Navigating Medicare: Your Rights and Options

Understand the ins and outs of Medicare, your entitlements, and how to cover out-of-pocket costs. Learn about the basics of Medicare, your enrollment options, and the importance of timely enrollment. Discover the four parts of Medicare and the role of Medigap insurance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

UNDERSTANDING MEDICARE, YOUR RIGHTS & OPTIONS Educational Presentation We are not connected with the U.S government, federal Medicare program, social security or any other government agency REV 12/2021

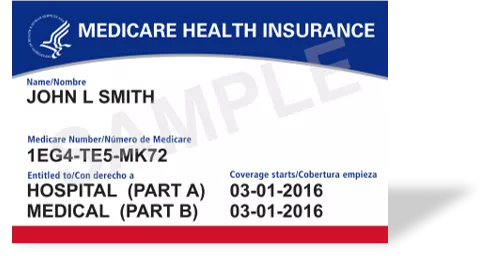

AGENT/PRODUCER NAME Licensed Insurance Agent PHONE NUMBER 1-999-999-9999 [INSERT PHOTO HERE] EMAIL agent@myemail.com REV 12/2021

UNDERSTANDING MEDICARE AND YOUR CHOICES In this presentation you will learn: The Basics of Medicare and How it Works Your Entitlements According to Federal Law Your Rights, Options, and Choices How to Cover Out of Pocket Costs When and How to Enroll We will help you navigate the confusing maze and unravel the mysteries of Medicare. REV 12/2021

WHAT IS MEDICARE? A federal health insurance program enacted by Congress in July of 1965 (under the Social Security Act) to provide health insurance for people 65 and older Also, for people under 65 with certain disabilities For people of any age with End-Stage Renal Disease (ESRD) or permanent kidney failure requiring dialysis or kidney transplant Source: Medicare and You book www.medicare.gov/medicare-and-you/medicare-and-you.html REV 12/2021

MEDICARE FACTS What is the Reality? Most people turning 65 must enroll into Original Medicare A&B Since 1965, all U.S employees, employers and self-employed workers have paid payroll taxes on earned income to fund Medicare Even if you have job-based coverage and plan to keep it, you may not be eligible to delay your enrollment into Medicare If you are required to enroll when you turn 65 and do not take action, you may face increasing late enrollment penalties Penalties are not one-time fees, and they increase the longer you wait to sign up. In some cases, you pay them monthly for life Source: What Does Medicare Cost https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/what-does-medicare-cost REV 12/2021 For Illustrative Purposes Only

THE 4 PARTS OF MEDICARE & MEDIGAP + Usually Includes PART A PART B PART C PART D Hospital Insurance Medical Insurance Medicare Advantage Insurance Company Prescription Drug Coverage Insurance Company Federal Federal Medigap (Medicare Supplement) Insurance Company REV 12/2021

Hospitalization Days You Pay MEDICARE PART A $1,600/benefit period Part A Deductible $400/day $800/day 100% 1 60 61 - 90 91 150 151+ HOSPITAL INSURANCE Part A helps cover costs with For 2023, most Part A premiums start at $0/month You Pay Skilled Nursing Confinement Must enter Medicare approved facility within 30 days of 3-day inpatient hospital stay 1 - 20 21 - 100 101+ Inpatient Hospital Stay Skilled Nursing Blood Hospice $0 $200/day 100% Blood Pints 1 - 3 3+ You Pay 100% $0 Hospice (Certified Terminal) No cost for hospice care 5% inpatient respite care Source: Medicare and You book www.medicare.gov/medicare-and-you/medicare-and-you.html REV 12/2021

Covered Services You Pay MEDICARE PART B Part B Deductible $226/annual Medical Expenses Outpatient Hospital Services Excess Doctor Charges Clinical Lab Services 20% MEDICAL INSURANCE 20% or more + Additional Hospital Costs Part B helps cover costs with For 2023, most Part B premiums start at $164.90/month All COSTS Physician Services Outpatient Care Tests & Supplies $0 Nothing for Care 20% For Durable Medical Equipment 100% pints 1 - 3 20% pints 3+ Home Healthcare Blood Source: Medicare and You book www.medicare.gov/medicare-and-you/medicare-and-you.html REV 12/2021

PART A & B: FREEDOM TO CHOOSE PROVIDERS! NO NETWORKS! NATIONWIDE COVERAGE REV 12/2021

WHY IS NATIONWIDE COVERAGE IMPORTANT? Any doctor Any hospital Any specialist No referral needed to see a specialist REV 12/2021

PREMIUM FREE PART A INITIAL ENROLLMENT PERIOD For those who qualify for Premium Free Part A Premium Free Part A: : For those who qualify for 3 months prior to 65th birthday Birthday Month 3 months after 65th birthday 1 1 1 1 3 3 2 2 2 2 3 3 Coverage begins month Coverage begins month of 65 of 65th th birthday birthday REV 12/2021

PREMIUM PART A & PART B INITIAL ENROLLMENT PERIOD For premium premium- -Part A Part A as well as as well as Part B Part B: : For The month you turn 65, or during the 3 months after 3 months prior to 65th birthday 1 1 1 1 3 3 2 2 2 2 3 3 Coverage begins the next Coverage begins the next month month Coverage begins your Coverage begins your birthday month birthday month REV 12/2021

