Gross Domestic Product (GDP) in Macroeconomics

This chapter delves into the significance of Gross Domestic Product (GDP) as a measure of economic activity, explaining its components, measurement, and connection to national income. It covers the concepts of GDP, final vs. intermediate goods, expenditure components, and consumption within the context of macroeconomics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Data of Macroeconomics Chapter 2 of Macroeconomics, 10thedition, by N. Gregory Mankiw ECO62 Udayan Roy

Chapter Overview What do the following macroeconomic variables represent? How are they measured? Gross Domestic Product (GDP) The Consumer Price Index (CPI) The Unemployment Rate You ve seen this before in Introductory Macroeconomics. So, I will try to be brief.

GROSS DOMESTIC PRODUCT AND ITS COMPONENTS

Gross Domestic Product An economy s Gross Domestic Product (GDP) is the market value of all final goods and services produced within an economy in a given period of time.

GDP is both Total expenditure on domestically-produced final goods and services. Total income earned by domestically-located productive resources. Expenditure equals income because every dollar spent by a buyer becomes income to the seller.

Final and Intermediate Goods GDP counts the value of only final goods, not intermediate goods Intermediate goods are those goods that disappear inside other goods that are produced for sale Final goods are goods that are not intermediate goods This way, the value of intermediate goods is counted only once, not multiple times.

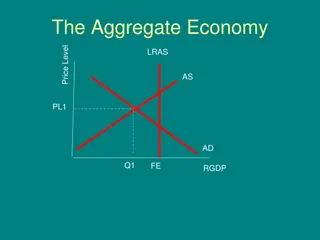

The expenditure components of GDP consumption, C investment, I government spending, G net exports, NX The national income identity: Y = C + I + G + NX total expenditure (GDP) Sum of all components of expenditure

Consumption (C) Consumption is the value of all goods and services bought by households. It includes: durable goods last a long time e.g., cars, home appliances nondurable goods last a short time e.g., food, clothing services work done for consumers e.g., dry cleaning, air travel

U.S. Consumption, 2017 Gross Domestic Product and its components, 2017 Source: Bureau of Economic Analysis, U.S. Department of Commerce, bea.gov Last Revised on: March 28, 2018 - Next Release Date April 27, 2018 Total $ millions 19,390,605 13,395,505 4,295,313 1,473,802 2,821,511 9,100,192 Percent of GDP % 100 69.1 22.2 7.6 14.6 46.9 Per Person $ 59,483.49 41,092.65 13,176.49 4,521.10 8,655.39 27,916.16 Gross domestic product Personal consumption expenditures Goods Durable goods Nondurable goods Services Population (midperiod, thousands) 325,983

Consumption, as a share of GDP 1929 2021

Investment (I) This is spending on goods bought for future use (i.e., capital goods) It includes: Business fixed investment Spending on plant and equipment Residential fixed investment Spending by consumers and landlords on housing units Inventory investment The change in the value of all firms inventories

U.S. Investment, 2017 Gross Domestic Product and its components, 2017 Source: Bureau of Economic Analysis, U.S. Department of Commerce, bea.gov Last Revised on: March 28, 2018 - Next Release Date April 27, 2018 Total $ millions 19,390,605 3,212,828 3,197,164 2,449,581 560,180 1,098,360 791,040 747,583 15,664 Percent of GDP % 100 16.6 16.5 12.6 2.9 5.7 4.1 3.9 0.1 Per Person $ 59,483.49 9,855.81 9,807.76 7,514.44 1,718.43 3,369.38 2,426.63 2,293.32 Gross domestic product Gross private domestic investment Fixed investment Nonresidential Structures Equipment Intellectual property products Residential Change in private inventories 48.05 Population (midperiod, thousands) 325,983

Investment, as a share of GDP 1929 2021

Government Purchases (G) G includes all government spending on goods and services. Itexcludes transfer payments (e.g., unemployment insurance payments), because they do not represent spending on goods and services.

U.S. Government Spending, 2017 Gross Domestic Product and its components, 2017 Source: Bureau of Economic Analysis, U.S. Department of Commerce, bea.gov Last Revised on: March 28, 2018 - Next Release Date April 27, 2018 Total $ millions 19,390,605 3,353,834 1,260,656 744,421 516,235 2,093,178 Percent of GDP % 100 17.3 6.5 3.8 2.7 10.8 Per Person $ 59,483.49 10,288.37 3,867.24 2,283.62 1,583.63 6,421.13 Gross domestic product Government consumption expenditures and gross investment Federal National defense Nondefense State and local Population (midperiod, thousands) 325,983

Government Purchases, as a share of GDP 1929 - 2021

Net Exports (NX) Net Exports = Exports Imports Recall the national income identity: ? = ? + ? + ? + ?? or ? = ? + ? + ? + ??????? ??????? Why do we subtract imports? GDP (Y) is spending on domestically produced goods and services. So, the spending on foreign goods within C, I, and G on the right-hand side of the equation must be deducted.

