Falkland Islands Holdings: Results Overview for Year Ended 31 March 2015

Falklands Islands Holdings (FKL) reported a pre-tax profit of 3.56m in 2015, showcasing a foundation for growth. The trading overview for the year highlighted various segments such as FIC, Momart, PHFC, and FOGL. Despite quieter trading for Momart, FKL witnessed a slight increase in group revenue. Cash flow and liquidity improved, with notable changes in bank loans and borrowings. The segmental analysis showed growth in FIC turnover and a mixed performance across the different business units. Overall, FKL demonstrated a focus on organic and acquisition-led earnings growth.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Click to edit Master title style FALKLAND ISLANDS HOLDINGS Results - Year ended 31 March 2015 Creating foundations for growth

FKL: Overview Pre-Tax profits 3.56m (2014: 3.65m) Cash flow from operations 7.2m (2014 3.6m)- Cash on hand 7.4m FIC: Strong recovery, continued investment Momart: Quieter trading year, growth with blue-chip clients PHFC: Stable trading new ferry delivered FOGL: Disposal of 7.8m shares - 2.3m. and residual 5m shares sold post year-end. Focus on organic and acquisition led earnings growth 2 2

FKL: Year ended 31 March 2015 Trading Overview Group revenue +0.8% to 38.6m (2014: 38.3m) FIC : Operating profits + 0.3m to 1.3m (2014: 1.0m) Growth in Retail and Housebuilding & Construction Momart: Quieter trading year profits -32% to 1.2m PHFC: Small decline in passenger numbers (-2.1%) Revenue & profits stable at 0.8m Operating profit -2.3% to 3.8m (2014: 3.9m) Underlying pre tax profits -2.4% to 3.56m (2014: 3.65m) EPS on underlying profits unchanged 22.0p (2014: 22.0p) Reported pre tax profits + 0.5m at 3.9m Cash + 1.7m to 7.4m (2014: 5.7m) Bank borrowings reduced to 0.7m (2014: 1.0m) 1.4m annual dividend suspended to facilitate investment and acquisition led growth 3

FKL: Year ended 31 March 2015 Trading Overview Year ended 31 March 2015 000 2014 000 Change +/- 38,560 38,263 +0.8% Turnover continuing operations Underlying operating profit 3,763 3,852 -2.3% (204) (205) -0.5% Interest (net) incl. pensions costs 3,559 3,647 -2.4% Underlying pre tax profit 477 64 +645.3% Non trading items Amortisation of Intangibles (142) (307) -53.7% 3,894 3,404 +14.4% Reported Profit Before Tax 22.0p 22.0p -% Diluted EPS on taxed underlying PBT 12,446,097 12,460,985 -0.1% Weighted shares in issue 4

FKL: Cash & Liquidity 31 March 2015 31 March 2014 Change 000 000 000 Bank Loans (735) (1,019) 284 Hire Purchase & Other borrowings (280) (265) (15) Total borrowings (1,015) (1,284 269 Cash 7,435 5,715 1,720 Net Cash /(Borrowings) 6,420 4,431 1,989 Pontoon Finance Lease (4,858) (4,886) 28 Margin on bank loans: 2.8% + Bank of England base rate 5

FKL: Segmental Analysis year ended 31 March 2015 2015 000 2014 000 Change +/- Turnover FIC +16.5% 18,506 15,881 PHFC +4.3% 4,301 4,124 Momart -13.7% 15,753 18,258 +0.8% Total Turnover 38,560 38,263 Pre Tax Profit +39.4% FIC 1,556 1,116 +3.4% PHFC 796 770 -31.5% Momart 1,207 1,761 Underlying Pre-Tax Profit (PBTa) 3,559 3,647 -2.4% 6

