Practical Aspects of Strike Off and Restoration of Companies by CS Ashish O. Lalpuria

This presentation discusses the practical aspects of striking off and restoring companies based on analysis of case laws from NCLT and NCLAT. It covers types of strike off, companies that cannot be struck off by ROC, and the process of strike off by the Registrar of Companies. Various scenarios and procedures are outlined, emphasizing the importance of compliance and legal obligations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

PRACTICAL ASPECTS OF STRIKE OFF AND RESTORATION OF COMPANIES By CS Ashish O. Lalpuria 1

Disclaimer The views expressed in this presentation are based on personal analysis of various Case Laws of NCLT and NCLAT. This presentation is for knowledge sharing and research purposes only. Any references made in this presentation are not meant to criticize any individual or authority either professionally or personally. 2

Types of Strike Off or Closing down of Companies By Registrar of Companies u/s 248(1) Suo-Moto u/s 248(2) By extinguishing all liabilities; Failed to commence business within one incorporation; Not carrying on any business or operation for a period of two immediately preceding FY; Not made any within two years for obtaining the status of company u/s 455; Failed to File Form INC-20A as per section 10A within 180 days of incorporation year of By special resolution or with consents from shareholders holding 75% of paid up share capital. application Provided Company to file overdue returns up to the end of the FY in which the company ceased to carry its business operations. (Amendment dated - May 10, 2019) a dormant 3

Companies that cannot be struck off by ROC u/s 248(1) Section 8 Companies or section 25 Companies under Old Act Listed Companies, Delisted Companies due to non compliance of listing regulations or any other statutory Laws Vanishing companies Companies where inspection or investigation is ordered or investigation are pending in any court Companies where notice u/s 206 or 207 has been issued by Registrar or Inspector and its notice is pending Companies whose application for compounding is pending before competent authority Companies whose public deposit are outstanding or default in repayment of the same Pending Charges for satisfaction Companies against which prosecution for offence is pending in any court 4

Process of Strike Off By the Registrar of Companies u/s 248(1) RoC sends a notice to the Company and the Directors of its intention to remove the name of the Company from the register of companies in Form STK-1 Company/Director may send representation to RoC within 30 DAYS from the date of receipt of the notice. After the expiry of the time mentioned in the notice, RoC may strike off the company unless cause to the contrary is shown by the company Notice will be issued by RoC and the same shall be published in Official Gazette and placed on the website of Ministry of Corporate Affairs to seek objection from public within 30 days from the date of Notice in FORM No. STK-5 If no objection is received from public, notice of striking off the name of the company and its dissolution will be published in Official Gazette and Official Website of MCA in FORM NO. STK 7 5

Procedure for Application of Strike Off u/s 248(2) by the Company NOC from regulators in case of following Companies By the Company Application in Form STK 2 Indemnity Bond by Directors in Form STK -3 Statement of Accounts not older than 30 days certified by CA. Affidavit by Directors in Form STK 4 Special Resolution or Consents Statement regarding pending litigations Filing fee of Rs. 10,000/- NBFC Housing Finance Companies Insurance Companies Capital Market Intermediaries Companies engaged in Collective Investment Scheme Assets Management Companies Any other Regulatory Authorities as may be required. 6

Process of Strike Off Application by Company u/s 248(2) Notice to be issued by ROC and the same shall be published in official Gazette and placed on the website of MCA to seek objection from public within 30 days from the date of the notice in FORM NO. STK 6 Letter of intimation to be issued by RoC to tax and other regulatory authorities. If no objection is received from public, notice of striking off the name of the company and its dissolution to be published in Official Gazette and Official Website of MCA. 7

Cases under which strike off application cannot be made u/s 248(2) Section 249 prescribes the cases under which application under section 248(2) cannot be made A Company cannot apply for strike off, if at anytime in the previous three months, the Company has: has changed its name has shifted registered office from one state to another has made disposal for value of property has filed an application to Tribunal for sanctioning of Compromise or Arrangement is being wound up under Chapter XX of the Act or under Insolvency and Bankruptcy Code, 2016 8

Effect of Strike Off (Section 250) Company stands dissolved and cease to operate Certificate of Incorporation as issued shall be deemed to have been cancelled Except for realisation of due and discharge of liabilities 9

Fraudulent removal of name by Company (Section 251) Where an Application has been made with an object to evade liabilities or with an intention to deceive creditors or defraud any person Management jointly and severally liable Punishable for fraud u/s 447 Additionally, ROC may recommend prosecution 10