U.S. Net Exports, 2017 Gross Domestic Product and its components, 2017 Source: Bureau of Economic Analysis, U.S. Department of Commerce, bea.gov Last Revised on: March 28, 2018 - Next Release Date April 27, 2018 Total $ millions 19,390,605 -571,563 2,343,988 1,546,843 797,146 2,915,551 2,381,754 533,797 Percent of GDP % 100 -2.9 12.1 8 4.1 15 12.3 2.8 Per Person $ 59,483.49 -1,753.35 7,190.52 4,745.16 2,445.36 8,943.87 7,306.37 1,637.50 Gross domestic product Net exports of goods and services Exports Goods Services Imports Goods Services Population (midperiod, thousands) 325,983

Exports, Imports, Net Exports, as a share of GDP 1929 - 2021

Net Exports, as a share of GDP 1929 - 2021

Gross Domestic Product and its components, 2017 Source: Bureau of Economic Analysis, U.S. Department of Commerce, bea.gov Last Revised on: March 28, 2018 - Next Release Date April 27, 2018 Total $ millions 19,390,605 13,395,505 4,295,313 1,473,802 2,821,511 9,100,192 3,212,828 3,197,164 2,449,581 560,180 1,098,360 791,040 747,583 15,664 -571,563 2,343,988 1,546,843 797,146 2,915,551 2,381,754 533,797 3,353,834 1,260,656 744,421 516,235 2,093,178 Percent of GDP % 100 69.1 22.2 7.6 14.6 46.9 16.6 16.5 12.6 2.9 5.7 4.1 3.9 0.1 -2.9 12.1 8 4.1 15 12.3 2.8 17.3 6.5 3.8 2.7 10.8 Per Person $ 59,483.49 41,092.65 13,176.49 4,521.10 8,655.39 27,916.16 9,855.81 9,807.76 7,514.44 1,718.43 3,369.38 2,426.63 2,293.32 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Gross domestic product Personal consumption expenditures Goods Durable goods Nondurable goods Services Gross private domestic investment Fixed investment Nonresidential Structures Equipment Intellectual property products Residential Change in private inventories Net exports of goods and services Exports Goods Services Imports Goods Services Government consumption expenditures and gross investment Federal National defense Nondefense State and local 48.05 -1,753.35 7,190.52 4,745.16 2,445.36 8,943.87 7,306.37 1,637.50 10,288.37 3,867.24 2,283.62 1,583.63 6,421.13 Population (midperiod, thousands) 325,983

Real and Nominal GDP GDP is the marketvalue of all final goods and services produced. Nominal GDP measures these values using current prices. Current prices are the prices that prevailed at the time of production Real GDP measure these values using constant prices (the prices during the base year).

NOW YOU TRY: Real and Nominal GDP 2016 2017 2018 P Q P Q P Q good A $30 900 $31 1,000 $36 1,050 good B $100 192 $102 200 $100 205 Nominal GDP Real GDP Compute nominal GDP in each year. Compute real GDP in each year using 2016 as the base year.

NOW YOU TRY: Real and Nominal GDP 2016 2017 2018 P Q P Q P Q good A $30 900 $31 1,000 $36 1,050 good B $100 192 $102 200 $100 205 (30 900) + (100 192) = $46,200 (31 1000) + (102 200) = $51,400 (36 1,050) + (100 205) = $58,300 Nominal GDP (30 900) + (100 192) = $46,200 (30 1000) + (100 200) = $50,000 (30 1,050) + (100 205) = $52,000 Real GDP

GDP Deflator: overall price level 2016 2017 2018 P Q P Q P Q 100 100 GDP 51,400/50,000 = 102.8 58,300/52,000 = 112.1 100 good A Deflator $30 900 $31 1,000 $36 1,050 Average prices compared to good B base year $100 192 $102 2.8% higher 200 $100 12.1% higher 205 Same (30 900) + (100 192) = $46,200 (31 1000) + (102 200) = $51,400 (36 1,500) + (100 205) = $58,300 Nominal GDP (30 900) + (100 192) = $46,200 (30 1000) + (100 200) = $50,000 (30 1,500) + (100 205) = $52,000 Real GDP

U.S. Nominal and Real GDP, 1929-2021 Real GDP: https://fred.stlouisfed.org/series/GDPCA Nominal GDP: https://fred.stlouisfed.org/series/GDPA

Growth Rate: Computation Value for the year value for previous year = Growth Rate 100 value for previous year

2016 2017 2018 NOW YOU TRY: Real and Nominal GDP Nominal GDP Growth Rate % Real GDP Growth Rate % $46,200 $51,400 $58,300 $46,200 $50,000 $52,000 Value for the year previous for value year = Growth Rate 100 previous for value year

