for the domestic premium beer segment decreased 3.1%, and case sales 4.1%, for the 52 weeks ending 12/29/19. Total dollar sales were better for the sub-premium segment, increasing 1.2%, but case sales decreased -0.7%. Conversely, total dollar sales for the domestic super- premium segment increased 13.3%, and case sales +12.4%, during the same period. To combat the fragmentation of the beer market, the major companies are trying to diversify into more popular alcoholic beverages, which has resulted in them damaging their traditional brands growth.

Imports Remain Very Popular Dollar sales for the import-beer segment increased 6.1%, and case sales 4.3%, for the 52 weeks ending 12/29/19. Industry analysts expect the segment to increase sales through 2025 and at a higher rate than the total beer market. The varying styles and flavors that reflect where they are brewed are the primary factors generating strong consumer appeal for imports, plus the marketing of import brands elicit emotional connections and imagery associated with their locales and/or culture. The only slightly negative trend is Mexican brands are primarily responsible for the current increase of import sales. Nielsen data reveals total Mexican off-premise sales increased 9.4%, compared to 6.6% for all imports for the 52 weeks ending 12/28/19.

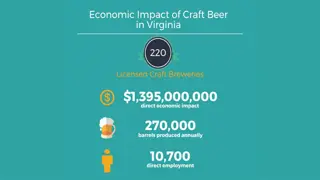

Craft Beers Hit a Speed Bump Craft beer brands have performed so spectacularly for so long that the current reduction of sales from double to single digits may indicate the arrival of the segment s maturation period, which means its novelty has evolved into a norm, plus there is more competition. Consumers increasing focus on health and wellness may also be contributing to a slowing of craft beer sales. These brands typically include more calories per serving and the increasing number of healthier alternatives, such as hard seltzer, are additional competitive pressures. The segment still generated a positive dollar sales increase for the 52 weeks ending 12/29/19, or +2.8%, to a total of $4.34 billion. Case sales increased 2% to 114.4 million.

A Sales Surge for Flavored Malt Beverages FMBs, or flavored malt beverages, vaulted into the limelight of the beer market during 2019, as dollar sales increased 43.1% to $3.9 billion, and case sales 41.8% to 119.2 million, for the 52 weeks ending 12/29/19. FMBs have become a popular choice among consumers who want more health and wellness from their beverages, with hard seltzers, specifically, leading the pack with their reduced calories and driven by White Claw Hard Seltzer s 330% dollar sales increase for 2019. Industry analysts expect hard tea, hard kombucha and hard coffees to generate more significant increases. Dollar sales for the hard-tea sub-segment increased 13.1%, and hard kombucha 68.7%, during the same 52-week period of 2019.

Advertising Strategies Food and beverages stores that are opened during the pandemic are having no trouble selling beer, but some of their marketing messages should reassure consumers of the supply and there will be plenty despite increasing consumption and demand. As some states begin to open, bars, nightclubs other establishments in the on-premise alcohol beverages sector will want to initiate ad campaigns to announce when they are opening and promote some kind of Welcome Back special offer. Consider partnering with one or more other retailers selling beer to provide first responders, hospital personnel and others on the frontline of the pandemic fight with a free six- pack once a week.

New Media Strategies Short videos posted to social media are also excellent message formats to announce the reopening of bars, nightclubs, etc., but those messages should also clearly explain new safety policies because of the pandemic. Offer free face masks at the door. Employees might have fun creating and posting short videos of themselves portraying one of the consumer beer portraits on page 4 of the Profiler. The table could also be posted, and then ask visitors to create and post their videos as The Surfer or The Cool Cigar Guy. Bars, nightclubs, etc. can ask patrons to dress in over-the- top protective garments/gear to fight the pandemic. Host a contest that first night (or during an entire week) and have everyone vote for the best. Post photos and videos on social media to regenerate interest.