Appeal to Tribunal for Restoration (Section 252) 252 (1) 252 (3) Any Company or Member or Creditor or Workman aggrieved by Order of ROC may appeal to the Tribunal before the expiry of Twenty years from the date of publication in Gazette Any person aggrieved by Order of ROC may file an appeal to the Tribunal within three years from the date of the Order of ROC. the Official ROC may also apply to Tribunal for restoration within three years if he is satisfied that name of struck off either inadvertently or upon incorrect furnished by Company/Directors. information 11

Requirements for Appeal Synopsis List of dates Application/Appeal in Form NCLT 9 Affidavit verifying Application/Appeal ROC Notice Reply to ROC notice, if any MOA & AOA Audited Balance Sheets for pending years Memorandum of Appearance Bank Statements Affidavit on Demonetization and Dormant Status Any Other supporting documents 12

DISQUALIFICATIONOF DIRECTOR & VACATIONOF OFFICEOF DIRECTOR SECTION 167 (1) SECTION 164(2) No person who is or has been a director of a company which The office of a director shall become vacant in case (a) has not filed financial statements or annual returns for any continuous period of three financial years; or (b) xxxxx (a) disqualifications in Section 164; he incurs any of specified the shall be eligible to be re-appointed as a director of that company or appointed in other company for a period of five years from the date on which the said company fails to do so. Provided that where a person is appointed as a director of a company which is in default of clause (a) or clause (b), he shall not incur the disqualification for a period of six months from the date of his appointment. Provided disqualification under sub-section (2) of Section 164, the office of the director shall become vacant in all the companies, other than the company which is in default under that sub- section. that where he incurs 13

1.Traveltime Cars India Private Limited v/s ROC, Pune CP No.3259/252(1)/NCLT/MAH/2018 The Company failed to file Financial Statements for 2015 & 2016. ROC struck off the name u/s 248(5). .1. Traveltime Cars NCLT.pdf An Appeal was preferred against the Order of NCLT before NCLAT. 1. Traveltime Cars NCLAT.pdf Section 248.pdf 14

Summary NCLT: Dismissed petition on grounds that Company did not carry on any business since the last few years. NCLAT: Allowed the appeal citing that ROC did not comply with Section 248 (6) and also the Company had a Fixed Deposit of Rs. 1.50 Crores amongst other assets and liabilities. IMPLICATIONS IN TERMS OF FILING FEES: Due to time taken in the filing and disposal of the appeal the Company had to bear an additional filing fees of Rs. 1,70,000/- . 15

Compliance of Section 248(6) before strike off by the Registrar of Companies The ROC before passing an Order for Strike Off shall satisfy himself that sufficient provision has been made for realisation of all amount due to the Company and for payment or discharge of the liabilities and obligations by the Company within a reasonable time and if necessary, obtain necessary undertakings from the managing director, director or other person in charge of the Management of the Company. [Section 248(6)] 16

2. Insuflex Industries Private Limited vs ROC, Pune CP No.1296/252/NCLT/MAH/2019 The Company failed to file Financial Statements from 2012 to 2016. ROC struck off the name u/s 248(5). 2. Insuflex vs ROC Pune NCLT.pdf An Appeal was preferred against the Order of NCLT before NCLAT. 2. Insuflex vs ROC Pune NCLAT.pdf 17

Summary NCLT: Dismissed petition on grounds that Company did not carry on any business since the last few years. NCLAT: Allowed the appeal citing that the appellant is having assets and liabilities and therefore it cannot be said that the Company is not carrying on business. IMPLICATIONS IN TERMS OF FILING FEES: Due to time taken in the filing and disposal of the appeal the Company had to bear an additional filing fees of Rs. 2,40,000/-. 18

3. Arihant Realties Pvt. Ltd. vs ROC, Pune (08/08/2018) Company Appeal (AT)No. 164 of 2018 The Company failed to file Financial Statements for 2015 & 2016. ROC struck off the name u/s 248(5). NCLT allowed the application subject to payment of cost of Rs. 5,00,000/-. An Appeal was preferred against the cost of Rs. 5,00,000/-. .3. Arihant Realties NCLAT.pdf 19

Summary NCLT: Allowed petition by imposing cost of Rs. 5,00,000/-. NCLAT: Allowed the appeal and set aside the cost levied by NCLT. IMPLICATIONS IN TERMS OF FILING FEES: Due to time taken in the filing and disposal of the appeal the Company was burdened with an additional filing fees of Rs. 1,90,000/-. 20