2016 2017 2018 NOW YOU TRY: Real and Nominal GDP Nominal GDP Growth Rate % Real GDP Growth Rate % $46,200 $51,400 $58,300 11.26 13.42 [(51,400 46,200) / 46,200] 100 = 11.26 11.26 100 = $46,200 $50,000 $52,000 8.23 4.00 Value for the year previous for value year = Growth Rate 100 previous for value year

2016 2017 2018 NOW YOU TRY: Real and Nominal GDP Nominal GDP Growth Rate % Real GDP Growth Rate % GDP Deflator Growth Rate % $46,200 $51,400 $58,300 11.26 13.42 GDP Deflator = Nominal GDP / Real GDP $46,200 $50,000 $52,000 It is a measure of the overall price level 8.23 4.00 Its growth rate is a measure of the rate of inflation 1.00 1.028 1.121 As an approximation, the GDP Deflator s growth rate = growth rate of Nominal GDP growth rate of Real GDP 2.80 9.06

Where to find US data Bureau of Economic Analysis, U.S. Department of Commerce: http://bea.gov Federal Reserve Bank of St. Louis: http://research.stlouisfed.org/fred2/categories/18

How can we measure national productive activity so that the numbers can be compared across nations? INTERNATIONAL GDP COMPARISONS

International Comparisons When the GDP numbers for various countries are compared, the same currency units must be used There are two ways of converting from national currencies to a common currency, such as the US dollar Use market exchange rates Use a common set of prices (PPP)

Market Exchange Rate Method Step 1: Look up Mexico s GDP in Mexico s currency, the peso Step 2: Look up how many US dollars one Mexican peso is worth Step 3: Multiply the numbers in Steps 1 and 2 This gives you Mexico s GDP in US dollars If the GDPs of two countries are both expressed in US dollars, they can be compared head to head There s another way to calculate Mexico s GDP in US dollars

Market Exchange Rate Method As on December 13, 2022

Purchasing Power Parity Method Step 1: Find out the quantities of all the final goods that were produced in Mexico during 2016 Step 2: Find out the prices of those goods in the United States not Mexico in 2016. These prices are in US dollars Step 3: Calculate Mexico s GDP in US dollars, by Step 3a: multiplying the quantities in Step 1 by the corresponding prices in Step 2 and Step 3b: then adding the results obtained in Step 3a

Lets Compare GDP! country GDP 2021 (2021 US$ billions) country GDP.PPP 2021 (2021 international $ billions) United States China Japan Germany United Kingdom India France Italy Canada Korea, Rep. Russian Federation Brazil Australia Spain Mexico Indonesia Netherlands Saudi Arabia Turkiye Switzerland 22,996 17,734 4,937 4,223 3,187 3,173 2,937 2,100 1,991 1,799 1,776 1,609 1,543 1,425 1,293 1,186 1,018 834 815 813 China United States India Japan Germany Russian Federation Indonesia Brazil France United Kingdom Italy Mexico Turkiye Korea, Rep. Canada Spain Saudi Arabia Australia Poland Egypt, Arab Rep. 27,313 22,996 10,219 5,397 4,815 4,785 3,566 3,436 3,424 3,344 2,713 2,610 2,591 2,428 1,992 1,930 1,751 1,436 1,417 1,388

Lets Compare GDP per capita! country GDP.per.cap 2021 (2021 US$) country GDP.per.cap.PPP 2021 (2021 international $) country GDP.per.cap 2021 (2021 US$) country GDP.per.cap.PPP 2021 (2021 international $) Burkina Faso Mali Tajikistan Uganda Gambia, The Rwanda Guinea-Bissau Sudan Chad Yemen, Rep. Liberia Malawi Niger Congo, Dem. Rep. Sierra Leone Madagascar Central African Republic Mozambique Somalia Burundi 918 918 897 858 836 834 813 764 696 691 673 643 595 584 516 515 511 500 446 237 Luxembourg Bermuda Ireland Switzerland Norway Singapore United States Iceland Denmark Qatar Sweden Australia Netherlands Finland Austria Canada Belgium Israel Germany Hong Kong SAR, China 135,683 110,869 99,152 93,457 89,203 72,794 69,288 68,384 67,803 61,276 60,239 59,934 58,061 53,983 53,268 52,051 51,768 51,430 50,802 49,661 Luxembourg Singapore Ireland Qatar Bermuda Norway Switzerland Macao SAR, China United States Brunei Darussalam Hong Kong SAR, China Denmark Netherlands Sweden Belgium Austria Germany Iceland Australia Finland 134,754 116,486 106,456 93,521 85,192 79,201 77,324 73,802 69,288 66,620 65,973 64,651 63,767 59,324 58,931 58,427 57,928 57,646 55,807 55,007 Ethiopia Rwanda Burkina Faso Mali Zimbabwe Gambia, The Uganda Togo Guinea-Bissau Sierra Leone Malawi Madagascar Chad Liberia Mozambique Niger Somalia Congo, Dem. Rep. Central African Republic Burundi 2600 2494 2462 2447 2444 2434 2398 2380 2057 1816 1658 1635 1591 1553 1342 1310 1302 1219 1021 793 Comparing by purchasing power parity, the average resident of Luxembourg earns 170 times what the average resident of Burundi earns. Comparing by market exchange rates, the average resident of Luxembourg earns 572 times what the average resident of Burundi earns.

