Retirement Savings Strategies & Compound Interest Growth

Explore retirement savings strategies, the power of compounding, and how saving consistently over time can significantly grow your nest egg. Learn about the benefits of long-term investing and the potential impact on your financial future as you plan for retirement. Take charge of your financial well-being today and start building a secure future for yourself.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Advisor Firm Logo Here RETIREMENT SAVINGS STRATEGIES Client logo placeholder Add Rep Name Here

TERMS OF USE By using this presentation, you understand and agree to the following: You understand that T. Rowe Price does not undertake to give investment advice in a fiduciary capacity by making available this presentation and that T. Rowe Price Associates, Inc. and/or its affiliates ( T. Rowe Price ) may receive revenue from products and services made available by T. Rowe Price, including investment management, servicing, or other fees related to making available and/or servicing certain investments on its recordkeeping platform. To the extent you modify this presentation you will not attribute this presentation to T. Rowe Price through co-branding or otherwise. To the extent you provide investment recommendations to clients or prospective clients, you will not attribute any such recommendation(s) to T. Rowe Price. You are responsible for satisfying all applicable regulatory standards relating to this communication s use by your firm, including all applicable content, approval, recordkeeping, and filing requirements. As long as you agree to these terms, T. Rowe Price grants you a limited, personal, nontransferable, nonsublicensable, revocable, non-exclusive license to use this presentation in its entirety and only in the manner expressly permitted by T. Rowe Price. Please insert your data/content where indicated and delete these terms of use and various instructions throughout the PPT before using.

This presentation has been prepared by [Add Firm Name Here] for general education and informational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide fiduciary recommendations concerning investments or investment management; it is not individualized to the needs of any specific benefit plan or retirement investor, nor is it directed to any recipient in connection with a specific investment or investment management decision. Any tax-related discussion contained in this presentation, including any attachments, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or professional tax advisor regarding any legal or tax issues raised in this presentation.

WHY ARE WE HERE? YOUR SAVINGS TODAY BECOMES YOUR INCOME IN RETIREMENT. ACCUMULATION DISTRIBUTION Retirement Today

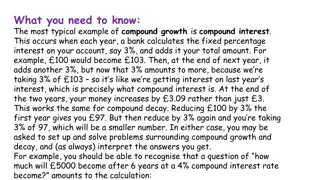

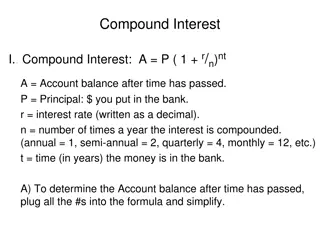

COMPOUNDING COMPOUNDED SAVINGS OVER 45 YEARS SAVING $500 PER MONTH Account Value at Age 65 Years of Saving $918,000 10 years no contributions $861,000 no contributions 35 years $1,779,000 45 years 30 Age 20 65 This chart is for illustrative purposes only and is not meant to represent the performance of any specific investment option. Final account balances are rounded to the nearest thousand. Assumes $500 invested each month in a tax-deferred account and a 7% annual rate of return for a hypothetical investor from age 20 to age 65. The Account Value at age 65 is tax-deferred, and contributions and earnings are subject to taxes upon withdrawal. All investments involve risk, including possible loss of principal.

PLAN FEATURES Plan Eligibility You are eligible to participate in the plan [plan-specific detail] Contribution Limits Contribution Types Company Contributions Vesting Schedule

PLAN FEATURES Plan Eligibility You can contribute: Between [xx%] and [xx%] of your pay to your plan Contribution Limits Up to the IRS limit: $19,500 for 2020 Contribution Types Up to an additional $6,500 if you will be age 50 or over by the end of the year and contribute the maximum allowed by your plan Company Contributions Vesting Schedule These limits exclude any after-tax (non-Roth) contribution limits discussed on next slide.

PLAN FEATURES Plan Eligibility You can make before-tax [and/or Roth and/or after-tax] contributions to the plan Contribution Limits Contribution Types Company Contributions Vesting Schedule

PLAN FEATURES For slide variations, see the Plan Features presentation. Company Contribution: [Describe the company match here] Plan Eligibility Contribution Limits [Contribution type] Years of service [xx%] [xx years] Contribution Types [xx%] [xx years] [further plan-specific detail on contribution type] Company Contributions Vesting Schedule

PLAN FEATURES For slide variations, see the Plan Features presentation. Plan Eligibility Company Contribution: Vested percentage [xx%] [xx%] [xx%] [xx%] [xx%] Years of service [xx years] [xx years] [xx years] [xx years] [xx years] Contribution Limits Contribution Types Company Contributions You are always 100% vested in the salary deferral portion of your account. Vesting Schedule

RETIREMENT SAVINGS: How do I get there? 15%* SALARY Investors should strive to SAVE6% Consider increasing contributions by 2% gradually to build toward 15% target AT LEAST *including company match 11

