Impact of Modern Social Policy on Families Since 1997

Modern social policies implemented since 1997 have significantly influenced families. Through analyzing government policies, students learn about their impact on families and societal perspectives, leading to evaluations of strengths and weaknesses. The study delves into how different political parties have shaped these policies and their implications on family dynamics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

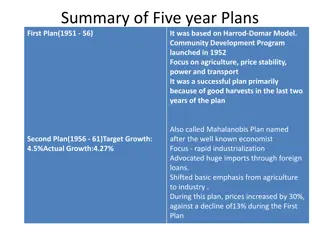

How has modern social policy impacted the family? L/O: To understand how social policy since 1997 has had an impact on the family. Starter: Listen to the song and annotate the parts that relate to different sociological perspectives. https://www.youtube.com/watch?v=WYZ8aJm I040

How has modern social policy impacted the family? Read the cards and put them in order of highest impact to lowest impact on the family.

How has modern social policy impacted the family? Glue the cards in your book in the order you have said. Colour them in blue for conservative. Colour them red for labour. Which political party do you think has the biggest impact on the family? Why?

Outline three government policies that may affect families (6 marks)

Outline three government policies that may affect families (6 marks) 2 marks per statement. 1 mark for identifying the policy, 1 mark for describing it in more detail. 9 minutes.

Outline three government policies that may affect families (6 marks) Two marks for each of three appropriate reasons clearly outlined or one mark for appropriate reasons partially outlined, such as: Child Tax Credit introduced in 2003 (1) so that working families can get extra money for the children. This can help to end child poverty (1). Child maintenance introduced in 1993 (1) to help ensure single mothers can afford to bring their children up (1). Free childcare for 3-4 year olds (1) will allow parents to get back to work quicker, decreasing the risk of child poverty (1) Cuts in public spending under the coalition government (1) may lead to parents struggling to pay for their children s childcare, or unable to claim benefits to support them (1). No marks for no relevant points. Write a WWW and EBI for your partner.

Next steps Evaluate each social policy (consider the strengths and weaknesses, include named studies). Pages 245-250 of the jazzy textbook will be beneficial here.

Homework Create a mind map of everything we have studied up until now in sociology. Use colours and pictures to help. Functionalism essays on the family still waiting!!!!

Plenary If you had Dave s job, what would social policy would you introduce to help families?

2012: Troubled families programme introduced. It s aims were to identify 120,000 families who were involved in crime and ASB, truanting children, unemployed parents, high cost to taxpayer. It aims to hep turn these families lives around. 2003: Labour government introduced Child Tax Credit so working primary carers (usually mothers) got extra money for the kids. 2003: First Minister for Children appointed. Duties include: child protection, special educational needs and disability, family law and justice. 2007: Department for Children, Schools and Families founded. Changed to DfE in 2010. 1993: Child support agency established to ensure absent fathers contributed financially to the upbringing of their children. At the same time single mothers benefits were cut. 2010-2015: Cuts in public spending including benefit cuts, NHS cuts, education cuts, elderly care. 2010: Free childcare for all 3-4 year olds (5 half days a week). New Deals: A initiative to help single parents transition from benefits to work. 1999: National minimum wage introduced to support the most poorly paid. 2010: Tax benefits married couples.