Growth Matters a Lot There are huge differences in growth rates too And differences in growth rates can matter a lot over time country Bosnia and Herzegovina Equatorial Guinea China Myanmar Lithuania Vietnam Nauru Estonia Latvia Lao PDR year.beg year.end GDP.per.cap.PPP.beg GDP.per.cap.PPP.end GDP.per.cap.PPP.growth 1994 2021 901.39 1990 2021 653.21 1990 2021 981.42 1990 2021 400.09 1995 2021 5,927.33 1990 2021 1,165.42 2004 2021 4,389.81 1995 2021 6,476.33 1995 2021 5,514.67 1990 2021 1,024.63 16,846.46 18,127.19 19,338.23 4,344.94 42,665.32 11,553.07 15,102.66 42,191.51 34,468.60 8,674.03 11.45 11.32 10.09 8.00 7.89 7.68 7.54 7.47 7.30 7.13 Years From Today Gabon Oman Brunei Darussalam Congo, Rep. Cayman Islands Qatar Curacao United Arab Emirates Kuwait South Sudan 1990 1990 1990 1990 2006 2000 2000 1990 1995 2008 2021 2020 2021 2021 2020 2021 2020 2020 2020 2015 12,381.91 26,185.95 55,853.61 3,471.17 71,482.57 96,713.11 21,888.35 87,131.68 59,865.10 2,913.32 15,597.52 31,117.76 66,619.87 3,616.86 72,481.01 93,521.44 20,681.24 66,766.05 47,303.13 1,234.73 0.75 0.58 0.57 0.13 0.10 -0.16 -0.28 -0.88 -0.94 -11.54 Annual Growth % Today 1 2 20 100 270.48 724.46 200 731.60 5248.49 100 100 122.02 148.59 So, even small increases in annual growth rates can make a big difference if sustained over a long time.

Data Sources GDP (current US$): https://data.worldbank.org/indicator/NY.GDP.MKTP.CD GDP, PPP (current international $): https://data.worldbank.org/indicator/NY.GDP.MKTP.PP.CD GDP per capita (current US$): https://data.worldbank.org/indicator/NY.GDP.PCAP.CD GDP per capita, PPP (current international $): https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD GDP growth (annual %): https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG GDP per capita growth (annual %): https://data.worldbank.org/indicator/NY.GDP.PCAP.KD.ZG

Basic Facts of Wealth Video: https://youtu.be/PzAr_mL0Qd8 CHAPTER 5 MEASURING A NATION S INCOME

If Z = X Y then gz = gx + gy z z z The growth rates here are in decimal form: for example, if X grows at the rate of 5%, then gx = 0.05. The product of two decimals is small enough to be ignored: for example, 0.05 0.04 = 0.0020. = 1 new old new z g z z old old z x y + = 1 new z 1 ( new x )( new y g z old + old 1 old ) + = + 1 g g g + z x y g + = + + 1 1 g = g g g z x + y x y + g g g g g z x y x y + g g g z x y

If Z = X Y then gz = gx gy x = z y = z y + x = g g g z y x = g g g z x y

If Z = Xa then gz = a gx ? = ??= ? ? ?, or x multiplied by itself a times Therefore, ??= ??+ ??+ + ??= ? ??, or the growth rate of x added to itself a times

Consumer Price Index (CPI) The CPI is a measure of the overall level of prices Recall that the GDP deflator is also a measure of the overall level of prices The CPI is published by the Bureau of Labor Statistics (BLS) The CPI is used to: track changes in the typical household s cost of living adjust many contracts for inflation ( COLAs ) allow comparisons of dollar amounts over time

How the BLS constructs the CPI 1. Survey consumers to determine composition of the typical consumer s basket of goods 2. Every month, collect data on prices of all items in the basket, and compute cost of basket 3. CPI in any month equals Cost of basket in that month Cost of basket in base period 100

The composition of the CPIs basket Food and bev. 6.2% 17.4% 5.6% Housing 3.0% Apparel 3.1% 3.8% 3.5% Transportation Medical care Recreation 15.1% Education Communication Other goods and services 42.4%