Aggregate Demand in Macroeconomics

Economic well-being in the aggregate economy is determined by Real GDP, influenced by current levels of Aggregate Demand (AD) and Aggregate Supply (AS). Aggregate Demand slopes downward due to various effects like Wealth Effect and Interest Rate Effect. It is crucial in determining total spending in an economy through Consumption, Investment, Government, and Net Exports. Changes in Consumption directly impact Aggregate Demand, leading to shifts in the AD curve and Real GDP.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

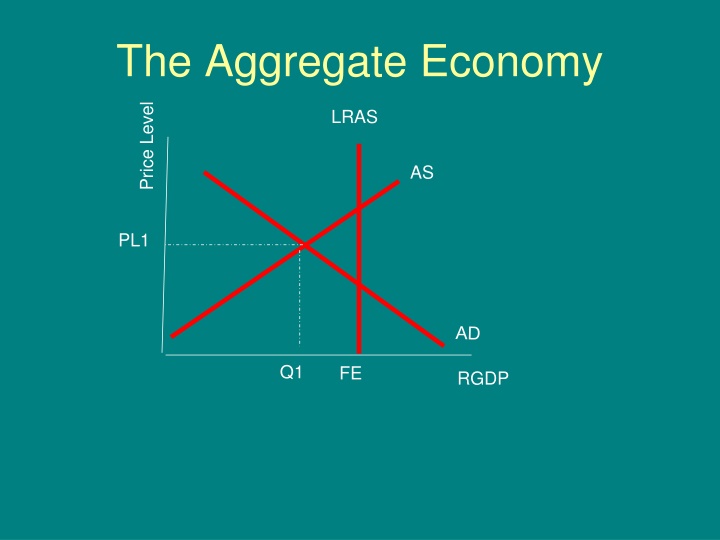

The Aggregate Economy Price Level LRAS AS PL1 Q1 FE RGDP

The Aggregate Economy Economic well being is determined by the level of Real GDP The level of RGDP is determined by current levels of aggregate demand (AD) and aggregate supply (AS). Since spending levels are more easily changed than production levels most macroeconomic policy focuses on aggregate demand.

Down Sloping Nature of AD Price Level A r1 B r2 AD Q2 Q1 RGDP

Aggregate Demand slopes downward for reasons different than the demand curve for a single product Aggregate Demand Wealth Effect Interest Rate Effect Product Demand Income Effect Substitution Effect Aggregate Demand differs from the demand curve for an individual item in that 1. an increase in overall price level does NOT diminish purchasing power because overall income is tied to overall price levels in the macroeconomy 2. when price levels increase there are no cheaper substitutes (all prices are rising)

The Aggregate Demand The level of total spending in an economy is the most important determinant of GDP. Aggregate demand is the total spending by all four sectors of our economy. AD = Consumption + Investment + Government + Net Exports = GDP Aggregate demand is determined by current price level and the current level of spending (Consumption, Investment, Government , Net Exports)

Aggregate Demand(AD) AD A change in Price Level moves the economy along the AD curve. A change in C , I , G or NX moves the location of the curve. Price Level AD2 AD Real GDP

Consumption is a determinant of AD --A change in C causes a shift in the AD Curve Consumption (C) spending by households on goods and services Determinants of Consumption Disposable income (Yd) - income after taxes & transfer payments Wealth (accumulated savings) Expectations of income

Changes in Consumption Any increase in C (consumption spending) will change AD (total spending). If C increases then AD increases The opposite is also true. An increase in Consumption increases AD PL AD1 AD2 RGDP

Investment Investment (I) Spending by businesses on capital Machinery, factories, technology, inventories Investment Demand (I) is the quantity businesses want to spend within a given time period. Determinants of Investment Interest rates Future level of GDP Productive capacity

Changes in Investment Any increase in Investment (business spending on capital) will change AD (total spending). If I increases then AD increases The opposite is also true. An increase in Investment increases AD PL AD1 AD2 RGDP

Adding Government Government policies can have a powerful influence on aggregate demand Government influences AD through fiscal and monetary policy Fiscal Policy has two main components Government spending government purchases of goods and services and government transfer payments A change in government spending has a direct effect because it is a component of AD. A decrease in spending shifts the curve left, an increase in spending shifts the curve right Tax & transfer payment policies Changes in tax policy & transfer payments influence the economy indirectly through changes in consumers disposable income. Increases in taxes decrease AD. Increases in transfers increases AD.

Adding Government Monetary Policy involves the use of changes in the money supply and consequently changes in the interest rate to affect overall spending levels An increase in the money supply gives households and firms more money, which they are then more willing to loan out. This decreases interest rates increasing consumption (C) and investment spending (I). The opposite is also true. An increase in Government spending or an increase in the money supply increases AD PL AD1 AD2 RGDP

Net Exports Net Exports (exports imports) Determinants of Net Exports: Income abroad (if foreign income is up our exports go up) Exchange rates (if the dollar appreciates our exports go down) Tariffs (if we place a tariff on imports our imports go down) Net Exports (NX) goes up If exports go up or if imports go down Net Exports (NX) goes down if exports go down or if imports go up. An increase in NX leads to an increase in AD A decrease in NX leads to a decrease in AD