FIC: Background to Oil June 2015 Premier Oil (PMO) progressing technical development of Sea Lion PMO Engaging with supply chain to capture lower costs May 2015 Lower cost engineering concept- Leased FPSO production facility Phased approach to develop 400mmbbls in total Pre first oil costs reduced to $1.8bn Further cost reductions being targeted for drilling, subsea and fabrication costs FEED being progressed for Board sanction- decision in Summer 2016 Commitment depend on further recovery in oil price and positive news from drilling programme 2015 drilling programme to determine ultimate resource potential of N. Falklands Basin Positive results from first two wells , Zebedee and Isobel Deep. Four more wells to be drilled Noble Energy drilling large Humpback prospect in June / July 2015 in S&E Basin 7

Timeline for Oil Falklands: Timeline for Oil Revised Sea Lion Timeline Jun-15 2015 2016 2017 2018 2019 2020 Temp dock in Stanley Harbour Complete Nov 2014 Exploration Drilling 1 rig 6 wells Eirik Raude Rig March - Nov 2015 "H1 2016 " PMO Project Sanction / FDP Approval Field Development Revised view June 2015 Phase 1 using lower cost FPSO Prepare Develop Develop Construct Construct First Oil FIRST OIL Now estimated 2020 ( 4 yrs following Project Sanction ) "Premier Oil " Engaging with supply chain to capture lower costs " May 2015 , Pre First Oil costs now "Premier Oil " Engaging with supply chain to capture lower costs " May 2015 , Pre First Oil costs now reduced to $1.8bn reduced to $1.8bn 8

FIC: Year ended 31 March 2015 Revenue 2015 million 2014 million Change % Retail Falklands 4x4 Freight and port services Support services Property and construction 3.0% 15.6% -1.7% 28.1% 113.5% 16.5% 9.54 3.07 1.24 1.66 3.00 18.51 9.26 2.66 1.26 1.30 1.40 15.88 Total Revenue 1.31 0.18 0.07 1.56 7.1% 0.98 0.04 0.10 1.12 6.2% Operating profit Share of Joint Venture Net Interest Pre Tax profit Operating profit margin 34.3% 400.0% -37.9% 39.4% 15.2% 10

FIC: Trading - Year ended 31 March 2015 Revenue ahead + 16.5% at 18.51 million (2014: 15.88 million ) Contribution +39.4% to 1.56m (2014: 1.1m ) Retail revenues + 3% to 9.5m better margins - further investment Good growth in Falklands 4x4 + 15.6% to 3.1m - 76 vehicles sold (2014: 79 ) Falkland Building Services Kit Homes growth 16 properties sold 2014: 8) Stronger cruise ship visitors numbers +26% to 50,000 helped H2 sales. Good contribution from SAtCO at 0.18m (2014: 0.04m) - Installation of Noble Energy temporary dock from March Nov 2014 11

FIC: Further progress to First Oil FBS Kit Homes on Government plots FBS Kit Home 13

FIC: Year ended 31 March 2015 2.6m capital investment during year. New chiller and warehouse / container facilities at Airport Road nearing completion Refurbishment complete of the Company s Head Office at Crozier place, offering attractive office space for external rental and improved Head Office facilities for FIC ; Three new houses built in central Stanley, and one four bedroomed house purchased to add to rental portfolio Creation of new Home Builder Retail Warehouse and Garden Centre 0.4 million spent on the purchase and installation of 10 mobile homes for staff Strong contribution from SAtCO JV 180k (after tax) Temp Dock project for Premier Oil & Noble Energy FIG plans for Deep Water Port on hold pending green light on Sea Lion 14

Momart: Trading year ended 31 March 2015 Revenue 2015 million 2014 million Change % Museums & Public Exhibitions 8.68 10.86 -20.0% 5.21 1.86 5.57 1.83 -6.5% 1.3% Gallery Services Storage 15.75 18.26 -13.7% Total Revenue 1.24 (0.03) 1.83 (0.07) -32.1% -50.8% Operating Profit Interest 1.21 1.76 -31.5% Pre Tax Profit * * Before amortisation of intangibles Operating profit margin 7.9% 10.0% -21.4% 18