ANNUAL CONTRIBUTION INCREASES Multiple of Ending Salary Saved $2,500,000 12x 11x 10x $2,000,000 Amount Saved $1,500,000 7x 5x $759,014 $1,000,000 $500,000 $- 25 30 35 40 45 50 55 60 65 $333,432 Age Age 25, 6% steady contributions Age 30, 15% steady contributions Age 40, 15% steady contributions Age 25, 6% with 1% increases until 15% Age 30, 6% with 2% increases until 15% Assumptions: Examples beginning at age 25 assume a beginning salary of $40,000 escalated 5% a year to age 45 then 3% a year to age 65. Examples beginning at age 30 assume a beginning salary of $50,000 escalated 5% a year to age 45 then 3% a year to age 65. Example beginning at age 40 assumes a beginning salary of $80,000 escalated 5% a year to age 45 then 3% a year to age 65. This example is for illustrative purposes only and is not meant to represent the performance of any specific investment option. The assumptions used may not reflect actual market conditions or your specific circumstances, and do not account for plan or IRS limits. Please be sure to take all of your assets, income, and investments into consideration in assessing your retirement savings adequacy. 12

PLAN FEATURES: INVESTMENT OPTIONS Stock Mutual Funds/Trusts [xx] Bond Mutual Funds/Trusts Money Market Funds/ Stable Value Trusts Age-Based Investments

PLAN FEATURES: INVESTMENT OPTIONS Stock Mutual Funds/Trusts [xx] Bond Mutual Funds/Trusts Money Market Funds/ Stable Value Trusts Age-Based Investments

PLAN FEATURES: INVESTMENT OPTIONS Stock Mutual Funds/Trusts [xx] Bond Mutual Funds/Trusts Money Market Funds/ Stable Value Trusts Age-Based Investments

PLAN FEATURES: INVESTMENT OPTIONS Stock Mutual Funds/Trusts [xx] Bond Mutual Funds/Trusts Money Market Funds/ Stable Value Trusts Age-Based Investments

PLAN FEATURES: INVESTMENT OPTIONS [xx] Stock Mutual Funds/Trusts Fill in website address where participants can obtain additional information [xx] FURTHER DETAIL AT website address Bond Mutual Funds/Trusts [xx] Current list of investment options Money Market Funds/ Stable Value Trusts Performance information Morningstar fund fact sheets Add/delete based on what participant can find at the website listed above [xx] Age-Based Investments All investments involve risk, including possible loss of principal.

Asset Allocation 90% 100% Stocks 90% 100% Stocks 80% 100% Stocks Age: 20s Age: 30s Age: 40s 0% 10% Bonds 0% 10% Bonds 0% 20% Bonds 45%-65% Stocks 30%-50% Stocks 65%-85% Stocks 30%-50% Bonds 40%-60% Bonds Age: 70s and over Age: 50s Age: 60s 15%-35% Bonds 0%-10% Money Market/Stable Value 0%-20% Money Market/Stable Value Stocks Bonds Money Market/Stable Value The allocations are age-based only. Depending on your risk tolerance, time horizon, and financial situation, you may need to make adjustments. Diversification cannot assure a profit or protect against loss in a declining market. 18 CCON0048675

ASSET ALLOCATION ASSUMPTIONS ASSET ALLOCATION ASSUMPTIONS Our asset allocation models are designed to meet the needs of a hypothetical investor with an assumed age 65 retirement and a withdrawal horizon of 30 years. The model allocations are based upon an analysis that seeks to balance long term return potential with anticipated short term volatility. The model reflects our view of appropriate levels of tradeoff between potential return and short term volatility for investors of certain age ranges. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash. Limitations: While the models have been designed with reasonable assumptions and methods, the tool provides hypothetical models only and has certain limitations. The models do not take into account individual circumstances or preferences, and the model displayed for your age may not align with your accumulation timeframe, withdrawal horizon, or view of the appropriate levels of tradeoff between potential return and short-term volatility. Investing consistent with a model allocation does not protect against losses or guarantee future results. Please be sure to take other assets, income and investments into consideration in reviewing results that do not incorporate that information. Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different outcomes.

PLAN FEATURES For slide variations, see the Plan Features presentation. Under specific circumstances, you have access to your vested account balance Withdrawals Loans Beneficiaries

PLAN FEATURES For slide variations, see the Plan Features presentation. You have the option to borrow from your vested account balance Withdrawals Loans Beneficiaries

PLAN FEATURES For slide variations, see the Plan Features presentation. In the event of your death, your designated beneficiaries will inherit your account Withdrawals Loans Beneficiaries

MONITOR YOUR ACCOUNT ONLINE Please add in any graphics you think are appropriate, like images of participant websites or account summaries: Quickly view and access accounts and balances Perform transactions Check in on your progress toward retirement Research investments Log in wherever you are, whatever your device (if that is true)

GETTING STARTED Add screen images of enrollment/sign-up process to show how easy it is to get started.

ITS YOUR FUTURE

SAVE ENOUGH FOR RETIREMENT

WERE HERE TO HELP

Add your logo, telephone number, email/website C13NWU3LW 202006-1202975

LINKED SLIDES These slides remain at the back of the presentation and can be linked from within the presentation (via gears) if the rep feels it s necessary to support their talking points

AUTO-ENROLL You are enrolled automatically into your employer's plan once you're eligible. You must give specific instructions to be excluded (opt out) during a specific grace period. You are enrolled with a default deferral percentage and investment option. You can change your contribution rate or investment at any time.

AUTO-REBALANCING Automatically rebalances your account to your selected investment allocation strategy. Lets you select quarterly, semiannual, or annual rebalancing. Helps you stay in line with your risk tolerance and helps reduce long- term account volatility. Diversification cannot assure a profit or protect against loss in a declining market.

AUTO-INCREASE Automatically increases your payroll deduction each year. Lets you choose the amount of the increase and the month you want it to occur.