The Enforceability of Taxpayer Bill of Rights (TBOR)

Explore the enforceability of the Taxpayer Bill of Rights (TBOR) as outlined in IRC 7803(a)(3), delving into its history, statutory interpretation, the question of remedy, and enforcement issues. Discover the evolution of TBOR, statutory text, and challenges surrounding its enforcement.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Is the TBOR Enforceable? Leandra Lederman William W. Oliver Professor of Tax Law Taxpayer Rights Symposium, Temple Law Review Oct. 26, 2018

Structure of the Talk A quick history of the TBOR The language of IRC 7803 The question of remedy Can we infer a private right of action? A right to an appeal? 2

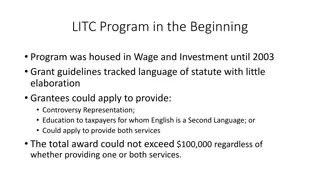

History of the TBOR: Highlights 2007: The NTA s annual report to Congress proposed a TBOR, listing taxpayer rights & responsibilities. 2011: The NTA called for it again & provided a list of statutes & IRS guidance related to each right/responsibility. 2013: The NTA listed as the #1 most serious problem that the IRS Should Adopt a Taxpayer Bill of Rights. 2014: IRS adopted a TBOR; NTA called again for codification. 2015: Congress codified the TBOR. 2017: NTA called for Congress to make the TBOR IRC 1. 4

The Statutes Text & Structure 5

The Statute: IRC 7803(a)(3) 26 U.S. Code 7803 - Commissioner of Internal Revenue; other officials (a) COMMISSIONEROF INTERNAL REVENUE .... (2) DUTIESThe Commissioner shall have such duties and powers as the Secretary may prescribe . (3) EXECUTIONOFDUTIESINACCORDWITHTAXPAYERRIGHTSIn discharging his duties, the Commissioner shall ensure that employees of the Internal Revenue Service are familiar with and act in accord with taxpayer rights as afforded by other provisions of this title, including (A) the right to be informed, (B) the right to quality service, (C) the right to pay no more than the correct amount of tax, (D) the right to challenge the position of the Internal Revenue Service and be heard, (E) the right to appeal a decision of the Internal Revenue Service in an independent forum, (F) the right to finality, (G) the right to privacy, (H) the right to confidentiality, (I) the right to retain representation, and (J) the right to a fair and just tax system. (4) CONSULTATIONWITH BOARDThe Commissioner shall consult with the Oversight Board on all matters set forth in paragraphs (2) and (3) .... 6

Enforcement Issues The statute seems to be phrased in mandatory terms: In discharging his duties, the Commissioner shall.... But no enforcement mechanism is provided in the statute. 9

Enforcement Issues: A Contrast We can contrast the TBOR with another statute, the Ten Deadly Sins (in RRA 98): Subject to subsection (c), the Commissioner of Internal Revenue shall terminate the employment of any employee of the Internal Revenue Service if there is a final administrative or judicial determination that such employee committed any act or omission described under subsection (b) in the performance of the employee s official duties. * *10 acts and omissions are listed in subsection (b). 10

Enforcement Issues: Another Contrast We can also contrast it with a statute that eliminates a particular remedy, IRC 7522(a): Any notice to which this section applies shall describe the basis for, and identify the amounts (if any) of, the tax due, interest, additional amounts, additions to the tax, and assessable penalties included in such notice. An inadequate description under the preceding sentence shall not invalidate such notice. Eliminating one remedy, as in IRC 7522(a), could imply that others are available. IRC 7803(a)(3) is simply silent regarding enforcement. 11

Who Can Enforce It? In discharging his duties, the Commissioner shall ensure that employees of the Internal Revenue Service [1] are familiar with and[2] act in accord with taxpayer rights as afforded by other provisions of this title . [1] = The Commissioner must provide some kind of training regarding such rights? & [2] = The Commissioner must punish employees who don t act in accord with such rights? In other words, is the statute referring to agency enforcement? OR Is there is a private right of action? Can we infer a private right of action in section 7803(a)(3)? 13