Momart: Trading year ended 31 March 2015 Quieter Trading Absence of high added value contracts seen in prior year. Revenue -14% to 15.8m (2014: 18.26m ) Profits down to 1.24m (2014: 1.83m ) Exhibitions revenues - 2.2m (-20% ) Overseas revenues - 0.8m Commercial Gallery Services revenues -6.5% to 5.21million Storage revenues +1.3% to 1.86m: 33% expansion of storage space arriving Q1 2016 . Strengthened management team increased focus on sales and marketing New marketing director and full time manger appointed March 2015 Specialist PR Agency now advising March 2015 New Business Development Manager appointed- Nov 2014 Notable exhibitions: Matisse Cut Outs at Tate Modern; Anselm Keifer and Rubens at the Royal Academy; Virginia Woolf at the National Portrait Gallery; and Ming at the British Museum. 19

Momart: Working with Blue Chip clients Matisse: Cut Outs, Tate Modern New dedicated storage racks for Royal Academy 20

Momart: Working with Blue Chip clients Landmark Trust: Installing works by Anthony Gormley 21

PHFC - Year ended 31 March 2013 PHFC: Trading year ended 31 March 2015 Revenues 2015 million 2014 million Change % 4.5% Ferry fares Other revenue Total Revenue 4.13 0.17 4.30 3.95 0.17 4.12 0.6% 4.4% 1.9% -2.9% 3.4% 1.03 (0.24) 0.79 1.01 (0.24) 0.77 Operating Profit Pontoon lease finance interest Profit before tax -0.9 % Net margin on revenue (%) 18.5% 18.7% -2.1% Passenger journeys (000s) 2,923 2,986 23

PHFC: Trading year ended 31 March 2015 P Revenue +4.4% to 4.3million PBT + 3.4% to 0.79m (2014: 0.77m ) Passenger journeys -2.1% to c.2.92 m (2014: -1.6% to c.2.99m ) BAE,1,000 local job losses summer 2014 Subsidised Park & Ride in Portsmouth Fares increased 6% June 2014 Adult Return fares 2.90 > 3.10, Child / OAP unchanged at 2.10 10 Trip Ticket 13.50 > 14.50 New vessel arrived from Croatia Q1 2015 cost 3.2million 30 year life No further vessel investment for 15-20 years Medium term outlook for Portsmouth positive QE2 carriers - 2017 onwards 24

FKL: Outlook FIC Falklands economy buoyant in H1 with drilling programme and FI Govt capital spending Further positive news from drilling will lessen reliance on oil price recovery Significant longer term growth linked to Sea Lion development Momart No immediate repetition of exceptional 2013-14 result Commercial art market expected to remain buoyant importance of London growing New ERP system will boost efficiency in 2014-15 Plans to expand storage business in 2015 to remove block to further growth PHFC Stable outlook more active promotional offers to offset cheap petrol Increased costs for new vessel ( deprec. / finance ) will hold back 2015-16 Cyclical recovery & Dockyard expansion gives positive medium term view Overall Further investment in growth businesses Strategic acquisitions using cash and bank borrowings 25

FKL: Strategy FKL: Strategy FIC: Leverage property assets and support services to maximise long term returns from oil Momart: Expand storage capacity and develop sales & marketing to capitalise on brand reputation. PHFC: Maintain fleet, steady profits & strong cash flow Group: No final dividend planned - cash reinvested to accelerate earnings growth Leverage cash flow to finance strategic acquisitions 26 26

Appendices Additional Information on Falkland Islands Holdings

FKL Group balance sheet FKL: Balance Sheet 31 March 2015 000 31 March 2014 000 Change 000 Property, plant and equipment 19,621 16,609 3,012 Investment properties 3,693 3,396 297 Intangibles & goodwill 12,226 12,238 (12) Deferred tax assets & sundry other 1,852 1,602 250 Investment in FOGL at market value (5m shares @ 30.0p (2014: 12.825m shares at 25.5p ) 1,500 3,270 (1,770) Total fixed assets and investments 38,892 37,115 1,777 Working capital - Net 1,132 3,255 (2,123) Cash 7,435 5,715 1,720 Net operating assets 47,459 46,085 1,374 Income tax payable (27) (419) 392 Bank loans, Finance Leases & HP (5,873) (6,170) 297 Pension provisions & Deferred tax (4,871) (4,119) (752) Net Assets / Shareholders funds 36,688 35,377 1,311 Net assets per share 2.95 2.85 0.10 28

