Overview of Wireless Industry: Competition and Financialization Impact on Workers

The wireless communications industry is rapidly evolving, with increasing data traffic, market penetration, and a shift towards wireless-only households. Major companies like AT&T, Verizon, Google, and Netflix are shaping the industry with a focus on network infrastructure and services. Despite the growth, there are concerns about employment levels and the fight for market share among wireless service providers. Investments in networks outweigh those in apps and social media, highlighting the importance of infrastructure development in the industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Wireless Industry Overview: The Impact of Competition and Financialization on Wireless Workers CWA Wireless Workers Conference November 2016, San Antonio, TX 1

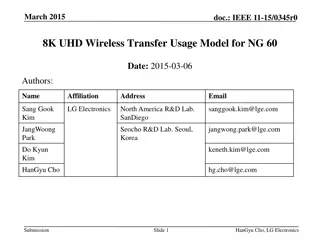

The Wireless Communications Industry is Dynamic Wireless Data Traffic (Billions of MB) Wireless coverage approaching 100%. Majority of households soon to be wireless- only Market penetration at 116% of subscribers Data is taking off! 77,200 9,650 3,230 867 2011 2013 2015 2020 (est.) Sources: CTIA and Cisco 2

Content Companies & Network Carriers in the Wireless Industry: A Virtuous Circle Google, Netflix, Facebook, etc. AT&T, Verizon, T-Mobile, Sprint Content: Web Sites Social Media Infrastructure: Cell sites Spectrum Satellites Fiber Copper Music Video VOIP Games Smart Car Smart Home Services: Voice, Text, Email, Internet Access 3

The Companies Who Build and Service the Networks New Entrants: Google Cable Cos. Wired + Wireless AT&T Verizon Pure Wireless T-Mobile Sprint 4

Networks Require Greater Investment than Apps & Social Media CapEx for Wireless and Content Companies in 2015 ($ billion) Network Carriers Content Providers $11.7 $9.9 $8.9 $6.0 $4.7 $2.5 $0.5 $0.0 AT&T Mobility Verizon Wireless T-Mobile Sprint Google Facebook LinkedIn Pandora 5

Employment at the Network Carriers Leveling Off but watch out for contractors Direct Wireless Carrier Employees 250,393 235,818 233,067 184,449 Contractors 68,165 21,382 2,727 1985 1990 1995 2000 2005 2010 2015 Source: CTIA, Annual Wireless Survey 6

Wireless Market Share (and the fight over subscribers) Total Wireless Subscribers for Wireless Service Providers 2Q2016 (millions) 142.8 131.8 67.4 58.4 Verizon Wireless AT&T Mobility Sprint T-Mobile Source: FierceWireless, August 15, 2016 7

Price Competition Drives Down ARPU (average revenue per unit) Negative ARPU trend puts pressure on network companies to deliver profits Company response: Sales programs to attract and retain customers efficiency programs to cut labor costs Estimated Monthly ARPU 2010 vs. 2016 $51.51 $49.68 $48.92 $47.96 $46.50 $37.89 $34.77 $33.89 Verizon Wireless Source: BoA Merrill Lynch AT&T Mobility Sprint T-Mobile 2010: Solid Color 2016: Striped 8

Company Response: Attract and Retain Customers Company Goals: Maintain current customers to stabilize churn Acquire new customers to increase profitability Increase number of devices, services, accounts per customer Company Tactics: Sales and marketing programs Bundling Early Termination Fee buyouts Free devices No contracts - EIPs Retention 9

Company Response: Efficiencies to Target Workers Company Goals: Reduce overhead and labor costs Company Tactics: Performance metrics Monitoring At risk pay Outsourcing Replace workers with technology Forced overtime 10

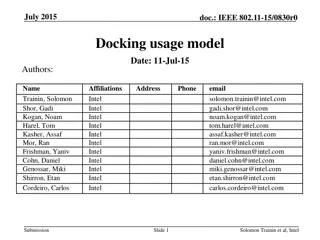

Outsourcing Tactic to Cut Costs Use non-union, low-wage call centers AT&T has presence in the Philippines, Mexico, and elsewhere VZ contracted out over 5,000 jobs in the Philippines, Dominican Republic, and Mexico TMUS has 17 in-house and 25 outsourced centers Sprint has cut 6,000 customer service jobs in three years due to technology and outsourcing Shift retail function to third-party, authorized dealers GameStop now owns 1,421 AT&T authorized stores 20% of 10,000 T-Mobile retail stores, are corporate owned All carriers sell through Best Buy, Costco, Target, etc. 11

Unreasonable Metrics Drive Bad Customer Service Ratio of Consumer Complaints about Fraudulent Enrollment per One Million Subscribers, 2013-16 10.1 7.1 5.9 5.0 T-Mobile Sprint Verizon AT&T 12

In This Competitive Environment, Some Prosper More than Others Changes in Productivity, Share Price, and Wages for Customer Service Representative at AT&T Mobility Texas 2004-2015 (2004=100) 147% 108% 43% Productivity Share Price Wages 13

Some Prosper More than Others, Part 2 Wirelesss Industry and Inequality John Legere (3-year avg) $20,405,296 TMUS Call Center Worker Wichita, KS $29,286 R. Stephenson (3-year avg) $20,750,211 AT&T Mobility CSR 1 Texas $36,656 L. McAdam (3-year avg) $23,940,766 VZ retail worker Brooklyn 14 $58,421

Financial Strip Mining at AT&T and Verizon Financialization = Financial strip-mining: Company is seen as a cash cow Rewards flow to shareholders Shareholder Reward = Dividends + Share Buybacks 126% ofnet income at AT&T, 2011 - 2015 98% of net income at Verizon, 2011 - 2015 15

Consquences of Financial Strip- Mining in a Competitive Industry Competition exerts pressure on revenue and earnings Financialization siphons off profits for investors and execs, so less money is available for cap ex and wages and benefits Could lead to Increases in debt Delay in network upgrades Decline in network quality Decline in service quality Increase in income inequality 16

Summing Up Wireless industry is dynamic Content companies are thriving but not paying their fair share of building the network Network carriers in fierce competition Pressure to cut costs harms workers Aggressive sales tactics harm customers and may be unethical CEOs and shareholders rewarded handsomely 17

The Challenge for CWA Union-Eligible Jobs in the Wireless Industry CWA s Goals: Increase union presence Organized Unorganized Negotiate for our share of success Sprint 13% AT&T Mobility 33% Take on Wall Street T- Mobile 21% One Industry, One Workforce, One Fight VZW 33% 18 Contractors