Inferring A Private Right of Action (1/2) Cort v. Ash, 422 U.S. 66 (1975), set forth 4 factors regarding when to infer a private remedy: 1) Does the statute create a federal right in favor of plaintiff ? 2) Is there an indication of legislative intent, explicit or implicit, to create such a remedy or deny one? 3) Is it consistent with the underlying purposes of the legislative scheme to imply such a remedy for the plaintiff? 4) Is the cause of action traditionally one relegated to state law ? 14

Inferring A Private Right of Action (2/2) Post-Cort v. Ash pushback: Textualism: if the statute doesn t specify a private right of action, there is none. Public choice analysis: Don t undermine the legislative deal. Case law focuses primarily on legislative intent. E.g.: Thompson v. Thompson (1988): Unless congressional intent can be inferred from the language of the statute, the statutory structure, or some other source, the essential predicate for implication of a private remedy simply does not exist. Alexander v. Sandoval (2001): Statutory intent on this latter point [(private remedy)] is determinative. Ziglar v. Abbasi (2017): If the statute itself does not displa[y] an intent to create a private remedy, then a cause of action does not exist and courts may not create one, no matter how desirable that might be as a policy matter, or how compatible with the statute. (quoting Alexander v. Sandoval (2001)) (dicta). 15

Looking Elsewhere in Title 26 Here s an example of a right in section 7803(a)(3) that has a private right of action elsewhere in the Code: In discharging his duties, the Commissioner shall ensure that employees of the Internal Revenue Service are familiar with and act in accord with taxpayer rights as afforded by other provisions of this title, including . (H) the right to confidentiality . I.R.C. 6103(a): Returns and return information shall be confidential . I. I.R.C. 7431(a)(1): If any officer or employee of the United States knowingly, or by reason of negligence, inspects or discloses any return or return information with respect to a taxpayer in violation of any provision of section 6103, such taxpayer may bring a civil action for damages against the United States in a district court of the United States. 16

What Would Be Enforced? (1/2) In discharging his duties, the Commissioner shall ensure that employees of the Internal Revenue Service are familiar with and act in accord with taxpayer rights as afforded by other provisions of this title, including . Are all of the items listed actually afforded elsewhere in Title 26? (A) the right to be informed, (B) the right to quality service, (C) the right to pay no more than the correct amount of tax, (D) the right to challenge the position of the Internal Revenue ..Service and be heard, (E) the right to appeal a decision of the Internal Revenue Service in .an independent forum, (F) the right to finality, (G) the right to privacy, (H) the right to confidentiality, (I) the right to retain representation, and (J) the right to a fair and just tax system. 17

What Would Be Enforced? (2/2) In discharging his duties, the Commissioner shall ensure that employees of the Internal Revenue Service are familiar with and act in accord with taxpayer rights as afforded by other provisions of this title, including (E) the right to appeal a decision of the Internal Revenue Service in an independent forum . What is the right to appeal a decision of the [IRS] in an independent forum afforded by Title 26? 18

The Right on the IRSs Website The Right to Appeal an IRS Decision in an Independent Forum Taxpayers are entitled to a fair and impartial administrative appeal of most IRS decisions, including many penalties, and have the right to receive a written response regarding the Office of Appeals decision. Taxpayers generally have the right to take their cases to court. (Emphasis added.) Source: https://www.irs.gov/taxpayer-bill-of-rights#appeal 19

The Facebook Decision Facebook, Inc. & Subs.v. IRS (N.D. Calif. 2018). Suit under APA to provide an IRS appeal. Court held for IRS. IRC 7803(a)(3) does not give taxpayers legally enforceable rights. Even if it did, the independent forum could be the U.S. Tax Court, in which Facebook was already litigating. In my view, Facebook was correctly decided. It is also in line with the idea that TBOR did not create new rights or a private right of action. 20

Thank you! 21