4. A. Venture Realtors Pvt Ltd Vs ROC Pune (08/10/18) CP NO: 2367/252/NCLT/MB/MAH/2018 The Company failed to file Financial Statements from 2007 to 2017. ROC struck off the name u/s 248(5). 4. A venture vs ROC pune NCLT.pdf An Appeal was preferred against the cost of Rs. 7,50,000/-. 4. A venture vs ROC pune NCLAT.pdf 21

Summary NCLT: Allowed the petition subject to payment of cost of Rs. 7,50,000/-. NCLAT: Allowed the appeal setting aside the cost of Rs. 7,50,000/- and observations made against the Company. IMPLICATIONS IN TERMS OF FILING FEES: Due to the proactive approach of the Company, it saved an amount of Rs. 1,54,000/-. 22

5.Leading Age Properties Private Limited v/s ROC, Mumbai CP No. 1958/252(1)/MB/C-IV/2019 The Company failed to file Financial Statements for 2016 & 2017. ROC struck off the name u/s 248(5). 5. Leading Age properties private Limited NCLT.pdf Despite having a deserving case, the Company till date has not preferred an appeal with NCLAT. 23

Whether CIRP can be initiated against a struck off Company 6.Hemang Phophalia vs The Greater Bombay Co-operative Bank (Penguin Umbrella Works Pvt Ltd.) [CA(AT)765 of 2019] GBCB filed an Petition u/s 7 of IBC Code for initiation of CIRP against Penguin Umbrella Works Pvt Ltd, which was struck off. The Petition was admitted by NCLT, Mumbai Bench. Hemang Phophalia, Director of the Company preferred an appeal against the Order of NCLT admitting the Company into CIRP. NCLAT after carefully analysing the provisions of section 248 to section 252 and section 60(1) of IBC held that it is open to the Adjudicating Authority to give such directions and make such provisions as deemed just for placing the name of the Company and all other persons in the same position nearly as may be as if the name of the Company had not been struck off from the Register of Companies .6. Hemang Phophalia.pdf NCLAT also held that CIRP can be initiated against a struck off Company and accordingly dismissed the appeal. 24

7. Elektrans Shipping Private Limited Vs ROC, Mumbai The Company failed to file Financial Statements from 2016 to 2018. ROC struck off the name u/s 248(5). CIRP was initiated against the Company. Resolution Professional filed petition for restoration of name of Company. 7. Elektrans Shipping NCLT.pdf An Appeal was preferred against the Order of NCLT. NCLAT after taking into consideration the decision made in Mr. Hemang Phophalia vs. The Greater Bombay Co-operative Bank Limited and Anr. - Company Appeal (AT) (Insolvency) No. 765 of 2019 dismissed the appeal. 7. Elektrans Shipping NCLAT.pdf 25

Revival Petition by Creditor u/s 252(3) Although it is now a settled proposition of law, that CIRP can be initiated against a Struck Off Company, any creditor can still press for restoration of name of the Company to avail of other remedies like: Summary Suit for recovery; and/or Civil Suit for recovery and damages 26

8. Ayoli Abdulla Vs ROC, Kerala (Meezan Realtors Pvt Ltd) Company Application No. 65/2019 The Company failed to file Financial Statements. ROC struck off the name u/s 248(5). An appeal was preferred before NCLT, Chennai Bench. NCLT allowed the restoration and also directed the ROC to waive off the additional fee for filing returns. 8. Meezan Realtors vs ROC Kerala NCLT.pdf An Appeal was preferred against the Order of NCLT by ROC, Kerala. 8. Meezan Realtors vs ROC Kerala NCLAT.pdf 27

Summary NCLT: Allowed the petition and waived the additional fees for filing Annual Returns. NCLAT: Allowed the appeal filed by ROC, Kerala stating that NCLT has no power to waive additional fees. IMPLICATIONS IN TERMS OF FILING FEES: Due to the time taken in the filing and disposal of the appeal filed by ROC Kerala, the Company was burdened with an additional filing fees of Rs. 3,30,000/-. 28

Oppression & Mismanagement and Strike Off 29

9. Chaitanya Manohar v/s All Square Realtors India Private Limited C.P. No. 52/2013 The petitioner filed a petition u/s 397 & 398 of the Companies Act, 1956 against the respondent company which was transferred from High Court to NCLT, Bengaluru Bench. The question which fell before the Bench was to decide whether the petition could be entertained inspite of the status of the Company being Strike Off. Chaitanya Manohar vs All Square Realtors.pdf 30