FKL: Cash Flow FKL Group cash flow Year ended 31 March 2015 2014 000 000 Underlying operating profit 3,763 3,852 Depreciation 1,426 1,233 Tax paid (792) (780) Decrease / (Increase) in working capital 2,145 (1,676) Other (158) 169 Net cash flow from operating activities 6,384 2,798 Capital expenditure (4,944) (4,974) Dividends paid (1,424) (1,423) Loan repayments & Interest (1,408) (1,435) FOGL shares sold 2,287 - Loan repaid by / (loan to) Joint Venture 151 (529) Bank & other loans drawn down 833 - Other (159) (138) Net Cash Inflow / (outflow) 1,720 (5,701) 29

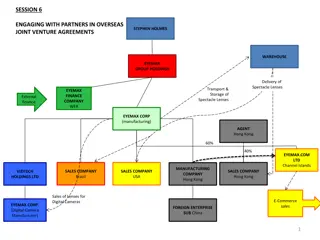

FIC: Sites for development FIC: Sites for development Site Location & size Development Potential 1 Fitzroy Road 2 acres , Central Stanley 26 x 2 bed apartments / Terraced Housing 2 Dairy Paddock Western Stanley 36 acres Planning for 350 houses / Work camp 3 YPF site Central Stanley, 2.25 acres Offices , high quality residential 4 East Jetty Waterfront Stanley , 3.0 acres FIC warehousing prime site for re- development Coastel Road 5 FIPASS area, 7.5 acres Warehousing & lay down areas with planning 6 Airport Road/FIPASS FIPASS ,11.0 acres Warehousing & lay down areas with planning 7 Fairy Cove North side of Stanley Harbour, 301 acres Adjoins site for proposed new deep water port at Navy Point 30

Map of FIC Development Sites Map of FIC Development Sites 31

Map of FIC Development Sites Map of FIC Development Sites 32

FIC: Development sites in Stanley FIC: Development sites in Stanley Dairy Paddock 36 acre site in central Stanley YPF site on Stanley Harbour 2.25 acres Fairy Cove : 300 acre site next to Navy Point harbour site Prestige site for high quality residential homes Planning permission for workers camp and 350 houses Prime central site for offices , hotel / leisure Site 2 Site 3 Crozier Place and East Jetty, 3.0 acres Coastel Rd site on Stanley Harbour 7.5 acres Warehousing, lay down areas and storage Prime central site for Offices, Hotel or Leisure. Site 5 Site 4 33

Management Team Management Team Edmund Rowland, Chairman Edmund was appointed to the Board on 16 April 2013, and became Chairman on 9 February 2015. He currently serves as a Director of Blackfish Capital Management, a specialist asset manager based in London and as Chief Executive Officer of Banque Havilland S.A (London Branch), previously having gained experience in London and Hong Kong, as an analyst and investment manager with BNP Paribas S.A and Blackfish. He has broad experience of principal investing in both equity and credit capital markets, with a focus on special situations. He sits on the board of Banque Havilland (Monaco) SAM and Certus Trust Limited. John Foster, Managing Director John joined the Board in 2005. He is a Chartered Accountant and previously served as Finance Director for software company Macro 4 plc and toy retailer, Hamleys plc. Prior to joining Hamleys, he spent three years in charge of acquisitions and disposals at FTSE 250 company Ascot plc and before that worked for nine years as a venture capitalist with a leading investment bank in the City. Jeremy Brade, Non Executive Jeremy joined the Board in 2009. He is a Director of Harwood Capital Management where he is the senior private equity partner. Jeremy has served on the boards of several private and publicly listed international companies. Formerly Jeremy was a diplomat in the Foreign and Commonwealth Office, and before that an Army officer. 34