The Impact of Retiree Health Costs on Medicare and Medicaid Programs

This content discusses how retiree health costs affect individuals and government programs, specifically focusing on the rising Medicare and Medicaid spending projections. It highlights the challenges posed by out-of-pocket expenses for retirees and the gaps in Medicare coverage that contribute to high healthcare costs. The aging population is also a key factor driving up per capita Medicare and Medicaid costs over time.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Health Costs and Retirement Security for Older Americans: A Balancing Act August 3, 2017 How Do Retiree Health Costs Affect People and Programs? Annual Meeting of the Retirement Research Consortium Tricia Neuman, Sc.D. Director, Program on Medicare Policy, Kaiser Family Foundation TNeuman@kff.org | @tricia_neuman

Exhibit 1 Figure 2 Affordability: A Balancing Act Retirees: Out-of-pocket spending Federal and State Budgets: Medicare and Medicaid

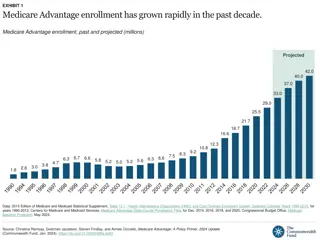

Exhibit 2 Figure 3 Medicare spending is projected to rise as a share of the federal budget and overall economy $1,159 Actual Net Outlays (in billions) Projected Net Outlays (in billions) $1,079 $996 $847$872$895 $446$480$466$492$505$540$588 $590$584$648$698$754 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 % of: Federal Outlays 14.6 15.3 14.7 17.1 17.5 12.9 13.3 13.2 14.2 14.4 14.3 14.8 15.1 15.4 16.3 16.1 15.9 16.7 3.2 4.1 3.0 3.1 2.9 3.0 2.9 3.0 3.1 2.9 3.1 3.3 3.4 3.7 3.6 3.6 3.8 4.0 GDP NOTE: All amounts are for federal fiscal years; amounts are in billions and consist of mandatory Medicare spending minus income from premiums and other offsetting receipts. SOURCE: Congressional Budget Office, An Update to the Budget and Economic Outlook, 2017 to 2027 (June 2017).

Exhibit 3 Figure 4 The aging of the population will contribute to higher per capita Medicare and Medicaid costs over time Medicaid Spending per Enrollee (FY2011) Medicare Spending per Enrollee (2011) $28,681 $17,619 $14,152 $11,949 $11,339 $7,333 Ages 65-74 Ages 75-84 Ages 85+ Ages 66-74* Ages 75-84 Ages 85+ NOTE: *The estimate for 65-year olds with Medicare is excluded because it includes beneficiaries enrolled for less than a full year. SOURCE: (Medicare) KFF analysis of a five percent sample of Medicare claims from the CMS Chronic Condition Data Warehouse, 2011; (Medicaid) KFF and Urban Institute estimates based on data from FY2011 MSIS and CMS-64 reports.

Exhibit 4 Figure 5 Gaps in the Medicare benefit package contribute to relatively high out-of-pocket costs NO limit on out-of-pocket expenses in traditional Medicare NO hard cap on Medicare Part D OOP spending NO long-term care benefit (covers post-acute SNF and home health services) NO routine eye exams or eyeglasses NO dental services or dentures NO hearing aids

Exhibit 5 Figure 6 Medicare beneficiaries pay more out-of-pocket for health care as a share of household expenses than non-Medicare households Medicare Household Spending Non-Medicare Household Spending Transportation Transportation $9,479 17% Health Care $5,277 15% $3,511 7% Housing $17,855 33% Housing $12,468 35% Health Care $5,342 15% Food $8,070 15% Food $5,400 15% Other $15,316 28% Other $7,593 21% Average Household Spending = $36,080 Average Household Spending = $54,232 SOURCE: Kaiser Family Foundation analysis of the Bureau of Labor Statistics Consumer Expenditure Survey, 2014.

Exhibit 6 Figure 7 Average out-of-pocket health spending for Medicare beneficiaries rises with age and is higher for women than men Average out-of-pocket health spending, 2013: $11,223 $12,000 $10,000 $8,000 $6,279 $6,244 $5,817 $5,295 $6,000 $4,936 $4,000 $2,000 $0 Average Total 65-74 75-84 85+ Men Women NOTE: Analysis excludes beneficiaries enrolled in Medicare Advantage plans. Premiums includes Medicare Parts A, B, D, and other types of health insurance beneficiaries may have. SOURCE: Kaiser Family Foundation analysis of the Medicare Current Beneficiary Survey 2013 Cost and Use file.

Exhibit 7 Figure 8 Figure 1 Half of all Medicare beneficiaries live on incomes below $26,200 per person (2016) 1% had incomes above $182,900 5%had incomes above $103,450 50% had incomes below $26,200 25% had incomes below $15,250 SOURCE: Kaiser Family Foundation, Income and Assets of Medicare Beneficiaries, 2016-2035, April 2017.

Exhibit 9 Figure 9 Numerous policy proposals on the table that could impact health costs and retirement security for retirees Medicare: Raise age of Medicare eligibility Premium support Changes in benefits and cost-sharing Restrictions on supplemental coverage More income-relating of premiums Medicaid: Per capita caps More flexibility for states; other changes (by waiver)

Exhibit 9 Figure 10 This analysis makes an important contribution Key take away: the average retiree loses a substantial share of his or her Social Security income to health expenses With health costs projected to rise more rapidly than Social Security income, these trends are likely to continue and worsen over time, even in the absence of policy changes In some ways, this analysis overstates the financial burden because by focusing on Social Security income, not total income But at the same time, it greatly understates the financial burden by excluding out-of-pocket costs for long-term care.

Exhibit 11 Medicare Resources on KFF.org The Facts on Medicare Spending and Financing How Much Is Enough? Out-of-Pocket Spending Among Medicare Beneficiaries: A Chartbook It Pays to Shop: Variation in Out-of-Pocket Costs for Medicare Part D Enrollees in 2016 Medicare Spending at the End of Life: A Snapshot of Beneficiaries Who Died in 2014 and the Cost of Their Care The Rising Cost of Living Longer: Analysis of Medicare Spending by Age for Beneficiaries in Traditional Medicare For more information, visit kff.org/medicare