10. Shailesh N. Shah and Anr v/s Sun Shine Realtors Private Limited and Ors. CP No. 2870/252/NCLT/MB/C-IV/2019 The Company was under management dispute and did not file the returns since 2015 and was struck off by ROC. Shareholders applied for restoration of Company and filed petition before NCLT. 10. Sun Shine Realtors Private Limited.CP 2870 MB 2019.pdf NCLT ordered restoration on the condition of payment of cost and filing of returns. Instead of filing appeal, an application u/s 420 was made for rectification of Order. 10. Sunshine Realtors MA.pdf 10. Sun Shine Realtors Private Limited. MA 74 2020 in.pdf 31

Important Submission If your Lordship is not satisfied with our submissions, this Hon ble Bench may be pleased to pass detailed orders to enable us to evaluate further legal recourse. 32

11. Mausam Hotels Private Limited Vs ROC, Mumbai CP No. 1464/252(3)/MB/C-IV/2019 Company voluntarily applied for strike off and received letter of closure in Form STK-7. After the Company was struck off, the Company received a letter of allotment of land for development from MIDC. Company applied to NCLT for restoration citing unintentional filing of strike off application due to no business, however after the allotment of land for development, the Company decided to correct the unintentional mistake and applied for restoration. 11. Mausam Hotels Private Limited nclt.pdf 33

12. Dalmia Investments And Leasing Private Limited Vs ROC, Mumbai CP No. 1464/252(3)/MB/C-IV/2019 The name of the Company was struck off by the ROC, Mumbai. Company applied to NCLT for restoration of name pursuant to settlement of family dispute. 12. Dalmia Investments and Leasing Private Limited.pdf 34

Amalgamation and Strike off 35

13. Cyfast Enterprises Private Limited CSP No. 725/230-232/MB/C-IV/2019 Company had made an application u/s 232 for Amalgamation with AFL Private Limited. Specific observation by Regional Director suggesting that since the transferor company does not have any business, the same is liable to be struck off u/s 248 (1) (c) of the Companies Act, 2013. 13. Cyfast Enterprises Private Limited.pdf 36

CASE STUDY 37

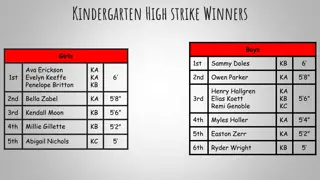

Particulars Rokdeshwar (Case 2) Android (Case 1 ) Pending Returns 2014-15 to 2017-18 2014-15 to 2017-18 Revenue 2017-18 - 2018-19 - 2,56,243 98,425 2017-18 - 2018-19 - 6,04,770 4,24,197 Expenses 2017-18 101,250 2018-19 - 2,56,243 2017-18 3,25,970 2018-19 - 4,42,757 Current Assets 2017-18 - 1,02,59,131 2018-19 - 1,02,17,594 No Information Available Rejected Allowed Cost - Rs. 25,000/- Order Android Ventures Private Limited.pdf Rokdeshwar Plastic.pdf Rokdeshwar Plastic- 1.pdf 38

EXAMPLE List of Dates Particulars of Event 03/06/2019 Mr. A, a Professional filed Section 7 Petition under IBC for his client. 10/06/2019 Listed for hearing before NCLT and Court Notice directed to be served. Adjourned to 05/07/2019. 05/07/2019 Petitioner present. No response from Corporate Debtor. Adjourned to 20/08/2019 with directions to communicate next date of hearing to the Corporate Debtor. 20/08/2019 Petitioner present. No response from Corporate Debtor. Adjourned to 25/09/2019 with directions to communicate next date of hearing to the Corporate Debtor. 25/09/2019 Matter not taken up by the Bench due to paucity of time. Adjourned to 30/10/2019. 30/10/2019 Petitioner present. No response from Corporate Debtor. Bench decides to give final opportunity to Corporate Debtor. Listed for admission on 05/12/2019. 05/12/2019 Petitioner present. No response from Corporate Debtor. Bench reserves the matter for orders. 16/12/2019 Listed in Cause List for pronouncement of order for 17/12/2019. 39

17/12/2019 Order pronounced. Petition dismissed as infructuous. Company admitted under CIRP vide Order dated 10/04/2019, passed by another bench of the same NCLT. Directed Petitioner to lodge claim before RP. 40

Ashish O. Lalpuria & Co. Practising Company Secretaries Add: 204, Zee Square, M. G. Road, Vile Parle (East), Mumbai - 400 057 Ph: 022 2612 1371 Cell: 98204 73932 Email Id: ashishlalpuria@yahoo.co.in 44