HOW TO ENROLL IN ORIGINAL MEDICARE PARTS A & B Ways to Apply: Online by visiting the Social Security website By phone by calling Social Security Or in person by visiting your local Social Security office IMPORTANT: Social Security cannot give advice on your options You need to decide before applying if you are going to take Social Security income, or only apply for Medicare and defer SS REV 12/2021

POTENTIAL A & B COSTS AT A GLANCE There s no yearly limit on what you pay out-of-pocket + $50,000 Outpatient & Medical Expenses* 150 Day Hospitalization* $60,000 $10,000 $40,000 $5,000 $20,000 $0 $0 Medicare Part A Days 61 - 90 Medicare Part B 20% Coinsurance Days 1 - 60 Days 91 - 150 Part B Deductible *Hypothetical Example for illustrative purposes only. Medicare costs can change annually, and actual costs could be higher or less than what is shown. REV 12/2021

2 MAIN WAYS TO HELP COVER MEDICARE COVERAGE GAPS + PART B PART A Usually Includes Medigap (Medicare Supplement) + PART C Insurance Company + Medicare Advantage Insurance Company Part D (Prescription Drug Coverage) Insurance Company REV 12/2021

PART C & MEDIGAP SIDE-BY-SIDE HELPS COVER: OUT-OF-POCKET EXPENSES DEDUCTIBLES COINSURANCE Original Medicare + Medigap Medicare Advantage (Part C) Freedom to choose providers/hospitals. May need to use in-network providers/hospitals No referrals needed to see a specialist May need a referral to see a specialist Benefits are standardized only difference is price Benefits vary by plan and can change annually Guaranteed renewable if premiums are paid Carrier can cancel plan at anytime Must purchase drug coverage separately Usually includes built-in drug coverage REV 12/2021

Most plans have a premium that you pay in addition to the Part B Premium PRESCRIPTION DRUG PLANS You also pay costs when you get prescriptions through deductibles, co-pays and coinsurance PART D Avoid the penalty If your job-based drug coverage isn t considered creditable drug coverage, you may pay a monthly Part D penalty if you don t join a Medicare drug plan within 63 days of getting Medicare. The penalty is lifetime and increases the longer you wait to join a plan. Contact your plan to see if your coverage is creditable. REV 12/2021

Original Medicare Late Enrollment Penalties PART A PART D PART B 10% penalty applied to monthly premium 10% penalty for each 12-month period, applied to monthly premium 1% penalty per month, based on the national base beneficiary premium You will have to pay the penalty for twice the numbers of years you were eligible You will have to pay the penalty monthly for life You will have to pay the penalty for life REV 12/2021

WHO IS ELIGIBLE TO DELAY A & B ENROLLMENT? Insurance from job or spouse's job Insurance from family member's job (Disability and ALS only) Tri Care 1 19 Employees * 20+ 1 99 Employees 100+ Active Duty Retired Veteran Employees Employees Even if you re eligible to delay A & B, your plan also needs to have what s known as creditable drug coverage to delay your Part D enrollment without penalty. *Because the company has less than 20 employees, your job-based coverage might not pay for health services if you don t have Medicare Parts A & B. Check with your employer to verify how your current plan works with Medicare. REV 12/2021

ELIGIBLE TO DELAY A & B ENROLLMENT? Avoid Potential Penalties and Unnecessary Costs You must sign up within 8 months of when you or your spouse stop working to qualify for a Special Enrollment Period and avoid any ongoing penalties, even if you are offered COBRA If you are eligible to delay enrollment, it does not guarantee that your current plan is cheaper or better REMEMBER: Penalties are not one-time fees, and they increase the longer you wait to sign up. In some cases, you pay them monthly for life Source: What Does Medicare Cost https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/what-does-medicare-cost REV 12/2021 For Illustrative Purposes Only

IMPORTANT QUESTIONS TO ASK YOURSELF IN CHOOSING YOUR MEDICARE OPTIONS: Is my group health plan cheaper and better than my options through Medicare? How is my health and what will it be like in the future? Do I want freedom and flexibility in my plan? Can I choose any doctor or hospital in the USA?* What is the experience and rating of the company? What is the plans rate and benefit stability? What is the level of customer service I will receive? *That accepts Medicare REV 12/2021

QUICK RECAP If you do not have employer coverage through you or your spouse's employer with 20 or more employees, you must enroll in Parts A, B & D by your 65th birthday Original Medicare only covers up to 80% of medical costs with no out-of-pocket limits. Medicare Advantage (Part C), Medigap and employer coverages are the most common ways of covering the 20% Medicare does not cover, as well as adding out of pocket limits Failure to take action by your specific enrollment deadline can result in late enrollment penalties, which in some cases are paid monthly for life REV 12/2021

No Cost Assistance We Help You: Determine YOUR Specific Enrollment Deadlines Walk you through how to enroll into Medicare, Social Security, or both Compare your options to cover the 20% that Medicare does not cover All participants who would like further assistance are invited to schedule an appointment with us There are no costs for our services REV 12/2021

The purpose of this communication is the solicitation of insurance. We are not connected with, endorsed by, or sponsored by the U.S. Government, federal Medicare program, Social Security Administration, or the Department of Health and Human Services. Policies and benefits may vary by state and have some limitations and exclusions. Some states require these plans be available to persons under age 65 eligible for Medicare due to disability or End Stage Renal disease (ESRD). You may be contacted by an Agent. A licensed Agent will provide additional information upon request. REV 12/2021